Natural Antioxidants Market Size

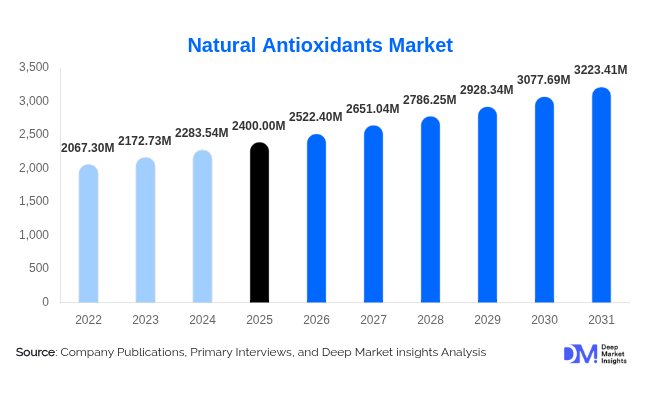

According to Deep Market Insights, the global natural antioxidants market size was valued at USD 2,400.00 million in 2025 and is projected to grow from USD 2,522.40 million in 2026 to reach USD 3,223.41 million by 2031, expanding at a CAGR of 5.1% during the forecast period (2026–2031). The natural antioxidants market growth is primarily driven by the accelerating shift toward clean-label ingredients, rising consumer awareness of preventive healthcare, and increasing regulatory pressure to replace synthetic antioxidants across food, nutraceutical, cosmetic, and pharmaceutical applications.

Key Market Insights

- Plant-based antioxidants dominate the global market, accounting for more than 70% of total revenue due to regulatory acceptance and consumer trust.

- Food & beverage applications represent the largest demand segment, driven by shelf-life extension needs in processed and packaged foods.

- Dietary supplements are the fastest-growing end-use segment, supported by rising preventive healthcare adoption and aging populations.

- North America and Europe together account for nearly 60% of global demand, reflecting strong clean-label regulations.

- Asia-Pacific is the fastest-growing regional market, led by China and India, due to expanding food processing and nutraceutical industries.

- Technological innovation in extraction and encapsulation is improving stability, bioavailability, and application versatility.

What are the latest trends in the natural antioxidants market?

Shift from Synthetic to Natural Preservatives

One of the most significant trends in the natural antioxidants market is the accelerated replacement of synthetic antioxidants such as BHA and BHT with plant-derived alternatives. Regulatory scrutiny in North America and Europe, combined with rising consumer skepticism toward artificial additives, has compelled food and beverage manufacturers to reformulate products using natural antioxidants like rosemary extract, tocopherols, and green tea polyphenols. This shift is particularly evident in processed foods, edible oils, and functional beverages, where clean-label claims have become a key purchasing factor.

Advanced Extraction and Formulation Technologies

Manufacturers are increasingly adopting supercritical CO₂ extraction, fermentation-based production, and microencapsulation technologies to enhance antioxidant purity, stability, and solubility. These innovations allow natural antioxidants to perform more effectively in demanding applications such as high-temperature food processing and pharmaceutical formulations. Encapsulation techniques are also enabling controlled release and improved bioavailability, expanding usage in nutraceuticals and cosmetics.

What are the key drivers in the natural antioxidants market?

Rising Demand for Clean-Label Food Products

Global consumers are increasingly prioritizing transparency and natural ingredients in food and beverage products. Natural antioxidants play a critical role in extending shelf life while maintaining clean-label status, making them essential ingredients for processed food manufacturers. This driver has significantly boosted adoption across bakery, meat products, dairy alternatives, and edible oils.

Growth in Preventive Healthcare and Nutraceuticals

The expanding global focus on immunity, anti-aging, and chronic disease prevention has fueled demand for antioxidant-rich dietary supplements. Natural antioxidants such as polyphenols, carotenoids, and vitamin-based antioxidants are widely marketed for cardiovascular health, cognitive support, and skin health, making nutraceuticals a high-growth application segment.

What are the restraints for the global market?

Raw Material Price Volatility

The cost of key raw materials such as rosemary, green tea leaves, berries, and oilseeds is highly dependent on agricultural yields and climatic conditions. Price volatility directly impacts production costs and margins, particularly for small- and mid-sized manufacturers.

Lower Stability Compared to Synthetic Alternatives

Natural antioxidants generally offer lower oxidative stability than synthetic counterparts, often requiring higher dosages or advanced formulation technologies. This can increase costs and limit adoption in highly price-sensitive applications.

What are the key opportunities in the natural antioxidants industry?

Expansion in Emerging Markets

Asia-Pacific and Latin America present significant growth opportunities as food processing, dietary supplement consumption, and cosmetic manufacturing expand rapidly. Localized sourcing and regional production facilities can help manufacturers reduce costs and improve market penetration.

Sustainable and Upcycled Antioxidant Sources

The use of agricultural by-products and marine algae as antioxidant sources is gaining traction. These sustainable sourcing models align with ESG goals and offer differentiation opportunities for manufacturers targeting environmentally conscious customers.

Source Insights

Plant-based antioxidants lead the market with approximately 72% share in 2025, driven by widespread acceptance of botanical extracts such as rosemary, green tea, and citrus-derived antioxidants. Marine-based antioxidants, primarily algae-derived carotenoids, represent a growing niche due to rising interest in sustainable and high-potency ingredients. Microbial and fermentation-derived antioxidants remain small but are gaining traction in pharmaceutical and specialty applications.

