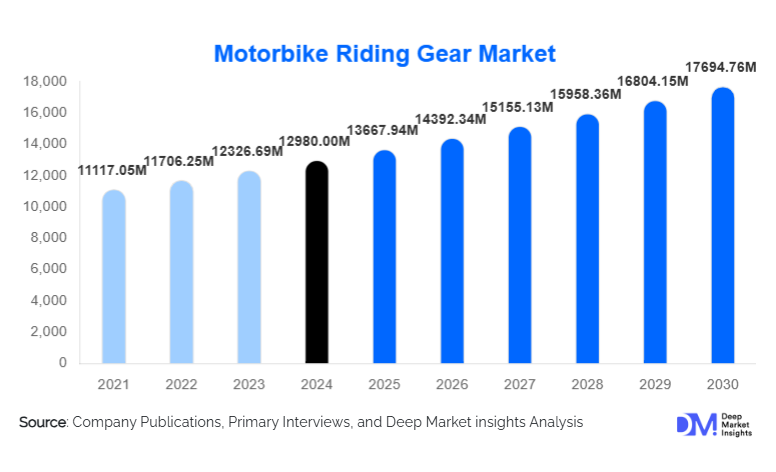

Motorbike Riding Gear Market Size

According to Deep Market Insights, the global motorbike riding gear market size was valued at USD 12,980 million in 2024 and is projected to grow from USD 13,667.94 million in 2025 to reach USD 17,694.76 million by 2030, expanding at a CAGR of 5.3% during the forecast period (2025–2030). The motorbike riding gear market growth is primarily driven by increasing motorcycle ownership, rising awareness about rider safety, stricter government regulations, and growing adoption of premium and technologically advanced protective gear globally.

Key Market Insights

- Helmets and protective apparel dominate demand, with full-face helmets and leather jackets leading globally due to safety compliance and frequent replacement cycles.

- Emerging smart gear technologies, including airbag jackets, sensor-integrated helmets, and navigation-enabled helmets, are increasingly shaping consumer preferences in developed markets.

- Asia-Pacific dominates volume demand, driven by high motorcycle penetration in India, China, Indonesia, and Vietnam, representing nearly half of global consumption in 2024.

- Europe and North America lead in value terms, due to the adoption of premium and technologically advanced gear among touring and sports riders.

- E-commerce channels are rapidly expanding, offering wider product choices, customization options, and competitive pricing, especially in urban markets.

- Regulatory compliance and road safety initiatives, such as mandatory helmet laws, are directly contributing to higher adoption rates of certified gear worldwide.

What are the latest trends in the motorbike riding gear market?

Smart and Connected Riding Gear

Technological integration is transforming riding gear, with smart helmets featuring Bluetooth communication, GPS navigation, heads-up displays, and crash detection gaining traction. Airbag-integrated jackets and sensor-equipped protective armor are attracting touring and sports riders seeking enhanced safety. These innovations are particularly appealing to tech-savvy riders in Europe, North America, and Japan. The trend is expected to accelerate as production costs decrease and mid-range gear incorporates advanced features, expanding the market beyond premium segments.

Premiumization and Adventure Touring Gear

The rising popularity of adventure motorcycles and long-distance touring has created demand for premium, multi-season riding gear. Full-featured jackets, modular helmets, off-road boots, and reinforced gloves are increasingly sought after, offering superior safety and comfort. Riders are willing to invest in high-quality products, driving revenue growth. Manufacturers are also incorporating lightweight materials, ventilated designs, and sustainable fabrics, making premium products more appealing to the growing adventure riding segment.

What are the key drivers in the motorbike riding gear market?

Increasing Motorcycle Ownership and Urban Mobility

Rising motorcycle adoption, particularly in Asia-Pacific and Latin America, is a major growth driver. High fuel costs, urban congestion, and the need for affordable transport are increasing the rider population, which in turn boosts demand for safety gear. Replacement cycles for helmets, jackets, and gloves ensure recurring revenue streams for manufacturers, particularly in densely populated urban centers.

Regulatory Compliance and Safety Awareness

Stricter safety laws and helmet regulations are encouraging the adoption of certified gear. Insurance requirements, government campaigns, and enforcement of standards like DOT, ECE, and ISI in key markets have increased awareness, leading riders to invest in compliant helmets and protective apparel. Public emphasis on injury prevention and road safety is further boosting demand for high-quality gear.

