Luxury Fashion Market Size

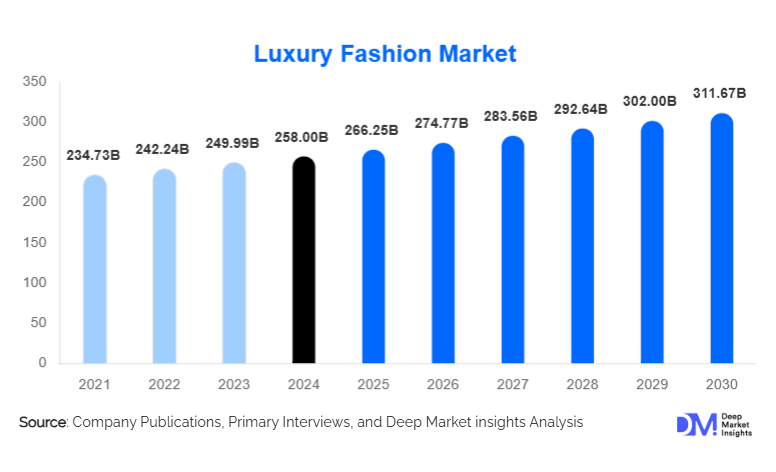

According to Deep Market Insights, the global luxury fashion market was valued at USD 258.0 billion in 2024 and is projected to grow from USD 266.25 billion in 2025 to reach USD 311.67 billion by 2030, expanding at a CAGR of 3.2% during the forecast period (2025–2030). This growth is driven by rising global disposable incomes, rapid expansion of premium consumer bases in Asia-Pacific and the Middle East, and accelerated digital transformation across luxury retail channels.

Key Market Insights

- Leather goods and handbags lead the product category, driven by strong global demand for high-margin, iconic luxury accessories.

- Women account for the largest share of luxury fashion purchases, representing over 55% of global consumption due to broader category participation.

- Europe remains the largest regional market, supported by heritage luxury houses, inbound tourism, and established retail networks.

- Asia-Pacific is the fastest-growing geographic segment, with significant contributions from China, India, South Korea, and Southeast Asia.

- Digital and omnichannel luxury retailing is accelerating, with online luxury sales gaining substantial traction worldwide.

- Certified pre-owned luxury and circular-economy models are creating new value pools, especially among Millennials and Gen Z consumers.

What are the latest trends in the Luxury Fashion Market?

Premium Leather Goods & Accessories Outperforming Apparel

Across global markets, luxury leather goods, particularly handbags, wallets, belts, and small accessories, continue to outperform apparel categories. High resale value, iconic product status, durability, and investment appeal are fueling consumer interest. Many luxury brands increasingly allocate R&D and design budgets toward signature handbags and limited-edition accessories. This shift is also influenced by the rapid growth of the certified pre-owned luxury market, where leather goods retain significantly higher resale value than clothing. Brands are innovating with artisanal craftsmanship, exotic materials, and sustainable eco-leather alternatives to meet rising demand.

Digital-First Luxury Retail & Virtual Shopping Experiences

Technology adoption in luxury fashion is accelerating, with brands integrating virtual try-ons, AR showrooms, AI-powered recommendations, and blockchain-based authenticity tracking. Luxury consumers increasingly prefer hybrid retail experiences, researching and personalizing purchases online before finalizing them in-store. Virtual runways, digital product passports, and immersive online flagship stores are becoming integral to brand engagement. Social commerce, influencer-driven personalization, and luxury livestream shopping, especially prominent in Asia-Pacific, are reshaping how consumers discover and purchase premium fashion goods.

What are the key drivers in the Luxury Fashion Market?

Rising Global Affluence and Expansion of HNWI Demographics

The luxury fashion industry is heavily supported by the growing global population of high-net-worth individuals (HNWIs) and affluent middle-class consumers. Rapid economic growth in China, India, Southeast Asia, and the Middle East has substantially expanded the consumer base. This demographic shift has increased demand for premium lifestyle goods, statement accessories, and international luxury labels. Strengthening urbanization, exposure to Western fashion, and investments in luxury retail infrastructure further accelerate consumption in emerging markets.

Digital Transformation and Omnichannel Retail Innovation

E-commerce growth is a major driver of luxury fashion sales, supplemented by seamless omnichannel experiences such as buy-online-pick-up-in-store (BOPIS), virtual consultations, and personalized digital styling. Luxury brands are investing in proprietary online platforms to strengthen direct-to-consumer (D2C) engagement. AI-driven personalization, real-time inventory visibility, and cross-channel loyalty programs enhance customer experience and increase conversion rates. The evolution of digital storefronts and immersive technologies is unlocking new value creation opportunities for luxury companies.

What are the restraints for the global market?

Macroeconomic Uncertainty and Currency Fluctuations

Luxury fashion is highly sensitive to global economic volatility, inflationary pressures, and exchange rate fluctuations. Economic slowdowns in key markets, including China, Europe, and the U.S., reduce discretionary spending on premium goods. Geopolitical tensions and supply-chain disruptions also affect production and distribution costs, prompting brands to adjust pricing strategies. These forces may impact profit margins and slow overall sector growth during unstable periods.

Threats to Brand Exclusivity from Resale and Discount Channels

While resale markets offer growth opportunities, they also present risks. Excessive discounting, outlet-driven price dilution, and increased accessibility of pre-owned luxury goods may erode brand exclusivity. Luxury houses must carefully balance volume growth with scarcity-driven brand value. Unregulated resale channels and authenticity issues further complicate the ecosystem, prompting brands to invest in blockchain-led authentication and controlled resale partnerships.

