Low-Sugar High-Protein Dairy Blends Market Size

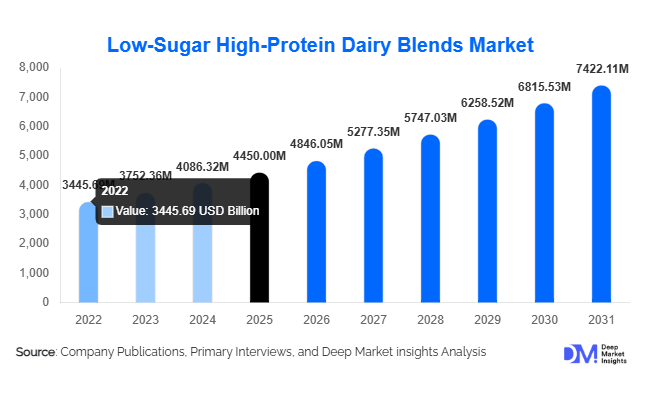

According to Deep Market Insights,the global low-sugar high-protein dairy blends market size was valued at USD 4,450 million in 2025 and is projected to grow from USD 4,846.05 million in 2026 to reach USD 7,422.11 million by 2031, expanding at a CAGR of 8.9% during the forecast period (2026–2031). Market growth is primarily driven by rising global demand for protein-enriched functional foods, regulatory-driven sugar reduction initiatives, and increasing adoption of fortified dairy beverages across sports nutrition, clinical nutrition, and mainstream food applications.

Key Market Insights

- Whey protein isolate (WPI)-based blends dominate the product landscape, accounting for nearly 26% of 2025 market share due to superior purity and functionality in RTD beverages.

- No-added-sugar formulations represent the largest sugar category, contributing approximately 38% of total revenue in 2025 amid global sugar reduction mandates.

- Powdered blends lead the form segment with over 50% share, driven by extended shelf life and lower logistics costs.

- Functional dairy beverages remain the leading application, contributing around 34% of overall demand globally.

- North America holds the largest regional share at roughly 34% in 2025, led by the United States.

- Asia-Pacific is the fastest-growing region, expanding at over 10% CAGR due to rising protein awareness and middle-class consumption.

What are the latest trends in the low-sugar high-protein dairy blends market?

Hybrid Dairy-Plant Protein Blends Gaining Momentum

Manufacturers are increasingly launching hybrid dairy-plant protein blends that combine whey or milk proteins with pea or soy isolates to optimize amino acid profiles and improve sustainability positioning. These blends reduce formulation costs while maintaining high protein density and clean-label appeal. The trend is particularly strong in Asia-Pacific and Europe, where sustainability-driven purchasing decisions are influencing ingredient innovation. Hybridization also improves digestibility and broadens consumer acceptance among flexitarian populations.

Advanced Sugar Reduction Technologies

Technological advancements in enzymatic lactose hydrolysis, membrane filtration, and natural high-intensity sweeteners are enabling deeper sugar reductions without compromising taste or texture. Ingredient manufacturers are investing in flavor-masking technologies to offset bitterness associated with sugar substitutes. These innovations are strengthening adoption across yogurt, RTD beverages, and protein desserts. Clean-label sweetening systems are becoming a competitive differentiator, particularly in North America and Western Europe.

What are the key drivers in the low-sugar high-protein dairy blends market?

Rising Global Protein Consumption

Increasing health awareness, muscle maintenance trends, and weight management goals are driving demand for protein-enriched foods. Dairy proteins, known for complete amino acid profiles and high bioavailability, remain preferred ingredients in fortified food and beverage applications. The mainstreaming of sports nutrition has expanded demand beyond athletes to everyday consumers.

Regulatory Pressure on Sugar Reduction

Governments across developed markets are implementing sugar taxes, labeling mandates, and reformulation guidelines. These policies are compelling dairy beverage and yogurt manufacturers to adopt low-sugar protein blends to maintain compliance and protect brand reputation. Reformulated products are commanding premium pricing, supporting margin expansion.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in milk production, feed costs, and global whey supply influence pricing stability. Price swings in Europe and Oceania can compress margins for ingredient suppliers, especially in high-purity isolates.

