Luxury Sunglasses Market Size

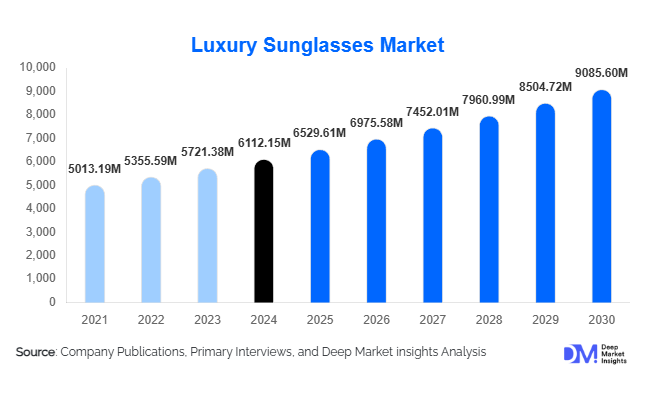

According to Deep Market Insights, the global luxury sunglasses market size was valued at USD 6,112.15 million in 2024 and is projected to grow from USD 6,529.61 million in 2025 to reach USD 9,085.6 million by 2030, expanding at a CAGR of 6.83% during the forecast period (2025–2030). The market growth is primarily driven by rising disposable incomes, the increasing influence of fashion and celebrity endorsements, growing awareness of UV eye protection, and the demand for high-quality premium eyewear among affluent consumers worldwide.

Key Market Insights

- Luxury sunglasses are increasingly considered a fashion statement, with consumers willing to pay a premium for designer brands, limited editions, and personalized eyewear.

- Celebrity endorsements and social media marketing are playing a critical role in shaping purchase decisions, particularly among millennials and Gen Z consumers.

- North America dominates the luxury sunglasses market, led by strong consumer preference for high-end accessories and established brand penetration.

- Europe is witnessing rapid growth driven by luxury fashion hubs in Italy, France, and Germany, and increasing demand for eco-conscious eyewear collections.

- Asia-Pacific is emerging as a high-potential region, particularly in China, India, and Japan, fueled by rising urbanization, higher disposable incomes, and a growing interest in Western fashion brands.

- Technological innovations, such as anti-glare, polarized lenses, and augmented reality (AR) virtual try-on platforms, are enhancing consumer engagement and driving adoption.

What are the latest trends in the luxury sunglasses market?

Designer Collaborations and Limited Editions

Luxury eyewear brands are increasingly collaborating with high-fashion designers, celebrities, and influencers to create exclusive collections. Limited-edition sunglasses, often produced in small volumes, appeal to consumers seeking uniqueness and exclusivity. These collaborations boost brand equity, generate social media buzz, and often command higher profit margins. Collectible and heritage designs are also gaining traction among affluent buyers, turning luxury sunglasses into status symbols rather than just functional accessories.

Sustainable and Eco-Friendly Materials

The market is witnessing a shift toward sustainable eyewear, with brands using biodegradable plastics, recycled metals, and ethically sourced materials. Consumers are becoming more eco-conscious and prefer premium sunglasses that align with sustainability goals. This trend is supported by government regulations in Europe and North America encouraging responsible manufacturing practices. Luxury brands are also marketing their sustainability initiatives as part of brand storytelling, creating strong emotional engagement with eco-conscious buyers.

Digitalization and AR Try-On Platforms

Technological adoption in the luxury sunglasses market is accelerating, particularly with augmented reality (AR) platforms for virtual try-ons, AI-driven personalization, and mobile apps for product customization. Retailers are integrating AR solutions into e-commerce and brick-and-mortar stores, improving customer experience and reducing purchase hesitation. Social media integration allows consumers to share virtual try-on experiences, driving organic engagement and brand visibility.

What are the key drivers in the luxury sunglasses market?

Rising Disposable Income and Premium Lifestyle

Increasing disposable incomes globally, particularly in developed markets and emerging urban centers, have expanded the consumer base for luxury goods, including high-end sunglasses. Affluent consumers increasingly view luxury eyewear as an essential fashion accessory and a symbol of status. Growth in high-net-worth individuals in regions such as North America, Europe, and Asia-Pacific directly contributes to increased demand for designer sunglasses, boosting both volume and value sales.

Fashion and Celebrity Influence

The influence of fashion trends, social media, and celebrity endorsements is significant in the luxury sunglasses market. Consumers are driven by aspirational branding, limited editions, and seasonal collections, often influenced by top models and fashion icons. Luxury eyewear companies collaborate with celebrities and designers to maintain exclusivity, ensuring high consumer engagement and repeat purchases. Social media platforms amplify these trends, making them accessible to younger demographics with high purchasing power.

