Nutritional Supplements Market Size

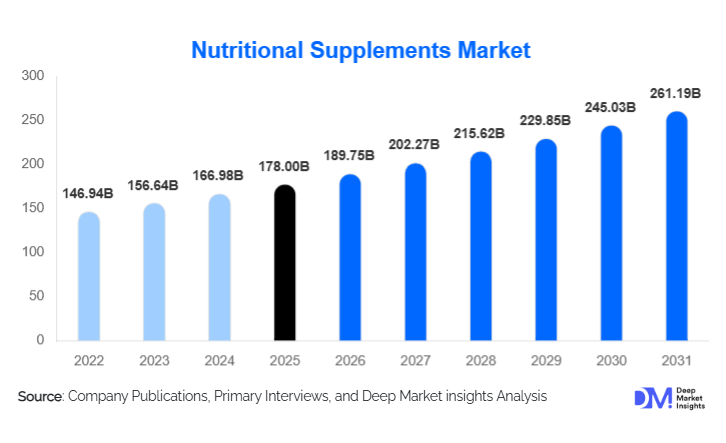

According to Deep Market Insights, the global nutritional supplements market size was valued at USD 178.0 billion in 2025 and is projected to grow from USD 189.75 billion in 2026 to reach USD 261.19 billion by 2031, expanding at a CAGR of 6.6% during the forecast period (2026–2031). The nutritional supplements market growth is primarily driven by rising health awareness, increasing preventive healthcare adoption, aging populations, and sustained demand for immunity, wellness, and lifestyle-related nutritional products across both developed and emerging economies.

Key Market Insights

- Preventive healthcare adoption is accelerating globally, positioning nutritional supplements as a core component of daily health regimens rather than discretionary wellness products.

- Vitamins and minerals remain the largest product category, supported by widespread micronutrient deficiencies and government-backed health awareness initiatives.

- North America dominates the global market, led by high supplement penetration, premium pricing, and strong brand loyalty in the U.S.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class income, urbanization, and growing acceptance of functional and herbal supplements.

- E-commerce and D2C channels are reshaping distribution, enabling subscription models, personalized nutrition, and higher consumer engagement.

- Product innovation in delivery formats, including gummies, liquids, and personalized sachets, is improving compliance and expanding the consumer base.

What are the latest trends in the nutritional supplements market?

Personalized and Precision Nutrition Gaining Momentum

Personalized nutrition is emerging as one of the most influential trends in the nutritional supplements market. Advances in nutrigenomics, digital health platforms, and AI-driven wellness assessments are enabling companies to offer customized supplement formulations tailored to individual health needs, age, lifestyle, and genetic profiles. Subscription-based personalized nutrition programs are gaining popularity, particularly in North America and Europe, as consumers seek targeted solutions rather than generic multivitamins. This trend is helping brands improve customer retention, command premium pricing, and differentiate themselves in an increasingly competitive landscape.

Clean-Label, Plant-Based, and Herbal Supplements on the Rise

Consumers are increasingly demanding clean-label, natural, and plant-based supplements, driven by concerns around artificial additives, allergens, and sustainability. Herbal and botanical supplements such as ashwagandha, turmeric, ginseng, and adaptogenic blends are witnessing strong growth, particularly in Asia-Pacific and Europe. Plant-based protein supplements are also gaining traction as vegan and flexitarian diets expand globally. Transparency in sourcing, organic certification, and sustainability credentials are becoming key purchase decision factors, reshaping product development strategies across the industry.

What are the key drivers in the nutritional supplements market?

Rising Preventive Healthcare Awareness

Growing awareness of preventive healthcare is a major driver of the nutritional supplements market. Consumers are increasingly prioritizing long-term health maintenance to reduce the risk of chronic diseases such as diabetes, cardiovascular disorders, and osteoporosis. Governments and healthcare organizations are also promoting micronutrient supplementation programs, particularly for vitamin D, iron, and calcium, further supporting demand. This shift from reactive to preventive health management is sustaining consistent, recurring consumption of supplements.

Aging Global Population

The rapidly expanding global geriatric population is significantly boosting demand for nutritional supplements. Older adults require targeted nutrition to support bone health, joint mobility, cognitive function, and immunity. Supplements such as calcium, vitamin D, omega-3 fatty acids, and joint health formulations are seeing strong uptake, particularly in North America, Europe, Japan, and China. This demographic trend ensures long-term demand stability for the market.

Innovation in Product Formats and Bioavailability

Continuous innovation in supplement formats and bioavailability enhancement technologies is driving market growth. Gummies, soft gels, liquids, and fast-dissolving powders are improving palatability and convenience, encouraging regular usage among children and older consumers. Advanced encapsulation and sustained-release technologies are enhancing nutrient absorption, strengthening product efficacy, and consumer trust.

What are the restraints for the global market?

