Marine Tourism Market Size

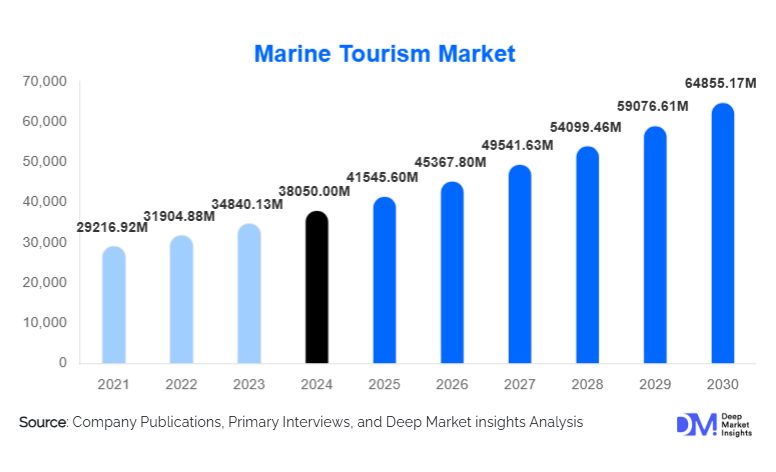

According to Deep Market Insights, the global marine tourism market size was valued at USD 38,050.00 million in 2024 and is projected to grow from USD 41,545.60 million in 2025 to reach USD 64,855.17 million by 2030, expanding at a CAGR of 9.2% during the forecast period (2025–2030). The growth of the marine tourism market is primarily driven by the increasing popularity of cruise vacations, rising demand for adventure and eco-tourism experiences, and the expansion of sustainable and technologically enhanced marine travel services across key regions globally.

Key Market Insights

- Cruise tourism continues to dominate the marine tourism market, offering luxury, comfort, and diverse itineraries that appeal to high-income travelers seeking all-inclusive experiences.

- Adventure and eco-tourism segments are growing rapidly, fueled by rising interest in water sports, scuba diving, coral reef exploration, and environmentally conscious travel options.

- Asia-Pacific is emerging as a fast-growing market, led by China, India, and Southeast Asia, where rising middle-class income levels are boosting demand for both mid-range and premium marine tourism.

- Technological integration, including AI-based itinerary planning, VR/AR onboard experiences, and digital booking platforms, is enhancing customer engagement and personalized travel experiences.

- North America and Europe remain key mature markets, with the U.S., Canada, the U.K., and Germany showing strong outbound marine tourism demand.

- Sustainable marine tourism initiatives, including low-emission vessels, eco-friendly cruises, and conservation-linked experiences, are reshaping market preferences.

What are the latest trends in the marine tourism market?

Eco-Friendly and Sustainable Marine Tourism

Marine tourism operators are increasingly integrating sustainability into travel experiences. Eco-cruises, wildlife-focused marine tours, and coral reef conservation trips are gaining popularity among environmentally conscious travelers. Vessel designs now incorporate low-emission engines, renewable energy sources, and zero-waste onboard practices. Governments and NGOs are also collaborating with tour operators to promote sustainable practices, fund marine conservation initiatives, and offer eco-certifications. These measures enhance the appeal of marine tourism among younger demographics and international tourists seeking low-impact, meaningful travel.

Technology-Enhanced Travel Experiences

Technology adoption in marine tourism is transforming customer engagement. AI-based itinerary planning, VR previews of cruise itineraries, and AR-guided underwater tours allow travelers to explore and customize their experiences before departure. Mobile apps now provide real-time water sport booking, safety tracking, and interactive learning about marine ecosystems. Drone-assisted sightseeing and smart onboard entertainment systems are becoming common on luxury and adventure cruises, catering to tech-savvy travelers and improving overall satisfaction. Digital platforms also enhance customer retention through loyalty programs and personalized offers.

What are the key drivers in the marine tourism market?