Technological Advancements and Premium Features

Innovations in lens technology, including polarization, anti-reflective coatings, photochromic lenses, and blue light protection, add functional value to luxury eyewear. Enhanced durability, lightweight frames, and comfort-focused designs are increasingly influencing consumer preferences. Brands offering AR virtual try-on tools and customizable options are gaining a competitive edge by combining style with high-tech convenience, driving premium adoption.

What are the restraints for the global market?

High Price Point Limits Mass Adoption

The premium pricing of luxury sunglasses restricts accessibility to a niche consumer base. Middle-income consumers often perceive these products as non-essential, limiting market penetration in emerging economies. Seasonal discounts, knock-offs, and counterfeit products further impact sales growth among price-sensitive buyers.

Counterfeit Products and Brand Dilution

The proliferation of counterfeit luxury sunglasses poses a major challenge, undermining brand equity and consumer trust. Counterfeits are widely available online and in informal markets, offering lower-priced alternatives that cannibalize legitimate sales. Brands are increasingly investing in anti-counterfeit technologies, serial number tracking, and consumer education to maintain authenticity and loyalty.

What are the key opportunities in the luxury sunglasses market?

Expansion into Emerging Markets

Emerging economies such as India, China, Brazil, and Southeast Asia present significant growth potential due to rising disposable incomes, urbanization, and fashion consciousness. Luxury brands can tap into these regions through flagship stores, localized marketing, and online retail channels. Tier-2 and Tier-3 cities are also gaining importance as aspirational consumers seek premium lifestyle products.

Integration of Smart and AR-Enabled Sunglasses

Technological innovation presents an opportunity for luxury brands to differentiate products through smart eyewear and AR-enabled features. This includes health monitoring lenses, augmented reality displays, and interactive shopping experiences. Early adoption of these technologies can attract tech-savvy consumers and create new revenue streams, blending fashion with functionality.

Sustainability and Eco-Conscious Fashion

Consumers increasingly value sustainable fashion, creating opportunities for brands that use recycled, biodegradable, or ethically sourced materials. Eco-conscious initiatives, such as carbon-neutral manufacturing and sustainable packaging, not only enhance brand image but also attract younger demographics. Regulatory support in regions like Europe and North America further encourages luxury brands to pursue eco-friendly production.

Product Type Insights

Among luxury sunglasses, premium designer frames dominate, accounting for approximately 45% of the 2024 market. These frames, often crafted from high-grade metals, titanium, and acetate, offer superior durability, aesthetics, and brand prestige. The polarized segment is particularly strong due to its higher functionality, including glare reduction, outdoor usability, and tourism-friendly applications, while non-polarized frames appeal primarily to fashion-conscious buyers, driven by aesthetics, brand heritage, and design innovation. Aviator-style frames are globally leading because of their timeless appeal, broad unisex adoption, and strong celebrity endorsement, which reinforces brand desirability. Retro and fashion-forward styles such as oversized and cat-eye frames are emerging rapidly, especially among female consumers in North America and Europe, reflecting social media trends, influencer endorsements, and the growing demand for distinctive, statement-making eyewear. These trends indicate a synergy between functionality and fashion, with consumers willing to pay premium prices for both utility and status.

Application Insights

Luxury sunglasses continue to serve primarily as fashion and lifestyle accessories, with eye protection and UV care being secondary but increasingly valued features. Fashion-driven usage dominates social events, urban leisure, and international travel, particularly in duty-free and high-end retail settings. Sports and outdoor activities are emerging niches, supporting the growth of polarized and high-performance lenses among affluent adventure seekers. Collaborations with lifestyle and luxury sports brands, as well as influencer marketing campaigns, are expanding applications by blending functionality with aspirational appeal. This crossover between lifestyle, sports, and fashion reflects the growing expectation among consumers that luxury sunglasses provide both aesthetic value and high-end practical performance.

Distribution Channel Insights

High-end retail stores, brand boutiques, and flagship stores remain the dominant channels, accounting for nearly 60% of sales. Offline channels are driven by the luxury boutique experience, tactile product engagement, and premium in-store service, critical to reinforcing brand perception. Online channels, including D2C websites, luxury e-commerce marketplaces, and AR-enabled virtual try-on platforms, are growing rapidly due to convenience, global shipping capabilities, and accessibility for younger affluent consumers. Omni-channel strategies are increasingly important, allowing consumers to explore, try, and purchase products across both physical and digital environments. This trend is particularly pronounced in North America, Europe, and the Asia-Pacific region, where tech-savvy luxury shoppers value the flexibility to interact with brands both online and offline.