What are the key opportunities in the Luxury Fashion Industry?

Expansion into Emerging High-Growth Markets

Asia-Pacific, the Middle East, and parts of Latin America represent major untapped opportunities. India’s luxury market is expanding rapidly due to rising incomes and urban aspirations, while Gulf nations such as Saudi Arabia and the UAE are witnessing unprecedented luxury retail spending. Brands investing in localized product lines, region-specific campaigns, and luxury mall developments are set to benefit significantly. Tourism-driven luxury spending further enhances growth opportunities in these regions.

Certified Pre-Owned Luxury & Circular Fashion Ecosystems

The pre-owned luxury market is transforming consumer behavior, especially among younger buyers who value sustainability and affordability. Luxury houses can capitalize on this opportunity by building in-house authentication programs, branded resale platforms, and refurbishment services. These initiatives extend product life cycles, boost brand loyalty, and generate new revenue streams. Circular-fashion models are also aligned with global sustainability expectations and ESG compliance requirements.

Product Type Insights

Leather goods and handbags dominate the luxury fashion market, contributing approximately 25–30% of the total 2024 market value. High global demand for designer handbags, increased investment interest, and strong resale value make this the most resilient product segment. Luxury apparel continues to hold a significant share, while footwear and fine jewelry are witnessing steady expansion due to broader lifestyle trends and rising consumer confidence. Accessories, including eyewear, scarves, and belts, are becoming key entry-level luxury products, especially for younger demographics.

Application Insights

Personal lifestyle consumption accounts for the majority of luxury fashion demand, driven by individual purchases of apparel, accessories, and footwear. Gift-oriented purchases form a secondary but rapidly growing application, especially in Asia-Pacific and Middle Eastern cultures, where luxury gifting is a social norm. The resale and pre-owned luxury application is expanding fast due to sustainability concerns and affordability dynamics. Corporate and institutional applications, such as luxury uniforms for hospitality brands and red-carpet dressing, remain niche but steadily growing segments.

Distribution Channel Insights

Brick-and-mortar flagship stores retain the largest share at nearly 40–45% of 2024 global luxury fashion sales, driven by experiential shopping and personalized services. However, online luxury retail is the fastest-growing channel, enabled by digital platforms, high mobile penetration, and AI-driven personalization. Travel retail and duty-free luxury outlets continue to rebound with global tourism recovery. Resale platforms, both brand-owned and third-party, are emerging as high-growth channels, attracting environmentally conscious and price-sensitive customers.

Customer Segment Insights

Women represent the largest customer segment, accounting for 55–60% of luxury fashion purchases due to broader participation across apparel, handbags, jewelry, and accessories categories. Men’s luxury consumption is growing steadily, propelled by premium sneakers, watches, and tailored apparel. Younger demographics, particularly Millennials and Gen Z, are driving demand for streetwear-inspired luxury and resale fashion. Children’s luxury fashion, though niche, is expanding in developed markets as high-income households seek premium apparel for younger family members.

| By Product Category | By Customer Segment | By Distribution Channel | By Price Tier | By End-Use Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe remains the world’s largest luxury fashion market with an estimated 30–35% global share in 2024. Heritage luxury houses, tourism-driven purchases, and well-developed retail infrastructure support market dominance. France, Italy, Switzerland, and the U.K. are the major contributors. European consumers demonstrate strong loyalty toward established luxury brands and a high interest in sustainable, ethically sourced fashion.

North America

North America holds approximately 25–30% of the global market, driven by high disposable incomes, rapid adoption of omnichannel retail, and strong demand for luxury accessories and premium streetwear. The U.S. is the region’s largest market, accounting for the majority of luxury purchases, with affluent millennials and Gen Z emerging as increasingly influential buyers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for 25–30% of global luxury consumption in 2024. China remains a powerhouse, though India, South Korea, Japan, and Southeast Asia are experiencing rapid acceleration in luxury spending. Expanding middle-class populations, digital adoption, and cultural affinity for premium products fuel regional growth. Social-commerce-driven luxury discovery is particularly prevalent in the Asia-Pacific.

Latin America

Latin America contributes roughly 3–5% of global luxury sales. Brazil and Mexico lead the region, supported by increasing economic stabilization and growing urban affluence. Outbound luxury purchases, particularly through travel retail, play a significant role in regional consumption trends.

Middle East & Africa

The Middle East, particularly the UAE, Saudi Arabia, and Qatar, represents one of the most lucrative luxury markets per capita. With a 5–8% global share, the region benefits from high-income households, tourism growth, luxury mall developments, and government-led economic diversification. Africa’s luxury market remains smaller but is expanding through South Africa, Nigeria, and Kenya.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Luxury Fashion Market

- LVMH

- Kering

- Chanel

- Hermès International

- Richemont

- Prada Group

- Burberry

- Valentino

- Bottega Veneta

- Saint Laurent

- Dior

- Balenciaga

- Versace

- Fendi

- Gucci

Recent Developments

- In 2025, LVMH expanded its leather goods manufacturing facilities in France and Italy, focusing on sustainable materials and artisan workforce development.

- Kering announced a major investment in circular luxury by launching cleathertified pre-owned programs across Europe and Asia.

- Prada Group implemented digital product passports across select handbag lines, enhancing transparency and resale verification.