Regulatory Complexity and Compliance Challenges

The nutritional supplements market faces regulatory challenges due to varying standards across regions regarding ingredient approvals, health claims, and labeling requirements. Navigating these regulatory frameworks increases compliance costs and delays product launches, particularly for smaller manufacturers and new entrants. Regulatory scrutiny is especially stringent in Europe and North America, acting as a barrier to rapid market expansion.

Pricing Pressure and Product Commoditization

Intense competition, particularly in vitamins and minerals, has led to pricing pressure and commoditization risks. The proliferation of private-label brands and online price transparency can erode margins unless companies differentiate through branding, scientific validation, or personalization. Raw material price volatility, especially for botanicals and proteins, further adds to cost pressures.

What are the key opportunities in the nutritional supplements industry?

Expansion in Emerging Markets

Emerging economies in the Asia-Pacific, Latin America, and parts of Africa present significant growth opportunities. Rising disposable incomes, urbanization, and increasing health awareness are driving first-time supplement adoption in countries such as India, China, Indonesia, Brazil, and Vietnam. Local manufacturing incentives and expanding retail infrastructure further enhance market accessibility in these regions.

Integration with Digital Health Ecosystems

The integration of nutritional supplements with digital health platforms, wearable devices, and telehealth services offers new growth avenues. Supplements aligned with digital health monitoring can provide data-backed efficacy insights, improve personalization, and support long-term consumer engagement. Partnerships between supplement manufacturers and health-tech companies are expected to accelerate innovation and value creation.

Product Type Insights

Vitamins represent the largest product type segment, accounting for approximately 32% of the global market in 2025, driven by widespread deficiency awareness and broad consumer applicability. Minerals follow closely, particularly calcium, magnesium, and iron supplements. Proteins and amino acids form a rapidly growing segment, supported by sports nutrition and active lifestyle trends. Herbal and botanical supplements are gaining strong momentum due to consumer preference for natural and traditional remedies, while specialty supplements such as collagen, probiotics, and omega fatty acids are expanding premium sub-segments within the market.

Application Insights

General health and wellness applications dominate the market, contributing nearly 38% of total demand in 2025. Immunity enhancement has emerged as a critical application, accounting for around 19% of the market, driven by post-pandemic behavioral shifts. Sports nutrition is the fastest-growing application, supported by gym memberships, home fitness adoption, and rising protein consumption. Digestive health, cognitive wellness, and bone & joint health applications are also witnessing steady growth across aging and urban populations.

Distribution Channel Insights

Pharmacies and drug stores remain the largest distribution channel, holding approximately 34% market share due to consumer trust and professional recommendations. Online retail and D2C platforms account for over 22% of global sales and are growing rapidly through subscription models, personalized offerings, and aggressive digital marketing. Supermarkets, specialty nutrition stores, and practitioner-prescribed channels continue to play important roles, particularly in developed markets.

Consumer Group Insights

Adults aged 18–64 years represent the largest consumer group, contributing nearly 46% of total demand, driven by wellness, stress management, and lifestyle nutrition needs. The geriatric population forms a high-value segment focused on bone, joint, and cognitive health supplements. Sports and fitness enthusiasts are driving demand for protein and amino acid supplements, while children, pregnant women, and lactating mothers support demand for targeted micronutrient formulations.

| By Product Type | By Form | By Application | By Distribution Channel | By Consumer Group |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global nutritional supplements market in 2025, led by the United States, which alone represents nearly 28% of global demand. High supplement penetration, premium product adoption, and strong brand loyalty underpin regional dominance. Innovation, personalization, and e-commerce adoption further support growth.

Europe

Europe holds around 22% of the global market, driven by aging demographics, a preventive healthcare focus, and high demand for clean-label and herbal supplements. Germany, the U.K., France, and Italy are key contributors, with strong regulatory oversight ensuring product quality and consumer trust.

Asia-Pacific

Asia-Pacific represents nearly 30% of the market and is the fastest-growing region. China, India, and Japan lead demand, supported by large populations, rising disposable incomes, and cultural acceptance of herbal and functional nutrition. Rapid urbanization and expanding e-commerce penetration are accelerating market expansion.

Latin America

Latin America accounts for approximately 8% of global demand, with Brazil and Mexico leading consumption. Growth is supported by increasing health awareness and expanding middle-class populations, although pricing sensitivity remains a key challenge.

Middle East & Africa

The Middle East & Africa region holds about 6% of the global market. The UAE and Saudi Arabia lead demand due to high income levels and wellness-focused lifestyles, while South Africa and parts of North Africa are emerging as regional growth hubs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Nutritional Supplements Market

- Nestlé Health Science

- Abbott Laboratories

- Amway

- Herbalife Nutrition

- Bayer AG

- DSM-Firmenich

- Glanbia plc

- Pfizer (Consumer Health)

- Haleon

- Blackmores Limited

- Swisse Wellness

- USANA Health Sciences

- Otsuka Holdings

- Himalaya Wellness

- Nature’s Bounty (Brand Owner)