Longevity Ingredients Market Size

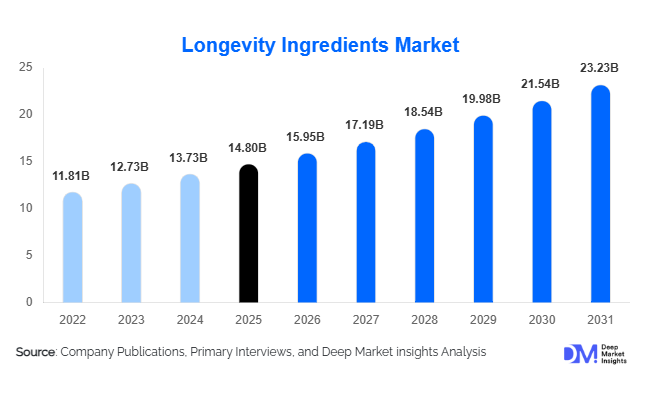

According to Deep Market Insights, the global longevity ingredients market size was valued at USD 14.8 billion in 2025 and is projected to grow from USD 15.95 billion in 2026 to reach USD 23.23 billion by 2031, expanding at a CAGR of 7.8% during the forecast period (2026–2031). The longevity ingredients market growth is primarily driven by increasing consumer focus on health and wellness, rising adoption of anti-aging nutraceuticals, and growing demand for functional foods, beverages, and personal care products fortified with bioactive ingredients.

Key Market Insights

- Botanical extracts and nutraceutical compounds dominate the market, with consumers preferring natural, plant-based ingredients for anti-aging and cognitive health benefits.

- Dietary supplements remain the leading application, accounting for over 50% of market consumption globally, due to convenience, precise dosing, and strong preventive healthcare awareness.

- North America holds the largest market share, with the U.S. and Canada leading demand for high-value, clinically validated longevity ingredients.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class affluence, urbanization, and increasing awareness of preventive health and longevity-focused products.

- Online retail channels are increasingly preferred for purchasing supplements and functional foods, leveraging e-commerce penetration and subscription-based models.

- Technological innovations, including bioactive peptide extraction, nano-formulations, and advanced fermentation methods, are reshaping product development and bioavailability, enhancing market competitiveness.

What are the latest trends in the longevity ingredients market?

Rise of Clean-Label and Plant-Based Ingredients

Consumers are increasingly seeking clean-label, natural, and sustainable ingredients, with botanical extracts such as resveratrol, ginseng, and polyphenols leading demand. Functional foods, beverages, and dietary supplements incorporating these ingredients are gaining traction as consumers prefer products with minimal additives and scientifically validated health benefits. The trend toward plant-based anti-aging compounds has driven product innovation, with companies introducing high-bioavailability formulations to maximize efficacy.

Integration into Functional Foods, Beverages, and Personal Care

Longevity ingredients are no longer limited to supplements. Functional beverages, protein bars, fortified foods, and anti-aging personal care products are increasingly incorporating bioactive compounds. Collagen peptides, NAD+ precursors, probiotics, and sirtuin activators are used in both edible and topical applications, broadening consumer touchpoints. This integration provides consumers with convenient, daily-use solutions, driving overall market expansion.

What are the key drivers in the longevity ingredients market?

Increasing Awareness of Healthy Aging

Growing awareness about preventive health and wellness is driving demand for ingredients that promote longevity. Consumers are actively seeking products to support immunity, cognitive health, and cellular repair. The rising global aging population, particularly in developed economies, has further accelerated demand for anti-aging nutraceuticals.

Expansion of Functional Foods & Beverages

Functional foods and beverages fortified with longevity ingredients are expanding rapidly. Consumers prefer convenient, on-the-go options that deliver health benefits alongside daily nutrition. The trend is particularly strong in North America, Europe, and Asia-Pacific, where fortified beverages contribute 12–15% annual growth to the segment.

Technological Innovations in Ingredient Development

Advances in biotechnology, such as peptide synthesis, nano-formulations, and precision fermentation, are enabling high-bioavailability and clinically validated products. These innovations allow manufacturers to differentiate their offerings and cater to health-conscious consumers willing to pay premium prices.

What are the restraints for the global market?

High Cost of Premium Ingredients

Many bioactive compounds and clinically validated extracts are expensive to produce, which limits accessibility for price-sensitive consumers. The cost factor remains a barrier to mass adoption, particularly in emerging markets.