Formulation and Sensory Challenges

Reducing sugar often affects mouthfeel and flavor balance. Without advanced processing technologies, products may suffer from chalky textures or off-notes, limiting consumer repeat purchases and slowing adoption in mass-market segments.

What are the key opportunities in the industry?

Clinical and Medical Nutrition Expansion

The aging global population and increasing incidence of metabolic disorders are accelerating demand for high-protein, low-sugar clinical formulations. Hospitals and elderly care facilities are incorporating specialized dairy protein blends into nutritional therapy programs, creating long-term procurement contracts.

Emerging Asia-Pacific Demand

India, China, Indonesia, and Vietnam present strong growth opportunities due to rising middle-class incomes and fitness awareness. Localized flavor adaptation and affordable powdered formats are enabling market penetration. Export-driven supply chains from Europe and New Zealand further support regional expansion.

Product Type Insights

Whey protein isolate blends dominate the market, contributing approximately 26% of 2025 revenues due to their high protein purity exceeding 90%, superior amino acid profile, and rapid absorption kinetics that support sports recovery and clinical nutrition applications. Their strong solubility and neutral sensory characteristics further enhance suitability for ready-to-drink (RTD) beverages and fortified dairy formulations. Milk protein concentrates and isolates remain widely adopted in yogurt and fermented dairy applications, supported by balanced whey-to-casein ratios that deliver both texture enhancement and sustained protein release. Casein-based blends are preferred in slow-digesting and satiety-focused products, particularly in nighttime recovery and weight management formulations. Meanwhile, dairy-plant hybrid blends are emerging as the fastest-growing category, driven by cost optimization strategies, improved environmental positioning, and consumer demand for flexitarian nutrition solutions that combine functional performance with sustainability narratives.

Sugar Level Insights

No-added-sugar blends account for around 38% of total market value in 2025, reflecting stringent sugar reduction regulations, clean-label positioning, and growing diabetic and calorie-conscious consumer bases. Manufacturers are increasingly leveraging natural sweeteners and lactose management technologies to maintain taste profiles without compromising nutritional claims. Ultra-low sugar variants are gaining traction in premium RTD beverages, particularly in North America and Asia-Pacific, where metabolic health awareness is rising. Reduced-sugar formulations continue to dominate mainstream yogurt and fermented dairy categories, balancing flavor retention with compliance to public health guidelines. Product innovation is increasingly centered on glycemic control, metabolic wellness, and alignment with government-driven sugar reformulation initiatives.

Form Insights

Powdered blends hold roughly 52% share of the global market in 2025 due to extended shelf stability, lower transportation costs, and seamless integration into B2B ingredient supply chains. Their flexibility in large-batch manufacturing and compatibility with dry-mix beverage systems further reinforce market dominance. Liquid ready-to-use blends are expanding steadily, particularly in beverage manufacturing hubs across North America and Europe, where automated filling lines and cold-chain infrastructure support efficiency. Semi-solid concentrates cater to industrial-scale dairy processors requiring high-viscosity protein bases for yogurt, desserts, and cultured dairy products. Growth across forms is closely tied to advancements in spray drying, membrane filtration, and protein standardization technologies.

Application Insights

Functional dairy beverages represent the largest application segment with approximately 34% share in 2025, supported by sustained global demand for RTD protein drinks, on-the-go nutrition, and performance-focused hydration solutions. Yogurt and fermented dairy products follow closely, leveraging high-protein claims to drive premiumization, product differentiation, and consumer willingness to pay. Clinical nutrition and sports nutrition applications are the fastest-growing sub-segments, both recording high single-digit to low double-digit growth rates, driven by aging populations, rising preventive healthcare adoption, and increasing gym participation rates. Additionally, protein fortification is expanding into dairy desserts, meal replacements, and specialized medical nutrition products.

