Nisin Market Size

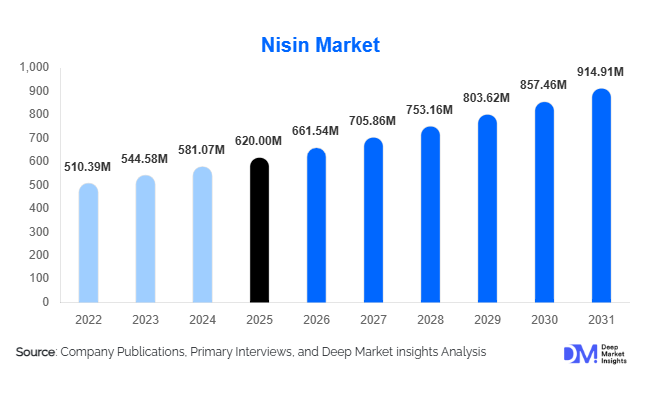

According to Deep Market Insights, the global nisin market size was valued at USD 620 million in 2025 and is projected to grow from USD 661.54 million in 2026 to reach USD 914.91 million by 2031, expanding at a CAGR of 6.7% during the forecast period (2026–2031). The market growth is primarily driven by increasing demand for natural food preservatives, tightening global food safety regulations, and the accelerating shift toward clean-label reformulation across dairy, meat, and ready-to-eat food categories.

Nisin, a bacteriocin produced through controlled fermentation, is widely used as a natural antimicrobial agent effective against Gram-positive bacteria such as Listeria monocytogenes. With growing consumer scrutiny over synthetic additives, food manufacturers are actively replacing traditional chemical preservatives with bio-based alternatives. Regulatory approvals across North America, Europe, and Asia-Pacific have strengthened its commercial adoption. Beyond food processing, emerging applications in pharmaceuticals, cosmetics, and animal nutrition are gradually diversifying the revenue base. Improvements in fermentation efficiency, purification technologies, and encapsulation systems are enhancing yield economics and enabling premium-grade production, positioning the nisin market for stable mid-single-digit growth through 2031.

Key Market Insights

- Food & beverage processing accounts for nearly 78% of total market demand, led by dairy and processed meat applications.

- Powdered nisin dominates with approximately 72% market share, due to longer shelf life and easier integration into dry blends.

- Asia-Pacific holds the largest regional share at around 32%, driven by China and India’s expanding food export sectors.

- High-purity (≥95%) grades represent nearly 48% of global revenue, supported by stringent safety standards and premium formulations.

- The top five companies control approximately 60% of the global supply, indicating moderate consolidation.

- Clean-label reformulation and export-driven food production are the strongest long-term structural growth drivers.

What are the latest trends in the nisin market?

Clean-Label Reformulation Accelerating Adoption

Global food brands are actively reformulating products to eliminate synthetic preservatives such as benzoates and sorbates. Retailers and regulatory authorities increasingly require transparent ingredient labeling, boosting demand for natural antimicrobials like nisin. Premium dairy, plant-based foods, and organic processed meat segments are particularly driving adoption. Manufacturers are developing synergistic preservative blends combining nisin with organic acids to expand the antimicrobial spectrum and improve cost-efficiency. This trend is strengthening long-term structural demand, particularly in North America and Europe, where clean-label penetration exceeds 65% of new product launches.

Advancements in Fermentation & Encapsulation Technologies

Technological improvements in strain engineering, bioreactor optimization, and downstream purification are increasing yield efficiency and reducing unit production costs. Encapsulated nisin solutions are being introduced to improve stability under varying pH and temperature conditions. These innovations are enabling broader applications in beverages and ready-to-eat meals, segments that historically faced stability limitations. Automation in fermentation facilities across China and Europe is further improving margin structures, supporting competitive pricing while maintaining product purity standards.

What are the key drivers in the nisin market?

Stringent Food Safety Regulations

Global regulatory bodies have tightened microbial contamination limits in processed foods, particularly for dairy, canned foods, and meat exports. Compliance with international export standards is encouraging processors in emerging economies to adopt reliable antimicrobial systems. Nisin’s established regulatory approval and safety profile make it a preferred solution in pathogen-control strategies.

