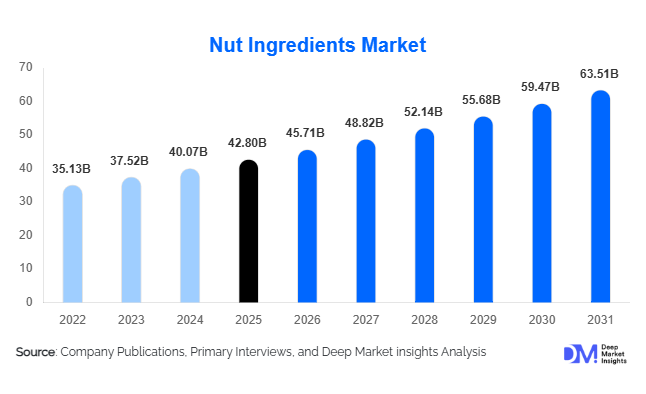

Nut Ingredients Market Size

According to Deep Market Insights, the global nut ingredients market size was valued at USD 42.8 billion in 2025 and is projected to grow from USD 45.71 billion in 2026 to reach USD 63.51 billion by 2031, expanding at a CAGR of 6.8% during the forecast period (2026–2031). The nut ingredients market growth is primarily driven by rising demand for plant-based proteins, clean-label food formulations, premium bakery and confectionery products, and increasing adoption of nuts as functional and nutritional ingredients across food, beverage, and nutraceutical industries.

Key Market Insights

- Almond ingredients dominate the global market due to extensive usage in bakery, dairy alternatives, and functional nutrition.

- Bakery and confectionery applications account for the largest demand share, supported by premiumization and indulgence trends.

- Direct B2B sourcing remains the preferred distribution channel, driven by traceability, quality assurance, and long-term supply contracts.

- Asia-Pacific is the fastest-growing regional market, fueled by expanding food processing industries in China and India.

- Plant-based dairy and sports nutrition applications are emerging as high-growth segments, outpacing traditional food uses.

- Price volatility of raw nuts and allergen regulations remain key operational challenges for manufacturers.

What are the latest trends in the nut ingredients market?

Rapid Expansion of Plant-Based and Dairy-Alternative Products

The global shift toward plant-based diets has significantly increased demand for nut-based ingredients, particularly almond, cashew, and hazelnut derivatives. Nut ingredients are widely used in plant-based milk, cheese, yogurt, and ice cream formulations due to their favorable nutritional profile and natural appeal. Cashew-based cheese analogs and almond-based beverages are experiencing strong adoption, especially in North America and Europe. Manufacturers are investing in texture-optimized nut pastes, fermented nut bases, and functional nut proteins to enhance mouthfeel and nutritional value in dairy alternatives.

Premiumization and Functional Nutrition Integration

Nut ingredients are increasingly positioned as premium and functional components in food products. Cold-pressed nut oils, nut flours, and protein-rich nut meals are being incorporated into sports nutrition, keto-friendly foods, and meal replacement products. Consumers associate nuts with heart health, sustained energy, and clean-label benefits, driving higher willingness to pay. This trend is particularly strong in protein bars, nutritional snacks, and fortified bakery products, where nuts provide both functional and sensory benefits.

What are the key drivers in the nut ingredients market?

Rising Demand for Clean-Label and Natural Ingredients

Consumers are increasingly prioritizing transparency, simplicity, and natural sourcing in food products. Nut ingredients align well with clean-label trends, as they are minimally processed and widely recognized by consumers. Food manufacturers are replacing synthetic additives with nut-based solutions that offer flavor enhancement, texture improvement, and nutritional enrichment, driving sustained demand across multiple applications.

Growth of High-Protein and Functional Food Categories

The global rise in health-conscious consumption has accelerated demand for protein-rich and functional foods. Nut flours, nut protein concentrates, and nut oils are increasingly used in sports nutrition, clinical nutrition, and weight-management products. This driver is particularly strong in North America and Europe, where functional food markets are well-established.

Premiumization in Bakery and Confectionery

Nuts are perceived as premium inclusions in chocolates, baked goods, and desserts. Hazelnuts, pistachios, and macadamia nuts are widely used in high-end confectionery, enabling manufacturers to command premium pricing. This driver supports steady demand growth despite price volatility in raw nut supplies.

What are the restraints for the global market?

Volatility in Raw Nut Prices

Nut cultivation is highly sensitive to climate conditions, water availability, and seasonal yield fluctuations. Almonds, pistachios, and walnuts are particularly exposed to droughts and supply disruptions, leading to price volatility. These fluctuations impact ingredient cost structures and profit margins for processors and food manufacturers.

Allergen Regulations and Compliance Costs

Nuts are classified as major allergens in most regulatory frameworks, requiring strict labeling, segregation, and contamination controls. Compliance increases operational complexity and limits the use of nut ingredients in certain applications, acting as a restraint on market expansion.

What are the key opportunities in the nut ingredients industry?

Functional and Sports Nutrition Applications

The expanding sports nutrition and functional food sectors present strong growth opportunities for nut ingredient manufacturers. Customized nut protein blends, omega-rich nut oils, and fiber-dense nut flours are increasingly used in protein bars, supplements, and performance foods. Innovations targeting endurance, satiety, and metabolic health are expected to unlock premium market segments.

Value-Added Processing in Emerging Economies

Governments in the Asia-Pacific and Latin America are promoting domestic food processing through incentives and infrastructure investment. Establishing local nut processing facilities for roasting, grinding, and oil extraction enables higher value capture, reduces logistics costs, and improves export competitiveness, creating long-term growth opportunities.

