Nail Salon Market Size

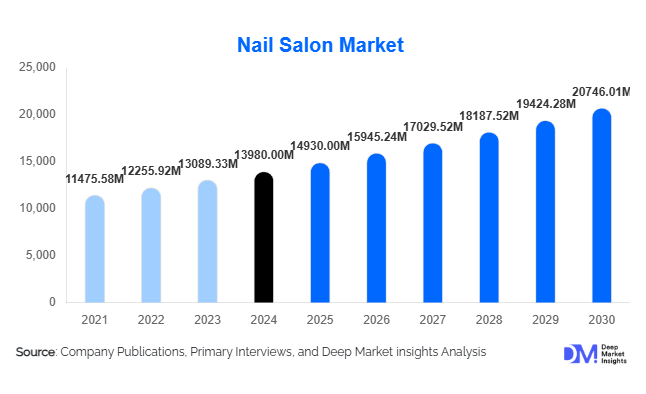

According to Deep Market Insights, the global nail salon market size was valued at USD 13,980.00 million in 2024 and is projected to grow from USD 14,930.64 million in 2025 to reach USD 20,746.01 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The nail salon market growth is driven by rising disposable incomes, increasing social media influence on beauty standards, and a growing consumer focus on self-care and personal grooming across all age groups.

Key Market Insights

- Manicure treatments lead the global market, accounting for over 32% of total revenue, owing to high repeat frequency and widespread adoption across demographics.

- Women customers dominate the market with around 69% share, though male grooming services are emerging rapidly as a growth niche.

- Standalone independent salons hold over 50% of the global market value, supported by flexible operations and strong local customer loyalty.

- North America leads the market with approximately 33% share in 2024, while Asia-Pacific is the fastest-growing region with 8–9% CAGR through 2030.

- Premiumisation and digital transformation, including online booking apps, mobile nail services, and membership models, are reshaping customer engagement.

- Eco-friendly and wellness-integrated nail treatments are emerging as differentiators among urban consumers seeking sustainable self-care options.

What are the latest trends in the nail salon market?

Premiumisation and Spa-Inspired Nail Services

Consumers are increasingly upgrading from basic manicures and pedicures to spa-level treatments featuring wellness add-ons such as paraffin hand therapy, aromatherapy, and foot massages. The growing desire for experiential self-care has transformed nail salons into wellness destinations. Premium services like gel extensions, UV-cured manicures, and intricate nail art have become status symbols, particularly among urban millennial and Gen Z clientele. These high-value offerings contribute significantly to revenue growth, allowing salons to maintain healthier margins despite rising competition.

Digital and Mobile Service Expansion

The surge in convenience-oriented consumer behaviour is propelling mobile nail salons and on-demand booking platforms. App-based scheduling, subscription models, and digital payment integration have become standard features for modern salons. Mobile nail technicians serving homes, offices, and events are attracting a broader customer base and expanding service accessibility. This digital shift also enhances client retention through loyalty programs, personalised marketing, and AI-powered service recommendations, revolutionising how salons interact with customers.

What are the key drivers in the nail salon market?

Rising Disposable Income and Self-Care Culture

Global consumers are spending more on grooming and beauty services as part of a broader self-care movement. With higher disposable incomes, nail maintenance is no longer viewed as a luxury but a regular wellness routine. Women, in particular, account for the bulk of service demand, though men’s participation is steadily increasing, diversifying the customer base and supporting overall market expansion.

Influence of Social Media and Fashion Trends

Platforms such as Instagram, TikTok, and Pinterest have turned nail art into a digital trend phenomenon. Influencers frequently promote seasonal nail designs and products, fuelling demand for customised styles and premium services. This social-media-driven aesthetic awareness directly impacts appointment frequency, with many consumers seeking the latest viral looks. The trend has also enabled small salons to reach new clients through visual marketing, reinforcing digital presence as a critical growth driver.

Service Diversification and Convenience Formats

Nail salons are diversifying beyond traditional treatments to include spa pedicures, wellness therapies, and product retailing. Hybrid models combining in-salon and mobile services cater to busy lifestyles, while membership and subscription systems ensure recurring revenue. This broad service mix increases customer lifetime value and differentiates brands in a fragmented market.

What are the restraints for the global market?

Market Fragmentation and Competitive Pressure

The global nail salon market remains highly fragmented, with numerous independent operators and limited large-scale consolidation. This leads to pricing pressure and thin profit margins, particularly in developed economies. To remain competitive, salons must invest in technology, staff training, and service innovation, factors that increase operational costs.

