Network Security Appliances Market Size

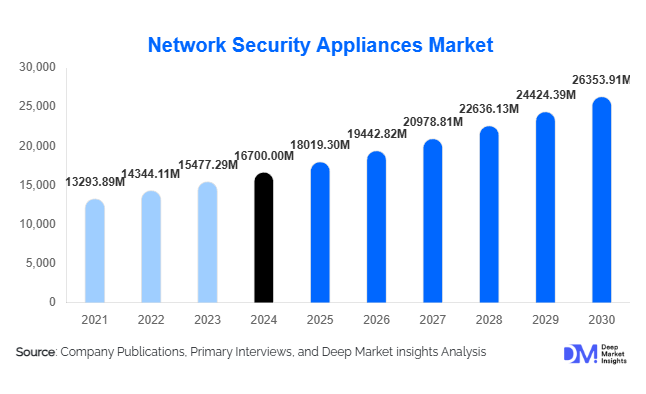

According to Deep Market Insights, the global network security appliances market size was valued at USD 16,700 million in 2024 and is projected to grow from USD 18,019.30 million in 2025 to USD 26,353.91 million by 2030, expanding at a CAGR of 7.9% during 2025–2030. Escalating cyber threats, accelerated digital transformation, growth of hybrid and multi-cloud environments, plus rising demand for branch/edge protection and SASE-ready appliances are the primary growth drivers of this market.

Key Market Insights

- Firewall appliances (including Next-Gen Firewalls) remain the largest product segment, reflecting their foundational role in perimeter protection, segmentation and NGFW refresh cycles across enterprises and service providers.

- Hybrid deployments (on-premises + virtual/cloud appliances) dominate adoption strategies, as organisations seek consistent policy enforcement across data centres, cloud workloads and distributed branches.

- North America holds the largest regional share, driven by substantial enterprise cybersecurity budgets, regulatory enforcement and a high concentration of large organisations and service providers.

- Asia-Pacific is the fastest-growing region, with China, India and Southeast Asia expanding spend due to digitalisation, telecom upgrades and localisation of security capabilities.

- SMBs and branch/edge deployments are rapidly expanding, creating demand for compact, cloud-managed appliances and subscription pricing models targeted at remote sites and distributed workforces.

- AI/ML, automation and threat-intelligence integration are reshaping appliance feature sets, improving detection accuracy, reducing false positives and enabling automated remediation workflows.

What are the latest trends in the network security appliances market?

Convergence to SASE and Secure Edge Architectures

Vendors are converging traditional network security appliances with cloud-native security services under SASE and secure-edge frameworks. This convergence enables unified policy enforcement, consolidated management, and secure access for remote users and cloud workloads. Appliances are increasingly offered as part of hybrid stacks, on-device enforcement with cloud orchestration and analytics, to meet distributed security requirements.

AI/ML and Automation Embedded in Appliance Stacks

AI/ML-driven detection engines, behavioural analytics and automated response capabilities are being embedded in appliances or offered as tightly coupled cloud services. These enhancements improve threat triage, prioritisation and automated containment, which helps organisations reduce mean time to detect and respond while lowering operational overhead for security teams.

What are the key drivers in the network security appliances market?

Escalation in Cyber Threats and Ransomware Activity

The rising volume and sophistication of cyberattacks (APT campaigns, supply-chain intrusions and ransomware) compel organisations to invest in inline prevention and deep inspection appliances. Enterprises prioritise appliances that combine signature-based, behavioural and threat-intelligence capabilities to reduce exposure and protect critical assets.

Regulatory and Compliance Pressure

Stricter data-protection and industry-specific regulations drive deployment of appliances that enable segmentation, logging, inspection and auditability. Financial services, healthcare and critical infrastructure sectors, in particular, invest heavily in network security appliances to demonstrate compliance and reduce regulatory risk.

Distributed IT Environments and Remote Work

Hybrid work models, remote branch offices, IoT/OT deployments and multi-cloud architectures expand the network attack surface. Organisations are deploying appliances at branch edges, cloud ingress points and OT/ICS boundaries to ensure consistent security controls and reliable connectivity for distributed users and devices.

What are the key challenges in the global industry

High Total Cost of Ownership and Operational Complexity

Capital costs for appliances, perpetual licence models, recurring subscriptions for threat intelligence and the need for skilled staff to manage rule sets and updates increase TCO. Complex policy orchestration across multiple appliance types and locations can slow deployments and deter cost-sensitive buyers, particularly SMEs.

Migration to Cloud-Native and Managed Security Models

As organisations adopt cloud-native security services and SASE, some use cases move away from legacy hardware appliances. Vendors that fail to deliver virtualised/cloud-native equivalents and managed services risk losing share as customers prefer flexible, software-centric security consumption models.

