On-the-Go Breakfast Products Market Size

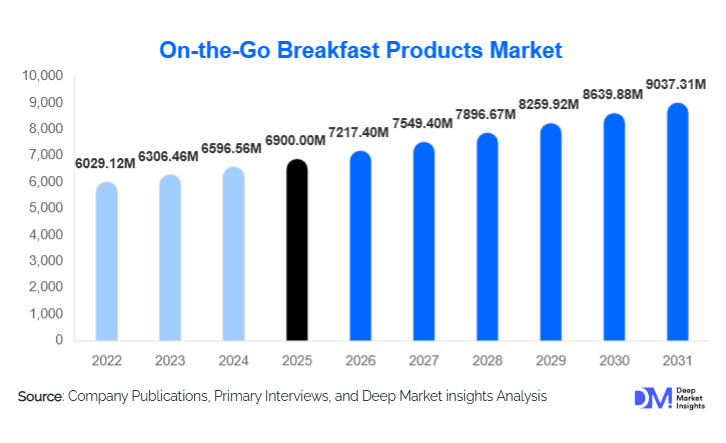

According to Deep Market Insights, the global on-the-go breakfast products market size was valued at USD 6,900 million in 2025 and is projected to grow from USD 7,217.40 million in 2026 to reach USD 9,037.31 million by 2031, expanding at a CAGR of 4.6% during the forecast period (2026–2031). The market growth is primarily driven by changing lifestyles, increasing urbanization, rising demand for convenient and nutritious breakfast solutions, and the expansion of e-commerce and modern retail channels globally.

Key Market Insights

- Convenience and health-oriented products are dominating consumer preference, as working professionals and students increasingly replace traditional sit-down breakfasts with portable and fortified options.

- Dairy-based drinks, protein bars, and cereal cups are witnessing high adoption, fueled by rising interest in functional nutrition, protein-enriched foods, and low-sugar formulations.

- North America leads the global market, driven by high disposable incomes, urban lifestyles, and well-developed retail infrastructure, with the U.S. as the key contributor.

- Asia-Pacific is the fastest-growing region, propelled by rapid urbanization, a growing middle-class population, and increasing dual-income households in China and India.

- E-commerce and direct-to-consumer channels are expanding, allowing both global and regional brands to reach consumers efficiently, particularly in urban hubs.

- Sustainability and eco-friendly packaging are becoming critical differentiators, with consumers preferring recyclable packaging and brands that emphasize environmental responsibility.

What are the latest trends in the on-the-go breakfast products market?

Rise of Functional and Fortified Products

Consumers are increasingly seeking breakfast products that offer specific health benefits, such as protein-enriched bars, fiber-rich cereals, and probiotic yogurt drinks. Brands are innovating to meet demand for functional nutrition, including products aimed at digestive health, energy boost, and immunity support. This trend is particularly strong among millennials and Gen Z, who value transparency in ingredient sourcing and scientifically validated health claims. Subscription services and personalized nutrition offerings are emerging as new engagement models for health-conscious consumers.

Digital Retail and E-Commerce Growth

Online retail platforms and direct-to-consumer sales are reshaping market dynamics. E-commerce enables smaller regional brands to reach urban consumers, offering personalized multipack subscriptions and access to niche product lines. Digital marketing, influencer collaborations, and targeted promotions have increased product visibility and repeat purchases. Mobile apps now allow consumers to track nutrition information, compare products, and receive curated recommendations, enhancing engagement and brand loyalty.

What are the key drivers in the on-the-go breakfast products market?

Urbanization and Busy Lifestyles

Rising urban populations and dual-income households are driving demand for convenient, portable breakfast options. Products such as ready-to-eat cereals, breakfast bars, and portable dairy drinks cater to consumers who require quick, nutritious meals during commutes or at workplaces, particularly in metropolitan areas of North America, Europe, and the Asia-Pacific.

Increasing Health and Nutrition Awareness

Consumers are prioritizing nutrient-dense options. Fortified cereals, protein bars, and functional beverages are gaining traction. Health-conscious choices are further reinforced by trends in plant-based diets, low-sugar formulations, and clean-label packaging, encouraging product innovation and premiumization.