Growth in Processed & Ready-to-Eat Foods

Urbanization and lifestyle changes are expanding global consumption of packaged and convenience foods. The processed food industry, growing at approximately 5–6% annually, directly supports antimicrobial ingredient demand. Expanding dairy processing capacity in Asia-Pacific and Latin America is further stimulating baseline consumption levels.

What are the restraints for the global market?

High Production Costs

Nisin production requires controlled fermentation infrastructure and energy-intensive purification processes. Fluctuations in raw material and energy prices directly impact manufacturing margins, especially for smaller producers.

Limited Antimicrobial Spectrum

Nisin is primarily effective against Gram-positive bacteria, limiting standalone usage in certain applications. Manufacturers often combine it with complementary preservative systems, increasing formulation complexity and overall costs.

What are the key opportunities in the nisin industry?

Emerging Asia & Latin America Expansion

Rapid growth in processed food exports from India, Brazil, Thailand, and Mexico presents strong localization opportunities. Establishing regional fermentation plants can reduce logistics costs and improve supply reliability.

Pharmaceutical & Biomedical Applications

Research into nisin’s antimicrobial role in wound care, oral hygiene, and drug delivery systems is expanding. Rising antibiotic resistance concerns globally are encouraging bacteriocin research, potentially unlocking high-margin pharmaceutical-grade demand.

Product Form Insights

Powdered nisin accounts for approximately 72% of global revenue in 2025, maintaining its position as the dominant product form across industrial applications. The leading driver behind this dominance is its superior storage stability and extended shelf life, which significantly reduces spoilage risk during long-distance transportation and bulk storage. Powdered nisin integrates seamlessly into dry-blend systems used in processed cheese, powdered dairy mixes, seasoning premixes, and meat marinades. Additionally, food manufacturers prefer powder due to its ease of dosage standardization in automated processing lines, improving production efficiency and minimizing formulation errors.

Liquid formulations hold a smaller but steadily growing share, particularly in beverage preservation, ready-to-drink products, and pharmaceutical suspensions, where uniform dispersion and rapid solubility are critical. Growth in liquid nisin is being supported by rising demand in high-moisture foods and specialized antimicrobial pharmaceutical formulations. However, stability limitations and shorter shelf life compared to powder continue to favor powdered formats in large-scale food manufacturing.

Purity Grade Insights

High-purity (≥95%) nisin leads the market with nearly 48% share in 2025, primarily driven by stringent global food safety regulations and the expansion of premium food and pharmaceutical applications. The key growth driver for this segment is the increasing need for consistent antimicrobial efficacy and regulatory compliance in export-oriented food production. High-purity grades provide reliable inhibition of Gram-positive bacteria at lower inclusion rates, improving cost-efficiency despite higher upfront pricing.

Mid-range purity grades (90–94%) cater to cost-sensitive bulk applications in processed foods where regulatory requirements are less stringent. Lower-purity grades serve limited industrial uses but are gradually losing share as manufacturers standardize toward higher-performance formulations. The trend toward clean-label and pharmaceutical adoption continues to structurally favor high-purity variants.

Application Insights

Dairy products represent approximately 34% of total global market demand, making them the leading application segment. The primary driver for dairy dominance is the high susceptibility of processed cheese, yogurt, and milk-based beverages to microbial spoilage. Rising global dairy exports and increasing consumption of packaged dairy products in Asia-Pacific and North America further strengthen this segment’s leadership.

Meat, poultry, and seafood follow closely, supported by pathogen-control requirements and international export compliance. The increasing incidence of foodborne illness recalls has accelerated antimicrobial adoption in processed meats. Bakery, canned foods, and beverages collectively represent a stable secondary demand base. Pharmaceutical applications, while currently smaller in share, are growing at approximately 8–9% annually, driven by research into bacteriocin-based antimicrobial systems and antibiotic-resistance mitigation strategies.

