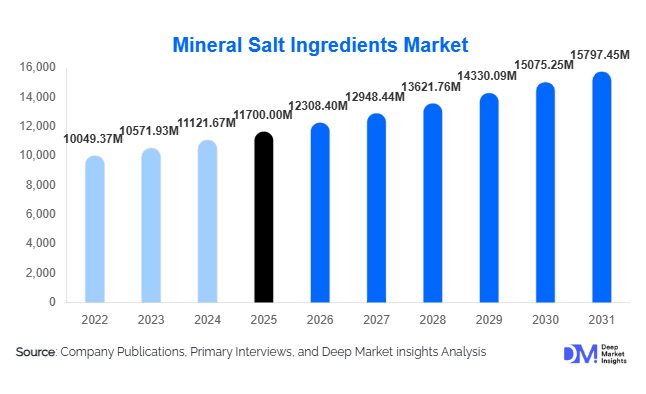

Mineral Salt Ingredients Market Size

According to Deep Market Insights, the global mineral salt ingredients market size was valued at USD 11,700.00 million in 2025 and is projected to grow from USD 12,308.40 million in 2026 to reach USD 15,797.45 million by 2031, expanding at a CAGR of 5.2% during the forecast period (2026–2031). The mineral salt ingredients market growth is primarily driven by the rising adoption of food fortification programs, increasing consumption of dietary supplements, expanding pharmaceutical applications, and growing demand from animal nutrition and industrial processing sectors.

Key Market Insights

- Food and beverage fortification remains the largest demand driver, supported by global initiatives to address micronutrient deficiencies.

- Calcium, magnesium, and sodium salts collectively account for over half of global demand, due to their essential nutritional and functional roles.

- Asia-Pacific dominates the market by volume, led by China and India, driven by population growth and government-backed nutrition programs.

- Pharmaceutical-grade mineral salts are the fastest-growing segment, benefiting from rising preventive healthcare and supplement consumption.

- Natural mineral extraction is increasingly preferred, aligned with clean-label, sustainability, and traceability trends.

- Technological advancements in purification and encapsulation are improving bioavailability and expanding premium applications.

What are the latest trends in the mineral salt ingredients market?

Shift Toward Clean-Label and Naturally Sourced Minerals

Manufacturers are increasingly focusing on naturally sourced mineral salts to meet clean-label and sustainability requirements, particularly in food, beverage, and nutraceutical applications. Consumers are demanding transparency in ingredient sourcing, prompting food processors to replace synthetic minerals with naturally extracted calcium, magnesium, and potassium salts. This trend is especially prominent in Europe and North America, where regulatory scrutiny and consumer awareness are high. Certifications related to sustainability, traceability, and environmental impact are becoming important differentiators, encouraging investments in eco-friendly extraction and processing technologies.

Advancements in Bioavailability and Specialty Formulations

Technological innovation is reshaping the mineral salt ingredients market through the development of chelated, encapsulated, and sustained-release mineral formulations. These advanced forms improve absorption and reduce gastrointestinal side effects, making them particularly attractive for pharmaceutical and dietary supplement manufacturers. Encapsulation technologies are also enabling the use of mineral salts in sensitive applications such as infant nutrition, functional beverages, and personalized nutrition solutions. As a result, value-added mineral ingredients are gaining market share over commodity-grade salts.

What are the key drivers in the mineral salt ingredients market?

Rising Global Focus on Nutritional Fortification

The increasing prevalence of micronutrient deficiencies worldwide is a major growth driver for the mineral salt ingredients market. Governments and international health organizations are mandating the fortification of staple foods such as flour, salt, dairy products, and beverages with essential minerals, including calcium, iron, iodine, and zinc. These initiatives are creating consistent, long-term demand for food-grade mineral salts, particularly in emerging economies across Asia-Pacific, Africa, and Latin America.

Expansion of Dietary Supplements and Preventive Healthcare

Growing awareness of preventive healthcare and wellness is driving robust demand for mineral-based dietary supplements. Aging populations, rising lifestyle-related disorders, and increased fitness consciousness are accelerating the consumption of calcium, magnesium, potassium, and trace mineral supplements. Pharmaceutical-grade mineral salts are benefiting from higher pricing, stringent quality requirements, and expanding prescription and OTC supplement markets, especially in North America and Europe.

What are the restraints for the global market?