Expanding Modern Retail and E-Commerce Channels

Supermarkets, hypermarkets, convenience stores, and online platforms enhance product accessibility. E-commerce adoption, particularly in Asia-Pacific and North America, is enabling brands to reach urban consumers efficiently, support subscription-based models, and track purchasing behaviors for portfolio optimization.

What are the restraints for the global market?

Price Sensitivity and Cost Pressures

On-the-go breakfast products often carry a premium compared to traditional home-prepared meals. Volatility in raw material costs for grains, dairy, and packaging materials can increase retail prices, limiting adoption among price-sensitive consumers.

Perception of Healthfulness

High sugar content and processed ingredients in some portable breakfast products can negatively affect health perception. Brands need to invest in reformulation, clean labeling, and transparent marketing to address consumer concerns and maintain trust.

What are the key opportunities in the on-the-go breakfast products market?

Functional and Fortified Product Innovation

There is strong potential to develop breakfast items with added functional benefits such as protein, fiber, probiotics, and vitamins. Innovative formulations targeting specific health needs, like energy, immunity, or digestive wellness, can command premium pricing and build consumer loyalty. Collaboration with nutrition experts enhances product credibility and differentiation.

E-Commerce and Digital Expansion

Brands can leverage digital platforms to reach niche markets, offer subscription services, and gather consumer insights. E-commerce enables global reach without significant retail overhead, allowing small and mid-sized brands to scale efficiently and expand international exports, particularly in the Asia-Pacific and Latin America.

Sustainability and Eco-Friendly Packaging

Consumer demand for environmentally responsible products is growing. Adoption of recyclable, biodegradable, or reduced-plastic packaging helps brands differentiate themselves while aligning with global sustainability trends. Brands that emphasize eco-conscious sourcing and production are likely to strengthen brand loyalty and attract younger, environmentally aware consumers.

Product Type Insights

Breakfast cereals dominate the on-the-go breakfast products market, accounting for approximately 46% of global consumption in 2024. This leadership is primarily driven by their ease of consumption, long shelf life, widespread consumer familiarity, and ability to deliver essential nutrients in a convenient format. Ready-to-eat cereals and portable cereal cups are particularly popular among working professionals and families, as they offer a quick breakfast solution with minimal preparation. Continuous innovation in low-sugar, high-fiber, whole-grain, and fortified cereal formulations has further strengthened their appeal among health-conscious consumers.

Dairy-based breakfast drinks contribute approximately 28% of market value and are among the fastest-growing product categories. Their growth is fueled by increasing demand for high-protein, probiotic, and functional beverages that support digestive health, immunity, and sustained energy. Ready-to-drink yogurt beverages and protein shakes are gaining popularity across North America, Europe, and Asia-Pacific, supported by advancements in cold-chain logistics and lactose-free or plant-based dairy alternatives. Across all product types, innovation in clean-label ingredients, plant-based formulations, and fortified nutrition continues to drive market expansion.

Application Insights

Consumption of on-the-go breakfast products is strongest among working professionals and students, who prioritize convenience, portability, and nutritional balance amid busy schedules. These consumers rely heavily on packaged breakfast solutions that can be consumed during commutes, at workplaces, or between classes. The rising prevalence of dual-income households and extended working hours has reinforced demand within this application segment.

Institutional demand is emerging as a notable growth area, with corporate cafeterias, co-working spaces, educational campuses, and healthcare facilities increasingly incorporating on-the-go breakfast options into meal programs and wellness initiatives. This trend is particularly visible in developed markets where employers emphasize employee productivity and health. In addition, export-driven demand is strengthening in emerging economies, where urbanization and rising disposable incomes are encouraging the adoption of packaged breakfast products. Functional and fortified offerings are especially popular among health-conscious end users, while premium and organic product variants cater to affluent urban consumers willing to pay higher prices for quality, nutrition, and brand trust.

