Melon Seeds Market Size

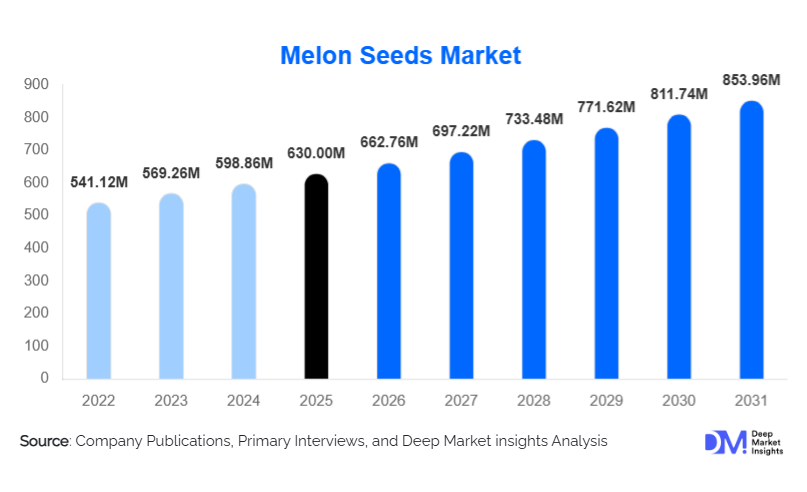

According to Deep Market Insights, the global melon seeds market size was valued at USD 630.00 million in 2025 and is projected to grow from USD 662.76 million in 2026 to reach USD 853.96 million by 2031, expanding at a CAGR of 5.2% during the forecast period (2026–2031). The melon seeds market growth is primarily driven by rising global fruit consumption, increasing acreage under high-value horticultural crops, and rapid adoption of hybrid and disease-resistant melon seed varieties across both open-field and protected cultivation systems.

Key Market Insights

- Hybrid melon seeds dominate the market due to higher yields, disease resistance, and uniform fruit quality, accounting for nearly two-thirds of total market value.

- Watermelon seeds represent the largest melon type segment, supported by strong global consumption and export-oriented production.

- Asia-Pacific leads global demand, driven by China and India’s large cultivation base and expanding commercial horticulture.

- Protected cultivation is the fastest-growing cultivation method, increasing demand for premium, high-performance seed varieties.

- Commercial farming accounts for the majority of seed demand, reflecting consolidation and professionalization of melon production.

- R&D-led seed innovation, including marker-assisted breeding and climate-resilient traits, is reshaping competitive dynamics.

What are the latest trends in the melon seeds market?

Shift Toward Hybrid and High-Performance Seeds

The melon seeds market is increasingly shifting from open-pollinated varieties toward hybrid and genetically enhanced seeds. Farmers are prioritizing higher yields, uniform fruit size, improved sweetness levels, and resistance to pests and diseases. Hybrid seeds offer superior productivity and better adaptability to varied climatic conditions, making them especially attractive for commercial growers and export-focused farms. As a result, seed companies are expanding hybrid portfolios and investing heavily in breeding programs tailored to specific regional growing conditions.

Rising Adoption of Protected Cultivation

Protected cultivation systems such as greenhouses, polyhouses, and net houses are gaining traction globally, particularly in Europe, North America, and parts of Asia-Pacific. This trend is driving demand for melon seeds optimized for controlled environments, including varieties with shorter crop cycles and higher yield density. Protected cultivation enables year-round production, better quality control, and reduced climate risk, encouraging growers to invest in premium seed varieties with higher margins.

What are the key drivers in the melon seeds market?

Growing Global Demand for Fresh and Healthy Fruits

Increasing consumer awareness of health and nutrition is driving higher consumption of melons, which are rich in vitamins, antioxidants, and water content. Watermelon and muskmelon consumption is rising across both developed and emerging markets, directly increasing demand for quality seeds. Retail chains, foodservice operators, and export markets are placing greater emphasis on consistent quality and supply, pushing farmers toward improved seed inputs.

Expansion of Export-Oriented Horticulture

Export-driven melon production is a major growth driver, particularly in Asia-Pacific and Latin America. Countries such as China, India, Mexico, and Brazil are expanding melon exports to Europe, the Middle East, and North America. Export standards require uniformity, shelf life, and disease resistance, which are primarily delivered through advanced hybrid seeds. This has strengthened long-term demand for premium melon seed varieties.

What are the restraints for the global market?

