Luxury Plumbing Fixtures Market Size

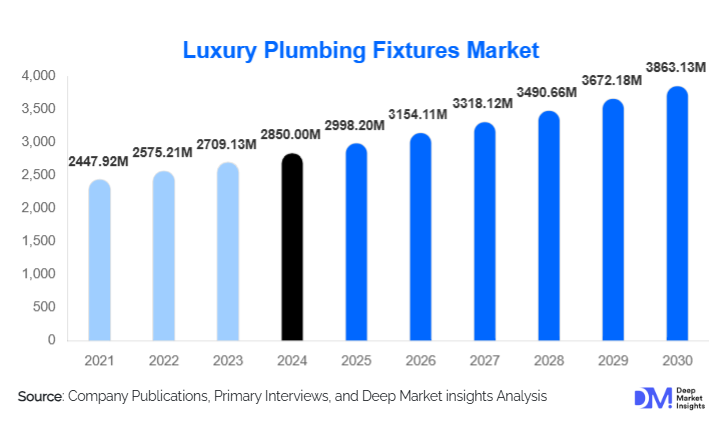

According to Deep Market Insights, the global luxury plumbing fixtures market size was valued at USD 2,850.00 million in 2024 and is projected to grow from USD 2,998.20 million in 2025 to reach USD 3,863.13 million by 2030, expanding at a CAGR of 5.2% during the forecast period (2025–2030). The market growth is primarily driven by rising investments in luxury residential construction, premium hospitality infrastructure, increasing demand for aesthetically superior bathroom and kitchen solutions, and rapid adoption of smart and water-efficient plumbing technologies.

Key Market Insights

- Luxury faucets remain the largest product segment, supported by high replacement frequency and strong demand across residential and commercial projects.

- Residential applications dominate global demand, driven by luxury villas, premium apartments, and high-end renovation activity.

- Europe leads the global market, supported by strong design heritage and premium manufacturing capabilities.

- Asia-Pacific is the fastest-growing region, fueled by luxury real estate expansion in China, India, and Southeast Asia.

- Smart and sensor-based fixtures are gaining rapid traction, driven by smart home adoption and hygiene awareness.

- Sustainability and water efficiency are key purchase criteria, influenced by green building certifications and regulatory mandates.

What are the latest trends in the luxury plumbing fixtures market?

Smart and Connected Plumbing Fixtures

Technology integration is reshaping the luxury plumbing fixtures market, with increasing adoption of smart faucets, digital showers, and intelligent toilets. These products offer features such as touchless operation, personalized temperature settings, real-time water consumption monitoring, and mobile app or voice assistant connectivity. Smart fixtures are increasingly being positioned as wellness and lifestyle products, enhancing convenience, hygiene, and energy efficiency. The trend is particularly strong in North America, Europe, and developed Asia-Pacific markets, where smart home ecosystems are expanding rapidly.

Premium Sustainable and Eco-Luxury Designs

Sustainability has emerged as a defining trend in the luxury plumbing fixtures market. Manufacturers are focusing on water-saving technologies, low-flow systems, recycled materials, and eco-certified coatings without compromising aesthetics or performance. Products aligned with green building standards such as LEED and BREEAM are gaining preference in both residential and commercial projects. This trend reflects growing consumer awareness of environmental impact and stricter government regulations on water conservation across key markets.

What are the key drivers in the luxury plumbing fixtures market?

Growth in Luxury Residential Construction and Renovation

The expansion of luxury housing developments and high-end renovation activity is a major driver of market growth. High-net-worth individuals are increasingly investing in premium bathroom and kitchen spaces to enhance lifestyle quality and property value. Bathrooms are evolving into wellness-focused environments, boosting demand for designer faucets, freestanding bathtubs, and advanced shower systems. This trend is particularly prominent in North America, Europe, and emerging Asian economies.

Rising Investments in Luxury Hospitality and Commercial Infrastructure

Global expansion of luxury hotels, resorts, premium office buildings, and high-end retail spaces is significantly boosting demand for luxury plumbing fixtures. Hospitality operators prioritize premium aesthetics, durability, and brand differentiation, leading to higher per-project spending on fixtures. Large-scale tourism developments in the Middle East and Asia-Pacific further support long-term demand growth.

What are the restraints for the global market?

High Product Costs and Limited Affordability

Luxury plumbing fixtures are associated with premium pricing due to high-quality materials, advanced manufacturing processes, and imported components. This limits adoption to affluent consumers and high-end commercial projects, restricting market penetration in price-sensitive regions.

Volatility in Raw Material Prices

Fluctuations in the prices of brass, stainless steel, specialty coatings, and energy inputs impact production costs and profit margins. Supply chain disruptions and longer lead times for premium materials further challenge pricing stability and project timelines.

What are the key opportunities in the luxury plumbing fixtures industry?

Expansion of Smart Home and IoT Integration

The growing adoption of smart homes presents significant opportunities for luxury plumbing fixture manufacturers. Integration with broader home automation systems allows companies to offer premium, connected solutions with higher margins and long-term service potential.

Rising Demand from Emerging Luxury Real Estate Markets

Rapid urbanization and increasing disposable incomes in the Asia-Pacific and the Middle East are creating strong demand for luxury residential and hospitality developments. Localized manufacturing, customization, and strategic partnerships offer growth opportunities for global brands in these regions.

