Music Production Equipment Market Size

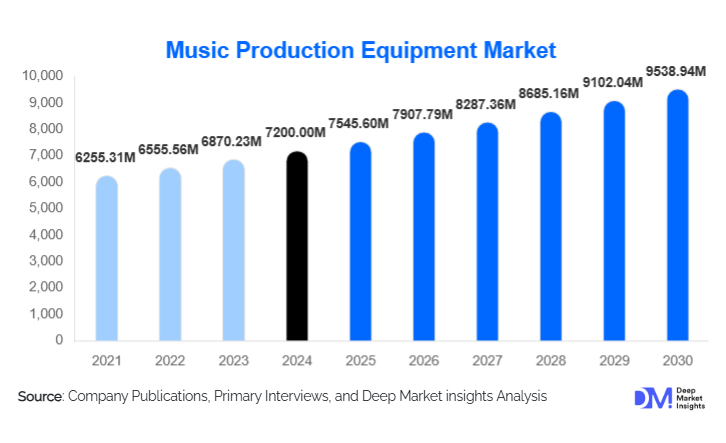

According to Deep Market Insights, the global music production equipment market size was valued at USD 7,200.00 million in 2024 and is projected to grow from USD 7,545.60 million in 2025 to reach USD 9,538.94 million by 2030, expanding at a CAGR of 4.80% during the forecast period (2025–2030). The market’s growth is primarily driven by the rapid expansion of home studios, rising global content-creation activity, and the increasing integration of digital, cloud-based, and AI-driven production technologies across professional and consumer segments.

Key Market Insights

- Music production is shifting toward creator-driven, digital, and hybrid workflows, enabling home studios and independent producers to access professional-grade tools at affordable prices.

- Premium studio monitoring equipment, including headphones and studio monitors, dominates category demand, accounting for nearly 25–30% of total 2024 revenues.

- North America leads global adoption, driven by mature studio ecosystems, high spending power, and strong demand from professional producers and content creators.

- Asia-Pacific is the fastest-growing region, supported by surging creator economies in India, China, South Korea, and Southeast Asia.

- Software integration, cloud collaboration, and AI-driven plugins are transforming production workflows, enabling greater efficiency and accessibility for users across skill levels.

- Subscription-based models for DAWs and plugins are reshaping pricing and revenue strategies for audio manufacturers and software developers.

What are the latest trends in the music production equipment market?

AI-Driven and Cloud-Enabled Production Accelerating Adoption

Manufacturers and software developers are integrating artificial intelligence into mixing, mastering, noise reduction, arrangement assistance, and sound design. AI-driven plugins are helping beginners achieve professional results quickly while enabling experienced producers to streamline repetitive tasks. Cloud-based collaboration tools are also gaining traction, allowing producers, vocalists, and mixing engineers to work together remotely. These innovations support an increasingly globalized music ecosystem where cross-border creative collaboration is standard practice. Cloud DAWs, virtual studios, online plugin libraries, and real-time remote recording sessions are becoming mainstream technical capabilities in modern production.

Hybrid Hardware–Software Ecosystems Transforming Workflows

Music producers are increasingly adopting integrated ecosystems that combine audio interfaces, controllers, DAW licenses, and plugin bundles into unified production environments. Hardware manufacturers now offer seamless DAW integration, touch-sensitive controls, and custom presets linked to digital workflows. This trend is driven by home-studio creators seeking simplicity and efficiency while maintaining flexibility for advanced production. Additionally, modular music synthesizers, wireless controllers, compact mixing surfaces, and USB-C interfaces are guiding the shift toward portable, creator-friendly setups. Immersive audio (e.g., Dolby Atmos Music) is also becoming a major growth arena, triggering demand for multi-speaker monitoring setups and advanced spatial audio tools.

What are the key drivers in the music production equipment market?