Rising Affluent Travel Demand

The increasing global population of high-net-worth individuals is driving demand for luxury cruise vacations, personalized yacht experiences, and bespoke marine tourism packages. Travelers are willing to pay premium prices for comfort, exclusivity, and curated adventures. Luxury cabins, gourmet dining, on-demand activities, and wellness-focused offerings such as spa cruises are contributing to revenue growth in the premium segment. Expanding interest from emerging markets in Asia-Pacific and the Middle East is also accelerating growth in high-value marine tourism.

Increasing Popularity of Adventure and Experiential Travel

Marine tourism aligns with the trend toward adventure-driven, experiential travel. Activities such as scuba diving, snorkeling, deep-sea fishing, and marine wildlife observation are driving consumer engagement. Eco-conscious travelers are particularly drawn to marine tours that combine leisure with education and conservation. Adventure-oriented cruises and expedition vessels are experiencing higher occupancy rates, with emerging destinations in Southeast Asia, Latin America, and the Caribbean benefiting from this shift.

Government and Regional Initiatives

Governments are promoting coastal tourism infrastructure, including marinas, ports, and eco-tourism facilities, creating favorable conditions for marine tourism growth. Incentive programs, subsidies for sustainable vessels, and marketing campaigns supporting regional tourism have increased tourist inflows. Public-private partnerships in infrastructure development further enhance connectivity and accessibility, contributing to the overall expansion of marine tourism markets.

What are the restraints for the global market?

High Operational and Travel Costs

Marine tourism, especially luxury cruises and adventure-focused tours, remains cost-intensive. High fuel costs, vessel maintenance, port fees, and onboard services contribute to elevated prices, limiting access for middle-income travelers. Seasonal demand fluctuations, visa regulations, and international travel complexities further constrain affordability and widespread adoption.

Environmental and Regulatory Challenges

Marine tourism growth is susceptible to environmental and regulatory risks. Overcrowding in popular destinations, coral reef damage, marine pollution, and climate-related sea-level changes can impact visitor satisfaction and ecosystem sustainability. Inconsistent maritime regulations across countries and regions also challenge operators in maintaining compliance and sustainability standards. Balancing demand with ecological preservation remains a key concern.

What are the key opportunities in the marine tourism industry?

Emerging Adventure and Wellness Experiences

The convergence of wellness tourism with marine adventure activities presents significant growth opportunities. Operators offering yoga retreats, wellness therapies, and stress-relief packages alongside cruises and diving expeditions are attracting health-conscious travelers. These hybrid offerings extend traveler stay durations and create niche demand beyond traditional leisure tourism.

Expansion into Emerging Regions

Emerging destinations in Southeast Asia, the Caribbean, and Latin America offer untapped potential for marine tourism operators. Growing domestic tourism, middle-class income growth, and government-led port and marina development create favorable conditions. New entrants can establish early footholds by introducing customized itineraries, adventure cruises, and eco-focused packages in these regions before they become saturated.

Technology-Driven Personalization

AI-powered itinerary planning, immersive VR/AR experiences, and digital booking platforms allow operators to offer highly personalized marine tourism experiences. Real-time activity scheduling, interactive onboard entertainment, and immersive cultural experiences enhance traveler engagement and loyalty, creating opportunities for premium pricing and differentiated services.

Product Type Insights

Cruise tourism dominates the market, accounting for over 40% of global marine tourism in 2024. Luxury cruises are leading due to their ability to provide premium experiences, onboard entertainment, wellness amenities, and curated itineraries. Adventure and eco-tourism segments, including scuba diving, snorkeling, and coral reef exploration, are witnessing the fastest growth, with rising interest in experiential and sustainable travel. Ferry and yacht services remain essential for regional connectivity and private, personalized experiences, particularly in Europe and the Asia-Pacific.

