Liquid Malt Extract Market Size

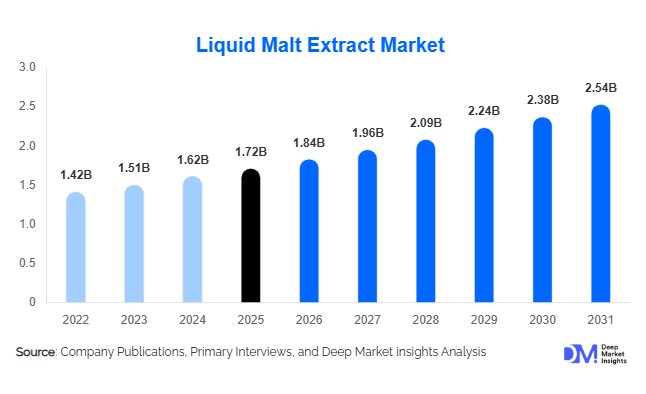

According to Deep Market Insights, the global liquid malt extract market size was valued at USD 1.72 billion in 2025 and is projected to grow from USD 1.84 billion in 2026 to reach USD 2.54 billion by 2031, expanding at a CAGR of 6.7% during the forecast period (2026–2031). The liquid malt extract market growth is primarily driven by rising demand from the brewing industry, increasing adoption in food and bakery applications, and expanding use of malt-based ingredients in nutraceutical and functional food formulations.

Key Market Insights

- Brewing applications account for over half of global liquid malt extract consumption, supported by steady growth in commercial and craft beer production.

- Barley-based liquid malt extract dominates the market, owing to its superior enzymatic activity, fermentability, and flavor profile.

- Europe leads global demand, backed by strong brewing traditions in Germany, the U.K., Belgium, and France.

- Asia-Pacific is the fastest-growing regional market, driven by expanding food processing industries and rising beer consumption in China and India.

- Non-diastatic liquid malt extract holds a larger share, reflecting its widespread use in food, bakery, and beverage formulations.

- Manufacturers are increasingly investing in customized malt solutions, tailored to specific flavor, color, and functional requirements.

What are the latest trends in the liquid malt extract market?

Premiumization and Customization of Malt Extracts

Liquid malt extract producers are increasingly focusing on premium and customized offerings to meet the evolving needs of breweries and food manufacturers. Craft brewers, in particular, are demanding specific malt profiles that deliver unique flavor notes, color intensity, and fermentability. This has led to the development of specialty liquid malt extracts such as dark, amber, and roasted variants. Custom enzyme treatment and controlled kilning processes are being used to deliver consistent quality and differentiated products, enabling suppliers to command premium pricing and improve margins.

Growing Adoption in Food, Bakery, and Functional Nutrition

Beyond brewing, liquid malt extract is gaining traction in food processing due to its natural sweetness, clean-label appeal, and ability to enhance texture and moisture retention. Bakery manufacturers are increasingly using liquid malt extract as a natural sweetener and flavor enhancer in breads, cereals, and confectionery products. Additionally, nutraceutical and functional food manufacturers are incorporating liquid malt extract into syrups, tonics, and energy formulations, driven by consumer demand for natural and minimally processed ingredients.

What are the key drivers in the liquid malt extract market?

Expansion of the Global Brewing Industry

The continued growth of the global brewing industry remains the most significant driver for the liquid malt extract market. Commercial breweries value liquid malt extract for its consistency, ease of handling, and predictable fermentation performance. At the same time, the rapid expansion of craft and microbreweries across North America, Europe, and Asia-Pacific is supporting incremental demand, as smaller brewers rely on liquid malt extract to simplify production and reduce capital investment in malting infrastructure.

Rising Demand for Clean-Label Ingredients

Consumers are increasingly favoring clean-label food and beverage products, prompting manufacturers to replace refined sugars and artificial additives with natural alternatives. Liquid malt extract, derived from cereal grains and processed without synthetic chemicals, aligns well with this trend. Its nutritional profile, which includes trace minerals and B vitamins, further strengthens its appeal in health-oriented food and beverage formulations.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuations in barley and other cereal grain prices pose a significant challenge for liquid malt extract manufacturers. Weather-related disruptions, supply chain constraints, and geopolitical factors can impact raw material availability and pricing, leading to margin pressure and pricing uncertainty for end users.

Higher Storage and Transportation Costs

Compared to dry malt extract, liquid malt extract requires specialized storage, handling, and transportation due to its higher moisture content and viscosity. These logistical requirements increase overall costs, particularly for long-distance exports, and can limit adoption in price-sensitive markets.

What are the key opportunities in the liquid malt extract industry?

Growth in Asia-Pacific Food and Beverage Processing

Rapid industrialization and urbanization in Asia-Pacific are driving strong growth in food processing, brewing, and nutraceutical manufacturing. Countries such as China, India, Vietnam, and Indonesia are witnessing rising consumption of malt-based beverages and baked goods. Government initiatives supporting domestic food processing and value-added agriculture are further encouraging investments in local malt extract production facilities.

Technological Advancements in Enzymatic Processing

Advances in enzymatic treatment, filtration, and process automation are enabling manufacturers to improve yield, consistency, and customization of liquid malt extract. These technologies support the development of application-specific malt extracts for brewing, food, and pharmaceutical uses, creating opportunities for differentiation and higher-margin products.