Rapid Expansion of the Creator Economy

The surge in independent musicians, podcasters, YouTubers, streamers, and digital content creators is significantly expanding demand for accessible production tools. Affordable MIDI controllers, home-studio microphones, USB/Thunderbolt audio interfaces, and entry-tier DAWs are enabling millions of creators to establish small-scale studios. Social media platforms, TikTok, Instagram, and YouTube, have democratized music distribution, allowing creators to monetize content and reinvest in better production gear. This trend continues to be the strongest global demand driver.

Growth of Digital and Hybrid Production Platforms

Professional and semi-professional producers increasingly rely on digital audio workstations, plugin ecosystems, software synthesizers, and cloud-enabled collaboration tools. Online music courses, remote audio engineering programs, and virtual masterclasses are accelerating skill development globally. The blend of physical equipment with powerful digital capabilities has reshaped production workflows, encouraging producers to adopt both hardware and software solutions simultaneously. Cloud storage for stems, AI-driven mixing assistants, and subscription-based plugin bundles are driving sustained equipment investments across regions.

What are the restraints for the global market?

High Cost of Premium Studio Equipment

High-end microphones, premium audio interfaces, mixing consoles, and studio monitors remain expensive for new entrants and freelance creators. Professional studios also face high refresh-cycle costs for upgrading analog consoles, acoustics, and multi-speaker systems used for immersive audio formats. This limits market penetration in cost-sensitive regions. Rising prices of electronic components, specialized transducers, and precision analog circuits further drive up equipment costs, widening the affordability gap between entry-level and professional gear.

Compatibility, Obsolescence, and Technical Complexity

Rapid software updates, plugin format changes, driver compatibility issues, and OS/HW mismatches create challenges for users and manufacturers alike. New standards such as immersive audio formats also require producers to invest in additional speakers, calibration systems, and new DAW versions. Smaller creators often struggle with the frequent upgrade cycles, making adoption slower in low-income markets. This fragmentation in technology ecosystems remains a key barrier to smooth market expansion.

What are the key opportunities in the music production equipment industry?

AI-Enhanced Studio Solutions and Smart Production Ecosystems

The rise of AI-based mixing, mastering, and sound design tools is opening new revenue opportunities for manufacturers and software developers. Intelligent production workflows, such as auto-gain staging, instant mastering, and AI-generated stems, allow producers to work faster and with higher consistency. Hardware equipped with AI-assisted DSP capabilities, such as intelligent preamps or adaptive monitoring calibration, presents a major future opportunity.

Community-Based Creator Ecosystems and Localized Production Growth

Emerging markets such as India, Brazil, Nigeria, Indonesia, and the Middle East are witnessing explosive growth in grassroots music creation. Community studios, government-backed creator programs, and local production hubs are expanding access to professional tools. Audio manufacturers have opportunities to develop localized bundles, budget studio kits, and training-led product ecosystems for young creators. Partnerships with music schools, universities, and online learning platforms further strengthen long-term adoption of hardware and software tools. These localized, community-driven music production networks are poised to drive strong incremental demand for affordable, versatile equipment.

Product Type Insights

Studio monitoring equipment, including studio monitors and professional headphones, dominates the product landscape, capturing approximately 25–30% of the 2024 market. These products remain essential for both professional studios and home creators, supporting accurate mixing and mastering. Audio interfaces form another rapidly growing segment, driven by USB-C and Thunderbolt adoption. DAWs and plugin ecosystems continue expanding as subscription models increase accessibility, while synthesizers and MIDI controllers are flourishing across live performance and studio contexts. Entry-level gear is increasingly favored by home studios, whereas high-end analog equipment and premium monitors remain the primary choice of professional production facilities.

Application Insights

Home studios and independent creators represent the fastest-growing application segment, accounting for nearly 35–40% of global demand in 2024. Professional studios continue to invest heavily in premium analog and digital consoles, multi-room speaker systems, and advanced DAWs, but face slower growth due to market saturation. Education and training institutions are expanding purchases of modular studio setups as music technology courses continue to rise worldwide. Live-event production, a significant application category, is seeing renewed investment in mixing consoles, monitoring systems, and portable recording rigs as concerts and festivals rebound globally.

