Motion Pictures Market Size

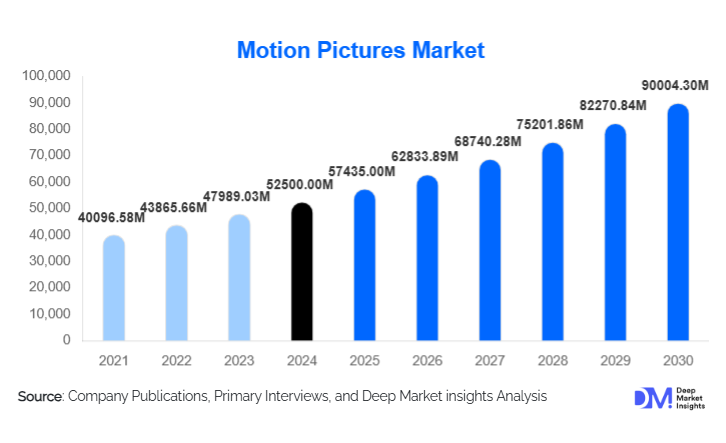

According to Deep Market Insights, the global motion pictures market size was valued at USD 52,500.00 million in 2024 and is projected to grow from USD 57,435.00 million in 2025 to reach USD 90,004.30 million by 2030, expanding at a CAGR of 9.4% during the forecast period (2025–2030). Market growth is driven by the recovery of theatrical exhibition, sustained expansion of streaming platforms, rising international box office revenues, and increasing investments in franchise-driven and original digital content.

Key Market Insights

- Theatrical exhibition remains the single largest revenue contributor, supported by premium formats such as IMAX, Dolby Cinema, and event-based blockbuster releases.

- Hybrid and direct-to-streaming distribution models are reshaping release strategies, allowing studios to maximize monetization across platforms.

- North America leads the global market, supported by high ticket pricing, strong IP ownership, and mature digital infrastructure.

- Asia-Pacific is the fastest-growing region, driven by China, India, and South Korea’s expanding domestic film industries.

- Franchise and IP-based films dominate profitability, generating long-tail revenues through merchandising, licensing, and sequels.

- Advanced production technologies, including virtual production, AI-assisted VFX, and real-time rendering, are improving cost efficiency and creative scalability.

What are the latest trends in the motion pictures market?

Shift Toward Hybrid Distribution Models

Studios are increasingly adopting hybrid release strategies that combine theatrical windows with early digital and streaming availability. This approach reduces revenue volatility, expands audience reach, and enables better content lifecycle management. Shortened theatrical windows and premium video-on-demand releases are becoming standard, particularly for mid-budget films. Hybrid distribution has improved return on investment while responding to evolving consumer preferences for flexibility and convenience.

Technology-Driven Film Production

Virtual production, AI-driven editing, and CGI-heavy workflows are transforming film production. LED volume stages, real-time rendering engines, and AI-assisted post-production tools are reducing filming timelines and costs while enhancing visual quality. These technologies are increasingly adopted by major studios and high-budget productions, enabling faster content delivery and greater creative experimentation.

What are the key drivers in the motion pictures market?

Revival of Premium Theatrical Experiences

The resurgence of cinema attendance is driven by premium viewing experiences that cannot be replicated at home. Large-format screens, immersive audio, and exclusive theatrical releases are driving higher average ticket prices. Franchise films and event-driven releases continue to draw audiences globally, reinforcing the relevance of theatrical exhibition.

Expansion of Global Streaming Platforms

Streaming platforms have become major financiers and distributors of motion pictures, significantly increasing global content demand. Investments in original films, localized storytelling, and global licensing deals are expanding revenue streams beyond traditional box office performance.

What are the restraints for the global market?

Rising Production and Marketing Costs

Escalating costs for visual effects, talent compensation, and global marketing campaigns are pressuring studio margins. Marketing expenses for major releases can exceed half of production budgets, increasing financial risk, especially for non-franchise films.

Content Oversupply and Audience Fragmentation

The rapid increase in film releases across streaming and theatrical platforms has intensified competition for viewer attention. Discoverability challenges and shortened content lifecycles can reduce revenue potential for mid- and low-budget productions.

What are the key opportunities in the motion pictures industry?

Growth of Regional and Local-Language Cinema

Regional film industries in India, China, South Korea, and Nigeria are experiencing strong growth, creating opportunities for co-productions and international licensing. Local-language films with global distribution potential are expanding audience reach and diversifying revenue sources.

New Monetization Channels and FAST Platforms

The rise of ad-supported streaming, airline entertainment licensing, and long-tail catalog monetization is unlocking incremental revenue. Studios are increasingly leveraging legacy content across multiple digital platforms to extend profitability.

Product Type Insights

Big-budget studio films continue to dominate the global motion picture market, accounting for approximately 45% of total revenue in 2024. Their leadership is driven by global day-and-date release strategies, established franchise ecosystems, and superior monetization across theatrical, streaming, merchandising, and licensing channels. High production value, star power, and strong marketing support allow these films to generate significant box office revenue while also creating long-term value through sequels, spin-offs, and intellectual property extensions.