Regulatory and Hygiene Compliance

Salons face stringent hygiene and safety standards, especially in North America and Europe, where improper sanitation can result in legal penalties and reputational damage. Recruiting and retaining certified nail technicians is also a challenge, raising labour costs. Compliance with chemical safety regulations for nail products further adds complexity and operational overhead for small businesses.

What are the key opportunities in the nail salon industry?

Eco-Friendly and Wellness-Oriented Nail Treatments

As sustainability becomes central to consumer choices, salons offering vegan, cruelty-free, and non-toxic nail products are gaining traction. Eco-friendly nail polishes, waterless manicures, and organic spa pedicures appeal to environmentally conscious clients. Integrating wellness components, such as aromatherapy or hand reflexology, further differentiates premium salons, positioning them within the broader wellness economy.

Technological and Mobile Innovation

Adoption of AR/VR nail design previews, AI-powered appointment systems, and mobile on-demand services presents immense growth potential. Digital convenience appeals strongly to younger consumers who value seamless, tech-enabled beauty experiences. Salons leveraging these tools can enhance brand visibility, optimise staff utilisation, and offer dynamic pricing or loyalty rewards to maximise profitability.

Emerging Market Expansion

Asia-Pacific, Latin America, and parts of the Middle East present lucrative frontiers for expansion. Rising urbanisation, growing female workforce participation, and increasing disposable incomes create fertile conditions for salon chain development and franchising. Localising service pricing and aesthetics to suit regional preferences will be key for international brands aiming to capture these fast-growing segments.

Service Type Insights

Manicure and Pedicure services dominate the global nail salon market, representing approximately 32% of revenue in 2024. This segment is driven by routine maintenance habits, aesthetic trends, and frequent repeat usage, alongside strong upselling potential through creative nail art and wellness add-ons. Pedicure demand continues to expand, supported by the trend toward spa-inspired relaxation experiences and holistic self-care. Meanwhile, artificial nails and extensions (acrylic, gel, and dip systems) are rapidly growing due to consumer preference for longer-lasting styles and durability.

Nail art and decoration services are witnessing robust expansion, driven by social media trends and personalization demand, which enable salons to charge premium pricing and boost visit frequency. Additionally, specialty and wellness treatments, such as paraffin therapy, aromatherapy, and detox manicures, are emerging as premium offerings as salons capitalize on the spa/wellness convergence trend. Collectively, these evolving service types reflect a shift toward experience-driven, high-margin offerings that enhance salon profitability and consumer loyalty.

Business Model & Outlet Type Insights

Independent salons continue to represent the backbone of the industry, accounting for over 50% of global outlets. Their success is supported by local reputation, pricing flexibility, and personalized customer service, although they remain sensitive to labor costs and local demand fluctuations. In contrast, chain and franchise salons are scaling rapidly through brand recognition, standardized training, and efficient franchising structures, which enhance scalability and consistency across regions.

Nail bars and express-format outlets thrive in high-traffic urban centers, meeting on-the-go consumer demand and impulse visits. Meanwhile, mobile and home-based nail services are gaining strong traction post-COVID due to convenience, app-based booking, and flexible service models that bring treatments directly to clients’ homes or workplaces. Together, these models illustrate a diversification strategy where flexibility, accessibility, and technology integration are key differentiators.

Price & Experience Tier Insights

The market is increasingly segmented by consumer spending power and service expectations. The luxury and premium tier continues to expand, driven by consumer willingness to trade up for superior experiences, hygiene, and branded products, resulting in higher average revenue per user. The mid-market segment remains the volume leader, offering balanced value and quality for the mass consumer base. Meanwhile, the budget/value segment caters to highly price-sensitive consumers, dominated by informal and independent providers competing on affordability.

End-User Insights

Women customers continue to dominate global demand, accounting for nearly 69% of total revenue in 2024. This segment’s strength is attributed to high service frequency, fashion integration, and seasonal beauty events such as weddings and festivals. However, male grooming has emerged as the fastest-growing customer category, expanding at double-digit rates through 2030 due to rising awareness of personal care and increased inclusion of men’s manicure and pedicure services in salon menus.

Additionally, Gen Z and millennial consumers (ages 19–40) form the most active user base, driven by digital engagement, social trends, and willingness to experiment with design aesthetics. Older demographics contribute to recurring revenue through routine maintenance and wellness-focused services, reinforcing the market’s broad age appeal and resilience.

