Online Cosmetics Market Size

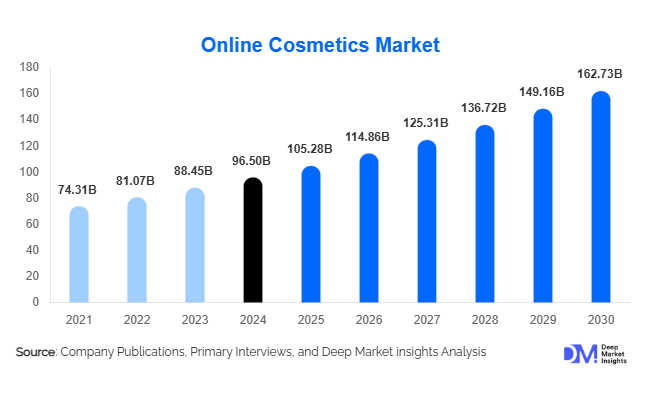

According to Deep Market Insights, the global online cosmetics market size was valued at USD 96.50 billion in 2024 and is projected to grow from USD 105.28 billion in 2025 to reach USD 162.73 billion by 2030, expanding at a CAGR of 9.1% during the forecast period (2025–2030). The online cosmetics market growth is primarily driven by the rapid shift toward digital-first beauty shopping, increasing penetration of direct-to-consumer (D2C) brands, and the rising influence of social media, influencers, and AI-powered personalisation across global beauty platforms.

Key Market Insights

- Skincare dominates the online cosmetics category, supported by high repeat purchases, ingredient transparency, and personalised digital consultations.

- Masstige products account for the largest value share, as consumers increasingly seek premium-quality formulations at accessible prices.

- Asia-Pacific represents the largest regional market, led by China’s social commerce ecosystem and India’s rapidly expanding digital consumer base.

- North America leads in premium and luxury online beauty sales, driven by strong D2C adoption and higher average selling prices.

- Natural, organic, and vegan cosmetics are growing faster than conventional products, reflecting rising sustainability and health awareness.

- Technology integration, including virtual try-ons, AI skin diagnostics, and live-stream shopping, is transforming online beauty engagement.

What are the latest trends in the online cosmetics market?

Social Commerce and Live-Stream Beauty Sales

Social commerce has emerged as a defining trend in the online cosmetics market, particularly in the Asia-Pacific region. Platforms integrating short-form video, influencer-led live-streams, and instant checkout are driving significantly higher engagement and conversion rates. Live demonstrations, real-time Q&A sessions, and limited-time product drops are reshaping how consumers discover and purchase beauty products. This model is increasingly being adopted in North America and Europe through platforms such as Instagram, TikTok, and YouTube, enabling brands to combine entertainment with commerce and accelerate impulse-driven purchases.

AI-Driven Personalisation and Virtual Try-On Technologies

Artificial intelligence and augmented reality are becoming core components of online cosmetics retail. AI-powered skin analysis tools recommend customised skincare routines, while virtual try-on solutions reduce shade mismatch and product returns in makeup categories. These technologies improve consumer confidence, enhance satisfaction, and support premium pricing strategies. Brands leveraging data analytics to offer personalised bundles, subscription replenishment, and targeted promotions are gaining a competitive edge in customer retention.

What are the key drivers in the online cosmetics market?

Shift Toward Digital-First and D2C Beauty Consumption

Consumers globally are increasingly favouring online channels for cosmetics purchases due to convenience, broader product selection, transparent pricing, and access to global brands. The rise of D2C beauty brands has reduced dependency on physical retail, allowing companies to directly engage consumers, gather data, and innovate faster. This shift is particularly pronounced among Gen Z and Millennial consumers, who prioritise mobile-first shopping experiences.

Rising Demand for Clean, Natural, and Ethical Beauty Products

Growing awareness around ingredient safety, sustainability, and ethical sourcing is driving demand for natural, organic, vegan, and cruelty-free cosmetics online. Digital platforms enable brands to communicate ingredient transparency and ESG credentials more effectively, accelerating adoption. This driver is particularly strong in Europe and North America, where regulatory frameworks and consumer activism reinforce clean beauty trends.

What are the restraints for the global market?

Counterfeit Products and Brand Trust Issues

The prevalence of counterfeit cosmetics on large online marketplaces poses a significant challenge. Fake products undermine consumer trust, damage brand equity, and raise safety concerns. Brands must invest continuously in authentication technologies, platform partnerships, and consumer education to mitigate this risk.

High Return Rates and Logistics Complexity

Online cosmetics, particularly colour cosmetics, experience elevated return rates due to shade mismatches and unmet expectations. Reverse logistics increase operational costs and impact profit margins. While virtual try-on tools help address this challenge, uneven adoption across regions remains a restraint.

What are the key opportunities in the online cosmetics industry?

Expansion in Emerging Markets

Emerging economies such as India, Southeast Asia, the Middle East, and parts of Latin America present significant untapped potential. Rising disposable incomes, smartphone adoption, and digital payment infrastructure are accelerating online beauty demand. Government initiatives supporting domestic manufacturing and e-commerce ecosystems further enhance growth prospects.

Premiumisation Through Technology and Customisation

Advanced personalisation tools, subscription models, and bespoke skincare solutions create opportunities for premiumization. Brands that integrate diagnostics, tailored formulations, and exclusive online-only products can increase average order values and long-term customer loyalty.

Product Type Insights

Skincare products account for approximately 38% of the online cosmetics market in 2024, making them the leading product category due to high usage frequency and strong personalisation potential. Makeup products represent around 28%, driven by influencer marketing and trend-led consumption. Hair care contributes nearly 18%, supported by routine purchases and treatment-based products. Fragrances and personal care collectively account for the remaining share, with premium fragrances gaining traction through online-exclusive launches and sampling programs.

Distribution Channel Insights

Online marketplaces dominate distribution with roughly 46% of total sales, benefiting from scale, logistics capabilities, and consumer trust. Brand-owned D2C platforms account for about 34%, driven by higher margins and stronger brand engagement. Speciality beauty e-retailers contribute nearly 14%, while social commerce platforms represent the fastest-growing channel, currently holding around 6% but expanding rapidly.

Consumer Demographic Insights

Women account for approximately 62% of global online cosmetics demand, reflecting broader product usage and earlier digital adoption. Men’s grooming represents about 22% and is the fastest-growing demographic segment, supported by the rising acceptance of skincare and grooming routines. Gender-neutral and unisex products account for nearly 16%, driven by inclusivity trends and minimalist beauty preferences.

| By Product Type | By Price Positioning | By Consumer Demographics | By Distribution Channel | By Formulation Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global online cosmetics market with approximately 36% share in 2024. China is the largest country market, driven by live-stream commerce and strong domestic brands, while India is the fastest-growing major market with a CAGR exceeding 15%, supported by social commerce and rising digital literacy.

North America

North America accounts for around 31% of global market value, led by the United States, which alone contributes nearly 24%. High premiumization, strong D2C ecosystems, and advanced technology adoption drive regional demand.

Europe

Europe represents approximately 22% of the market, with Germany, the UK, and France leading demand. Clean beauty regulations, premium skincare adoption, and cross-border e-commerce support sustained growth.

Latin America

Latin America holds about 7% of global demand, led by Brazil and Mexico. Growth is driven by mobile commerce and expanding middle-class consumers.

Middle East & Africa

The Middle East & Africa region contributes roughly 4%, with the UAE and Saudi Arabia emerging as high-value premium beauty markets supported by luxury consumption and strong logistics infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|