Medium Format Camera Market Size

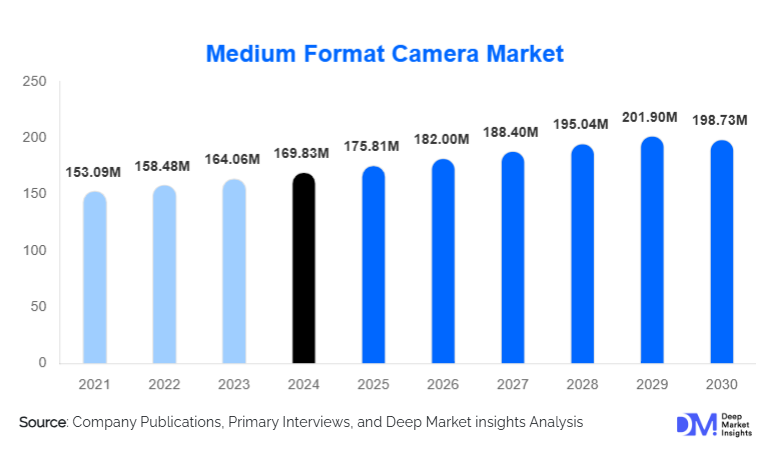

According to Deep Market Insights, the global medium format camera market size was valued at USD 169.83 Million in 2024 and is projected to grow from USD 175.81 Million in 2025 to reach USD 198.73 Million by 2030, expanding at a CAGR of 3.52% during the forecast period (2025–2030). This growth is driven by rising demand for ultra-high-resolution imaging, the rapid adoption of hybrid still-video medium format systems in commercial production, and the increasing use of advanced digital backs and studio workflows across advertising, fashion, and cinematic applications.

Key Market Insights

- Interchangeable-lens digital medium-format systems dominate the market, accounting for over half of all 2024 revenue due to their versatility, premium lens ecosystems, and strong adoption among professional studios.

- CMOS-based medium-format sensors represent the technological backbone of the market, capturing more than 70% share owing to superior dynamic range and fast readout performance.

- North America leads global demand, driven by high-end commercial studios, advertising agencies, and rapidly expanding rental houses.

- Asia-Pacific is the fastest-growing regional market, supported by booming creative economies in China, Japan, and South Korea.

- The 50–100 MP resolution tier remains the most popular, accounting for nearly half of all medium-format camera sales due to its price–performance balance.

- Hybrid medium-format video adoption is accelerating, driven by cinematic production, digital streaming content, and high-resolution brand storytelling.

What are the latest trends in the Format Camera Market?

Hybrid Medium-Format Cameras Enter Cinematography

Medium-format cameras are increasingly engineered for high-end cinema applications. Manufacturers are introducing internal RAW video, 6K–8K capture, and superior dynamic range that rivals dedicated cinema rigs. Production houses and premium content creators (fashion films, luxury ads, streaming platforms) now integrate medium-format systems into professional pipelines for their distinctive “large-format aesthetic.” This trend is supported by evolving workflows, color-science enhancements, and modular rigs designed for gimbals, drones, and studio environments. Hybridization is attracting studios seeking enhanced tonal depth, shallow depth-of-field characteristics, and unmatched color purity, enabling medium format to expand beyond still photography.

Sensor Innovations and Digital Backs Transform Studio Capture

New-generation CMOS sensors, stacked designs, and advanced digital backs are redefining image fidelity and studio efficiency. Manufacturers are focused on higher bit-depth, ultra-fast readouts, improved low-light performance, and thermal management for long-duration shooting. Digital backs with 100+ MP sensors are increasingly favored for archival reproduction, fine art digitization, and precision industrial imaging. Integration with cloud workflows, AI-assisted tethering, and automated color-managed pipelines enhances productivity for commercial studios, fueling demand for high-performance systems across photography, advertising, and print industries.

What are the key drivers in the Medium Format Camera Market?

Growing Demand for Premium Visual Content

The global surge in luxury advertising, fashion campaigns, and ultra-high-resolution print media continues to drive adoption of medium-format systems. Brands require consistent visual superiority for large-scale displays, catalog production, and e-commerce shoots, sectors where medium format excels with exceptional detail and tonal precision. Studios and agencies invest significantly in premium imaging equipment to differentiate brand experiences and support expanding creative requirements. As global advertising spending increases, the need for higher fidelity content accelerates medium-format camera procurement.

Hybrid Stills–Video Capabilities Expand Use Cases

The integration of powerful video features, internal RAW, advanced codecs, and professional frame rates has opened new markets for medium-format systems. Cinematographers and branded content creators increasingly rely on medium format for its cinematic depth of field, dynamic range, and color latitude. This evolution bridges the gap between photography and cinema, enabling production studios to use one system for dual workflows, reducing equipment redundancy and maximizing return on investment.

What are the restraints for the global market?

High Acquisition Cost and Limited Consumer Accessibility

Medium-format systems are significantly more expensive than full-frame professional cameras, limiting adoption to premium studios, high-end professionals, and rental houses. The cost-to-benefit ratio remains a barrier among mid-tier photographers and small businesses. Additionally, specialized lenses and accessories further increase total ownership costs. Price sensitivity in emerging markets also slows overall market expansion, particularly in regions where full-frame advancements offer near-parity performance for lower investment.