Application Insights

Leisure travel is the most significant application, including cruises, yacht charters, and coastal tours. Adventure marine tourism, such as scuba diving, snorkeling, and deep-sea fishing, is gaining traction among millennials and high-income adventure travelers. Eco-tourism applications, including wildlife observation, reef preservation trips, and marine conservation programs, are emerging as niche growth areas. Corporate and group travel, including MICE tourism and team-building cruises, is increasingly contributing to marine tourism revenue, particularly in Europe and North America.

Distribution Channel Insights

Online travel agencies and direct-to-consumer booking platforms dominate marine tourism bookings, providing real-time comparisons, reviews, and transparent pricing. Specialist agencies focusing on adventure and eco-tourism remain important for curated experiences. Increasingly, operators are adopting digital marketing, subscription-based travel models, and membership programs, offering loyalty benefits, seasonal packages, and exclusive activities. Social media and influencer campaigns are shaping awareness and traveler preferences, particularly among younger, digitally connected demographics.

Traveler Type Insights

Individual leisure travelers account for the largest share, seeking personalized experiences and adventure activities. Group and corporate travelers contribute significantly to demand through MICE tourism and package tours. Families are increasingly participating in marine tourism, with child-friendly itineraries and safe adventure activities. Luxury and high-net-worth travelers are driving premium cruise and yacht demand, while younger, budget-conscious travelers are exploring adventure and eco-tourism experiences through group bookings and affordable itineraries.

Age Group Insights

Travelers aged 31–50 represent the largest market segment, combining disposable income with interest in immersive experiences. The 18–30 segment is driving growth in adventure and eco-tourism, favoring budget-friendly options and digital booking platforms. Older travelers aged 51–65 prefer premium cruises and wellness-focused experiences, emphasizing comfort and guided activities. The 65+ segment, while smaller, represents high-value opportunities for private yacht charters and slower-paced, accessible marine experiences.

| By Type of Tourism | By Service Offerings | By Vessel Type | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds a significant market share of 28% in 2024, with strong demand from the U.S. and Canada for luxury cruises, adventure marine tours, and MICE tourism. High disposable incomes, awareness of sustainable travel, and strong air connectivity contribute to robust growth. The region also leads in outbound adventure marine tourism to Caribbean and Latin American destinations.

Europe

Europe accounts for 25% of the 2024 market, with the U.K., Germany, and France driving demand for eco-tourism and luxury cruises. Growing interest in sustainable travel, coupled with established maritime infrastructure and coastal tourism initiatives, supports steady growth. The region is also experiencing high growth in adventure tourism, such as scuba diving and marine safaris.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, and Southeast Asia. Rising middle-class incomes, increased outbound tourism, and social media-driven travel trends are boosting both mid-range and luxury marine tourism. Emerging cruise ports, new adventure tourism circuits, and eco-focused marine offerings are expanding market opportunities in this region.

Latin America

Latin America, including Brazil, Argentina, and Mexico, is witnessing growing interest in marine tourism, particularly in adventure and eco-tourism segments. Outbound travel to Caribbean and African destinations is increasing among affluent consumers, while domestic coastal tourism remains limited but promising. Growth is concentrated among niche operators offering personalized itineraries and conservation-focused experiences.

Middle East & Africa

Africa, home to iconic marine and coastal destinations, is central to marine tourism. Countries like South Africa, Egypt, and Kenya benefit from biodiversity, established cruise infrastructure, and government support. The Middle East, particularly the UAE, Saudi Arabia, and Qatar, is emerging as an important source market for luxury marine tourism due to high disposable incomes, luxury travel preferences, and connectivity to African and European destinations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Marine Tourism Market

- Carnival Corporation & PLC

- Royal Caribbean Cruises Ltd.

- Norwegian Cruise Line Holdings Ltd.

- MSC Cruises

- Disney Cruise Line

- Ponant Cruises

- Viking Cruises

- Hurtigruten

- Star Cruises

- Windstar Cruises

- Silversea Cruises

- Princess Cruises

- Azamara Cruises

- Celestyal Cruises

- Fred. Olsen Cruise Lines