Smart Helmet Market Size

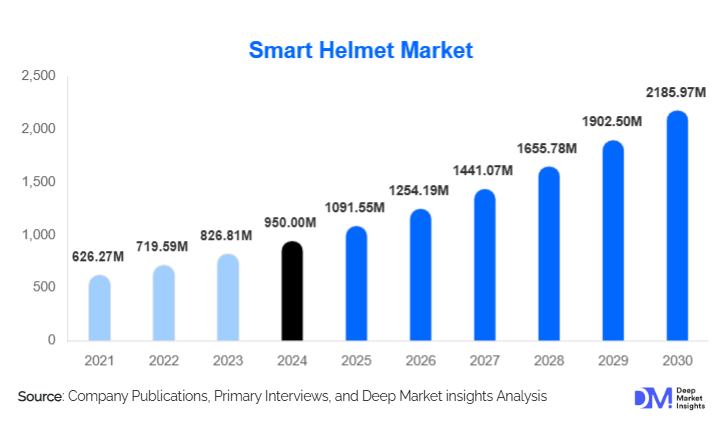

According to Deep Market Insights, the global smart helmet market size was valued at USD 950.00 million in 2024 and is projected to grow from USD 1,091.55 million in 2025 to reach USD 2,185.97 million by 2030, expanding at a CAGR of 14.9% during the forecast period (2025–2030). Market growth is driven by rising workplace safety requirements, increasing adoption of advanced wearable technologies, and strong demand from motorcyclists and industrial sectors seeking enhanced safety, connectivity, and situational awareness through integrated sensors and communication systems.

Key Market Insights

- Industrial and construction sectors are rapidly adopting IoT-enabled smart helmets to meet stringent safety regulations and improve worker monitoring.

- The consumer motorcycling segment dominates global demand, supported by growing interest in connected riding, crash detection, and hands-free communication.

- North America leads the global smart helmet market, driven by high technology adoption, strict safety standards, and a mature two-wheeler accessories industry.

- Asia-Pacific is the fastest-growing region, fueled by high two-wheeler usage in India, China, and Southeast Asia, along with increasing workplace safety modernization.

- Advancements in sensors, AR/HUD displays, and AI-driven analytics are accelerating next-generation product development.

- Industrial investments into Industry 4.0 and smart PPE ecosystems are strengthening long-term market opportunities.

What are the latest trends in the smart helmet market?

Rapid Expansion of IoT-Integrated Safety Systems

Enterprises in construction, mining, logistics, oil and gas, and manufacturing are integrating smart helmets into broader IoT safety ecosystems. These helmets provide real-time monitoring of worker fatigue, temperature exposure, fall detection, and environmental hazards such as gas leaks or high particulate matter. Companies are deploying centralized dashboards that aggregate helmet data for predictive analytics, enabling supervisors to anticipate high-risk conditions before accidents occur. As organizations aim to reduce workplace injuries and comply with tightening occupational safety laws, IoT-ready helmets are evolving into essential safety equipment rather than optional upgrades.

Consumer Shift Toward Connected Riding Experiences

In the consumer segment, smart helmets equipped with Bluetooth communication, built-in cameras, and GPS-based navigation are becoming mainstream. Riders increasingly prefer hands-free infotainment, group intercom connectivity, and crash-response systems integrated into helmets. Social media and content creation trends are pushing the adoption of helmets with 4K cameras, rear-view displays, and vehicle-to-everything (V2X) communication capabilities. Augmented reality (AR)-enabled HUDs, which project navigation and speed information onto the visor, appeal particularly to younger and tech-savvy riders. This trend is transforming helmets from passive safety tools into active riding companions.

What are the key drivers in the smart helmet market?

Growing Enforcement of Worker Safety Regulations

Governments worldwide are mandating stricter workplace protection standards, especially in construction, heavy engineering, and industrial environments. Smart helmets with sensors, geolocation tracking, and environmental monitoring help organizations comply with regulatory requirements while reducing insurance and operational risks. Companies are increasingly integrating these helmets into digital safety management systems, accelerating demand from large infrastructure and industrial projects.

Advancements in Wearable and Sensor Technologies

Rapid innovation in sensors, batteries, microprocessors, and wireless communication modules is enabling more compact, affordable, and multifunctional smart helmets. Improved battery life, lightweight AR displays, advanced thermal sensors, and AI-powered imaging are expanding the range of practical applications. This technological evolution is making smart helmets more attractive to both industrial buyers and everyday riders seeking upgraded functionality without compromising comfort.

What are the restraints for the global market?

High Cost of Smart Helmets Compared to Traditional Models

Smart helmets remain significantly more expensive due to the inclusion of electronics, connectivity modules, cameras, and advanced sensor systems. For price-sensitive markets in Asia and Latin America, this price gap limits penetration among mass motorcycle users. Companies face challenges balancing affordability with advanced functionality, especially as emerging markets represent the largest potential consumer base.

Certification Challenges and Technical Standardization

Smart helmets must meet dual compliance requirements, traditional safety certifications such as DOT or ECE, along with electronic and battery safety regulations. Lack of harmonized global standards for smart PPE and AR-integrated helmets results in lengthy certification procedures, slowing down market entry. These complexities increase R&D overheads and limit the speed of mass commercial adoption.

What are the key opportunities in the smart helmet industry?

