Low Sodium Sea Salts Market Size

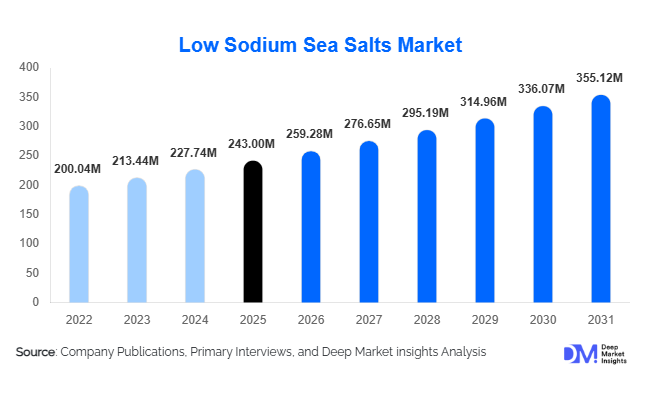

According to Deep Market Insights, the global low-sodium sea salts market size was valued at USD 243.00 million in 2025 and is projected to grow from USD 259.28 million in 2026 to reach USD 355.12 million by 2031, expanding at a CAGR of 6.7% during the forecast period (2026–2031). The market growth is primarily driven by increasing health awareness regarding sodium intake, regulatory support for reduced-sodium food products, and rising consumer preference for natural and clean-label ingredients in cooking and food processing applications.

Key Market Insights

- Consumer demand for healthier alternatives is fueling the adoption of low-sodium sea salts in households, processed food, and foodservice sectors globally.

- Product innovation in mineral-enhanced and flavored sea salts is creating premium offerings, enhancing taste retention while reducing sodium content.

- Asia-Pacific leads in volume demand due to rising middle-class affluence, expanding packaged food sectors, and increasing awareness of heart-healthy diets.

- North America dominates in value owing to high consumption in households, foodservice, and processed food reformulation driven by regulations and public health campaigns.

- E-commerce and retail channels are rapidly expanding, allowing direct-to-consumer access to niche low-sodium products worldwide.

- Industrial and non-food applications such as water softening and eco-friendly de-icing are emerging, providing new revenue streams for manufacturers.

What are the latest trends in the low-sodium sea salts market?

Clean-Label and Mineral-Enhanced Products

Consumers increasingly prefer natural, minimally processed ingredients, driving manufacturers to offer low-sodium sea salts with enhanced mineral content like potassium and magnesium. These products not only provide functional health benefits but also support clean-label marketing, allowing brands to differentiate in a competitive market. Innovation in flavored blends, organic certifications, and gourmet packaging is further expanding appeal in premium segments.

Expansion of E-Commerce and Direct-to-Consumer Channels

Online platforms are transforming the low-sodium sea salts market by providing wider geographic reach, subscription models, and personalized product recommendations. Health-conscious consumers can access specialized products that may not be available in conventional retail, while manufacturers leverage digital marketing to highlight functional benefits, track consumer preferences, and promote sustainability claims.

What are the key drivers in the low-sodium sea salts market?

Growing Health and Wellness Awareness

Increasing awareness of hypertension, cardiovascular disease, and dietary sodium limits is driving consumer adoption of low-sodium sea salts. Households and food manufacturers are incorporating these products to maintain flavor while reducing sodium content, supported by public campaigns and physician recommendations.

Regulatory Support and Reformulation Initiatives

Health authorities worldwide are encouraging sodium reduction in processed foods. Voluntary targets, nutrition labeling, and reformulation guidelines are prompting manufacturers to integrate low-sodium sea salts, stimulating market growth in both retail and industrial segments.

Technological Innovation in Salt Production

Advancements such as crystal milling, spray salts, granulated powders, and flavor-enhancing mineral blends improve palatability and usability. Such innovations increase consumer acceptance and broaden applications across culinary, industrial, and foodservice channels.

What are the restraints for the global market?

Price Premium Compared to Conventional Salt

Low-sodium sea salts involve more processing and functional formulation, leading to higher prices. In price-sensitive markets, this can restrict adoption, particularly in bulk industrial applications.

Taste and Consumer Acceptance Challenges

Some low-sodium salts may alter flavor profiles, limiting use in traditional cuisines. While technological improvements are mitigating this challenge, resistance to taste differences remains a potential restraint on rapid adoption.

What are the key opportunities in the low-sodium sea salts industry?

Functional and Mineral-Fortified Salt Blends

The integration of essential minerals such as potassium and magnesium in low-sodium sea salts presents a premium opportunity. Consumers seeking dual benefits of flavor and health are driving demand for these fortified products, particularly in North America and Europe.

Expansion in Emerging Markets

Rising middle-class populations in the Asia-Pacific and Latin America are adopting health-focused diets and processed foods with reduced sodium. Targeted marketing and localized distribution can unlock significant growth in these regions.

Industrial and Non-Food Applications

Low-sodium sea salts are increasingly being used in water softening, eco-friendly de-icing, and industrial anti-caking solutions. These applications provide diversification opportunities and additional revenue streams beyond traditional food markets.