Product Type Insights

Almond ingredients represent the largest product segment in the global nut ingredients market, accounting for approximately 31% of total revenue in 2025. This dominance is primarily driven by almonds’ exceptional versatility across multiple food applications, including bakery, dairy alternatives, snacks, and functional nutrition. Almonds offer a balanced nutritional profile with high protein, fiber, and healthy fat content, along with a neutral flavor that allows easy integration into both sweet and savory formulations. Additionally, strong consumer perception of almonds as a heart-healthy and premium ingredient has supported their widespread adoption by global food manufacturers.

Cashew ingredients are the fastest-growing product segment, driven by rising adoption in plant-based cheese, creamers, and premium culinary applications. Cashews offer superior emulsification and creamy texture, making them a preferred base for dairy-alternative formulations. Meanwhile, hazelnut and pistachio ingredients maintain strong demand in confectionery, especially in chocolates, spreads, and desserts, due to their distinctive flavor profiles and premium positioning.

Application Insights

Bakery and confectionery applications dominate the nut ingredients market, contributing nearly 34% of total demand in 2025. Nuts are extensively used as inclusions, fillings, pastes, and toppings in cakes, biscuits, chocolates, and desserts, where they enhance flavor, texture, and premium appeal. The continued premiumization of baked goods and indulgent confectionery products globally has reinforced the leading position of this segment.

Snacks and bars represent a significant and steadily expanding application segment, driven by on-the-go consumption patterns, demand for protein-rich snacks, and clean-label reformulation trends. Nut-based snack bars, trail mixes, and nut butter snacks are gaining popularity across both developed and emerging markets, supported by rising health awareness and convenience-driven lifestyles. Dairy alternatives are the fastest-growing application segment for nut ingredients, fueled by strong growth in plant-based milk, yogurt, cheese, and ice cream products. Almond and cashew ingredients are particularly prominent in this segment, as they offer desirable taste, texture, and nutritional benefits while aligning with vegan and lactose-free consumer preferences.

Distribution Channel Insights

Direct B2B supply is the dominant distribution channel, accounting for approximately 46% of global nut ingredient sales. Large food and beverage manufacturers prefer direct sourcing from nut processors to ensure consistent quality, traceability, supply reliability, and pricing stability through long-term contracts. This channel is particularly important for high-volume applications such as bakery, snacks, and dairy alternatives. Ingredient distributors play a critical role in serving small and mid-sized food manufacturers, offering flexibility, lower minimum order quantities, and access to a wide portfolio of nut ingredients. Distributors also support regional reach and enable penetration into niche and specialty food segments.

Online ingredient platforms are gaining traction, especially among artisanal, specialty, and emerging food brands. These platforms provide transparent pricing, product customization, and access to specialty nut ingredients that may not be readily available through traditional channels. Private-label and contract manufacturing arrangements are expanding as food brands increasingly outsource nut processing activities. This allows companies to focus on formulation, branding, and market expansion while leveraging the technical expertise and scale efficiencies of specialized nut processors.

| By Product Type | By Ingredient Form | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 34% of the global nut ingredients market in 2025, led by the United States. The region’s dominance is driven by strong consumption of almond, peanut, and walnut ingredients across bakery, snacks, functional foods, and dairy alternatives. High consumer awareness of health and wellness, coupled with early adoption of plant-based diets, has accelerated demand for nut-based proteins and oils. Additionally, North America benefits from advanced processing infrastructure, strong domestic nut production, and innovation-driven food manufacturers, supporting consistent growth and product diversification.

Europe

Europe holds around 26% of the global market share, with Germany, France, Italy, and the U.K. serving as major demand centers. The region’s growth is driven by strong consumption of hazelnut and almond ingredients in confectionery and bakery applications, particularly premium chocolates and spreads. European consumers exhibit a strong preference for clean-label, organic, and sustainably sourced ingredients, encouraging manufacturers to invest in certified and traceable nut ingredient supply chains. Regulatory emphasis on food quality and sustainability further reinforces demand for high-value nut ingredients.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR of nearly 7.9%. China and India are key growth engines, driven by the rapid expansion of food processing industries, rising disposable incomes, and increasing protein consumption among urban populations. Growing adoption of Western-style bakery products, snacks, and dairy alternatives is accelerating nut ingredient demand. Japan and South Korea contribute steady growth through premium confectionery and functional food applications, while increasing investments in domestic processing capacity are strengthening regional supply chains.

Latin America

Latin America accounts for approximately 9% of global demand, led by Brazil and Mexico. Regional growth is supported by expanding domestic food industries, rising snack consumption, and export-oriented nut processing activities, particularly for almonds and peanuts. Increasing urbanization and improving retail penetration are also contributing to higher consumption of packaged foods containing nut ingredients.

Middle East & Africa

The Middle East & Africa region represents around 7% of the global nut ingredients market. Turkey and South Africa are major contributors, driven by confectionery manufacturing, bakery production, and growing snack consumption. Rising urban populations, increasing disposable incomes, and the gradual expansion of packaged food industries are supporting demand growth. In addition, the Middle East benefits from strong import demand for premium nut ingredients used in desserts, sweets, and luxury food products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Nut Ingredients Market

- Blue Diamond Growers

- Olam Group

- Barry Callebaut

- Archer Daniels Midland (ADM)

- John B. Sanfilippo & Son

- Kerry Group

- Ingredion

- Borges Agricultural & Industrial Nuts

- Mariani Nut Company

- Treehouse Almonds

- Royal Nut Company

- Wonderful Pistachios & Almonds

- Savencia Ingredients

- Louis Dreyfus Company

- SunOpta