Material Innovation and Comfort Enhancements

Advances in composite materials such as carbon fiber, Kevlar, D3O, and textile blends are improving protection while reducing weight. Climate-adaptive jackets, ventilated helmets, and ergonomic designs enhance rider comfort, making premium gear more attractive. This trend is driving a shift from economy to mid-range and premium offerings in mature markets.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

A significant portion of riders in Asia-Pacific and Africa prioritize affordability over advanced safety features, which limits the penetration of premium gear. Counterfeit and non-certified products further reduce the adoption of high-quality riding gear, posing a challenge for manufacturers targeting mid-range and premium segments.

Raw Material Price Volatility

Fluctuating costs of leather, composites, and advanced textiles can compress margins or increase selling prices. Volatility in petrochemical-based materials and imported leather affects supply chain stability, posing a potential challenge to consistent market growth.

What are the key opportunities in the motorbike riding gear industry?

Regulatory Expansion and Safety Compliance

New helmet and protective gear regulations in emerging markets like India, Indonesia, Vietnam, and Brazil are creating opportunities for certified and locally manufactured products. Companies that align with local standards and pricing can capture first-time buyers at scale while reinforcing brand trust through compliance.

Smart and Connected Gear Adoption

Integrating technology such as airbags, Bluetooth communication, navigation, and crash alerts into riding gear opens a premium segment with high growth potential. As these innovations become accessible at mid-range pricing, broader adoption is expected in developed and urbanizing markets.

Adventure and Premium Touring Segment Growth

The rising demand for adventure touring, long-distance riding, and motorsports is driving premium gear adoption. Products offering enhanced protection, comfort, and style, including modular helmets, multi-season jackets, and specialized boots, present high-margin opportunities for both established and new players entering this segment.

Product Type Insights

Helmets remain the largest product category in the global motorbike riding gear market, accounting for approximately 42% of total market value in 2024. This dominance is primarily driven by mandatory helmet regulations across most motorcycle-dependent regions, high replacement frequency, and increasing consumer preference for certified safety gear. Among helmet types, full-face helmets lead globally due to superior impact protection, aerodynamic design, and suitability across commuting, touring, and sports riding applications. The rising adoption of advanced materials such as carbon fiber, fiberglass composites, and multi-layer thermoplastics has further accelerated demand, particularly in Europe and North America, where riders prioritize lightweight construction and enhanced safety ratings.

Protective apparel, including riding jackets and pants, represents the second-largest product segment, supported by increasing awareness of injury prevention beyond head protection. Jackets dominate this segment due to their ability to integrate armor, ventilation systems, and weather resistance. Gloves and riding boots are gaining traction, especially among touring and sports riders, as safety standards increasingly emphasize full-body protection. Premium footwear and gloves with reinforced knuckles, ankle protection, and abrasion-resistant materials are experiencing strong growth in developed markets, driven by rising participation in long-distance touring and motorsports activities.

Application Insights

Daily commuting remains the dominant application segment by volume, accounting for nearly 47% of total market demand, particularly in Asia-Pacific, Latin America, and parts of Africa, where motorcycles are a primary mode of transportation. The leading driver for this segment is the sheer scale of daily riders combined with regulatory enforcement of basic safety gear, particularly helmets. While average spending per rider is relatively low, the large installed base ensures sustained and recurring demand.

Touring and sports riding segments, although smaller in volume, contribute disproportionately to overall market revenue due to higher per-capita spending on premium and technologically advanced gear. Riders in these segments invest in full protective kits, including modular helmets, armored jackets, riding suits, gloves, and boots. Off-road and adventure riding is emerging as one of the fastest-growing application niches, driven by the global rise of adventure motorcycles and recreational riding culture. This segment is accelerating demand for multi-season jackets, airbag-integrated apparel, off-road boots, and dual-sport helmets designed for both on-road and rugged terrain use.

Distribution Channel Insights

Specialty motorcycle gear retailers continue to dominate the global distribution landscape, accounting for approximately 45% of total sales. The leading driver for this channel is the need for physical product fitting, safety assurance, and expert consultation, particularly for helmets, jackets, and boots. Consumers often prefer in-store purchases to evaluate comfort, fit, and certification compliance, especially for premium products.