Product Type Insights

Polyphenols dominate the natural antioxidants product landscape, accounting for nearly 34% of total market revenue in 2025. Their leadership is primarily driven by their broad-spectrum antioxidant activity, proven anti-inflammatory properties, and strong scientific backing for cardiovascular, cognitive, and metabolic health benefits. Polyphenols such as flavonoids, catechins, and anthocyanins are widely used across functional foods, dietary supplements, and beverages, making them highly versatile compared to other antioxidant classes. Additionally, growing consumer preference for plant-based and botanically sourced ingredients has significantly accelerated polyphenol adoption, particularly in clean-label food and nutraceutical formulations.

Vitamin-based antioxidants represent the second-largest product segment, with tocopherols (vitamin E) being extensively used in food preservation, edible oils, and dietary supplements due to their effectiveness in preventing lipid oxidation. Their dual role as both nutritional ingredients and functional preservatives gives them a stable and recurring demand base across the food and pharmaceutical industries. Meanwhile, carotenoids such as beta-carotene, lutein, and lycopene are witnessing strong growth, driven by rising demand for eye health supplements, skin protection products, and cosmetic formulations. The expanding use of carotenoids in premium nutraceuticals and anti-aging personal care products is positioning this segment as one of the fastest-growing within the product type category.

End-Use Industry Insights

The food & beverage industry remains the largest end-use segment in the natural antioxidants market, valued at approximately USD 2,330 million in 2025. This dominance is driven by the widespread use of natural antioxidants to extend shelf life, preserve flavor, and maintain nutritional quality in processed foods, bakery products, edible oils, meat alternatives, and functional beverages. Increasing regulatory scrutiny on synthetic preservatives, coupled with rising consumer demand for clean-label and minimally processed foods, continues to reinforce the food & beverage sector’s leadership.

Dietary supplements represent the fastest-growing end-use segment, expanding at over 12% CAGR, supported by increasing global focus on preventive healthcare, immunity enhancement, and anti-aging nutrition. Natural antioxidants are widely incorporated into capsules, powders, and functional blends targeting heart health, brain function, and oxidative stress reduction. Cosmetics and pharmaceuticals follow as high-value end-use segments, where natural antioxidants are increasingly used for anti-aging skincare, UV protection, wound healing, and therapeutic formulations. The growing convergence of beauty, health, and wellness trends is further strengthening demand across these end-use industries.

| By Product Type | By End-Use Industry | By Source | By Form | By Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 31% of the global market share in 2025, with the United States serving as the dominant contributor. Regional growth is driven by strong regulatory enforcement on food additives, high consumer awareness of ingredient safety, and widespread adoption of dietary supplements and functional foods. The U.S. market benefits from a mature nutraceutical industry, high per-capita supplement consumption, and continuous innovation in clean-label food formulations. Additionally, rising demand for natural antioxidants in premium cosmetics and anti-aging products is further supporting market expansion across the region.

Europe

Europe held around 29% of global demand, supported by stringent food safety regulations and a deeply embedded clean-label culture. Countries such as Germany, France, and the U.K. lead regional consumption, particularly in functional foods, organic products, and personal care formulations. The European market is strongly driven by regulatory restrictions on synthetic additives, high penetration of organic and plant-based products, and consumer preference for sustainably sourced ingredients. Growth is also supported by increasing use of natural antioxidants in pharmaceutical and clinical nutrition applications.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the natural antioxidants market, registering a CAGR of approximately 12.9%. China leads the region in both production and consumption, supported by its large food processing industry, expanding nutraceutical sector, and strong export-oriented antioxidant manufacturing base. India’s market is expanding rapidly due to rising demand for herbal supplements, traditional medicine formulations, and functional foods. Additional growth drivers across the region include rising disposable incomes, increasing health awareness, rapid urbanization, and government support for domestic nutraceutical and food ingredient manufacturing.

Latin America

Latin America represents a developing but steadily expanding market, led by Brazil and Mexico. Growth in the region is supported by increasing consumption of processed and packaged foods, rising awareness of natural health ingredients, and gradual regulatory alignment with global food safety standards. The cosmetics and personal care sector is also emerging as a key demand driver, particularly for plant-derived antioxidants used in skin and hair care products. Expanding middle-class populations and improving retail distribution networks are further contributing to market growth.

Middle East & Africa

The Middle East & Africa natural antioxidants market is driven by rising imports of food additives, increasing pharmaceutical manufacturing, and growing demand for fortified foods. Countries such as Saudi Arabia and the UAE are witnessing strong growth due to high healthcare spending, expanding nutraceutical markets, and increasing adoption of premium food products. South Africa leads demand within Africa, supported by a well-developed food processing sector and rising use of natural antioxidants in supplements and cosmetics. Government initiatives to strengthen food security and pharmaceutical production are expected to further support regional market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Natural Antioxidants Market

- DSM-Firmenich

- BASF

- ADM

- Kemin Industries

- Cargill

- IFF Health

- Givaudan (Naturex)

- Oterra

- Synthite Industries

- Kalsec

- Indena

- Frutarom

- Biosearch Life

- Sabinsa Corporation

- Chenguang Biotech