AR-Enhanced Industrial and Defense Applications

AR-enabled helmets offer immersive visuals, hands-free instructions, equipment diagnostics, and real-time hazard alerts, making them highly valuable in industrial, defense, and public safety sectors. Defense forces are testing helmets with night vision overlays, live mission data, and battlefield mapping. Firefighters and emergency responders are adopting thermal imaging visors and smoke navigation aids. This creates a strong pipeline for next-generation, high-margin smart helmet solutions tailored to mission-critical environments.

Expansion in Emerging Economies with High Two-Wheeler Usage

India, China, Indonesia, Vietnam, and the Philippines represent enormous untapped consumer markets where two-wheelers are the primary transportation. As governments tighten helmet regulations and road safety campaigns increase, the adoption of basic smart helmets is expected to surge. Localized manufacturing, affordable component sourcing, and partnerships with motorcycle OEMs present strong monetization opportunities for new entrants and established brands looking to scale globally.

Product Type Insights

The full-face smart helmet segment dominates the global market, accounting for nearly 58% of 2024 demand. These helmets offer superior protection, more internal space for sensors, and widespread acceptance among motorcyclists and premium riders. Open-face helmets serve urban commuter markets seeking lighter options with basic connectivity. Industrial smart helmets, including hard hats with integrated sensors and IoT modules, represent the fastest-growing product category as industries digitize safety operations and deploy connected PPE for workforce management.

Application Insights

Consumer applications, mainly motorcycling and cycling, represent the largest share of global demand, driven by the need for hands-free communication, navigation, and crash analytics. Industrial applications are rapidly increasing as organizations adopt smart PPE to manage worker safety, regulate compliance, and gain real-time insights into hazardous environments. Public safety, emergency response, and defense sectors are adopting smart helmets with AR displays, thermal cameras, and live data overlays, forming emerging high-value application areas.

Distribution Channel Insights

Online platforms and e-commerce portals dominate smart helmet sales due to greater product visibility, user reviews, and competitive pricing. Direct-to-consumer (D2C) channels are expanding as helmet manufacturers enhance digital storefronts and launch subscription-based software upgrades for navigation, analytics, and cloud services. Retail stores specializing in motorcycle gear remain important in regions with high two-wheeler adoption. B2B channels, serving construction, manufacturing, and industrial buyers, account for significant volume in enterprise-grade smart helmet procurement.

Traveler Type Insights

Tech-savvy consumers and motorcycle enthusiasts are the largest adopter group, prioritizing connectivity, onboard cameras, and safety analytics. Commuters in congested urban centers are increasingly purchasing entry-level smart helmets for navigation and communication convenience. Industrial workers represent a fast-growing user base as employers deploy smart PPE to monitor productivity, environmental conditions, and compliance. Emergency responders, including firefighters and paramedics, are adopting specialized thermal-vision helmets for mission-critical operations.

Age Group Insights

Riders aged 25–45 years account for the largest share of consumer smart helmet purchases due to high two-wheeler ownership and preference for connected mobility. Younger riders aged 18–30 represent strong growth potential, driven by social media content creation trends and demand for camera-equipped helmets. Industrial users span a broad age range, with adoption driven more by employer deployment than individual purchase decisions. Older consumers adopt smart helmets primarily for safety features such as crash alerts and emergency communication.

| By Product Type | By Technology / Component | By End-Use / Application |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest regional market, accounting for over 40% of global revenue in 2024. High adoption of advanced wearables, strong motorcycle accessory demand, and widespread industrial safety compliance drive continuous market expansion. The United States leads the region, supported by strong purchasing power and early adoption of AR-enabled helmets.

Europe

Europe demonstrates steady demand driven by stringent helmet regulations, electrification of mobility, and strong cycling culture across Germany, the U.K., and the Netherlands. Industrial buyers in Europe are early adopters of smart PPE solutions, and consumer cyclists increasingly prefer helmets with lighting, fall detection, and visibility-enhancing features.

Asia-Pacific

Asia-Pacific is the fastest-growing region globally, led by India, China, Japan, and South Korea. High two-wheeler use, rapid urbanization, and increasing regulation of helmet standards support strong adoption. China and India represent the largest future growth opportunities due to rising safety awareness and government-backed smart city initiatives. Local manufacturers are scaling production to compete with global brands.

Latin America

Latin America is witnessing growing adoption of smart helmets, especially in Brazil and Mexico, where urban motorcycle usage is rising. Cost barriers remain a challenge, but improving road safety enforcement and growth in app-based delivery fleets are boosting demand for connected helmet solutions.

Middle East & Africa

The region shows emerging demand driven by large infrastructure investments, industrial modernization, and rising adoption of premium motorcycle accessories. The UAE and Saudi Arabia lead consumer and industrial demand, while African nations increasingly adopt smart PPE for mining, construction, and oil and gas operations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Helmet Market

- Sena Technologies

- CrossHelmet (Borderless Inc.)

- Bell Helmets (Vista Outdoor)

- Forcite Helmet Systems

- LIVALL Tech Co.

- JARVISH Inc.

- Schuberth GmbH

- SHOEI Co.

- Lumos Helmet

- Fusar Technologies

- Torc Helmets

- 360fly Inc.

- Nand Logic Corp.

- Reevu

- H&H Sports Protection

Recent Developments

- In January 2025, Forcite introduced its next-generation smart helmet featuring a wide-field AR HUD and AI-based thermal sensing for enhanced rider awareness.

- In March 2025, Sena Technologies launched a new mesh-communication headset integrated into full-face helmets for improved multi-rider connectivity.

- In June 2025, Bell Helmets announced an industrial smart hard-hat line integrating biometric fatigue monitoring and IoT connectivity for construction sites.