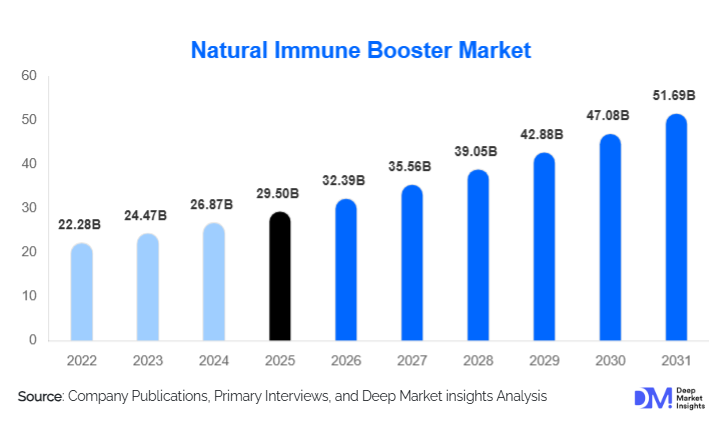

Natural Immune Booster Market Size

According to Deep Market Insights, the global natural immune booster market size was valued at USD 29.5 billion in 2025 and is projected to grow from USD 32.39 billion in 2026 to reach USD 51.69 billion by 2031, expanding at a CAGR of 9.8% during the forecast period (2026–2031). The market growth is primarily driven by rising consumer awareness of preventive healthcare, an increasing preference for plant-based and clean-label supplements, and a long-term shift toward immunity-focused daily nutrition across both developed and emerging economies.

Key Market Insights

- Herbal and botanical supplements dominate the natural immune booster market due to strong consumer trust in traditional and plant-based remedies.

- Preventive healthcare applications account for the largest share, as immune boosters are increasingly consumed for daily wellness rather than episodic illness recovery.

- North America leads the global market in value terms, supported by high per-capita spending on dietary supplements.

- Asia-Pacific is the fastest-growing region, driven by traditional medicine adoption, urbanization, and rising disposable incomes in China and India.

- Online and direct-to-consumer channels are expanding rapidly, reshaping distribution dynamics and improving consumer access.

- Technological advancements in formulation and bioavailability are enabling premium pricing and product differentiation.

What are the latest trends in the natural immune booster market?

Shift Toward Plant-Based and Clean-Label Formulations

Consumers are increasingly prioritizing transparency, safety, and sustainability in health supplements, accelerating demand for plant-based and clean-label immune boosters. Products free from artificial additives, allergens, and synthetic preservatives are gaining preference across age groups. Botanical ingredients such as elderberry, turmeric, echinacea, and ashwagandha are witnessing strong uptake, supported by traditional usage and growing clinical validation. Organic certifications, non-GMO claims, and sustainably sourced raw materials are becoming key differentiators, particularly in premium product segments.

Rising Adoption of Probiotics and Functional Ingredients

Probiotics, prebiotics, and functional natural ingredients such as beta-glucans and medicinal mushrooms are emerging as high-growth segments within the market. Scientific evidence linking gut health to immune function has driven consumer acceptance of microbiome-focused immunity solutions. Manufacturers are investing in advanced fermentation, encapsulation, and delivery technologies to improve stability and absorption, expanding applications across preventive healthcare, sports nutrition, and clinical nutrition.

What are the key drivers in the natural immune booster market?

Growing Emphasis on Preventive Healthcare

Preventive healthcare has become a central driver of demand for natural immune boosters. Consumers are increasingly incorporating immune-support supplements into daily routines to reduce long-term health risks and medical costs. Employers, insurers, and governments are also promoting self-care and wellness initiatives, indirectly supporting sustained demand for immunity-enhancing products.

Aging Population and Lifestyle-Related Health Concerns

The expanding global geriatric population is significantly boosting demand for immune-support products. Older adults are more vulnerable to infections and chronic conditions, leading to higher consumption of vitamins, minerals, and botanical supplements. Additionally, rising stress levels, poor dietary habits, and sedentary lifestyles among working-age populations are reinforcing the need for immune resilience solutions.

What are the restraints for the global market?

