Malt Ingredients Market Size

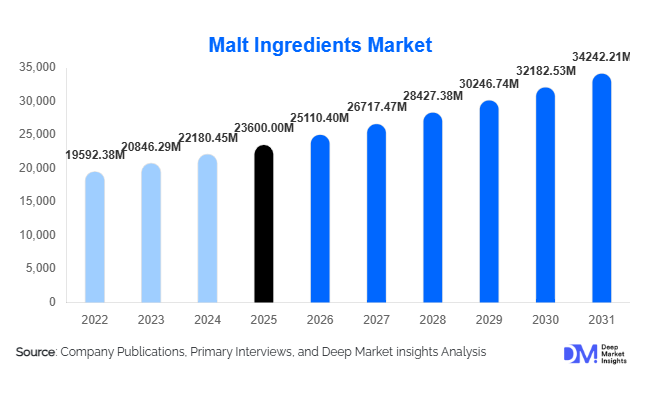

According to Deep Market Insights, the global malt ingredients market size was valued at USD 23,600 million in 2025 and is projected to grow from USD 25,110.40 million in 2026 to reach USD 34,242.21 million by 2031, expanding at a CAGR of 6.4% during the forecast period (2026–2031). The malt ingredients market growth is primarily driven by rising beer and spirits consumption, increasing adoption of malt-based natural sweeteners in food processing, and expanding applications in functional foods and nutraceuticals.

Key Market Insights

- Brewing remains the dominant application, accounting for nearly half of global malt ingredient demand due to sustained beer consumption worldwide.

- Specialty malt ingredients are gaining traction, supported by premiumization trends in craft beer, spirits, and artisanal bakery products.

- Europe leads global production and exports, driven by strong malting infrastructure in Germany, France, and Belgium.

- Asia-Pacific is the fastest-growing region, fueled by expanding food processing industries and rising alcoholic beverage consumption in China and India.

- Clean-label and natural ingredient demand is accelerating malt extract adoption as a substitute for refined sugars.

- Technological advancements in malting processes are improving yield efficiency, consistency, and specialty product development.

What are the latest trends in the malt ingredients market?

Rising Demand for Specialty and Craft Malts

The global shift toward craft brewing and premium alcoholic beverages is significantly influencing malt ingredient demand. Breweries are increasingly using caramel, roasted, and chocolate malts to develop differentiated flavor profiles, color variations, and mouthfeel characteristics. This trend is particularly strong in North America and Europe, where craft beer penetration continues to expand. Distilleries producing malt-based whiskies are also driving demand for high-quality specialty malts, contributing to higher revenue realization per ton compared to standard base malts.

Expansion into Functional and Health-Focused Foods

Malt ingredients are increasingly used in functional foods, breakfast cereals, energy bars, and nutrition drinks due to their natural sweetness, mineral content, and digestibility. Food manufacturers are adopting malt extracts to align with clean-label trends and reduce reliance on artificial additives. Low-glycemic and enzyme-modified malt ingredients are gaining popularity in health-oriented formulations, particularly in Europe and Asia-Pacific.

What are the key drivers in the malt ingredients market?

Growth of the Global Brewing and Distilling Industry

The alcoholic beverage industry remains the primary driver of the malt ingredients market. Global beer consumption continues to rise steadily, while premium and craft beer segments are growing at faster rates. Malt ingredients are essential for fermentation and flavor development, directly linking market growth to beverage production volumes. Expanding spirits consumption in Asia-Pacific further strengthens demand.

Increasing Use in Food Processing Applications

Malt flour and extracts are widely used in bakery, confectionery, and cereal manufacturing to enhance taste, texture, and appearance. Rising consumption of packaged and ready-to-eat foods in urban markets is driving consistent demand growth, particularly in emerging economies.

What are the restraints for the global market?

Volatility in Raw Material Prices

Barley price fluctuations caused by climatic variability, supply disruptions, and competing feed demand significantly impact malt production costs. This volatility poses challenges for manufacturers in maintaining stable pricing and margins.

Energy-Intensive Production Processes

Malting operations require substantial energy and water inputs. Rising energy costs and stricter environmental regulations, especially in Europe, are increasing operational expenses and limiting profitability for smaller producers.

What are the key opportunities in the malt ingredients industry?

Growth Opportunities in Asia-Pacific and Emerging Markets

Rapid expansion of food processing and beverage industries in China, India, Southeast Asia, and Africa presents significant growth opportunities. Government-backed initiatives to boost domestic food manufacturing and grain processing are supporting new malting capacity additions.

Clean-Label and Natural Ingredient Innovation

Growing consumer demand for natural sweeteners and clean-label formulations creates opportunities for malt extract innovation. Companies developing customized malt solutions for health-focused applications are expected to gain competitive advantages.