Distribution Channel Insights

Direct B2B sales dominate the market with nearly 65% share, as multinational food processors prefer long-term procurement contracts to ensure supply security, quality traceability, and price stability. The leading driver of this channel is the integration of nisin procurement into large-scale ingredient sourcing agreements by dairy and meat conglomerates. Specialty ingredient distributors serve mid-sized manufacturers lacking direct import capabilities, particularly in emerging economies. Online bulk platforms are expanding gradually, mainly for research institutions, small-scale processors, and niche cosmetic manufacturers. However, given the technical nature of antimicrobial formulation, direct supplier relationships remain the most preferred model globally.

End-Use Industry Insights

The food & beverage processing industry remains the largest end-use segment, accounting for roughly 78% of total revenue in 2025. The primary driver is the global expansion of processed and ready-to-eat food consumption, particularly in urban markets. Increasing private-label product launches and export-focused dairy production are reinforcing structural demand. Pharmaceutical manufacturing, though representing approximately 8–10% share, is the fastest-growing end-use segment due to rising antimicrobial resistance concerns and growing research investment in bacteriocin-based therapeutics. Animal nutrition and cosmetic manufacturing are emerging applications, supported by demand for natural feed preservatives and preservative-free personal care formulations. As clean-label standards expand beyond food, cross-industry demand for bio-based antimicrobials is expected to strengthen further.

| By Product Form | By Purity Grade | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global nisin market with approximately 32% share in 2025, making it the largest regional market. China alone accounts for nearly 18% of global demand, supported by its extensive fermentation capacity, large dairy processing sector, and strong export orientation. A major regional growth driver is the rapid expansion of packaged dairy and meat exports to Western markets, requiring compliance with international food safety standards. India is the fastest-growing country in the region, expanding at close to 8% CAGR, driven by the modernization of food processing infrastructure, government-backed food parks, and export compliance mandates. Southeast Asian nations are also witnessing increased antimicrobial adoption due to rising urban packaged food consumption.

North America

North America holds around 28% of global revenue, led by the United States. The primary growth driver in this region is the high penetration of clean-label products and strict regulatory enforcement of food safety standards. U.S. dairy and processed meat industries are mature but continue to reformulate products toward natural preservatives. Additionally, increasing demand for organic and minimally processed foods supports premium-grade nisin adoption. Canada contributes through dairy exports and government-backed food safety initiatives, further stabilizing regional demand.

Europe

Europe represents approximately 26% of the global market. Germany, France, the UK, and the Netherlands are key demand centers due to their advanced dairy processing industries and strong regulatory alignment with natural preservative usage. The main driver in Europe is the stringent EU food additive regulations combined with high consumer awareness regarding ingredient transparency. Europe also demonstrates strong adoption in premium cheese production, contributing significantly to high-purity nisin demand.

Latin America

Latin America accounts for roughly 8% of the global share, led by Brazil and Mexico. The primary driver in this region is the expansion of meat exports and the modernization of food processing facilities to meet U.S. and European safety standards. As export volumes increase, antimicrobial compliance becomes critical, strengthening nisin demand. Infrastructure investments in cold chain logistics and industrial processing are further supporting growth.

Middle East & Africa

The Middle East & Africa region contributes approximately 6% of total demand. Growth is primarily driven by food import substitution strategies and increasing domestic packaged food production, particularly in GCC countries such as Saudi Arabia and the UAE. Governments are investing in food security initiatives and local dairy processing plants, indirectly boosting antimicrobial ingredient demand. In Africa, gradual industrialization of food processing and rising urban consumption are creating long-term growth potential, although infrastructure limitations moderate short-term expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Nisin Market

- Koninklijke DSM N.V.

- DuPont

- Kerry Group

- Chr. Hansen Holding A/S

- Fufeng Group

- Shandong Freda Biotechnology

- Chihon Biotechnology

- Galactic

- Handary

- Siveele

- Danisco

- Zhejiang Silver-Elephant Bioengineering

- Angel Yeast Co., Ltd.

- Meihua Holdings Group

- Other regional fermentation specialists