Natural Sweeteners Market Size

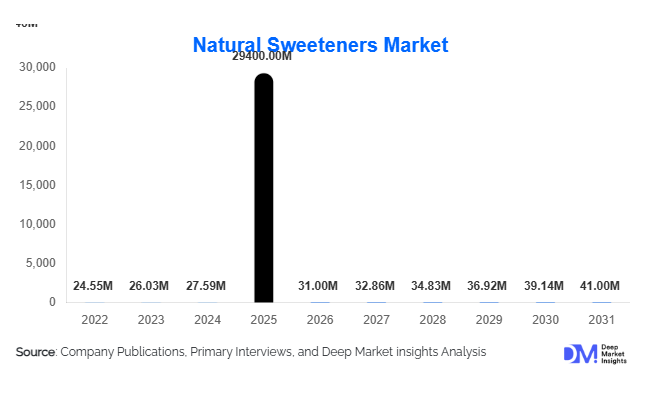

According to Deep Market Insights, the global natural sweeteners market size was valued at USD 29,400 million in 2025 and is projected to grow from USD 31,164.00 million in 2026 to reach USD 41,704.46 million by 2031, expanding at a CAGR of 6.0% during the forecast period (2026–2031). The natural sweeteners market growth is primarily driven by rising consumer preference for clean-label ingredients, increasing prevalence of diabetes and obesity, and global regulatory pressure to reduce refined sugar consumption in processed foods and beverages.

Natural sweeteners, including stevia, monk fruit, natural sugar alcohols, honey, agave nectar, and other plant-derived alternatives, are increasingly replacing artificial sweeteners and traditional sugar across beverages, dairy, bakery, nutraceuticals, and pharmaceutical formulations. Reformulation initiatives by major beverage and food manufacturers, combined with sugar taxation policies across North America, Europe, and parts of Asia-Pacific, are structurally accelerating demand. Advancements in fermentation-based production and glycoside extraction technologies are also improving taste profiles and cost efficiency, supporting broader industrial adoption.

Key Market Insights

- Stevia-based sweeteners dominate the market with nearly 34% share in 2025, driven by strong regulatory approvals and widespread beverage reformulation.

- Beverages represent the largest application segment (30%), fueled by rapid growth in zero-sugar and low-calorie drinks.

- North America accounts for approximately 32% of global demand, supported by sugar reduction mandates and strong consumer health awareness.

- Asia-Pacific is the fastest-growing region (7.5% CAGR), led by China and India due to rising diabetes prevalence and expanding food processing industries.

- Direct B2B industrial sales account for over 60% of total revenues, reflecting bulk procurement by multinational food & beverage manufacturers.

- Fermentation-based and precision biotech sweeteners are reshaping cost structures, improving scalability, and reducing agricultural dependency risks.

What are the latest trends in the natural sweeteners market?

Fermentation-Derived Sweeteners Scaling Rapidly

Biotechnology and precision fermentation are transforming the production of high-purity steviol glycosides (such as Reb M and Reb D) and naturally derived allulose. These methods reduce reliance on agricultural yields, improve sweetness quality, and minimize bitter aftertaste, historically a key barrier for stevia adoption. Companies are investing in fermentation facilities to stabilize supply chains and lower production costs. This trend is particularly strong in North America and China, where ingredient manufacturers are building integrated biotech capabilities to support beverage and dairy reformulation at scale.

Clean Label & Blended Sweetener Formulations

Food manufacturers are increasingly adopting blended sweetener systems that combine stevia, monk fruit, erythritol, and natural syrups to optimize taste and functionality. These blends improve mouthfeel, reduce bitterness, and enhance thermal stability in bakery and dairy applications. Clean-label positioning, “plant-based,” “non-GMO,” and “no artificial additives”, is becoming a core marketing differentiator. Retail demand for packaged natural tabletop sweeteners is also rising, especially through e-commerce channels and specialty health stores.

What are the key drivers in the natural sweeteners market?