Distribution Channel Insights

Supermarkets and hypermarkets account for approximately 35% of global distribution share, making them the leading sales channel for on-the-go breakfast products. Their dominance is driven by extensive product variety, strong brand visibility, promotional pricing, and consumer trust. These outlets serve as primary purchase points for families and bulk buyers, particularly in North America and Europe.

Online retail is the fastest-growing distribution channel, supported by rising digital adoption, urban e-commerce penetration, and demand for convenience. E-commerce platforms enable personalized subscription models, targeted promotions, and access to niche or premium product lines, particularly among younger and health-focused consumers. Direct-to-consumer models are also gaining traction, allowing brands to gather consumer insights and improve margins. Convenience stores, transit hubs, and foodservice outlets play a critical role in out-of-home consumption, especially in high-footfall urban locations such as airports, railway stations, and office districts. Meanwhile, specialty health and organic stores continue to support demand for functional, organic, and clean-label breakfast products, reinforcing premium segment growth.

Consumer Demographic Insights

Working professionals represent nearly 50% of global demand, driven by time constraints, urban commuting patterns, and the need for quick yet nutritious breakfast solutions. This demographic is particularly receptive to functional, protein-rich, and premium offerings that align with wellness goals. Students and youth populations significantly contribute to growth in cereal cups, snack bars, and affordable breakfast beverages, supported by rising enrollment in urban educational institutions and increased exposure to convenience foods. Brand-driven marketing, flavor innovation, and value pricing resonate strongly with this segment.

Health-conscious consumers are increasingly adopting fortified beverages, low-sugar cereals, and plant-based options, while families continue to purchase packaged breakfast products for consistency, nutritional assurance, and ease of preparation. Family demand is particularly strong in developed markets where packaged food consumption is deeply ingrained.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest regional market, accounting for approximately 35% of global demand, led by the United States. Regional growth is driven by high disposable incomes, fast-paced urban lifestyles, strong preference for convenience foods, and a mature retail ecosystem. Health-conscious consumption patterns, combined with widespread availability of fortified, organic, and protein-rich breakfast products, continue to support market expansion. Canada contributes significantly through a strong demand for clean-label and functional breakfast options.

Europe

Europe holds around 28% of the global market, with the U.K. and Germany serving as key demand centers. Growth is driven by rising nutrition awareness, increasing adoption of plant-based and functional foods, and strong regulatory emphasis on food quality and labeling. Highly urbanized populations and expanding e-commerce penetration are accelerating accessibility to on-the-go breakfast products, particularly in Western Europe.

Asia-Pacific

Asia-Pacific represents approximately 25% of the market and is the fastest-growing region. China and India are leading contributors, supported by rapid urbanization, rising middle-class incomes, increasing dual-income households, and growing exposure to Western eating habits. Expanding organized retail, aggressive e-commerce growth, and rising health awareness are key drivers, while younger populations are accelerating the adoption of portable and affordable breakfast formats.

Latin America

Latin America is experiencing steady growth, led by Brazil and Argentina. Market expansion is driven by urban lifestyle shifts, increasing female workforce participation, and growing availability of packaged breakfast products through modern retail formats. Rising imports of branded cereals, bars, and dairy-based drinks are further supporting regional demand.

Middle East & Africa

The Middle East accounts for approximately 12% of global demand, driven by high-income consumers in the UAE and Saudi Arabia, strong preference for premium packaged foods, and expanding convenience retail networks. Africa remains a smaller but emerging market, with growth concentrated in urban centers where organized retail penetration is improving and demand for convenient packaged foods is gradually increasing.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the On-the-Go Breakfast Products Market

- Kellogg Company

- Nestlé S.A.

- General Mills, Inc.

- Danone S.A.

- Mondelez International, Inc.

- PepsiCo, Inc.

- Post Holdings, Inc.

- The Hain Celestial Group, Inc.

- Unilever plc

- Quaker Oats Company

- Kraft Heinz Company

- Conagra Brands, Inc.

- Associated British Foods plc

- Campbell Soup Company

- Grupo Bimbo, S.A.B. de C.V.