Age Group Insights

Consumers aged 25–45 years dominate the market, accounting for nearly 50% of demand in 2024. This segment combines disposable income, fashion consciousness, and strong brand awareness, driving adoption of both classic and trend-forward luxury eyewear. Millennials and Gen Z (18–24 years) are increasingly influencing online and influencer-led purchases, favoring statement and retro styles showcased on social media platforms. Older demographics (46–65 years) represent loyal buyers of aviators, wayfarers, and timeless designs, supporting the sustained performance of heritage brands. The younger generation also drives demand for online retail, AR try-on experiences, and limited-edition collections, indicating that luxury sunglasses companies must continuously innovate to capture this evolving audience.

| By Product Type | By Style/Design Type | By Gender / Target Consumer | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 30% of the global luxury sunglasses market, with the U.S. and Canada leading adoption. Regional growth is driven by strong influencer and celebrity culture, which amplifies fashion trends and enhances brand desirability, and the high urbanization of luxury retail, making premium products highly accessible in metropolitan hubs. Consumers in North America prioritize designer collaborations, limited editions, and fashion-forward styles like aviators and oversized frames. Online penetration is high, with D2C platforms complementing physical boutiques, enabling affluent consumers to explore and purchase high-end sunglasses conveniently. High disposable incomes and the widespread integration of AR and virtual try-on technologies further stimulate demand.

Europe

Europe accounts for around 28% of the market, with Italy, France, Germany, and the U.K. as primary contributors. The region’s growth is supported by its longstanding heritage of luxury fashion houses, strong craftsmanship, and brand origins, which underpin premium positioning and global appeal. Italy, as the birthplace of many iconic eyewear brands, leads due to domestic production, design expertise, and international reputation. France and Germany are driving demand for eco-conscious and designer eyewear, reflecting growing consumer preference for sustainability alongside style. Urban affluence, high fashion awareness, and a culture of luxury consumption further strengthen market adoption, particularly for timeless styles such as aviators, wayfarers, and cat-eye designs, as well as limited-edition and seasonal collections.

Asia-Pacific

Asia-Pacific is the fastest-growing market for luxury sunglasses, led by China, India, Japan, and Australia. Growth is fueled by the rapid expansion of the affluent consumer base, the growth of upper-middle-class populations, and urbanization. Rising travel and tourism, particularly international and duty-free shopping, further drives luxury sunglasses adoption. China’s online luxury retail ecosystem supports widespread e-commerce penetration, while India’s market growth is concentrated in premium boutiques and metropolitan fashion hubs. Japan and Australia maintain steady demand, with consumers favoring designer eyewear with functional features like polarized and high-performance lenses. Social media, celebrity influence, and exposure to global fashion trends accelerate style adoption, particularly for retro and statement eyewear designs.

Middle East & Africa

The Middle East, led by the UAE, Saudi Arabia, and Qatar, shows strong demand for luxury sunglasses, driven by high per-capita luxury spending and strong demand for premium lifestyle goods. The proliferation of luxury boutiques, resorts, and shopping malls enhances accessibility and visibility of high-end brands. Africa represents a smaller but growing segment, particularly in urban centers such as Johannesburg and Lagos, where increasing fashion awareness and exposure to global luxury trends support adoption. Both regions favor iconic styles such as aviators, oversized, and designer frames, with consumers seeking a blend of status, fashion, and functionality.

Latin America

Latin America is an emerging market, with Brazil, Mexico, and Argentina driving adoption. Regional growth is fueled by increasing luxury retail penetration, rising brand awareness, and growing demand for lifestyle and fashion accessories among younger affluent cohorts. Urban centers are the primary hubs for high-end boutiques, while outbound travel and exposure to international luxury trends stimulate interest in premium sunglasses. Key consumer preferences include statement-making retro and oversized designs, as well as functional polarized eyewear for outdoor and leisure activities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Luxury Sunglasses Market

- Luxottica Group

- EssilorLuxottica

- Safilo Group

- Marchon Eyewear

- Marcolin

- Chanel

- Gucci

- Prada

- Ray-Ban

- Oakley

- Tom Ford

- Dior

- Fendi

- Burberry

- Cartier

Recent Developments

- In March 2025, Luxottica launched a new sustainable sunglasses collection using biodegradable acetate across North America and Europe.

- In January 2025, Gucci expanded its limited-edition eyewear line in Asia-Pacific, integrating AR virtual try-on features in flagship stores.

- In July 2024, Safilo introduced polarized high-performance sunglasses for luxury sports and lifestyle segments, increasing its presence in emerging markets.