Online and e-commerce channels, representing nearly 28% of market sales, are the fastest-growing distribution segment. Growth is driven by wider product assortments, competitive pricing, customization options, and increasing consumer confidence in digital purchasing. Online platforms are particularly effective in urban markets across North America, Europe, and the Asia-Pacific. OEM-branded stores and multi-brand sporting goods retailers play a complementary role, benefiting from brand loyalty, bundled offerings, and cross-category exposure, especially in mature motorcycle markets.

Rider Type Insights

Daily commuters represent the largest rider segment by volume, driven by affordability-focused demand for helmets and entry-level protective gear. The key growth driver in this segment is the expanding urban rider population and the enforcement of minimum safety requirements. In contrast, touring riders generate higher revenue per rider, as they typically purchase complete riding gear sets and upgrade products more frequently to enhance comfort and safety during long-distance travel.

Sports and off-road riders, while smaller in number, are critical to market value growth due to their preference for high-performance, premium, and smart riding gear. These riders drive early adoption of innovations such as airbag jackets, carbon-fiber helmets, and advanced body protection. Emerging rider types, including professional delivery personnel, ride-sharing motorcycle fleets, and motorsports training participants, are creating standardized, bulk-demand opportunities and supporting export-driven growth in certified riding gear.

| By Product Type | By Application | By Distribution Channel | By Rider Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 19% of the global motorbike riding gear market, led primarily by the United States. Market growth in this region is driven by high disposable income, a strong recreational and touring motorcycling culture, and widespread adoption of premium safety gear. Demand is concentrated in advanced helmets, airbag jackets, and touring-oriented apparel. Increasing participation in adventure riding and long-distance touring further supports premium gear sales. The rapid expansion of e-commerce and direct-to-consumer platforms is also improving access to technologically advanced products across urban and suburban markets.

Europe

Europe represents approximately 24% of the global market share, with Germany, France, Italy, and the United Kingdom as key contributors. The primary growth drivers in Europe include strict regulatory enforcement of safety standards, a mature motorsports ecosystem, and strong consumer preference for certified and sustainable riding gear. Adventure touring and performance riding are particularly popular, driving demand for premium helmets, multi-season jackets, and advanced protective apparel. European consumers also lead in the adoption of innovative materials and ergonomic designs, supporting higher average selling prices.

Asia-Pacific

Asia-Pacific is the largest regional market, accounting for approximately 48% of global demand, led by India, China, Indonesia, and Vietnam. The region’s dominance is driven by high motorcycle penetration, large commuter populations, and increasing enforcement of helmet and safety regulations. While volume demand is primarily concentrated in economy and mid-range segments, rising disposable incomes and growing interest in touring and premium motorcycles are accelerating demand for higher-quality riding gear. Asia-Pacific is also the fastest-growing region globally, with a CAGR exceeding 9.5%, supported by urbanization, local manufacturing expansion, and export-oriented production.

Latin America

Latin America accounts for approximately 6% of the global market, led by Brazil and Mexico. Growth in this region is driven by urban commuting demand, improving road safety regulations, and increasing motorcycle usage for professional and delivery services. Rising interest in adventure and recreational riding is also supporting demand for upgraded helmets and protective apparel, particularly in metropolitan areas.

Middle East & Africa

The Middle East & Africa region represents roughly 3% of global demand and is an emerging market for motorbike riding gear. Growth is led by the UAE, Saudi Arabia, and South Africa, supported by recreational motorcycling, premium lifestyle adoption, and improving retail infrastructure. In Africa, increasing motorcycle usage for commuting and commercial transport, particularly in Nigeria and Kenya, is driving the gradual adoption of certified safety gear, creating long-term growth opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the Motorbike Riding Gear Industry

- Shoei Co., Ltd.

- Arai Helmet Ltd.

- Dainese Group

- Alpinestars

- HJC Helmets

- AGV (Kering Group)

- Schuberth GmbH

- Bell Helmets

- Icon Motosports

- REV’IT!

- Klim

- LS2 Helmets

- Nolan Group

- Fox Racing

- Thor MX