Global Sugar Reduction Policies

Governments worldwide are implementing sugar taxes and labeling mandates to combat obesity and diabetes. Countries such as the U.S., UK, Mexico, and Saudi Arabia have introduced fiscal measures that incentivize food and beverage manufacturers to reduce sugar content. Natural sweeteners provide a scalable and regulatory-compliant alternative, driving consistent B2B demand across carbonated beverages, flavored waters, dairy products, and confectionery.

Rising Health & Wellness Awareness

Growing global diabetes prevalence, exceeding 530 million adults, has intensified demand for low-glycemic and zero-calorie alternatives. Consumers increasingly associate artificial sweeteners with health concerns, further shifting preference toward plant-derived options. The expanding nutraceutical and dietary supplement markets are also incorporating natural sweeteners into protein powders, gummies, and functional drinks.

What are the restraints for the global market?

Taste & Functional Limitations

Despite advancements, certain natural sweeteners still exhibit aftertaste or require blending to achieve sugar-like sensory profiles. This increases formulation complexity and cost for manufacturers.

Raw Material & Agricultural Volatility

Stevia and monk fruit cultivation are geographically concentrated, particularly in China and South America. Weather fluctuations, labor costs, and export policies can impact pricing stability and supply continuity.

What are the key opportunities in the natural sweeteners industry?

Expansion in Emerging Asian & Middle Eastern Markets

Rapid urbanization, rising disposable income, and growing packaged food industries in India, Indonesia, the UAE, and Saudi Arabia present high-growth opportunities. Increasing diabetes awareness in these regions is boosting institutional demand for low-calorie ingredients.

Pharmaceutical & Pediatric Applications

Natural sweeteners are gaining traction in cough syrups, chewable tablets, and pediatric formulations where taste masking is critical. As regulatory bodies encourage reduced sugar use in medicines, pharmaceutical-grade natural sweeteners are expected to witness rising adoption.

Product Type Insights

Stevia-based sweeteners lead the global market with approximately 34% share in 2025, primarily driven by widespread regulatory approvals across North America, Europe, and Asia-Pacific, along with aggressive reformulation initiatives in the beverage sector. High-purity steviol glycosides such as Reb M and Reb D have significantly improved taste profiles, reducing bitterness and enabling higher inclusion rates in carbonated drinks, flavored waters, dairy beverages, and tabletop sweeteners. The scalability of stevia cultivation, particularly in China and parts of South America, combined with advancements in fermentation-based production, has strengthened supply reliability and cost competitiveness, reinforcing its leadership position.

Natural sugar alcohols, especially erythritol, maintain a strong foothold in sugar-free confectionery, chewing gum, bakery, and diabetic-friendly foods due to their bulk properties and sugar-like mouthfeel. Their functional compatibility in baking and heat stability supports continued demand in processed food reformulation. Monk fruit extract is emerging as a high-growth segment, supported by premium clean-label positioning and increasing use in blended sweetener systems. Meanwhile, honey and natural syrups (agave, maple, coconut sugar syrup) continue to demonstrate stable demand in bakery, sauces, breakfast cereals, and retail packaged applications, driven by consumer perception of minimally processed and traditional sweetening solutions.

Application Insights

Beverages dominate the natural sweeteners market with nearly 30% share, serving as the primary growth engine. Zero-sugar carbonated soft drinks, functional beverages, energy drinks, flavored waters, and RTD teas are increasingly reformulated to meet sugar reduction targets of 20–50%. Beverage manufacturers favor natural sweeteners for their high sweetness intensity and regulatory acceptance, making this segment the most commercially scalable.

The processed food industry accounts for approximately 36% of total end-use demand, led by bakery, snacks, breakfast cereals, and dairy desserts. Reformulation strategies aimed at front-of-pack labeling compliance and calorie reduction are key drivers. Additionally, nutraceuticals and dietary supplements are expanding at above 7% CAGR, supported by strong demand for protein powders, gummies, functional beverages, and diabetic-friendly formulations. Pharmaceutical syrups and chewables are also increasingly adopting natural sweeteners to comply with sugar-free mandates.