Product Type Insights

Barley-based liquid malt extract continues to dominate the global market, accounting for approximately 68% of total demand in 2025. Its leadership is primarily driven by high fermentability, consistent enzymatic activity, and superior flavor contribution, making it the preferred choice for commercial and craft breweries worldwide. Additionally, barley malt extract benefits from established supply chains and standardized production processes, reinforcing its widespread acceptance across brewing and food applications.

Wheat-based liquid malt extract holds a comparatively smaller but steadily expanding share of the market. Growth in this segment is driven by rising demand for specialty and wheat-based beers, as well as its increasing application in bakery products where it enhances texture, color, and sweetness. The growing popularity of premium baked goods and artisanal food products is further supporting adoption.Rye and other cereal-based liquid malt extracts remain niche offerings, primarily catering to regional brewing traditions, specialty food formulations, and functional food products. While limited in volume, these extracts benefit from increasing consumer interest in differentiated flavors, heritage grains, and clean-label ingredients, particularly in developed markets.

Application Insights

The brewing industry represents the largest application segment, contributing approximately 52% of total market revenue in 2025. This dominance is driven by the continued global expansion of beer production, strong demand from craft and microbreweries, and the operational advantages of liquid malt extract, including ease of handling, shorter brewing cycles, and formulation consistency.

Food and bakery applications form the second-largest segment, supported by rising consumption of malt-flavored baked goods, breakfast cereals, confectionery, and snacks. The leading growth driver for this segment is the increasing use of natural sweeteners and flavor enhancers as food manufacturers respond to clean-label and reduced artificial additive trends.Nutraceutical and pharmaceutical applications, although smaller in volume, represent one of the fastest-growing segments. Growth is driven by increasing demand for malt-based syrups, energy supplements, and digestive health formulations, particularly in emerging economies and health-conscious consumer markets.

Distribution Channel Insights

Direct manufacturer sales dominate the liquid malt extract market, especially among large breweries and multinational food processors that depend on long-term supply contracts and consistent quality. This channel benefits from economies of scale, customized formulations, and secure raw material sourcing.

B2B ingredient distributors play a critical role in serving small and medium-sized breweries, bakeries, and nutraceutical manufacturers. Their strength lies in flexible order sizes, regional market reach, and technical support services.Contract manufacturing and private-label supply agreements are gaining traction, particularly in emerging markets, as local brands seek cost efficiency, faster market entry, and reduced capital investment while maintaining product differentiation.

End-Use Industry Insights

Commercial breweries account for the largest share of end-use demand, supported by large-scale beer production and stable consumption patterns in both developed and emerging markets. The key driver for this segment is operational efficiency and batch consistency offered by liquid malt extract.

Craft and microbreweries represent a high-growth end-use segment, driven by experimentation with new beer styles, seasonal brews, and specialty formulations. Liquid malt extract enables these producers to scale efficiently without compromising quality.Food processing companies constitute a rapidly expanding end-use segment, while nutraceutical and pharmaceutical manufacturers are emerging as high-value customers due to their emphasis on specialized formulations, traceability, and stringent quality standards.

| By Source | By Processing Type | By Color & Flavor Profile | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global liquid malt extract market with an estimated 34% share in 2025. Germany, the U.K., Belgium, and France are key contributors, supported by strong brewing traditions, high per capita beer consumption, and well-established food processing industries.Key regional growth drivers include the continued expansion of craft brewing, rising demand for premium and specialty beers, and increasing use of malt extracts in bakery and confectionery products. Stringent quality standards and a preference for traditional ingredients further reinforce market stability.

Asia-Pacific

Asia-Pacific accounts for approximately 29% of the global market and is the fastest-growing region, registering a CAGR of over 8%. China and India serve as primary growth engines, driven by rapid urbanization, rising disposable incomes, and changing consumer preferences toward alcoholic and malt-based beverages.Regional growth is driven by expanding beer production capacity, increased foreign investment in food and beverage manufacturing, and growing awareness of malt-based nutritional products. The region also benefits from a large population base and improving distribution infrastructure.

North America

North America represents around 22% of global demand, led by the United States. The region benefits from a mature brewing industry, a strong craft beer culture, and widespread adoption of liquid malt extract for production efficiency.Key growth drivers include innovation in craft and specialty beers, growing demand for malt-based bakery and functional food products, and increasing preference for natural and clean-label ingredients across food applications.

Latin America

Latin America holds an estimated 8% market share, with Brazil and Mexico as major contributors. The region is witnessing steady growth in beer production and consumption.Growth drivers include rising urban populations, improving disposable incomes, and gradual adoption of malt-based ingredients in food processing, supported by investments in local brewing and food manufacturing facilities.

Middle East & Africa

The Middle East & Africa region accounts for approximately 7% of global demand. While alcoholic beverage consumption remains regulated in parts of the region, demand for liquid malt extract is supported by alternative applications.Regional growth is driven by increasing consumption of malt-based non-alcoholic beverages, expansion of food processing industries, and rising intra-regional trade. The growing popularity of fortified foods and beverages is also contributing to market development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Liquid Malt Extract Market

- Malteurop Group

- Soufflet Group

- Boortmalt

- Viking Malt

- Muntons plc

- Simpsons Malt

- Crisp Malting Group

- GrainCorp Malt

- Axéréal

- IREKS GmbH

- Great Western Malting

- Castle Malting

- Malt Products Corporation

- Shandong Sanhe Bio-Tech

- Jiangsu Zhengchang Malt