Men’s Health Supplements Market Size

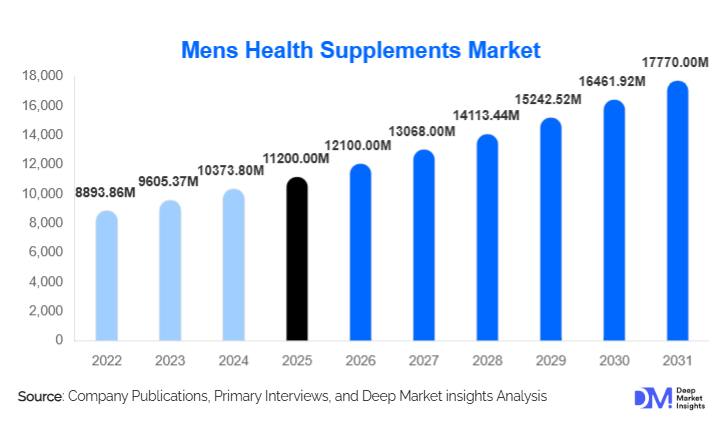

According to Deep Market Insights, the global men’s health supplements market size was valued at USD 11,200 million in 2025 and is projected to grow from USD 12,100 million in 2026 to reach USD 17,770 million by 2031, expanding at a CAGR of 8.0% during the forecast period (2026–2031). The market growth is primarily driven by increasing male health awareness, the rising prevalence of lifestyle-related health issues, and the adoption of personalized nutrition and performance-enhancing supplements across various age groups worldwide.

Key Market Insights

- Testosterone boosters and sexual wellness supplements dominate the market, reflecting heightened consumer focus on hormonal balance, libido, and male vitality.

- North America leads global demand, owing to high per capita spending, mature retail infrastructure, and strong preventive health culture.

- Asia Pacific is the fastest-growing region, driven by urbanization, rising disposable income, and increasing awareness of fitness and age-related health needs.

- E-commerce is transforming distribution, providing convenient access, personalized subscription models, and direct-to-consumer marketing strategies.

- Emerging trends in digital health and personalized nutrition, including AI-based wellness recommendations and genetic profiling, are reshaping consumer engagement.

- Regulatory compliance and quality certifications, such as GMP, NSF, and organic labels, are critical for premium product differentiation and global market expansion.

What are the latest trends in the men’s health supplements market?

Personalized Nutrition and Digital Health Integration

Personalized supplements tailored to lifestyle, genetics, and health biomarkers are becoming mainstream. Digital health apps, wearables, and AI-driven diagnostics allow consumers to select formulations that match energy levels, muscle goals, and hormonal profiles. Subscription-based D2C models, coupled with telehealth consultations, are increasing customer loyalty and repeat purchases. This trend aligns with a growing interest in data-driven, science-backed wellness solutions.

Clean Label and Natural Ingredient Adoption

Consumers are increasingly seeking supplements with organic, non-GMO, and minimally processed ingredients. Brands emphasizing transparency, clinical support, and natural formulations are gaining preference. Herbal-based testosterone boosters, plant-derived amino acids, and antioxidant-rich compounds are attracting health-conscious male consumers, particularly in developed markets with stringent safety expectations.

Expansion of E-Commerce Channels

Online platforms, including direct-to-consumer websites and e-commerce marketplaces, are rapidly increasing accessibility and reducing distribution costs. Younger consumers prefer online purchasing due to convenience, detailed product information, and subscription models. This trend supports global penetration, particularly in emerging regions where traditional retail networks are less developed.

What are the key drivers in the men’s health supplements market?

Rising Male Health Awareness

Growing knowledge of preventive healthcare and lifestyle-related health risks is encouraging men to adopt supplements targeting testosterone, energy, muscle performance, and immunity. Educational campaigns, social media influence, and fitness trends are amplifying consumer interest, especially among millennials and middle-aged men.

