Milk Thistle Oil Market Size

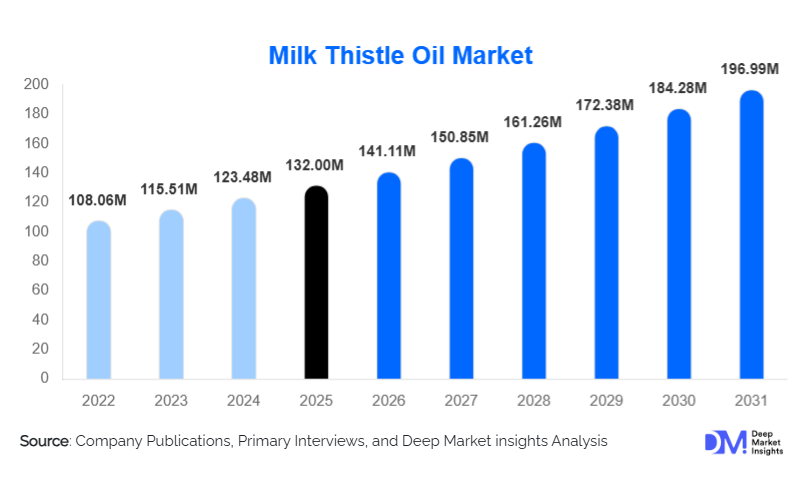

According to Deep Market Insights, the global milk thistle oil market size was valued at USD 132.00 million in 2025 and is projected to grow from USD 141.11 million in 2026 to reach USD 196.99 million by 2031, expanding at a CAGR of 6.9% during the forecast period (2026–2031). The milk thistle oil market growth is primarily driven by rising demand for plant-based nutraceutical ingredients, increasing prevalence of liver-related health conditions, and expanding applications across dietary supplements, pharmaceuticals, and clean-label cosmetics.

Key Market Insights

- Dietary supplements remain the largest application segment, supported by growing awareness of liver health, detoxification, and preventive wellness.

- Cold-pressed and organic milk thistle oil dominates product demand due to higher bioactive retention and clean-label positioning.

- Europe leads global consumption, driven by strong adoption of herbal medicine and widespread use in pharmaceutical formulations.

- North America represents a high-value market, supported by premium nutraceutical pricing and strong supplement penetration.

- Asia-Pacific is the fastest-growing region, fueled by expanding middle-class income, traditional medicine practices, and rising nutraceutical manufacturing.

- Technological advancements in extraction, including CO₂ and solvent-free processes, are improving yield consistency and product purity.

What are the latest trends in the milk thistle oil market?

Rising Demand for Clean-Label and Organic Botanical Oils

Consumers are increasingly scrutinizing ingredient transparency, favoring cold-pressed, organic, and non-GMO botanical oils. Milk thistle oil aligns strongly with clean-label trends due to its natural origin and minimal processing requirements. Manufacturers are responding by expanding certified organic product lines, investing in traceability systems, and highlighting sustainable sourcing practices. This trend is particularly strong in Europe and North America, where regulatory frameworks and consumer awareness support premium pricing for organic nutraceutical ingredients.

Growing Integration into Cosmetic and Dermocosmetic Formulations

Milk thistle oil is gaining traction in cosmetics for its antioxidant, anti-inflammatory, and skin barrier repair properties. Skincare brands are incorporating the oil into anti-aging creams, serums, and sensitive-skin formulations. Demand is being driven by the clean beauty movement and increasing preference for plant-based actives over synthetic alternatives. Premium skincare manufacturers in Europe, Japan, and South Korea are actively adopting milk thistle oil as a functional botanical ingredient.

What are the key drivers in the milk thistle oil market?

Expanding Global Nutraceutical Industry

The rapid growth of the nutraceutical industry is a major driver for milk thistle oil demand. Supplements targeting liver health, detoxification, metabolic health, and antioxidant support increasingly feature milk thistle oil as a core ingredient. Aging populations, rising healthcare costs, and a shift toward preventive care are reinforcing long-term consumption trends. Manufacturers benefit from repeat purchases and high consumer loyalty in this segment.