Volatility in Raw Material and Energy Costs

The mineral salt ingredients market faces challenges from fluctuating raw material and energy prices, particularly for naturally extracted minerals. Mining, purification, and drying processes are energy-intensive, making production costs sensitive to fuel price volatility and environmental compliance costs. These factors can compress margins for manufacturers, especially those operating in commodity-grade segments.

Stringent Regulatory and Quality Compliance Requirements

Regulatory frameworks governing mineral salts vary significantly across regions, particularly for food and pharmaceutical applications. Compliance with purity standards, dosage limits, labeling regulations, and approval timelines increases operational complexity and costs. Smaller manufacturers often face barriers to entry due to the capital-intensive nature of regulatory compliance and quality assurance.

What are the key opportunities in the mineral salt ingredients industry?

Government-Led Food Fortification Programs in Emerging Markets

Expanding government-backed nutrition programs present significant growth opportunities, particularly in the Asia-Pacific, Africa, and Latin America. Mandatory fortification of staple foods is increasing institutional procurement of mineral salts, offering stable, high-volume demand. Companies aligning product portfolios with public health objectives can secure long-term supply contracts and strengthen regional market presence.

Growth of Sports Nutrition and Functional Beverages

The rapid expansion of sports nutrition, hydration products, and functional beverages is creating new opportunities for mineral salt ingredient suppliers. Electrolyte-rich formulations containing sodium, potassium, and magnesium salts are increasingly used in energy drinks, recovery beverages, and fitness supplements. Innovation in clean-label, low-sodium, and bioavailable electrolyte blends is expected to drive premiumization and margin expansion.

Product Type Insights

Calcium salts dominate the mineral salt ingredients market, accounting for approximately 28% of global market value in 2025, driven by widespread use in food fortification, supplements, and pharmaceuticals. Magnesium salts follow closely, supported by rising demand in sports nutrition and healthcare applications. Sodium salts remain essential across food processing and industrial uses, while potassium salts are gaining traction due to growing awareness of cardiovascular health. Trace mineral salts, although smaller in volume, represent a high-value segment due to their critical role in animal nutrition and specialized pharmaceutical formulations.

Application Insights

Food and beverage processing represents the largest application segment, contributing nearly 36% of global demand in 2025, supported by fortified foods, dairy alternatives, and functional beverages. Pharmaceuticals and dietary supplements form the fastest-growing application segment, driven by preventive healthcare trends and higher-value formulations. Animal nutrition and aquaculture applications are expanding steadily, particularly in the Asia-Pacific region, as industrial livestock farming and protein consumption increase globally.

End-Use Industry Insights

The food and beverage industry remains the largest end-use sector, valued at approximately USD 2.5 billion in 2025. Healthcare and pharmaceuticals are growing at the fastest pace, with a CAGR exceeding 8%, supported by rising supplement consumption and prescription mineral therapies. Animal feed and aquaculture represent a critical growth area, benefiting from increasing demand for productivity-enhancing trace minerals and specialty feed formulations.

| By Product Type | By Source | By Form | By Purity Grade | By Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the mineral salt ingredients market with approximately 42% share in 2025. China leads regional demand due to large-scale food processing, feed production, and pharmaceutical manufacturing, while India is the fastest-growing market, supported by national nutrition programs and expanding supplement consumption.

North America

North America accounts for around 24% of the global market share, driven by strong demand for dietary supplements, fortified foods, and pharmaceutical-grade mineral salts. The United States represents the largest market, supported by high healthcare spending and advanced food processing industries.

Europe

Europe holds approximately 21% market share, led by Germany, France, and the United Kingdom. Stringent food safety regulations, clean-label preferences, and high adoption of fortified products define regional demand.

Latin America

Latin America represents about 7% of global demand, with Brazil and Mexico as key markets. Growth is supported by dairy fortification programs and expanding food processing industries.

Middle East & Africa

The Middle East & Africa region accounts for roughly 6% of the market. Rising imports, limited domestic production, and expanding food fortification initiatives in countries such as Saudi Arabia, the UAE, and South Africa are supporting growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Mineral Salt Ingredients Market

- BASF SE

- Evonik Industries AG

- Compass Minerals

- Cargill Incorporated

- Tate & Lyle PLC

- Jungbunzlauer Suisse AG

- K+S Group

- Arkema SA

- Albion Minerals

- Balchem Corporation

- LANXESS AG

- ICL Group

- Tata Chemicals

- Sumitomo Chemical

- Yara International