Aging Population Driving Supplement Demand

Men aged 45 and above increasingly use supplements for prostate health, bone density, heart function, and sexual wellness. This segment provides a steady demand base for premium formulations, often with higher frequency and longer consumption cycles, supporting overall market stability.

Technological Adoption in Product Development and Distribution

Companies are leveraging AI, big data, and mobile platforms to optimize product offerings, personalize recommendations, and manage subscription-based delivery. Technology enables better consumer engagement, targeted marketing, and loyalty programs, driving market growth across demographics.

What are the restraints for the global market?

Regulatory Complexity

Varied regulations across regions for ingredients, labeling, and health claims increase compliance costs and delay market entry. Small and medium enterprises often struggle to meet international standards, restricting global expansion.

Price Sensitivity

Competition in commodity segments, such as general multivitamins and basic energy supplements, has intensified, resulting in downward pressure on prices. Consumers demand scientifically backed, high-quality products at competitive prices, challenging profit margins.

What are the key opportunities in the men’s health supplements industry?

Emerging Markets and Regional Expansion

Asia Pacific, Latin America, and parts of Africa offer significant growth potential due to rising disposable income, increasing health awareness, and urbanization. Localized products, culturally relevant herbal formulations, and partnerships with regional distributors can capture untapped revenue streams.

Integration of Personalized Nutrition Solutions

AI-driven health assessments, genetic profiling, and tailored supplement subscriptions are creating niche opportunities. Brands integrating digital wellness solutions with personalized formulations can enhance loyalty, differentiate from competitors, and command premium pricing.

Premium and Clinical-Backed Product Development

Investments in clinical research, patented formulations, and third-party certifications offer avenues for differentiation. Products with scientific backing, high bioavailability, and clean label positioning appeal to high-value consumers, enabling brands to capture premium market segments.

Product Type Insights

Testosterone boosters dominate the men’s health supplements market, holding approximately 26% of the 2025 market share. Their prominence is primarily driven by rising male concerns over low testosterone levels, reduced energy, and sexual wellness challenges, which are increasingly prevalent due to aging, stress, and sedentary lifestyles. Muscle-building supplements follow closely, fueled by the global fitness culture, gym memberships, and lifestyle trends emphasizing strength, physique, and performance enhancement. Sexual wellness formulations, including libido and performance boosters, are also gaining traction across adult age groups seeking enhanced vitality. Meanwhile, prostate health supplements are experiencing steady growth among older demographics, reflecting the aging population and increasing awareness of preventive care. Overall, the product landscape indicates a clear demand for targeted, clinically-backed, and performance-oriented solutions, with testosterone boosters driving the market due to both high adoption rates and repeat consumption cycles.

Application Insights

Fitness and sports-focused applications remain the largest demand segment, primarily targeting young and middle-aged men (18–45 years) who are actively engaged in strength training, weight management, and endurance activities. Supplements for muscle gain, recovery, and energy enhancement are seeing robust uptake due to lifestyle-driven health priorities. For men above 45, preventive healthcare applications such as heart, bone, immunity, and prostate health supplements are growing steadily, reflecting the rising importance of proactive wellness among aging populations. Additionally, corporate wellness programs and digital health platforms are emerging as novel applications. Organizations increasingly integrate subscription-based, personalized nutrition solutions into employee wellness initiatives, creating recurring demand while enhancing awareness about male-specific health challenges. These applications collectively highlight a shift toward preventive and performance-driven supplementation, supporting sustained market growth across diverse age groups.

Distribution Channel Insights

Online retail dominates the market with approximately 35% share in 2025, driven by convenience, access to a wide variety of products, competitive pricing, and subscription-based models. E-commerce enables direct engagement with younger, tech-savvy consumers and allows brands to leverage personalized recommendations and loyalty programs. Traditional pharmacies, specialty health stores, and direct sales channels remain significant, particularly in regions where e-commerce penetration is lower or where consumers prioritize in-person consultation and trust. Increasingly, brands are adopting multi-channel approaches, combining online and offline presence to maximize reach, enhance brand visibility, and capture both urban and semi-urban markets. This omnichannel strategy is proving crucial for driving repeat purchases and establishing long-term customer relationships.