Mid-budget films play a critical and increasingly strategic role, particularly within streaming and hybrid distribution models. These films are well-suited for digital-first or limited theatrical releases, offering lower financial risk while delivering consistent returns through licensing deals and platform exclusivity agreements. Studios and streaming platforms increasingly rely on mid-budget productions to maintain content volume, address diverse audience preferences, and support localized storytelling. Low-budget and independent films are gaining visibility and commercial relevance due to the democratization of distribution through streaming platforms and international film festivals. Digital platforms have reduced barriers to entry, enabling independent filmmakers to reach global audiences without extensive theatrical rollouts. This segment is also benefiting from the growing demand for niche, experimental, and culturally authentic narratives.

Application Insights

Consumer entertainment remains the primary application of motion pictures, encompassing theatrical audiences and at-home viewers across physical and digital formats. Theatrical experiences continue to serve as the cornerstone for brand-building and premium content launches, while downstream digital consumption ensures extended revenue generation. Streaming and digital consumption are the fastest-growing application segments, supported by rising smart TV penetration, improved broadband infrastructure, and increasing mobile video consumption globally. Subscription-based and ad-supported streaming platforms are driving demand for exclusive and original film content, significantly influencing production decisions and release strategies.

Emerging applications such as educational films, branded storytelling, and immersive entertainment formats are expanding the functional scope of motion pictures. Educational institutions and corporations increasingly use cinematic content for training, communication, and brand engagement, while immersive formats such as VR-enhanced storytelling and interactive films are gaining traction as experimental applications with long-term growth potential.

Distribution Channel Insights

Theatrical distribution continues to generate the highest revenue per title, particularly for blockbuster and franchise-driven releases. Premium formats such as IMAX, Dolby Cinema, and large-format screens have strengthened pricing power and improved per-screen profitability, reinforcing the importance of theatrical windows for high-budget films. Digital platforms dominate volume-based distribution, enabling studios to reach global audiences at scale. Licensing agreements with subscription-based, transactional, and ad-supported streaming platforms have become a critical revenue pillar, particularly for mid- and low-budget films. These platforms also provide valuable audience data, enabling studios to optimize content strategy.

Direct-to-consumer (DTC) studio platforms are gaining importance as major studios seek greater control over distribution, pricing, and customer relationships. Additionally, ancillary channels such as airline entertainment, hospitality licensing, and television syndication provide stable long-tail revenues, extending the commercial lifespan of film content well beyond its initial release cycle.

End-Use Insights

Individual consumers represent the dominant end-use segment, accounting for the majority of global motion picture consumption across cinemas and digital platforms. Consumer demand is increasingly shaped by convenience, content variety, and pricing flexibility, driving growth in both theatrical and streaming consumption. Streaming platforms constitute the fastest-growing end-use segment, fueled by intense competition for exclusive content and global subscriber growth. These platforms are not only major buyers but also leading producers of motion picture content, fundamentally reshaping industry economics.

Institutional buyers, including broadcasters, airlines, hospitality chains, and educational institutions, represent a stable and growing end-use segment. Demand from these buyers is driven by content licensing for passenger entertainment, in-room services, and educational programming, contributing to consistent, contract-based revenue streams.

| By Product Type | By Application | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 32% of the global motion pictures market in 2024, led by the United States. Regional dominance is driven by high average ticket prices, widespread adoption of premium theatrical formats, and the presence of major global studios with extensive intellectual property portfolios. The U.S. remains the world’s largest exporter of motion picture content, benefiting from strong international distribution networks and high demand for English-language films. Continued investment in advanced production technologies and streaming platforms further supports sustained regional leadership.

Europe

Europe holds around 22% market share, with key contributions from the U.K., France, and Germany. Growth in the region is supported by robust government subsidies, tax incentives, and public funding programs aimed at preserving domestic cinema. Strong cultural affinity for theatrical viewing, coupled with cross-border co-productions within the EU, enhances content diversity and export potential. Europe’s emphasis on local-language films and regulatory support for domestic content also strengthens regional demand.

Asia-Pacific

Asia-Pacific represents nearly 30% of the global market and is the fastest-growing region, with a CAGR of approximately 6.8%. Growth is driven by expanding middle-class populations, rising disposable incomes, and rapid urbanization in China and India. Increasing investment in domestic film production, growing multiplex infrastructure, and strong government support for local film industries are accelerating regional output. Additionally, South Korea and Japan contribute through high-quality content exports and strong international appeal.

Latin America

Latin America accounts for approximately 9% of the global market, led by Brazil and Mexico. Regional growth is supported by rising cinema penetration, expanding middle-income populations, and increasing adoption of streaming services. Local content production is gaining momentum, supported by government incentives and partnerships with global streaming platforms seeking regional originals. Improved digital infrastructure is further accelerating demand for digital film consumption.

Middle East & Africa

The Middle East & Africa region holds about 7% market share, with Saudi Arabia and the UAE emerging as high-growth markets. Growth is driven by rapid cinema infrastructure expansion, government-backed entertainment reforms, and significant investment in domestic film production. Saudi Arabia’s reopening and expansion of cinemas, combined with national initiatives to build a local film industry, are transforming the regional market. In Africa, Nigeria and South Africa are strengthening regional production capabilities, contributing to increased content creation and consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Motion Pictures Industry

- The Walt Disney Company

- Warner Bros. Discovery

- Universal Pictures (Comcast)

- Sony Pictures Entertainment

- Paramount Global

- Netflix

- Amazon MGM Studios

- Lionsgate

- Toho Co.

- CJ ENM

- Alibaba Pictures

- Huayi Brothers

- STX Entertainment

- Legendary Entertainment

- StudioCanal