Distribution Channel Insights

Walk-in and on-demand channels dominate high-traffic retail zones such as malls and high streets, leveraging location convenience and impulse visits. Appointment and digital booking systems are growing rapidly, enabling salons to drive retention through prepayments, loyalty programs, and subscription-based engagement models.

Subscription and membership programs represent a strategic evolution in customer relationship management, providing predictable revenue streams and increasing customer lifetime value, especially among chains and premium salons. These channels collectively illustrate the industry’s digital transformation and its shift toward data-driven personalization.

Product Positioning Insights

Mainstream chemical-based products remain the dominant offering due to affordability and easy availability, but face increasing price competition. In contrast, organic, vegan, and non-toxic formulations are gaining share as consumers prioritize sustainability, health, and product transparency. Salons incorporating “clean beauty” positioning are successfully capturing eco-conscious demographics and premium clientele willing to pay higher prices for safer, sustainable alternatives.

| By Service Type | By Business Model / Outlet Type | By Price / Experience Tier | By End User / Demographic | By Service Delivery Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global nail salon market, holding roughly 33% market share in 2024, valued at approximately USD 4.0 billion. The region benefits from a mature salon infrastructure, high per-capita spending on beauty services, and rapid digital transformation. Growth is primarily driven by premiumization, male grooming adoption, and the expansion of subscription/membership models in the U.S. and Canada. Franchising and consolidation among major brands are reshaping the competitive landscape, while innovation in hygiene standards and product safety continues to elevate the consumer experience.

Western Europe

Europe accounts for approximately 25–30% of the global market, with the U.K., Germany, and France leading demand. The region’s growth is underpinned by stringent regulatory and hygiene standards, consumer preference for clean and sustainable products, and a strong cultural link between fashion and beauty. High regulatory compliance drives salons toward professional-grade products and branded experiences, fostering premium segment growth. Western Europe’s demand also benefits from increasing eco-consciousness and product transparency, positioning the region as a global leader in “clean nail care.”

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, forecasted to record an 8–9% CAGR between 2025 and 2030. The region’s momentum is driven by high demand for nail art, rapid urbanization, rising middle-class spending, and strong cultural influences from K-beauty and J-beauty trends. Local salon chains and franchise formats are expanding rapidly across China, Japan, South Korea, and India. Innovation thrives in this region, where youth-driven fashion cycles, social media engagement, and digital payment systems accelerate service adoption. APAC remains the top region for nail service innovation and investment.

Latin America

Latin America represents around 10–15% of global revenue, led by Brazil, Mexico, and Argentina. Growth is driven by urban population expansion, rising demand for affordable beauty services, and the emergence of organized salon networks. The region remains price-sensitive, dominated by independent and informal providers, but is witnessing increased consumer interest in branded and premium salon experiences in major cities. This evolving dual market structure, affordable mass services coexisting with upscale nail bars, creates opportunities for differentiated expansion strategies.

Middle East & Africa

The Middle East and Africa hold a smaller share (under 10%) but exhibit significant potential for premium growth. The region’s expansion is propelled by luxury and event-driven demand, with weddings, cultural festivals, and beauty tourism boosting salon visits in urban hubs like Dubai, Riyadh, and Cape Town. High disposable incomes, strong mall-based retail ecosystems, and government support for women-led businesses are further driving the market. Strategic partnerships between international and regional brands are creating high-end salon concepts tailored for affluent and cosmopolitan consumers across the Gulf and coastal Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Nail Salon Market

- Revive Nails & Massage Therapy

- Alluring Nails & Tanning

- Milano Nail Spa The Height

- Soho Beauty & Nail Boutique

- J and J Nails & Spa

- Hana Nail

- Shian Nails

- Nailaholics

- LOTUS Nailbar & Spa

- ZAZAZOO Nail Salon

- The Ten Spot

- Regal Nails Salon & Spa

- Paris Nails and Spa

- Pink Polish Nail Boutique

- Organic Nail Bar

Recent Developments

- In June 2025, Revive Nails & Massage Therapy launched a new eco-friendly salon model in Los Angeles featuring waterless manicures and biodegradable consumables.

- In April 2025, Milano Nail Spa The Height introduced an AI-based booking platform offering personalised service recommendations and dynamic pricing.

- In February 2025, Nailaholics announced expansion into Southeast Asia through a franchising agreement targeting Thailand and Vietnam.

- In January 2025, LOTUS Nailbar & Spa invested in premium LED curing systems and launched a sustainability training program for staff across 50 locations.