Age Group Insights

Men aged 31–45 years account for the largest segment (~33% of 2025 demand), balancing disposable income with health-conscious behavior. This group is highly engaged in fitness, muscle building, and energy-focused supplementation, driving frequent consumption and adoption of premium products. The 18–30 demographic contributes significantly to fitness-related supplement demand, particularly in urban centers and digitally connected markets. Meanwhile, men above 46 increasingly purchase age-targeted formulations such as prostate, heart, and immunity supplements, providing stable, high-value consumption patterns. The older male segment, while smaller in population, represents a critical driver for premium, clinically-backed supplements due to long-term usage, repeat consumption, and higher willingness to invest in quality products.

| By Product Type | By Application | By Distribution Channel | By Age Group |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 36% of the global market, led by the U.S. and Canada. The region’s growth is fueled by high disposable income, health-conscious male populations, and a well-established supplement culture. Premium formulations, particularly testosterone boosters and sexual wellness products, dominate due to both awareness and repeat consumption cycles. The region also benefits from advanced retail infrastructure and high e-commerce penetration, allowing both domestic and international brands to reach urban and suburban consumers efficiently. Additionally, increasing engagement with preventive healthcare, fitness programs, and corporate wellness initiatives acts as a strong driver for sustained market expansion.

Europe

Europe contributes approximately 24% of the market, with Germany, the U.K., and France leading demand. Growth is primarily driven by clinically-backed, natural formulations and clean-label supplements. Male consumers increasingly prioritize sustainability, transparency, and regulatory compliance when choosing supplements. The rise of personalized nutrition, preventive healthcare awareness, and fitness-focused lifestyles in Europe further supports the uptake of performance and age-targeted supplements. Additionally, robust regulatory frameworks and certification standards reinforce consumer trust in premium products, encouraging higher adoption rates across both young and older demographics.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a CAGR of approximately 10.5%, led by India and China. Regional growth is fueled by urbanization, rising disposable income, increasing health awareness, and expanding fitness culture, particularly among men aged 18–45. Demand for muscle-building, energy, and immunity supplements is increasing rapidly, driven by gym memberships, sports participation, and preventive wellness trends. The rapid expansion of e-commerce platforms, mobile shopping, and subscription models further accelerates market penetration. Additionally, government campaigns promoting preventive healthcare and rising exposure to global health trends act as strong catalysts for regional growth.

Latin America

Latin America accounts for approximately 12% of the market, with Brazil and Mexico as primary contributors. Market expansion is driven by growing interest in fitness, weight management, and energy supplements, particularly among urban young adults. The rise of online retail platforms and the import of international brands facilitates access to premium products. Additionally, increasing awareness of preventive male healthcare and the adoption of lifestyle-driven supplements are contributing to market growth. Despite slower growth compared to Asia-Pacific, urban centers show strong potential for new product launches targeting fitness and wellness-oriented male consumers.

Middle East & Africa

This region holds approximately 8% of the market. Growth in GCC countries is driven by high disposable income, premium product adoption, and awareness of performance and wellness supplements, particularly testosterone boosters and sexual wellness formulations. In urban centers across Africa, rising awareness of male-specific health issues, increasing retail infrastructure, and the introduction of imported international brands are driving nascent growth. Government health initiatives and lifestyle awareness campaigns further support demand, particularly in metropolitan areas where fitness, gym culture, and preventive health are on the rise.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Men’s Health Supplements Market

- Glanbia plc

- Herbalife Nutrition Ltd.

- NOW Health Group, Inc.

- Amway Corporation

- Nature’s Bounty

- MuscleTech

- BSN

- Optimum Nutrition

- Jarrow Formulas

- Puritan’s Pride

- Carlson Labs

- Twinlab Consolidated Holdings

- Nutrabolt

- Solgar

- Life Extension