Music Synthesizers Market Size

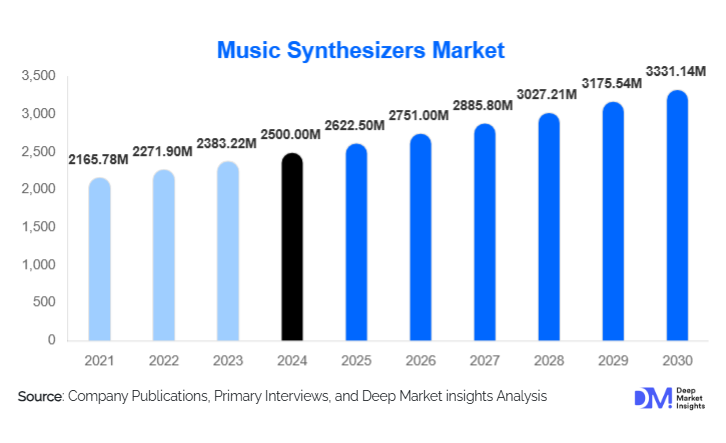

According to Deep Market Insights, the global music synthesizers market size was valued at USD 2,500.00 million in 2024 and is projected to grow from USD 2,622.50 million in 2025 to reach USD 3,331.14 million by 2030, expanding at a CAGR of 4.9% during the forecast period (2025–2030). The market’s growth is chiefly driven by the increasing adoption of home production setups, the resurgence of analog and modular synthesizers, and rising demand for software synths and hybrid hardware-software platforms among music producers, sound designers, and content creators.

Key Market Insights

- Digital synthesizers dominate in value and accessibility, driven by software plug-in sales and affordable DSP-based hardware.

- Analog and modular (“boutique”) synth segments remain high-margin and culturally vibrant, fueled by enthusiasts and professional musicians.

- Software-hardware integration via subscription ecosystems is gaining traction, increasing recurring revenue and user engagement.

- Home/project studios are the fastest-growing user base, benefiting from DAW proliferation and online learning platforms.

- Asia-Pacific is the fastest-growing region, supported by rising music education, middle-class penetration, and e-commerce adoption.

- Hybrid synthesis and AI-assisted patch design are reshaping product innovation, enabling new sound design workflows.

What are the latest trends in the Music Synthesizers Market?

Platformization & Subscription-Driven Models

Manufacturers are increasingly moving toward platform-based business models, bundling hardware instruments with software editors, patch libraries, and cloud-based preset sharing. These ecosystems allow recurring revenue through subscriptions, firmware updates, and soundpack sales. This trend benefits both users (who gain continuous value) and companies (that secure long-term engagement). As patch-sharing communities grow, brands are leveraging APIs or SDKs to let third-party designers contribute, enhancing stickiness and broadening their sound ecosystem.

Modular & Analog Renaissance

The analog and modular synthesis segment is experiencing a strong revival. Enthusiasts and professional musicians alike are gravitating toward boutique hardware, whether Eurorack modules, limited-run analog polysynths, or reissues of classic designs. This resurgence is supporting a high-margin, design-led niche and fueling adjacent markets (cases, patch cables, power supplies). Smaller specialist manufacturers are thriving, and larger companies are introducing modular-compatible lines, tapping into the passion economy of modular synth communities.

Immersive & Cross-Industry Sound Design

Synthesizers are increasingly used outside traditional music production. They’re now integral to immersive media (VR/AR), game audio, sound installation art, and experiential design. This broader usage opens up new customer segments, game studios, experiential design firms, and narrative producers are adopting hybrid synths and real-time engines to power immersive audio experiences. As demand for interactive soundscapes grows, companies that develop synthesis engines optimized for these applications stand to capture significant new revenue.

What are the key drivers in the Music Synthesizers Market?

Growth of Home Production & DAW Adoption

The democratization of music production, through affordable DAWs, high-quality audio interfaces, and online learning, has accelerated the number of home producers. These hobbyists and semi-professional artists increasingly purchase software synths and mid-range hardware synthesizers, driving volume growth. Content creators and social media also magnify exposure to new synths, with tutorials, demos, and preset packs converting viewers into buyers.

Analog & Modular Revival

A resurgence of interest in analog and modular synths is fueling demand for premium hardware. Modern reissues of classic analog designs, plus innovations in modular formats (especially Eurorack), are drawing both seasoned musicians and newcomers into high-value purchases. This analog renaissance supports a high-margin segment and encourages boutique makers to expand their lines, even in niche, small-batch production runs.

Technological Convergence & Innovation

Hybrid synthesis, integrating analog signal paths with advanced digital engines (such as wavetable, FM, granular), is boosting total addressable market value. Additionally, AI-assisted patch creation, deep DAW integration, mobile editors, and cloud-based collaboration tools are enriching the product landscape, making synthesizers more powerful and relevant for new applications beyond music, such as games, installations, and immersive media. These innovations are encouraging upgrades, cross-utilization, and deeper user engagement.

What are the restraints for the global Music Synthesizers Market?

Second-Hand Market & Price Pressure

The vibrant second-hand market for vintage and used synthesizers exerts downward pressure on demand for new lower- to mid-tier hardware. Enthusiasts often prefer pre-owned instruments for their character and lower cost, which can cannibalize new-unit sales. This dynamic is especially challenging for boutique makers and mass-market hardware companies alike, as it suppresses new purchase cycles and compresses margins.

