Microalgae Market Size

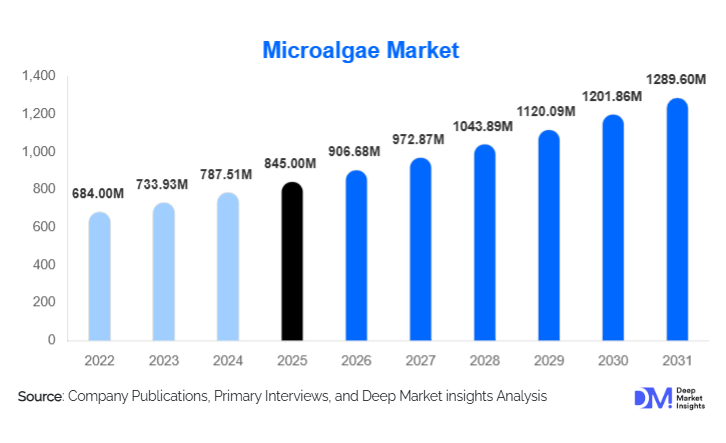

According to Deep Market Insights, the global microalgae market size was valued at USD 845 million in 2025 and is projected to grow from USD 906.68 million in 2026 to reach USD 1,289.60 million by 2031, expanding at a CAGR of 7.3% during the forecast period (2026–2031). The microalgae market growth is primarily driven by rising demand for plant-based and sustainable nutrition, increasing adoption of microalgae in nutraceuticals and aquaculture feed, and growing investments in algae-based environmental and bioindustrial applications.

Key Market Insights

- Nutraceuticals and dietary supplements dominate demand, driven by rising preventive healthcare spending and preference for natural, high-protein ingredients.

- Spirulina remains the most commercially cultivated microalgae species, owing to its affordability, scalability, and strong consumer awareness.

- Asia-Pacific leads global production and consumption, supported by large-scale cultivation capacity in China and India.

- Europe is the fastest-growing regional market, driven by sustainability regulations, alternative protein adoption, and green bioeconomy initiatives.

- Aquaculture feed is emerging as a high-growth application, as microalgae replace fishmeal and synthetic additives.

- Technological advancements in photobioreactors are improving yields and enabling pharmaceutical-grade microalgae production.

What are the latest trends in the microalgae market?

Shift Toward Sustainable Nutrition and Alternative Proteins

The microalgae market is witnessing a strong shift toward sustainable and alternative protein sources as consumers seek environmentally friendly nutrition. Microalgae such as spirulina and chlorella offer high protein density, essential amino acids, and micronutrients with significantly lower land and water usage than traditional agriculture. Food and beverage companies are increasingly incorporating microalgae into protein powders, fortified snacks, and functional beverages. This trend is reinforced by clean-label preferences and the growing vegan and flexitarian population globally.

Expansion of High-Value Algal Extracts

Another key trend is the rising commercialization of extracted microalgae compounds, including omega-3 oils, astaxanthin, phycocyanin, and chlorophyll. These compounds are gaining traction in pharmaceuticals, cosmetics, and premium nutrition products due to their antioxidant, anti-inflammatory, and coloring properties. Manufacturers are investing in downstream processing technologies to improve purity and margins, positioning extracted compounds as one of the most profitable segments within the microalgae market.

What are the key drivers in the microalgae market?

Growing Demand for Preventive Healthcare and Nutraceuticals

Rising awareness of preventive healthcare is a major driver of the microalgae market. Nutraceuticals account for nearly 38% of the global microalgae market in 2024, supported by strong demand for immunity-boosting, detoxifying, and antioxidant-rich supplements. Spirulina and chlorella are widely used in tablets, capsules, and powders, particularly in North America, Europe, and the Asia-Pacific region. Increasing disposable income and aging populations further strengthen demand for microalgae-based health products.

Rapid Growth of Sustainable Aquaculture

The expansion of global aquaculture is significantly driving microalgae consumption. Microalgae-based feed ingredients provide essential fatty acids and pigments, improving fish health and color while reducing reliance on fishmeal. The animal feed and aquaculture segment accounts for approximately 22% of the global market and is growing steadily as sustainability mandates reshape feed formulations.

What are the restraints for the global market?

High Production and Capital Costs

Despite strong demand, microalgae cultivation remains capital-intensive, particularly for closed photobioreactor systems. High energy consumption, infrastructure costs, and downstream processing expenses limit price competitiveness compared to conventional ingredients. These factors can restrict adoption in cost-sensitive food and fuel applications.

Regulatory and Standardization Challenges

Microalgae products face varying regulatory frameworks across regions, particularly in food, pharmaceutical, and cosmetic applications. Approval timelines, labeling requirements, and safety assessments can delay market entry and increase compliance costs, acting as a restraint to faster commercialization.

What are the key opportunities in the microalgae industry?

Environmental Applications and Carbon Capture

Microalgae offer significant opportunities in environmental applications, including carbon capture, wastewater treatment, and biofertilizers. Governments and industries are increasingly exploring algae-based systems to meet emissions reduction targets. Companies integrating microalgae production with carbon credit mechanisms and industrial wastewater treatment can unlock new revenue streams beyond traditional nutrition markets.

Emerging Markets and Regional Production Expansion

Asia-Pacific, the Middle East, and Latin America present strong opportunities for capacity expansion due to favorable climates and lower operating costs. Strategic partnerships, localized production, and technology transfer in these regions can improve supply chain efficiency and margins while meeting rising regional demand.