Regulatory Fragmentation Across Regions

The natural immune booster market faces challenges due to varying regulatory frameworks for dietary supplements across countries. Differences in ingredient approvals, health claims, and labeling requirements increase compliance costs and delay product launches, particularly for companies operating across multiple regions.

Raw Material Price Volatility

Many immune booster products rely on agricultural and natural raw materials, making them vulnerable to climate variability, supply chain disruptions, and seasonal availability. Price fluctuations for herbal extracts and specialty botanicals can impact profit margins and pricing stability, especially for mid-sized manufacturers.

What are the key opportunities in the natural immune booster industry?

Personalized and Precision Nutrition Solutions

The integration of personalized nutrition into immune health represents a major growth opportunity. Advances in health diagnostics, microbiome analysis, and digital wellness platforms are enabling customized immune formulations tailored to age, lifestyle, and health conditions. Subscription-based personalized immunity products offer higher margins and long-term customer retention.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East present strong growth potential due to rising middle-class populations, increasing health awareness, and cultural acceptance of natural remedies. Government initiatives promoting traditional medicine and preventive healthcare are further accelerating market penetration in these regions.

Product Type Insights

Herbal and botanical supplements account for the largest share of the natural immune booster market, contributing approximately 38% of total revenue in 2025. Vitamin-based immune boosters, particularly formulations of vitamin C and vitamin D, represent a significant portion of mainstream consumption due to their affordability and widespread clinical acceptance. Probiotics and functional ingredients, while smaller in share, are the fastest-growing product categories, driven by scientific validation and premium positioning. Mineral-based immune boosters, such as zinc and selenium, continue to see steady demand as complementary immunity-support nutrients.

Formulation Insights

Capsules and tablets dominate the market with around 44% share, supported by dosage accuracy, convenience, and long shelf life. Gummies and chewables are witnessing rapid growth, particularly among pediatric and young adult consumers, due to improved palatability. Liquid formulations and powders remain popular in pediatric and clinical nutrition applications, while softgels are preferred for oil-based and omega-rich immune products.

Distribution Channel Insights

Pharmacies and drug stores remain the largest distribution channel, benefiting from consumer trust and professional recommendations. However, online retail and direct-to-consumer platforms now account for nearly 29% of global sales, driven by digital marketing, subscription models, and broader product availability. Specialty health stores continue to serve premium and niche consumer segments, while practitioner-led channels support clinical and therapeutic applications.

Consumer Group Insights

Adults aged 18–59 years represent the largest consumer group, accounting for approximately 51% of total demand, driven by preventive health adoption and lifestyle-related immunity concerns. The geriatric population is a high-value segment with strong demand for clinically supported formulations. Pediatric immune boosters are gaining traction as parents increasingly prioritize early-life immunity and nutrition.

| By Product Type | By Formulation | By Application | By Distribution Channel | By Consumer Group |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global natural immune booster market, with the United States leading the way. High consumer spending power, strong supplement penetration, and widespread acceptance of preventive healthcare drive regional demand. Probiotics and premium botanical formulations are particularly popular in this region.

Europe

Europe represents around 27% of the global market share, with Germany, the United Kingdom, France, and Italy as key contributors. Demand is driven by aging populations, regulatory support for nutraceuticals, and strong consumer preference for organic and clean-label products.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 11% CAGR. China and India dominate regional demand, supported by traditional medicine systems, rising urbanization, and growing middle-class incomes. Japan and Australia contribute a steady demand for premium and clinically validated immune supplements.

Latin America

Latin America shows steady growth, led by Brazil and Mexico. Increasing health awareness and expanding retail infrastructure are supporting the gradual adoption of immune booster supplements, particularly herbal and vitamin-based products.

Middle East & Africa

The Middle East and Africa market is driven by rising healthcare spending, import dependence, and growing interest in preventive nutrition. The UAE and Saudi Arabia lead demand, while South Africa serves as a key regional hub for nutraceutical consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Natural Immune Booster Market

- Nestlé Health Science

- Amway

- Herbalife

- Bayer

- DSM-Firmenich

- Abbott Nutrition

- Blackmores

- Himalaya Wellness

- NOW Foods

- Otsuka Holdings