Distribution Channel Insights

Direct industrial B2B sales represent roughly 62% of global revenues, reflecting large-scale procurement contracts between ingredient manufacturers and multinational food & beverage companies. Long-term supply agreements, customized blends, and application-specific formulations characterize this channel. Bulk supply stability and pricing competitiveness are critical differentiators in B2B relationships. The retail packaged segment is expanding steadily, supported by supermarkets, hypermarkets, specialty health stores, and online platforms. Growing consumer awareness of low-calorie diets and keto-friendly products is boosting tabletop sweetener sales. Meanwhile, foodservice and HORECA channels are gradually integrating natural sweeteners into beverages, desserts, and quick-service restaurant menus as operators respond to consumer demand for reduced-calorie options.

End-Use Industry Insights

The global beverage industry, valued at over USD 1.4 trillion, remains the largest consumer of natural sweeteners, driven by sustained innovation in zero-sugar and functional drink categories. The health & wellness industry, including protein supplements, fortified snacks, and functional foods, is the fastest-growing end-use segment, benefiting from strong consumer preference for clean-label and plant-based ingredients. Pharmaceutical applications are witnessing a gradual but steady expansion as regulators and healthcare providers advocate sugar-free medicinal formulations, particularly for pediatric and diabetic populations.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest regional market, accounting for approximately 32% of global demand. The United States drives the majority of consumption due to structured sugar taxation in select states, strong FDA approvals for stevia and monk fruit, and aggressive sugar reduction targets by leading beverage brands. Rising obesity rates and heightened consumer awareness of clean-label products further stimulate retail demand. Canada complements regional growth with increasing adoption in dairy, plant-based beverages, and nutraceutical applications. Strong R&D infrastructure and investment in fermentation-based sweetener production also reinforce North America's leadership.

Europe

Europe holds nearly 27% of global revenues, led by Germany, the United Kingdom, and France. The region’s growth is driven by stringent labeling regulations, front-of-pack nutrition scoring systems, and government-led sugar reduction initiatives. Consumer preference for natural and non-GMO ingredients strongly supports demand for stevia and natural syrups. Additionally, rising vegan and plant-based product launches across Western Europe are integrating natural sweeteners as core formulation components. Eastern Europe is emerging as a secondary growth cluster due to expanding processed food industries.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at approximately 7.5% CAGR. China dominates as the world’s largest producer and exporter of stevia extracts, benefiting from established agricultural supply chains and export-driven manufacturing. Domestic demand in China is also rising due to increasing diabetes prevalence and urban dietary shifts. India represents a high-potential growth market supported by a rapidly expanding packaged food sector and government-led health awareness campaigns. Japan remains a mature adopter of natural sweeteners, particularly in beverages and functional foods. Expanding middle-class populations and growing health awareness across Southeast Asia further accelerate regional growth.

Latin America

Latin America is experiencing moderate growth, led by Mexico and Brazil. Mexico’s sugar tax framework has incentivized beverage reformulation, significantly boosting demand for stevia-based sweeteners. Brazil’s large food processing sector supports adoption across dairy and bakery categories. Paraguay remains strategically important as a major stevia cultivation hub, strengthening export volumes to North America and Europe. Regional trade agreements and agricultural investments continue to enhance production capacity.

Middle East & Africa

The Middle East & Africa region is gradually expanding, driven by Saudi Arabia and the UAE. Sugar taxation policies and rising premium beverage consumption are the primary growth drivers. Increasing lifestyle-related diseases in Gulf countries are prompting food manufacturers to introduce reduced-calorie alternatives. In Africa, South Africa leads in processed food reformulation, while improving urban retail infrastructure supports the gradual adoption of natural sweeteners across major metropolitan markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Natural Sweeteners Market

- Cargill

- Archer Daniels Midland

- Ingredion

- Tate & Lyle

- Roquette

- GLG Life Tech

- PureCircle

- Ajinomoto

- Sweegen

- Whole Earth Brands

- Wilmar International

- Pyure Brands

- Lakanto

- Now Foods

- Naturex