Increased Preference for Herbal and Traditional Medicine

Milk thistle has a long history of use in traditional medicine systems, particularly in Europe and Asia. Renewed interest in herbal remedies is driving pharmaceutical and nutraceutical companies to reformulate products using standardized botanical oils. Regulatory acceptance of herbal actives in multiple regions further supports this trend, contributing to stable long-term market growth.

What are the restraints for the global market?

Raw Material Supply and Price Volatility

Milk thistle seed production is highly dependent on climatic conditions, which can impact availability and pricing. Seasonal yield fluctuations and limited large-scale cultivation in certain regions can create supply bottlenecks, increasing input costs for manufacturers and compressing margins.

Regulatory Complexity Across Regions

Varying regulatory standards for botanical oils across regions create compliance challenges. Differences in approval pathways for dietary supplements, pharmaceuticals, and cosmetic applications can delay product launches and increase operational costs for global market participants.

What are the key opportunities in the milk thistle oil industry?

Emerging Demand in Asia-Pacific and Latin America

Asia-Pacific presents significant untapped potential due to rising disposable income, expanding nutraceutical manufacturing, and strong cultural acceptance of herbal medicine. Countries such as China and India are investing in medicinal plant cultivation, creating opportunities for localized sourcing and cost optimization. Latin America is also emerging as a growth market, supported by increasing supplement imports and rising health awareness.

Product Innovation and Combination Formulations

Opportunities exist in developing combination products that blend milk thistle oil with omega fatty acids, curcumin, or other liver-supporting botanicals. Such formulations enhance efficacy and allow manufacturers to differentiate products in a competitive supplement landscape, supporting premium pricing strategies.

Product Type Insights

Cold-pressed milk thistle oil accounts for the largest share of the global market, representing approximately 42% of total revenue in 2024. The dominance of this segment is primarily driven by its superior nutrient retention, including higher concentrations of silymarin complexes, essential fatty acids, and tocopherols, which are critical for therapeutic efficacy. Consumers and manufacturers increasingly prefer minimally processed oils, particularly in dietary supplements and clean-label cosmetic formulations, where product purity and bioavailability are key purchasing criteria. The growing preference for solvent-free extraction methods and transparent labeling has further strengthened the adoption of cold-pressed variants.

Refined milk thistle oil holds a significant share within pharmaceutical and nutraceutical applications, where uniformity, oxidative stability, and extended shelf life are essential. Refined oil is favored in standardized formulations that require consistent dosing and compliance with pharmacopeial standards. Meanwhile, organic certified milk thistle oil is the fastest-growing sub-segment, supported by increasing consumer demand for sustainably sourced, pesticide-free botanical ingredients. Growth in this segment is further driven by expanding organic certification frameworks in Europe and North America, as well as premium pricing opportunities for manufacturers targeting health-conscious and environmentally aware consumers.

Application Insights

Dietary supplements dominate application demand, accounting for nearly 48% of the global milk thistle oil market in 2024. This leadership is driven by the oil’s well-established hepatoprotective properties and its widespread use in liver health, detoxification, and metabolic wellness supplements. Rising prevalence of non-alcoholic fatty liver disease (NAFLD), alcohol-induced liver disorders, and lifestyle-related health issues has significantly increased consumer reliance on milk thistle-based supplements, particularly in capsule and softgel formats.

Pharmaceutical and nutraceutical formulations represent the second-largest application segment, supported by clinical validation of milk thistle’s antioxidant and anti-inflammatory effects. The segment benefits from growing acceptance of botanical actives in regulated healthcare products, particularly in Europe and parts of Asia. Cosmetic and personal care applications are expanding steadily, driven by the oil’s ability to reduce oxidative stress, soothe sensitive skin, and support skin barrier repair. Functional food and beverage applications remain niche but are gaining traction as manufacturers explore fortification of health drinks and nutrition bars. Veterinary and animal nutrition applications represent a small but emerging segment, driven by increasing demand for natural liver-support supplements in companion animals.