Competition from High-End Full-Frame Cameras

Rapid innovations in full-frame sensors, including stacked CMOS designs, AI-driven computational imaging, and improved dynamic range, pose a challenge to medium-format adoption. For many commercial uses, high-end full-frame systems deliver sufficient quality at much lower cost, reducing the incentive to transition to medium format. This technological convergence forces medium-format manufacturers to continuously innovate to maintain competitive differentiation.

What are the key opportunities in the Medium Format Camera Industry?

Medium-Format Cinematography Workflows

As streaming platforms and luxury brands invest heavily in high-end film production, medium-format systems are positioned to become the next frontier in cinematic capture. The opportunity lies in offering turnkey cinema solutions, camera bodies, cine-lenses, color-science packages, and modular rigs. Advanced workflows integrating cloud editing, AI correction, and HDR pipelines present avenues for manufacturers to offer premium, end-to-end studio ecosystems.

Archival Digitization and Industrial Imaging

Demand for ultra-high-resolution imaging in heritage preservation, museum archives, and industrial inspection continues to rise. Medium-format digital backs, coupled with calibrated color workflows, are ideal for capturing fine art, manuscripts, and micro-detail industrial components. Government-funded digitization projects and heritage preservation initiatives create long-term, high-margin opportunities for manufacturers. These specialized applications offer stable growth independent of consumer or commercial photography cycles.

Product Type Insights

Interchangeable-lens digital medium-format cameras dominate the market, accounting for approximately 56% of 2024 revenue. These systems are preferred by professional studios for their flexibility, extensive lens ecosystems, and superior dynamic range. Fixed-lens medium-format designs serve a smaller prosumer niche, while film medium-format cameras remain a boutique but resilient segment driven by analog resurgence, fine art photographers, and collector communities. Ultra-high-resolution digital backs (>100 MP) represent a premium subsegment used primarily in studios requiring precise color-critical imaging.

Application Insights

Commercial advertising and fashion photography represent the largest application segment, accounting for around 39% of the 2024 global demand. These industries require superior image fidelity for billboards, luxury catalogs, and high-end brand campaigns. Portrait and fine-art photography remain essential segments, driven by artists and boutique studios seeking exceptional tonal quality. Cinematography shows the fastest growth, fueled by hybrid video-enabled medium-format systems. Archival, printing, and industrial imaging, though smaller in volume, offer high-value and stable revenue driven by institutional procurement.

Distribution Channel Insights

B2B system sales (studios, rental houses, and production agencies) dominate distribution, capturing roughly 34% of market revenue. Specialist dealers and authorized retail channels remain essential for premium equipment, offering consultation, demos, and service packages. E-commerce is gradually expanding, particularly for mid-range medium-format systems and lenses. Rental houses play a critical role in providing access to high-cost gear, supporting cinematography, commercial shoots, and large-scale advertising projects.

End-User Insights

Professional studios remain the core end-user base for medium-format cameras, driven by recurring investment in high-resolution content production. Rental houses and production agencies are major contributors to demand due to frequent upgrades and equipment turnover. Fine-art photographers and museums represent premium buyers for ultra-high-resolution backs and specialty lenses. Industrial users, including print shops, engineering firms, and heritage institutions, represent a steady, high-value niche focused on reproduction accuracy and archival fidelity.

| By Product Type | By Resolution Tier | By Sensor / Technology Type | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 31% of the 2024 share. The region’s dominance is fueled by the presence of major commercial studios, fashion brands, and film production hubs. The U.S. is the largest single-country market, supported by rising investment in high-resolution content for luxury advertising, cinema, and e-commerce.

Europe

Europe held roughly 24% of global 2024 revenue, led by Germany, the U.K., France, and Italy. Demand is strong among fashion capitals (London, Paris, Milan) and industrial imaging sectors. Europe also hosts several high-end optical manufacturers, reinforcing ecosystem strength and export demand to global studios.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market, accounting for 28% of 2024 global demand. China, Japan, and South Korea are major creative hubs with expanding advertising industries and a strong appetite for premium imaging equipment. Japan also plays a central role as a manufacturing and export base for medium-format cameras and lenses.

Latin America

Latin America accounts for approximately 8% of the 2024 market, with Brazil and Mexico leading demand. Growth is driven by emerging commercial photography sectors, fashion industries, and the rising adoption of rental-based models.

Middle East & Africa

MEA captured nearly 9% of global demand in 2024. The UAE and Saudi Arabia lead premium purchases driven by luxury retail, cinematic production, and high-end commercial campaigns. Africa also hosts niche demand for archival and cultural heritage imaging projects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Medium Format Camera Market

- Fujifilm

- Hasselblad

- Phase One

- Leica Camera

- Ricoh Imaging (Pentax)

- Alpa

- Cambo

- Sinar

- Linhof

- Horseman Cameras

- Rollei

- Konica Minolta (specialist optics)

- Hensel (studio systems)

- CamRanger (capture ecosystem)

- Specialized cine and large-format manufacturers

Recent Developments

- In 2025, several medium-format manufacturers announced hybrid video–stills platform upgrades, adding enhanced 8K recording, improved codec support, and real-time color pipelines.

- In late 2024, multiple digital-back makers launched 100+ MP BSI CMOS backs designed for museum archival and precision industrial imaging applications.

- In 2025, APAC distribution networks expanded significantly, with new service hubs in China and South Korea to support rising demand for premium imaging systems.