Multimedia Speakers Market Size

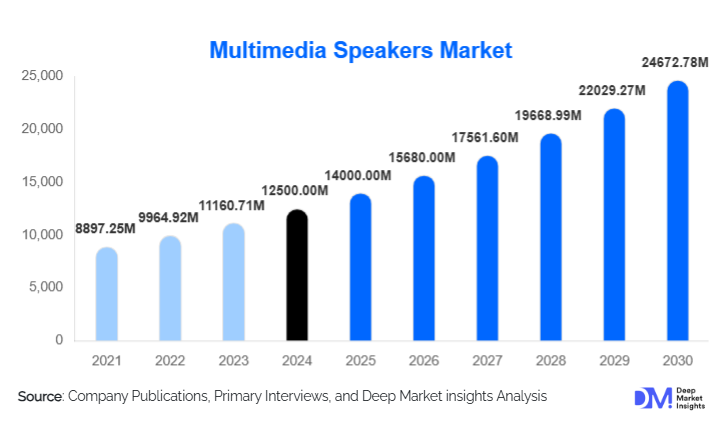

According to Deep Market Insights, the global multimedia speakers market size was valued at USD 12,500.00 million in 2024 and is projected to grow from USD 14,000.00 million in 2025 to reach USD 24,672.78 million by 2030, expanding at a CAGR of 12.00% during the forecast period (2025–2030). Market expansion is propelled by rising digital entertainment consumption, growth of wireless and smart audio technologies, and increasing adoption of multimedia speakers across homes, workplaces, and entertainment ecosystems. The growing demand for portable Bluetooth speakers, premium soundbars, and AI-enabled smart speakers has significantly accelerated global adoption.

Key Market Insights

- Wireless and smart speakers continue to dominate global demand, driven by Bluetooth 5.x, Wi-Fi 6, and voice-assistant integration across multimedia ecosystems.

- Portable Bluetooth speakers remain the single largest product segment, supported by outdoor usage, youth-driven consumption, and smartphone-led streaming trends.

- Asia-Pacific holds the largest market share, led by China’s massive electronics manufacturing base and India’s rapidly expanding consumer market.

- North America and Europe remain key premium audio markets, where consumers prefer advanced soundbars, multi-room speakers, and Dolby Atmos-enabled systems.

- Gaming, home entertainment, and hybrid office setups continue to boost audio hardware upgrades globally.

- Technological enhancements, including multi-room synchronization, AI audio tuning, and spatial sound, are reshaping customer expectations and driving product differentiation.

What are the latest trends in the multimedia speakers market?

Surge in Smart & Voice-Assistant–Enabled Speakers

Smart speakers equipped with AI voice assistants, Alexa, Google Assistant, Siri, are transforming the multimedia audio experience. Users increasingly prefer hands-free control, smart home integration, and AI-enhanced audio personalization. Speaker manufacturers are embedding advanced DSP, contextual voice recognition, and IoT-enabled automation features. This trend is especially strong in North America and Europe, where smart homes are already widely adopted. Multi-room connectivity, seamless cross-device playback, and Matter-compatible smart audio ecosystems are becoming standard in the premium segment, reshaping consumer audio preferences globally.

Premium Soundbars & Spatial Audio Becoming Mainstream

As home entertainment systems evolve, soundbars equipped with Dolby Atmos, DTS: X, and multi-driver acoustic chambers are gaining popularity. Consumers increasingly demand immersive surround sound for streaming platforms, gaming, and cinematic experiences. The soundbar category is becoming a high-growth opportunity, especially as compact living spaces in APAC and Europe favor sleek, integrated audio solutions. Spatial audio support through advanced tuning algorithms and up-firing drivers is becoming a core feature in mid- and high-end products.

What are the key drivers in the multimedia speakers market?

Growing Consumption of Streaming Content & Gaming

The rapid rise of OTT platforms, online gaming, and music streaming has significantly boosted global demand for multimedia speakers. Consumers increasingly seek richer, more immersive audio experiences while watching movies, playing games, and streaming music. Gaming, in particular, is fueling growth in mid-range desktop speakers and high-fidelity soundbars optimized for low-latency audio output. With global gaming revenue expected to exceed USD 250 billion by the end of the decade, demand for high-performance audio accessories will continue accelerating.

Advancements in Wireless Audio Technologies

Enhancements in Bluetooth 5.3, Wi-Fi 6/6E, and low-latency audio codecs have improved the overall performance and reliability of wireless speakers. These technologies offer stronger signal stability, wider range, and superior audio precision, leading consumers to upgrade older wired systems. Additionally, voice-assistant integration, AI-driven sound optimization, and enhanced battery efficiency in portable devices are driving faster adoption across both developed and emerging markets.

What are the restraints for the global market?

Fluctuating Raw Material Costs

Prices for neodymium magnets, copper coils, semiconductors, and polymer casings regularly fluctuate due to supply chain constraints. This volatility creates cost pressure for manufacturers, especially in the low-cost segment where margins are thinner. Chip shortages and rising freight costs have also contributed to price instability, making large-scale production more expensive.