Distribution Channel Insights

B2B bulk sales to dietary supplement, pharmaceutical, and cosmetic manufacturers remain the dominant distribution channel, accounting for approximately 46% of total market revenue in 2024. This dominance is driven by large-volume procurement requirements, long-term supply contracts, and the growing trend of vertical integration among nutraceutical and cosmetic brands seeking direct sourcing of active ingredients.

Pharmacies and drug stores play a critical role in finished product distribution, particularly in Europe and North America, where pharmacist-recommended supplements carry high consumer trust. Online retail and e-commerce channels are expanding rapidly, supported by the rise of direct-to-consumer supplement brands, digital health platforms, and subscription-based wellness models. Increasing consumer comfort with online health purchases and improved regulatory oversight of e-commerce supplements are further accelerating growth in this channel.

End-Use Insights

Human health and wellness remains the largest end-use segment, accounting for approximately 54% of total market demand. Growth in this segment is driven by preventive healthcare trends, aging populations, and increasing awareness of liver health across both developed and emerging economies. Milk thistle oil’s positioning as a natural, plant-based remedy supports sustained consumption in this segment.

The cosmetic and personal care segment follows, benefiting from clean beauty trends and rising demand for botanical oils with multifunctional skin benefits. Food and beverage manufacturers are gradually incorporating milk thistle oil into functional nutrition products, particularly in premium health-focused categories. Animal health and veterinary applications, especially liver-support supplements for pets, represent an emerging opportunity, supported by increasing pet ownership and rising expenditure on preventive pet healthcare.

| By Product Type | By Application | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe leads the global milk thistle oil market with an estimated 34% share in 2024. Germany, France, Italy, and Spain are major consuming countries, supported by strong herbal medicine traditions, high pharmaceutical usage, and a well-established cosmetic manufacturing base. The region benefits from clear regulatory frameworks governing botanical ingredients, which enhance manufacturer confidence and consumer trust. Additionally, Europe’s strong focus on organic certification and sustainable sourcing acts as a key growth driver, particularly for premium and pharmaceutical-grade milk thistle oil.

North America

North America accounts for approximately 29% of global market revenue, led by the United States. Regional growth is driven by high dietary supplement consumption, premium pricing tolerance, and robust retail and e-commerce distribution networks. Increasing awareness of liver health, rising incidence of lifestyle-related disorders, and strong marketing by nutraceutical brands further support demand. Canada contributes steadily through its expanding natural health product market and favorable regulatory environment for herbal supplements.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 10% CAGR during the forecast period. China and India are key growth markets due to the integration of milk thistle into traditional medicine systems, the rapid expansion of domestic nutraceutical manufacturing, and government support for medicinal plant cultivation. Rising disposable income, urbanization, and increasing adoption of preventive healthcare are accelerating demand. Japan and South Korea contribute through high-value cosmetic and pharmaceutical applications, particularly in antioxidant-rich skincare formulations.

Latin America

Latin America holds a smaller but steadily growing share of the global market, led by Brazil and Mexico. Growth in the region is driven by rising imports of nutraceutical ingredients, increasing middle-class health awareness, and the gradual expansion of the dietary supplement industry. Regulatory improvements and growing distribution through pharmacies and online channels are further supporting market penetration.

Middle East & Africa

The Middle East & Africa region shows moderate growth, led by the UAE, Saudi Arabia, and South Africa. Demand is driven by increasing supplement imports, rising prevalence of lifestyle-related health conditions, and growing consumer interest in herbal and natural health products. The UAE, in particular, serves as a regional distribution hub, facilitating re-exports and broader market access across the Middle East and Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Milk Thistle Oil Market

- Indena S.p.A.

- Naturex (Givaudan)

- Euromed S.A.

- Bio-Botanica Inc.

- Sabinsa Corporation

- Martin Bauer Group

- Nexira

- Alchem International

- Hunan Nutramax

- Shaanxi Jiahe Phytochem

- Xi’an Greena Biotech

- Naturalin Bio-Resources

- Frutarom Health

- Phyto Life Sciences

- Kancor Ingredients