Supply Chain Vulnerabilities & Component Cost Volatility

The production of synthesizers, particularly hardware, relies on specialized components (analog ICs, potentiometers, keybeds). Volatility in component pricing, extended lead times, and reliance on niche suppliers pose a risk to timely product launches and margin stability. For boutique manufacturers, any bottleneck can delay limited-run releases; for larger OEMs, supply constraints can impact volume and profitability.

What are the key opportunities in the Music Synthesizers Industry?

Subscription & Cloud-Native Business Models

The transition toward software-hardware ecosystems presents a major opportunity. By offering subscription-based firmware updates, cloud preset sharing, and patch marketplaces, companies can increase customer lifetime value. These models also encourage communities of users and third-party patch designers, driving engagement and differentiation. Brands that focus on recurring-revenue platforms can build more resilient businesses.

Expansion of Modular & Boutique Synthesis

The modular/Eurorack and boutique analog segments remain under-penetrated globally. By introducing mass-accessible module lines, modular cases, or hybrid modules (digital + analog), companies can capture enthusiasts’ growing spending. Boutique manufacturers can scale via direct-to-consumer models, online communities, and limited-edition releases, while large incumbents can enter modular with lower-cost, modular-friendly product lines.

Cross-Sector Applications (Immersive, Games, Media)

Synthesizers are finding increasing adoption in immersive media (VR/AR), game development, film, and experiential design. Companies can develop tools optimized for real-time sound generation, spatial audio, and interactive performance. Partnerships with game studios, content platforms, and experiential design firms can open new revenue streams. By designing hybrid instruments or software engines for these verticals, synthesizer manufacturers can tap into large, rapidly growing non-music markets.

Product Type Insights

Within the Music Synthesizers Market, digital synthesizers (software and DSP-based hardware) are the most dominant segment in terms of volume and accessibility, owing to low barriers to entry and broad distribution through online platforms. Meanwhile, analog and hybrid synthesizers attract professional musicians and synthesizer enthusiasts who prioritize sound authenticity and tactile interfaces. The modular/Eurorack category remains a high-margin niche, catering to enthusiasts and boutique buyers who invest in modular ecosystems (modules, cases, accessories) and community-driven patch design.

Application Insights

Music synthesizers are widely used in studio production and live performance, where professional producers and touring musicians rely on hardware and software synths for composition and sound design. In the home/project studio category, hobbyists and independent creators drive strong demand for affordable, integrated hardware and plugin synths. The media & entertainment segment (film, games, VR/AR) is emerging as a rapidly growing application, leveraging synthesizers for interactive sound design, immersive soundscapes, and real-time audio generation. Additionally, educational institutions use synthesizers for teaching, experimentation, and signal-processing research.

Distribution Channel Insights

E-commerce platforms (brand webstores, online marketplaces) are critical for both hardware and software synthesizers, providing global reach, direct sales, and downloadable products. Specialist music stores continue to play a vital role, particularly for high-end analog and modular instruments, offering hands-on demo experiences. Institutional procurement (studios, schools) leverages pro dealers and direct OEM relationships. Subscription-based platforms and cloud-based sound libraries are evolving as new channels for recurring sales and customer engagement.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest share (estimated 34%) of the Music Synthesizers Market, with strong demand driven by pro studios, touring musicians, content houses, and home producers. The U.S., in particular, is a major import market for both high-end analog hardware and cutting-edge software synthesizers. Brand loyalty, deep dealer networks, and a high concentration of professional users help sustain premium pricing and innovation.

Europe

Europe accounts for roughly 28% of the global market. Countries such as Germany, the UK, France, and the Nordics lead in both demand and manufacturing heritage. Boutique analog makers, modular builders, and legacy brands are particularly strong in this region. Educational institutions and electronic music culture further stimulate synth adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, contributing approximately 22% to the market in 2024. Key markets include Japan (both manufacturing and wealthy buyer base), South Korea (thriving production / electronic music scene), China, and India (rapidly growing middle-class producers). The rise of online retail, local music tech education, and growing interest in electronic music are fueling rapid adoption.

Latin America

Latin America (Brazil, Mexico, Argentina) accounts for an estimated 8% of the market. While the region is still maturing, demand is growing from rising electronic music scenes, home production, and middle-class purchasing power. Import dependence is high, and international e-commerce plays a major role.

Middle East & Africa

The Middle East & Africa also contribute around 8% of the Music Synthesizers Market. In Africa, countries with music production infrastructure (South Africa, Nigeria) are gradually expanding their adoption. In the Middle East, high-income markets such as the UAE and Saudi Arabia are investing in premium synthesizers, both for touring artists and studio-based content creators.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Music Synthesizers Market

- Roland Corporation

- Yamaha Corporation

- Korg Inc.

- Moog Music Inc.

- Behringer / Music Tribe

- Arturia SAS

- Native Instruments GmbH

- Elektron

- Nord (Clavia)

- Novation (Focusrite Group)

- Pioneer DJ / TORAIZ

- Sequential (Dave Smith / Sequential LLC)

- Akai Professional (InMusic)

- Kurzweil

- Casio Computer Co., Ltd.

Recent Developments

- In early 2025, a major synth brand released a flagship hybrid synthesizer combining analog filters with AI-assisted wavetable generation, boosting its recurring revenue through a companion cloud-based patch marketplace.

- In mid-2024, a leading modular manufacturer announced a limited-edition Eurorack filter module, sold exclusively via a direct-to-consumer web store and backed by a firmware/patch subscription.

- In late 2024, a top plugin company expanded its subscription model to include collaborative cloud-based sound design and sharing features, integrating with both DAWs and mobile devices.