What are the key opportunities in the network security appliances industry?

Rapid Growth in Edge & Branch Security

The expansion of branch offices, retail networks and edge compute sites is fueling demand for compact, ruggedised and cloud-managed appliances that offer zero-touch provisioning, centralized policy management and subscription pricing. Vendors that simplify deployment and management for distributed sites can quickly scale across midmarket and SMB segments.

Managed Detection & Response (MDR) and Subscription Offerings

Integrating appliance telemetry with MDR services, threat-intelligence feeds and automated playbooks creates recurring revenue streams and addresses the skills gap in many organisations. Vendors bundling appliances with managed services capture higher lifetime value and appeal to customers preferring outsourced security operations.

Industrial (OT/ICS) and Critical-Infrastructure Protection

Industrial environments require appliances tailored to OT/ICS protocols, deterministic performance and minimal operational disruption. Vendors offering certified, OT-aware appliances and managed services for industrial networks can access an under-penetrated market with high security requirements and long replacement cycles.

Product Type Insights

Firewall appliances (including next-generation firewalls) dominate the product landscape by value and volume, reflecting frequent refresh cycles and central role in segmentation and perimeter policy enforcement. IDPS/IPS and Unified Threat Management (UTM) appliances remain significant in SMB and midmarket deployments. Virtual/virtualised appliance forms and cloud gateway appliances are the fastest-growing product types, as organisations demand flexible deployment options for cloud and branch protections.

Application Insights

Perimeter defense, internal segmentation and secure remote access are the most common applications for network security appliances. Secure web gateway (SWG) and threat prevention functions are increasingly bundled into single appliances to reduce vendor sprawl and simplify policy management. Appliances are also being used for encrypted traffic inspection and east-west micro-segmentation in modern datacenter and cloud environments.

Distribution Channel Insights

Direct enterprise sales and channel partners/VARs remain the primary routes for large deals and complex rollouts. Cloud marketplaces and online procurement channels are gaining prominence for virtual appliances and subscription services. MSSPs and managed service providers are crucial channels for SMEs and organisations seeking fully outsourced security operations and monitoring capabilities.

| Product Type | Deployment Type | Organization Size | End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America continues to lead the global network security appliances market, commanding approximately 40% share in 2024. The region’s dominance stems from large enterprise spending, stringent regulatory frameworks, and a high concentration of technology companies and service providers. The United States is the primary contributor, with significant investments from financial services, healthcare, technology and government sectors. Despite market maturity, ongoing digital transformation and cybersecurity modernization initiatives are expected to sustain steady growth through 2030, particularly in sectors requiring advanced detection and compliance capabilities.

Asia-Pacific

The Asia-Pacific (APAC) region represents the fastest-growing market, with an estimated 20% share in 2024 and a projected double-digit CAGR through 2030. Rapid digitalisation, expansion of telecom infrastructure (including 5G), and increased cybersecurity budgets in China, India, Japan and Southeast Asia are driving demand. Government initiatives on data localisation, national cybersecurity strategies, and expansive branch/edge rollouts are propelling appliance adoption across enterprise and public sectors.

Europe

Europe accounted for around 22% of the global market in 2024, led by the UK, Germany, France and the Nordics. GDPR and national security strategies drive adoption of advanced appliances that provide logging, segmentation and inspection. Regulatory compliance, strong banking and telecommunications sectors, and increasing focus on home-grown security solutions sustain demand, albeit at a moderate growth pace compared to APAC.

Latin America

Latin America currently holds a 8% share of the global market in 2024, with Brazil and Mexico leading regional investments. Growth is driven by fintech expansion, telecom upgrades and an increasing need for enterprise-grade security. Although infrastructure and budget constraints persist, nearshoring trends and improving cloud adoption are increasing demand for next-gen appliances.

Middle East & Africa

The Middle East & Africa (MEA) region represents approximately 6% of the global market in 2024 and is evolving rapidly. The UAE, Saudi Arabia and South Africa lead regional investments through national digital initiatives and critical-infrastructure protection programs. With increasing submarine cable deployments, renewable energy projects and government cybersecurity strategies, MEA is expected to register strong growth from a smaller base through 2030.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Network Security Appliances Market

- Fortinet

- Palo Alto Networks

- Cisco Systems

- Check Point Software Technologies

- Juniper Networks

- Sophos

- Trend Micro

- McAfee

- Forcepoint

- F5 Networks

- Huawei Technologies

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- SonicWall

- Barracuda Networks

Recent Developments

-

At the 2025 Cisco Partner Summit, Cisco introduced new AI-driven security innovations, including enhanced Security Cloud Control tailored for managed service providers (MSPs). These updates aim to simplify policy management, strengthen threat detection, and provide unified visibility across hybrid and multi-cloud environments.