Product Type Insights

Among product types, powdered low-sodium sea salts dominate the market, accounting for approximately 48% of global revenue in 2025. Their leading position is driven by their versatility across culinary and industrial applications, ease of incorporation into processed foods, and strong retail acceptance. Powdered salts are particularly favored in food manufacturing because they blend seamlessly into seasonings, sauces, and packaged products while maintaining consistent taste and texture. Granular and flavored variants are gaining traction in specialty and premium segments, appealing to health-conscious consumers and gourmet cooking markets. The growing trend toward fortified and flavored blends is further boosting adoption of these formats, allowing producers to cater to niche preferences while maintaining a reduced-sodium profile. Overall, innovation, ease of use, and broad applicability are key drivers for the continued dominance of the powdered segment globally.

Application Insights

Household consumption remains the largest end-use segment (40% share in 2025), fueled by the rise in health-conscious home cooks and growing awareness of dietary sodium reduction. Consumers are increasingly replacing traditional salts with low-sodium alternatives in everyday cooking to maintain taste while adhering to healthier dietary practices. The processed and packaged food segment (30%) is also expanding rapidly, as manufacturers reformulate products to comply with regulatory sodium reduction targets and meet consumer demand for healthier alternatives. Emerging applications in water treatment, eco-friendly de-icing, and industrial anti-caking solutions offer additional growth avenues. In particular, the functional and mineral-enhanced properties of low-sodium sea salts are enabling these industrial applications, further diversifying the market beyond conventional food use.

Distribution Channel Insights

Retail supermarkets remain the dominant distribution channel (60% share), providing a broad consumer reach, high visibility, and established trust for household and packaged food buyers. E-commerce is the fastest-growing channel, driven by health-conscious consumers seeking specialized, mineral-enhanced, and flavored low-sodium salts unavailable in conventional retail. Online platforms enable subscription models, direct-to-consumer sales, and geographic expansion for niche and premium products. Foodservice and institutional channels are gradually increasing adoption, particularly for flavored or specialty salts, as restaurants and catering services respond to the growing demand for healthier menu options and reduced sodium formulations.

| By Product Type | By Source | By End-Use Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 30–35% of the global market in 2025, with the United States as the key driver. Growth in the region is supported by high consumer awareness of cardiovascular health, government-led sodium reduction initiatives, and stringent nutrition labeling regulations. The expanding processed food sector and robust retail infrastructure further fuel demand. Canada and Mexico contribute moderately, primarily through packaged food reformulation and urban consumer adoption. Additionally, the trend toward functional and mineral-fortified salts in households and foodservice is strengthening adoption across North America.

Europe

Europe holds 25–30% of the global market share, with Germany, the UK, and France as leading contributors. Growth is driven by strict regulatory frameworks, public health campaigns promoting reduced sodium intake, and consumer preference for premium natural products. Mediterranean dietary practices favor natural sea salts, which support the uptake of low-sodium alternatives. Rising awareness of heart health, coupled with the strong packaged food manufacturing sector, is creating continuous demand. Innovation in flavored and fortified products is further boosting market penetration in households, retail, and foodservice channels across the region.

Asia-Pacific

Asia-Pacific is the largest volume market (35% of global demand) and the fastest-growing region. Major contributors include China, India, Japan, and South Korea. Growth drivers include rising middle-class income, rapid urbanization, increasing processed food consumption, and heightened awareness of cardiovascular and lifestyle-related health issues. Rising demand for functional and flavored low-sodium salts in both household and industrial applications further accelerates market expansion. Additionally, increased exposure to Western dietary practices and the proliferation of e-commerce platforms are facilitating access to premium and specialty products, boosting regional growth.

Latin America

Latin America contributes 5–7% of global demand, with Brazil, Mexico, and Argentina as key markets. Growth is fueled by expanding processed food consumption, urbanization, and rising health awareness among middle-class consumers. Regulatory initiatives and nutrition campaigns are slowly encouraging low-sodium adoption. E-commerce and supermarket penetration are helping to expand market reach, while industrial applications like water treatment offer additional revenue potential in select countries.

Middle East & Africa

The region accounts for 5–7% of global demand. Gulf countries, including the UAE, Saudi Arabia, and Qatar, are leading due to high disposable incomes, premium product adoption, and growing health-conscious consumer segments. Africa serves as a production hub for sea salts, supporting intra-regional trade. Additionally, awareness of health and lifestyle diseases is gradually driving household adoption of low-sodium alternatives. Premium and flavored salt products in foodservice, retail, and processed food applications are gaining traction, creating a steady growth pathway for the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Low Sodium Sea Salts Market

- Cargill, Inc.

- SaltWorks, Inc.

- K+S Aktiengesellschaft

- Tata Chemicals Ltd.

- Selina Naturally

- ADM (Archer Daniels Midland Company)

- Infosa Saltworks

- A&B Ingredients

- Atacama Salt Co.

- Solo Sea Salt

- Maldon Salt Co.

- Morton Salt, Inc.

- Himalayan Chef

- Dominion Salt Ltd.