Distribution Channel Insights

Online platforms, including manufacturer D2C sites, music equipment e-retailers, and marketplaces, dominate sales due to extensive product availability, transparent pricing, and global accessibility. Specialist pro-audio retailers continue to thrive, particularly for mid-range and premium equipment that requires expert consultation. Bundled studio kits sold via online platforms are gaining traction among beginners. Subscription-based software distribution (DAWs, plugins, virtual instruments) is reshaping traditional retail models, while influencer-driven marketing and YouTube reviews play a pivotal role in consumer purchase decisions.

Traveler Type Insights

Group-based creator ecosystems, such as collaborative studios, music collectives, and shared production spaces, represent a significant portion of the market, driven by shared-resource models and community learning environments. Solo producers, including bedroom creators, digital nomads, and freelance audio engineers, form the largest and fastest-growing user type globally. Professional duos and production partnerships, such as songwriting teams and electronic-music pairs, drive investments in mid-range and premium gear. Family-based users, including parents supporting young learners, contribute to the rising demand for beginner-friendly equipment and education-oriented studio kits.

Age Group Insights

Producers aged 25–40 represent the largest demographic, balancing technical expertise with strong income levels that support mid-range to premium equipment purchases. The 18–25 age group, comprising students, early-stage creators, and aspiring producers, drives high-volume demand for entry-level gear and online software subscriptions. The 40–55 demographic contributes to premium studio gear demand, including high-end monitors, large-format controllers, and analog gear. Users above 55 represent a smaller but growing segment, often comprising hobbyists and retired musicians investing in personal studio setups for passion-driven creation.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest regional market, holding approximately 35–40% of global revenue in 2024. The U.S. leads adoption due to its dense professional studio network, strong entertainment industry, and thriving independent creator ecosystem. Podcasting, film scoring, gaming audio, and YouTube content production are major contributors to growth. Canada shows rising demand from indie musicians and home-studio creators, supported by a vibrant cultural music environment.

Europe

Europe accounts for nearly 20–25% of global demand, driven by strong music culture, established producer communities, and robust live-event industries. Countries such as Germany, the U.K., France, and the Netherlands exhibit high adoption of professional-grade and modular equipment. European consumers show a strong preference for sustainable manufacturing, premium analog gear, and hybrid production workflows.

Asia-Pacific

Asia-Pacific is the fastest-growing region, contributing approximately 20–22% of total revenue in 2024. India, China, Japan, South Korea, and Indonesia are leading adopters. Rising disposable income, booming creator culture, and expansion of music-tech education programs are accelerating equipment demand. K-pop, Bollywood, gaming audio, and digital content creation serve as major demand drivers.

Latin America

Latin America is emerging steadily, with Brazil, Mexico, and Argentina driving regional adoption. Growth is driven by rising independent music scenes, expanding local festivals, and increasing demand for budget-friendly studio equipment. Home-studio setups dominate this region’s entry-level consumption patterns.

Middle East & Africa

The Middle East is witnessing increased demand due to rising content creation, film production growth, and government-backed creative industry initiatives. In Africa, Nigeria, South Africa, and Kenya lead adoption, supported by the rapid expansion of Afrobeats, local film scoring (Nollywood), and digital audio production training programs. The region is increasingly important as a demand frontier for entry- and mid-tier equipment.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Music Production Equipment Market

- HARMAN International

- Yamaha Corporation

- Roland Corporation

- Avid Technology

- Focusrite Audio Engineering

- Apple (Logic Pro ecosystem)

- Ableton

- Sony (Audio Software)

- Shure

- Sennheiser

- Audio-Technica

- Steinberg Media Technologies

- Native Instruments

- Universal Audio

- PreSonus Audio Electronics

Recent Developments

- In March 2025, Universal Audio launched a new AI-assisted mastering suite integrated into its Apollo ecosystem, targeting home-studio creators.

- In January 2025, Yamaha introduced an advanced line of hybrid digital-analog mixers designed for both studio and live-event applications.

- In October 2024, Ableton released cloud-collaboration features for Ableton Live, enabling real-time co-production across regions.