Product Type Insights

Among all product types in the luxury plumbing fixtures market, luxury faucets are the largest segment, accounting for approximately 34% of the global market share in 2024. Their dominance is driven by widespread applications in both residential and commercial projects, high design differentiation, and frequent replacement cycles that maintain consistent demand. Consumers increasingly seek faucets that combine aesthetic appeal with functionality, including smart temperature and water flow controls. Luxury showers are the fastest-growing segment, reflecting rising consumer preference for spa-like bathroom experiences, wellness-focused home designs, and the integration of digital and sensor-based technologies. Bathtubs, smart toilets, and premium bathroom accessories continue to contribute steadily to market growth, particularly in ultra-luxury homes, five-star hotels, and premium resorts where design sophistication and advanced functionality are key decision factors.

Material Insights

In terms of materials, brass-based fixtures dominate with nearly 41% share of the market due to their durability, corrosion resistance, and suitability for premium finishes such as chrome, gold, and PVD coatings. Stainless steel fixtures are gaining traction in modern and minimalist designs, while ceramic and composite materials are increasingly used for customized and designer applications, offering aesthetic versatility and lightweight durability. The choice of material is a critical driver of luxury fixture adoption, particularly among consumers seeking long-lasting, low-maintenance, and visually appealing solutions.

End-Use Insights

The residential segment remains the largest end-use category, capturing approximately 52% of total demand in 2024. This is largely driven by growth in luxury homes, high-end apartments, and renovation projects where homeowners prioritize premium aesthetics, durability, and modern functionality. Meanwhile, the commercial segment, particularly luxury hotels and resorts, is the fastest-growing category. Demand in this segment is fueled by global tourism expansion, hotel brand positioning, and the need for differentiated, high-quality bathroom and kitchen experiences that elevate guest satisfaction. Institutional applications such as airports, luxury hospitals, and high-end office buildings are also emerging as niche but growing markets, particularly for smart and sensor-based fixtures.

Distribution Channel Insights

Distribution in the luxury plumbing fixtures market is dominated by exclusive brand showrooms, accounting for nearly 39% share. These showrooms allow customers to experience products physically, explore design customization, and interact with brand experts, reinforcing the premium positioning of products. Specialty retail stores and direct OEM sales remain important channels, particularly in regions with strong brand loyalty. Additionally, online luxury platforms are expanding rapidly, offering digital customization tools, AR-based previews, and virtual showroom experiences that cater to tech-savvy and affluent consumers.

| By Product Type | By Material | By Technology | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe holds the largest share of the luxury plumbing fixtures market at approximately 32% in 2024, led by Germany, Italy, France, and the U.K. Regional growth is driven by strong design heritage, premium manufacturing capabilities, and high domestic and export demand for luxury fixtures. The adoption of smart and water-efficient fixtures is further accelerated by stringent environmental regulations and widespread awareness of sustainability. Germany and Italy serve as global hubs for premium fixture production, with brand reputation and technological innovation attracting international buyers. The region’s focus on design-led, high-quality products ensures continued demand from both residential renovation projects and commercial hospitality investments.

North America

North America accounts for nearly 28% of global demand, led primarily by the United States. Market growth is fueled by high renovation activity in luxury homes, robust investments in high-end hospitality infrastructure, and early adoption of smart and sensor-based fixtures. Additionally, strong disposable incomes, evolving home automation trends, and a preference for wellness-centric bathrooms are key drivers supporting the expansion of luxury plumbing fixtures. Commercial projects, including premium offices and boutique hotels, are increasingly specifying high-end products to enhance brand perception and guest experiences.

Asia-Pacific

Asia-Pacific represents around 26% of the global market and is the fastest-growing region, with China, Japan, India, and South Korea leading demand. China alone contributes roughly 11% of global demand. Growth drivers include rapid urbanization, luxury real estate development, increasing disposable incomes, and rising awareness of premium lifestyle products. Additionally, the region is witnessing growing adoption of smart, water-efficient, and customized fixtures, supported by government initiatives for sustainable construction and high-end residential developments. Hospitality expansion, particularly luxury resorts and five-star hotels, further accelerates market demand in key APAC countries.

Middle East & Africa

The region accounts for approximately 9% of the market, driven primarily by luxury tourism, real estate megaprojects, and high-value infrastructure investments in the UAE, Saudi Arabia, and Qatar. Strong economic growth, government-supported urban development initiatives, and rising international tourism are fueling demand for premium fixtures. High-end residential and commercial projects often prioritize imported luxury products, boosting market potential. Additionally, regional preferences for opulent design, advanced technology integration, and large-scale hospitality projects continue to drive segment adoption.

Latin America

Latin America holds around 5% of the global market share, with Brazil and Mexico leading regional demand. Growth is gradually expanding due to increasing luxury residential developments, renovation of high-end hotels, and urban infrastructure projects. Rising disposable incomes among affluent populations and growing awareness of smart and sustainable fixtures are encouraging adoption. Commercial hospitality, including boutique resorts and premium hotels, is also contributing to steady market growth, despite slower penetration compared to Europe, North America, and APAC.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Luxury Plumbing Fixtures Market

- LIXIL Group

- Kohler Co.

- Geberit AG

- TOTO Ltd.

- Hansgrohe Group

- Roca Group

- Villeroy & Boch

- Duravit AG

- GROHE AG

- Jaquar Group

- Ideal Standard

- American Standard Brands

- Dornbracht AG

- Axor

- Porcelanosa Group