Market Saturation in Developed Economies

In mature markets such as the U.S., Canada, Germany, and Japan, multimedia speaker penetration is already high. Sales growth is driven mostly by replacement cycles rather than first-time buyers, creating a competitive environment where brands must rely on innovation and premium features to differentiate. This saturation slows down volume growth, forcing brands to focus heavily on emerging markets and premiumization strategies.

What are the key opportunities in the multimedia speakers market?

Expansion of AI-Enabled & Smart Home Integrated Speakers

As smart homes become mainstream, the potential for AI-driven multimedia speakers is rising sharply. Companies have strong opportunities to develop voice-controlled entertainment hubs that integrate home lighting, automation, and device ecosystems. Solutions that offer privacy-focused processing, contextual voice recognition, and adaptive acoustic tuning will lead the next wave of premium audio adoption. This segment represents one of the most profitable growth avenues globally.

Growing Premiumization in Emerging Markets

Rising disposable income in India, China, Indonesia, Brazil, and Mexico is driving demand for mid- to high-end audio solutions. Consumers who previously bought entry-level products are now upgrading to soundbars, subwoofer systems, and premium portable speakers. Brands that localize product design, such as bass-heavy audio for India and rugged outdoor speakers for Southeast Asia, can achieve a significant regional advantage. Local assembly supported by government programs (e.g., Make in India) can further reduce import duties and expand margins.

Product Type Insights

Portable Bluetooth speakers dominate the global market, accounting for nearly 34% of total sales in 2024. Their convenience, affordability, and universal smartphone compatibility make them a preferred choice among young consumers and travelers. Soundbars represent the second-largest segment, especially in North America, Europe, and parts of APAC, where home entertainment upgrades are frequent. Smart speakers are growing rapidly due to voice assistant adoption, while professional multimedia speakers, studio monitors, and conferencing speakers are seeing rising institutional demand.

Application Insights

Residential applications lead the market, representing over 61% of global demand in 2024. Increasing OTT streaming, gaming, and smart home automation support robust purchasing behavior. Commercial use, offices, hospitality, and retail continue expanding as hybrid work environments demand superior conferencing audio solutions. Studios and content creators are driving the adoption of high-precision monitors, with the creator economy growing at double-digit rates. Gaming and education applications are emerging as high-growth categories, driven by digital learning and the global eSports boom.

Distribution Channel Insights

Online platforms dominate multimedia speaker sales, accounting for nearly 52% of total revenue in 2024. E-commerce marketplaces provide competitive pricing, detailed product reviews, and convenient delivery options, making them the preferred channel for portable and mid-range speakers. Offline retail continues to play an important role in premium purchases, where physical demos influence buying decisions. Exclusive brand outlets and electronics stores are increasingly adopting experiential displays and sound-testing zones. Direct-to-consumer (D2C) brand websites are gaining traction, supported by influencer marketing, flash sales, and subscription-based loyalty programs.

| By Product Type | By Connectivity | By Price Range | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for around 29% of the global multimedia speakers market. The region’s strong preference for home entertainment systems, gaming audio, and smart speakers drives continuous product upgrades. The U.S. leads consumption of premium soundbars and multi-room speakers, supported by high streaming penetration and strong smart home adoption. Canada shows steady demand growth in wireless and portable speakers.

Europe

Europe holds roughly 24% of the global market share, led by Germany, the U.K., and France. European consumers prefer premium acoustic fidelity and sustainable materials in speaker construction. The region is rapidly adopting smart-enabled audio systems and spatial soundbars. Scandinavian countries are early adopters of advanced IoT home audio technologies.

Asia-Pacific

APAC is the largest and fastest-growing region with a 34% market share in 2024. China remains the world’s biggest production and consumption hub for multimedia speakers. India represents the fastest-growing country globally, driven by rising income, e-commerce expansion, and a young population heavily engaged in gaming and digital entertainment. Japan and South Korea continue to be strong markets for compact soundbars and high-tech audio systems.

Latin America

Latin America accounts for about 7% of global demand. Brazil, Mexico, and Argentina lead adoption, with portable Bluetooth speakers dominating sales due to affordability and outdoor lifestyle preferences. Streaming and gaming trends are accelerating speaker adoption across urban centers.

Middle East & Africa

MEA represents approximately 6% of the global market. The UAE, Saudi Arabia, and South Africa drive demand, especially for mid-range and premium soundbars. Modern retail expansion and rising smart home adoption support growth. Africa’s young population fuels strong demand for portable wireless speakers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Multimedia Speakers Market

- Sony Corporation

- Samsung Electronics

- Apple Inc.

- Bose Corporation

- Harman International

- Sonos Inc.

- Logitech International

- JBL

- Yamaha Corporation

- Edifier International

- LG Electronics

- Creative Technology

- Panasonic Corporation

- Philips (TPV Technology)

- Marshall (Zound Industries)

Recent Developments

- In February 2025, Sony introduced a new series of Dolby Atmos-enabled soundbars with AI-based room calibration, targeting premium home entertainment users.

- In March 2025, Samsung announced investments into Wi-Fi 6E–enabled multi-room speaker technology aimed at boosting wireless performance.

- In May 2025, Edifier launched a new line of studio monitors designed for content creators and small home studios, supporting advanced DSP tuning and low-latency recording features.