High Cost of Hybrid and Treated Seeds

The higher upfront cost of hybrid and treated melon seeds remains a key restraint, especially for smallholder farmers in developing regions. Although these seeds offer better yields and profitability in the long term, price sensitivity can slow adoption in cost-constrained markets. Limited access to credit and insurance further amplifies this challenge.

Climate Variability and Production Risks

Unpredictable weather patterns, including droughts, floods, and temperature extremes, pose risks to melon cultivation. Climate uncertainty can discourage farmers from investing in high-value seeds, particularly in rain-fed agricultural regions. Seed companies are increasingly required to develop climate-resilient varieties to mitigate this restraint.

What are the key opportunities in the melon seeds market?

Growth in Protected and Urban Farming

The rapid expansion of greenhouse and urban farming presents a strong opportunity for seed companies. High-density cultivation systems require specialized melon seed varieties with compact growth, shorter maturity cycles, and high productivity. This segment offers premium pricing and long-term supply contracts, making it attractive for both established players and new entrants.

Biotechnology and Marker-Assisted Breeding

Advancements in marker-assisted breeding and non-GMO genetic enhancement are creating opportunities to develop melon seeds with superior traits such as heat tolerance, salinity resistance, and extended shelf life. Governments in several regions are supporting seed innovation through horticulture development programs, encouraging private-sector investment in advanced breeding technologies.

Product Type Insights

Hybrid melon seeds dominate the market, accounting for approximately 64% of total market value in 2025. These seeds are widely adopted in commercial farming due to their higher yield potential and resistance to common diseases. Open-pollinated varieties continue to serve smallholder and subsistence farmers, particularly in price-sensitive regions, but their share is gradually declining. Genetically enhanced and specialty seeds represent a smaller but fast-growing segment, driven by export-oriented and protected cultivation demand.

Application Insights

Commercial fruit production is the largest application segment, representing nearly 70% of total seed demand. This segment benefits from expanding retail, foodservice, and export markets. Seed multiplication and breeding applications account for a smaller share but are strategically important, supported by rising R&D investments and varietal development programs. Research and trial cultivation are also growing as companies test climate-resilient and high-yield varieties.

Distribution Channel Insights

Agricultural input retailers remain the dominant distribution channel, providing localized access and advisory services to farmers. Direct institutional sales to large commercial farms and agribusinesses are expanding rapidly, particularly in export-oriented regions. Online and digital agri-platforms are emerging as a fast-growing channel, offering transparency, variety selection tools, and direct-to-farm delivery, especially in Asia-Pacific and North America.

End-Use Insights

Commercial and industrial farms account for approximately 68% of total end-use demand, driven by large-scale production and export requirements. Smallholder farms remain an important segment in Asia and Africa, though adoption of hybrid seeds is slower due to cost considerations. Export-driven horticulture is the fastest-growing end-use segment, positively impacting overall market growth through sustained demand for premium seeds.

| By Melon Type | By Seed Technology | By Cultivation Method | By Seed Treatment | By End Use | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global melon seeds market with around 38% share in 2025. China is the largest single market, accounting for approximately 22% of global demand, supported by large-scale watermelon production and strong domestic consumption. India is the fastest-growing market in the region, driven by expanding horticulture acreage and export-oriented farming.

North America

North America accounts for about 21% of the global market, led by the United States and Mexico. The U.S. market is driven by protected cultivation and demand for premium-quality melons, while Mexico plays a key role as an export hub supplying North American and European markets.

Europe

Europe represents roughly 19% of global demand, with Spain, Italy, and the Netherlands as key contributors. The region emphasizes greenhouse cultivation, quality standards, and traceability, supporting demand for advanced hybrid seeds.

Latin America

Latin America holds nearly 13% market share, led by Brazil and Mexico. Brazil is the fastest-growing country in the region, supported by export expansion and modernization of horticultural practices.

Middle East & Africa

The Middle East & Africa region accounts for around 9% of global demand. Turkey, Israel, and Morocco are major producers, while Gulf countries drive import demand for high-quality melons.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Melon Seeds Market

- Bayer CropScience

- Syngenta Group

- BASF (Nunhems)

- Limagrain Group

- Sakata Seed Corporation

- East-West Seed

- Takii & Co.

- Rijk Zwaan

- Enza Zaden

- Advanta Seeds

- Vilmorin & Cie

- KWS Group

- Known-You Seed

- UPL Seeds

- Mahyco