Complex Regulatory Environment

Global regulatory frameworks governing safety, labeling, and health claims vary across regions. Compliance challenges can delay product launches and create entry barriers for new players, slowing overall market growth.

What are the key opportunities in the longevity ingredients market?

Emerging Markets Demand

Asia-Pacific, Latin America, and the Middle East are witnessing growing consumer interest in wellness and anti-aging products. Countries such as China, India, and Brazil are experiencing rapid adoption due to rising disposable income, urbanization, and increased health awareness. Manufacturers and new entrants can tap into these regions with localized product offerings and targeted marketing strategies.

Technological Innovation and Ingredient Development

Biotechnological advancements, including bioactive peptide extraction, nano-formulations, and precision fermentation, provide opportunities for developing highly efficacious longevity products. Formulations with enhanced bioavailability and clinically proven benefits are attracting premium consumers globally.

Supportive Regulatory and Government Initiatives

Regulatory support in regions such as North America, Europe, and Asia facilitates the approval and commercialization of nutraceuticals and functional ingredients. Initiatives like "Make in India" and "Healthy China 2031" encourage domestic manufacturing and R&D investment, enabling companies to scale production and strengthen global presence.

Product Type Insights

Botanical extracts are the largest ingredient type segment, holding a 38% share in 2025. Natural compounds like resveratrol, ginseng, and polyphenols dominate due to consumer preference for plant-based solutions. Nutraceutical compounds, peptides, and omega fatty acids are also growing, particularly in functional foods, beverages, and anti-aging formulations. Capsules/tablets lead in form factor (45% share), favored for convenience, shelf stability, and precise dosing.

Application Insights

Dietary supplements account for over 50% of market demand, driven by consumer adoption for immunity, cognitive health, and anti-aging benefits. Functional foods and beverages are expanding rapidly, offering convenient daily nutrition. Personal care and cosmetics represent a niche but growing segment, leveraging bioactive peptides, botanical extracts, and anti-aging compounds in skincare products. Pharmaceuticals and therapeutic applications remain smaller but are essential for clinical use in age-related diseases.

Distribution Channel Insights

Online retail dominates (36% share) due to convenience, e-commerce penetration, and subscription-based models. Specialty stores, pharmacies, and supermarkets are key channels for retail distribution. Direct-to-consumer strategies and subscription models are becoming more popular for personalized longevity products, enhancing brand loyalty and repeat purchases.

| By Ingredient Type | By Form | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest market (35% share), driven by the U.S. and Canada. High consumer awareness, purchasing power, and preference for clinically validated ingredients fuel demand. Functional foods, supplements, and anti-aging products are widely adopted, with increasing integration of online retail channels and DTC models.

Europe

Europe holds 28% of the market, led by Germany, France, and the U.K. Consumers value clean-label, natural ingredients with proven efficacy. Rising health-consciousness, aging populations, and regulatory support are boosting the adoption of supplements and functional foods. Countries like Germany are also focusing on innovative bioactives and high-bioavailability formulations.

Asia-Pacific

APAC is the fastest-growing region, driven by China, India, Japan, and Australia. Rapid urbanization, rising middle-class wealth, and increased health awareness are driving adoption. Chinese consumers prefer premium supplements and group-focused wellness programs, while Indian demand is focused on functional foods and anti-aging dietary supplements. Expanding e-commerce platforms further support growth in this region.

Latin America

Brazil, Mexico, and Argentina are key markets, with increasing consumer interest in functional foods and dietary supplements. Growth is steady due to urbanization and rising health awareness, though market penetration remains lower than in North America and Europe. Niche operators are targeting affluent segments with premium longevity products.

Middle East & Africa

The Middle East (UAE, Saudi Arabia) is emerging as a high-potential market for premium longevity products due to high-income consumers and wellness-focused lifestyles. Africa, while smaller in size, shows growing domestic interest in anti-aging and functional foods. Local manufacturing and regulatory support are increasing the availability of high-quality ingredients in these regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Longevity Ingredients Market

- DSM Nutritional Products

- Lonza Group

- Kerry Group

- BASF SE

- Nutraceutical International Corporation

- GNC Holdings

- Amway

- Herbalife Nutrition

- Pfizer (Consumer Health Division)

- Glanbia Nutritionals

- Archer Daniels Midland

- Evolva

- Abbott Laboratories

- NOW Foods

- Naturex