Product Type Insights

Malt extract continues to dominate the global malt ingredients market, accounting for approximately 42% of total demand in 2025. Its leadership is driven by its high fermentable sugar content, consistent flavor profile, and versatility across brewing, bakery, confectionery, and functional food applications. Breweries prefer malt extract due to improved process efficiency and reduced dependence on whole grain handling, while food manufacturers utilize it as a natural sweetener and flavor enhancer.

Specialty malt ingredients represent the fastest-growing product segment, supported by premiumization trends in craft beer, flavored beverages, and artisanal bakery products. Increasing consumer demand for distinctive flavors, darker beer varieties, and specialty baked goods is accelerating adoption of roasted, caramelized, and smoked malt variants.Malt flour and malt syrups maintain steady demand, particularly within bakery, breakfast cereals, and confectionery applications. Growth in these segments is supported by the rising use of clean-label ingredients, where malt-based products are favored as natural alternatives to refined sugars and artificial additives.

Application Insights

Brewing remains the largest application segment, representing nearly 46% of global demand in 2025. The segment’s dominance is driven by sustained beer consumption, the global expansion of craft breweries, and the increasing popularity of premium and specialty beer styles that require diverse malt profiles.

Food processing applications are expanding rapidly, particularly in bakery products, breakfast cereals, snacks, and confectionery. Growth in this segment is supported by rising urbanization, demand for convenient foods, and the use of malt ingredients to enhance texture, color, and nutritional value.Nutraceutical and functional food applications are emerging as high-growth niches. Malt ingredients are increasingly incorporated into health drinks, energy bars, and dietary supplements due to their natural carbohydrate content, mineral profile, and perceived health benefits, aligning with growing consumer focus on wellness and functional nutrition.

Distribution Channel Insights

Direct B2B sales dominate the malt ingredients market, accounting for nearly 60% of global revenue. This channel benefits from long-term supply contracts with breweries, food manufacturers, and multinational beverage companies, ensuring consistent quality, stable pricing, and reliable supply.

Distributors and wholesalers play a critical role in serving mid-sized and regional buyers, particularly in emerging markets where localized supply chains remain essential. These intermediaries provide logistical flexibility and technical support to smaller manufacturers.Online B2B platforms are gradually gaining adoption, driven by digital procurement trends, improved supply chain transparency, and the growing presence of small and medium-sized food producers seeking diversified sourcing options.

| By Product Type | By Source Grain | By Form | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global malt ingredients market with approximately 38% share in 2025. The region’s dominance is supported by strong brewing traditions, advanced malting infrastructure, and export-oriented production across key markets such as Germany, France, Belgium, and the United Kingdom.

Regional growth is driven by the continued expansion of craft and specialty beer segments, rising demand for premium baked goods, and technological advancements in malting processes that enhance efficiency and product consistency. Additionally, Europe’s well-established regulatory framework supports high-quality standards, reinforcing its position as a major global exporter.

Asia-Pacific

Asia-Pacific accounts for around 29% of global demand and represents the fastest-growing regional market. China and India serve as primary growth engines due to rising beer consumption, expanding food processing industries, and increasing investments in domestic malting facilities.

Growth in the region is further supported by rapid urbanization, a growing middle-class population, and the westernization of dietary habits. Government initiatives encouraging food processing infrastructure and foreign investments in brewing and beverage manufacturing continue to strengthen regional demand.

North America

North America holds nearly 22% market share, driven by a strong craft brewing ecosystem and high consumption of bakery and cereal products across the United States and Canada.

Regional growth is fueled by innovation in specialty and flavored beers, increasing use of malt ingredients in functional foods, and strong consumer preference for natural and clean-label products. Continuous product innovation by malt producers further supports market expansion.

Latin America

Latin America represents an emerging market, led by Brazil and Mexico, where rising beer production and improving economic conditions are boosting demand for malt ingredients.

Growth drivers include increasing disposable incomes, expanding urban populations, and investments by multinational breweries to expand production capacity. The growing popularity of affordable packaged foods and bakery products also contributes to rising malt ingredient consumption.

Middle East & Africa

The Middle East & Africa region is witnessing gradual but steady growth. Expansion of brewing capacity in Africa, particularly in South Africa, Nigeria, and Kenya, is supporting regional demand.

In the Middle East, demand is largely driven by increasing imports for food processing applications and the growing non-alcoholic malt beverage segment. Improving supply chain infrastructure and rising consumer spending on packaged foods further enhance long-term growth prospects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Malt Ingredients Market

- Malteurop Group

- Boortmalt

- Cargill Incorporated

- Soufflet Group

- Viking Malt

- Simpsons Malt

- Muntons Plc

- GrainCorp Malt

- IREKS GmbH

- Crisp Malting Group

- Castle Malting

- Tereos Malting

- EverGrain Ingredients

- Malt Products Corporation

- Great Western Malting