Product Type Insights

Dry microalgae products dominate the global market, accounting for approximately 48% of the market in 2024. This leadership is primarily driven by their ease of storage, long shelf life, and wide applicability across dietary supplements, nutraceutical formulations, and animal feed. Dry formats allow for easier transport, standardization in powder or tablet forms, and flexible incorporation into functional foods, which supports steady growth across multiple end-use sectors. Liquid microalgae, while smaller in share, are gaining traction in live feed for aquaculture and industrial wastewater treatment, benefiting from high bioactivity and ease of integration into liquid-based applications. Extracted compounds, including omega-3 oils, pigments (astaxanthin, phycocyanin), and proteins, represent the fastest-growing product segment due to increasing demand for high-value, specialty applications in pharmaceuticals, cosmetics, and functional nutrition. The growth of extracted compounds is fueled by technological advancements in photobioreactor cultivation and downstream processing, which allow manufacturers to achieve high purity and bioactive content, commanding premium pricing.

Application Insights

The microalgae market is led by nutraceuticals and dietary supplements, reflecting consumer preference for natural, protein-rich, and antioxidant-dense products. This application benefits from global health trends emphasizing immunity support, plant-based nutrition, and preventive healthcare, making it a resilient and high-demand segment. Animal feed and aquaculture applications follow closely, driven by the need for sustainable, high-nutrient alternatives to traditional fishmeal and synthetic additives. Microalgae provide essential fatty acids and pigments that improve fish health and appearance, which is critical in high-value aquaculture markets. Food and beverages are steadily expanding as functional ingredients, incorporated in fortified drinks, protein bars, and snacks, while pharmaceuticals, cosmetics, and agriculture are emerging as high-margin applications. Pigments and bioactive extracts are particularly valuable for anti-aging skincare, natural colorants, and biofertilizer applications, offering both environmental and commercial benefits.

Cultivation Technology Insights

Open pond systems remain the most widely used cultivation technology, accounting for approximately 55% of global production, largely due to lower capital expenditure, operational simplicity, and suitability for large-scale spirulina production. These systems are particularly prevalent in regions with favorable climate conditions, such as India, China, and parts of Africa. However, photobioreactors are gaining adoption for high-value applications, such as pharmaceutical-grade extracts and pigments, because they offer enhanced contamination control, higher yield consistency, and the ability to cultivate specialized strains year-round. Hybrid systems are emerging in certain regions to combine the cost advantages of open ponds with the precision of closed systems, supporting both scalability and quality.

End-Use Industry Insights

The healthcare and life sciences sector represents the largest end-use industry, accounting for nearly 40% of total market demand, driven by the rise of preventive healthcare, nutraceutical adoption, and bioactive ingredient development. The animal nutrition industry is expanding steadily, supported by sustainable aquaculture and livestock feed demand. Emerging sectors such as agriculture, biofuels, and environmental applications, including wastewater treatment and carbon capture, are poised to become significant growth drivers, offering new revenue streams and diversifying market adoption beyond traditional nutrition applications.

| By Product Type | By Species Type | By Application | By Cultivation Technology | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global microalgae market with approximately 42% market share in 2024. China leads production and export, leveraging large-scale spirulina farms and government support for biotech and sustainable nutrition initiatives. India is emerging as a major hub for spirulina cultivation, benefiting from favorable climate conditions, low-cost labor, and rising domestic demand for nutraceuticals. Japan and South Korea drive growth in high-value nutraceuticals, pharmaceuticals, and cosmetics due to strong consumer preference for functional foods and anti-aging products. Regional growth is fueled by supportive government policies, rising health awareness, expansion of aquaculture industries, and strong export demand.

Europe

Europe accounts for around 26% of the global microalgae market and is the fastest-growing region. Germany, France, and Spain lead demand, driven by sustainability regulations, alternative protein adoption, and investments in bio-based industries. Growth is primarily propelled by stringent environmental policies, consumer preference for plant-based nutrition, and rising pharmaceutical and cosmetics applications. The European market also benefits from research-intensive investments in photobioreactors and high-purity microalgae extracts, enhancing quality and supply reliability.

North America

North America holds approximately 21% market share, with the U.S. as the largest importer of microalgae ingredients. Growth in this region is fueled by strong consumer demand for omega-3 supplements, clean-label products, and functional nutrition. Additionally, the expanding aquaculture and animal feed sectors in North America are driving microalgae adoption as sustainable protein and pigment sources. Drivers include increasing health consciousness, regulatory support for sustainable feed, and the presence of major nutraceutical companies leveraging algae-based products.

Latin America

Latin America represents a smaller but growing share of the market, with Brazil and Chile emerging as potential production hubs. Favorable climate conditions, expanding aquaculture and livestock industries, and government initiatives supporting sustainable agriculture are driving regional growth. Investments in spirulina cultivation and growing export opportunities to North America and Europe act as key growth drivers.

Middle East & Africa

The Middle East and Africa are witnessing increasing investments in algae farming for food security, sustainability, and water treatment applications, particularly in the UAE, Saudi Arabia, and South Africa. Regional growth is supported by arid climate suitability for algae cultivation, government-backed sustainability programs, and growing industrial applications for wastewater treatment and carbon capture. The market is further encouraged by rising health and nutraceutical awareness in affluent populations across the Middle East.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|