Distribution Channel Insights

B2B ingredient supply dominates with nearly 61% of global revenue, as large-scale dairy processors and beverage manufacturers increasingly source customized protein blends directly from specialized ingredient suppliers. Long-term procurement contracts, technical formulation support, and co-development partnerships strengthen this channel’s leadership. Retail and online direct-to-consumer channels are expanding, particularly for branded protein powders, ready-to-mix formulations, and functional beverage concentrates. E-commerce growth, subscription-based supplement models, and digital health marketing strategies are reshaping the competitive landscape, especially in urban markets.

End-Use Industry Insights

The food and beverage processing industry accounts for over 55% of total demand in 2025, driven by large-scale fortification initiatives across dairy beverages, yogurts, and meal replacement categories. Nutraceutical and dietary supplement manufacturers are growing at over 9% CAGR, supported by expanding protein supplementation trends among fitness enthusiasts and aging consumers. Clinical nutrition remains the fastest-growing end-use segment, propelled by hospital nutrition programs, medical meal formulations, and therapeutic protein requirements. Export-driven demand from European and Oceanian dairy exporters to Asia-Pacific markets continues to strengthen global trade flows, supported by favorable dairy production capacities and international quality certifications.

| By Product Type | By Sugar Content Level | By Form | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global market in 2025, with the United States contributing nearly 28% alone. Growth is supported by high sports nutrition penetration, advanced dairy processing infrastructure, and strong adoption of high-protein functional beverages. Regulatory pressure on sugar reduction, widespread consumer awareness of metabolic health, and a well-established supplement retail ecosystem further reinforce demand. Canada complements regional growth with strong clean-label preferences, expanding dairy innovation, and increasing demand for fortified yogurt and RTD protein beverages.

Europe

Europe holds around 29% share, led by Germany, France, the United Kingdom, and the Netherlands. Stringent sugar reformulation regulations, robust dairy farming networks, and advanced membrane filtration technologies enhance production efficiency and export competitiveness. Ireland and the Netherlands play a pivotal role as export-oriented dairy hubs, supplying protein ingredients to Asia-Pacific and Middle Eastern markets. Sustainability mandates, carbon reduction goals, and premium dairy branding strategies further support regional stability and long-term growth.

Asia-Pacific

Asia-Pacific represents approximately 24% of the 2025 market and is the fastest-growing region at over 10% CAGR. China and India serve as primary growth engines, driven by rapid urbanization, rising disposable incomes, expanding middle-class populations, and growing acceptance of protein-enriched beverages. Increasing gym memberships, e-commerce expansion, and local dairy capacity development accelerate market penetration. Japan and South Korea drive innovation-led premium demand, focusing on functional, low-sugar, and clinically positioned dairy protein products.

Latin America

Latin America contributes about 7% of global revenues, with Brazil and Mexico leading consumption due to expanding dairy beverage production, rising health awareness, and an evolving fitness culture. Investments in domestic dairy processing infrastructure and increasing multinational presence are strengthening regional supply capabilities. Growing urban retail networks and improving cold-chain logistics are also facilitating product availability.

Middle East & Africa

The Middle East & Africa accounts for nearly 6% of the global market. GCC countries act as major importers of premium protein blends due to limited domestic dairy production and high disposable incomes. Rising health-conscious expatriate populations and increasing retail modernization support demand growth. South Africa serves as a regional production hub, benefiting from established dairy farming systems and export access to neighboring African markets. Expanding healthcare infrastructure and clinical nutrition programs further contribute to long-term regional expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Low-Sugar High-Protein Dairy Blends Market

- Fonterra Co-operative Group Limited

- Arla Foods amba

- Glanbia plc

- FrieslandCampina Ingredients

- Lactalis Ingredients

- Kerry Group plc

- Saputo Inc.

- Agropur Cooperative

- Hilmar Cheese Company

- DMK Group

- Leprino Foods Company

- AMCO Proteins

- Milk Specialties Global

- Carbery Group

- Valio Ltd