Light Projector Market Size

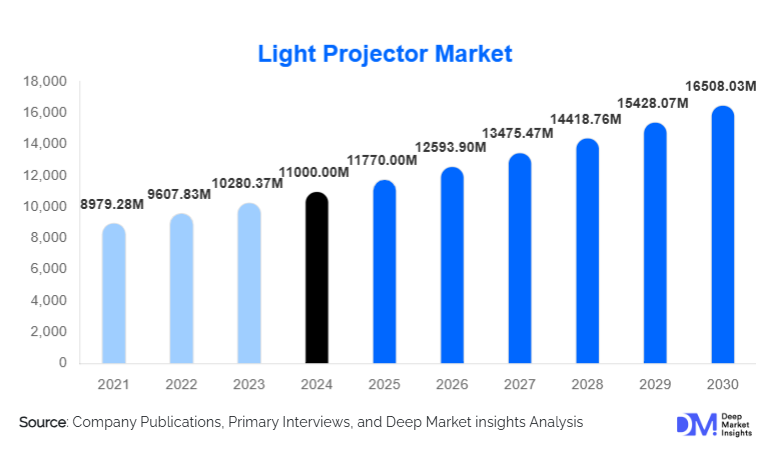

According to Deep Market Insights, the global light projector market size was valued at USD 11,000.00 million in 2024 and is projected to grow from USD 11,770.00 million in 2025 to reach USD 16,508.03 million by 2030, expanding at a CAGR of 7.0% during the forecast period (2025–2030). The light projector market growth is driven by rising adoption of digital learning technologies, increasing penetration of home entertainment projectors, advancements in laser and LED projection systems, and expanding commercial demand across corporate, events, and public-sector applications.

Key Market Insights

- LCD projectors dominate the technology mix, accounting for 40–45% of the market due to cost efficiency and broad adoption in education and enterprise sectors.

- Portable and pico projectors are rapidly emerging as the preferred choice among home users and small offices, supported by falling prices and compact designs.

- Asia-Pacific leads globally with 30–35% market share in 2024, driven by education digitization, urbanization, and strong consumer electronics adoption.

- Education is the largest application segment, contributing nearly 25–30% of demand as schools and universities shift toward interactive digital classrooms.

- Laser and LED-based light sources are accelerating upgrades, replacing traditional lamp projectors due to longer lifespan and higher energy efficiency.

- Hybrid work models and remote learning are boosting demand for portable and interactive projection systems.

What are the latest trends in the light projector market?

Shift Toward Laser & LED Projection Technologies

Projector manufacturers are rapidly transitioning from traditional lamp-based systems to laser and LED light engines. These newer technologies offer longer operational life, reduced maintenance, superior brightness, and improved color accuracy. The shift is particularly strong in enterprise, large-venue, and education markets where reliability and low total cost of ownership are crucial. Laser projectors are increasingly preferred for cinema, auditoriums, and events, while LED engines are becoming common in portable and home-theatre systems. This trend is reshaping product portfolios and driving premium pricing opportunities for manufacturers.

Rising Consumer Adoption of Smart & Portable Projectors

The popularity of compact, Wi-Fi-enabled portable projectors is surging globally. These devices integrate streaming platforms, wireless screen mirroring, Bluetooth audio, and Android-based operating systems, making them ideal for home entertainment and small-office use. Younger consumers are driving this shift, preferring flexible display solutions over traditional TVs. Social media and influencer-driven content have further propelled interest in portable projectors for gaming, movie nights, travel, and outdoor experiences. Manufacturers are responding with lightweight, high-lumen, battery-powered models that deliver enhanced convenience.

What are the key drivers in the light projector market?

Growing Demand for Home Entertainment Systems

The surge in OTT streaming, gaming, and cinematic home experiences has significantly increased demand for affordable mid-range and portable projectors. Consumers seeking large-screen viewing options without purchasing expensive TVs are fueling adoption. Home theaters, influencer-driven décor trends, and higher-resolution projection systems, 4K and beyond, continue to drive traction in the consumer segment.

Expansion of Digital Education & E-Learning Infrastructure

Schools and universities worldwide are replacing traditional whiteboards with interactive projector systems, particularly in APAC, the Middle East, and Latin America. The move toward hybrid learning has accelerated investments in digital classrooms, creating recurring demand for installation-grade projectors. Governments in emerging markets are prioritizing digital literacy programs, further strengthening this trend.

What are the restraints for the global market?

Growing Competition from Large Flat-Panel Displays

The rapid decline in prices of large LED and OLED televisions poses a significant challenge to projector adoption. For small meeting rooms and home entertainment, consumers increasingly prefer TVs that require no calibration, work well in bright environments, and offer long lifespans. This has forced projector manufacturers to differentiate through brightness, portability, and screen-size advantages.

High Cost of Professional-Grade Projectors

Large-venue and laser-based projectors carry higher upfront costs and installation requirements. Small institutions, SMEs, and cost-sensitive markets often delay upgrades due to these expenses. The need for skilled installation and maintenance also adds to the total ownership cost, creating barriers in price-sensitive regions.

What are the key opportunities in the light projector industry?

Growing Potential in Emerging Markets

Asia-Pacific, Latin America, and Africa present high-growth opportunities due to expanding educational infrastructure, increasing corporate investments, and rising middle-class consumption. Manufacturers offering cost-effective, durable, and energy-efficient models are positioned to capture significant market share. Government-led digital transformation programs, particularly in India and Southeast Asia, will continue fueling projector demand.

Technology Integration to Create Next-Generation Smart Projectors

AI-enhanced features such as automatic keystone correction, object detection, voice control, and real-time content optimization present major product innovation opportunities. Integrating smart-home compatibility (Alexa, Google Assistant, IoT platforms) will create differentiation in a competitive landscape. Premium projectors with augmented reality (AR) overlays and interactive collaboration tools are expected to emerge as high-value solutions in corporate and education markets.

Product Type Insights

Portable and pico projectors are the fastest-growing segment, contributing 17–18% of the market in 2024. Their affordability, battery operation, and ease of use make them attractive for home entertainment, travel, small offices, and classrooms. Fixed-installation projectors continue to dominate large venues and educational institutions, while interactive projectors are gaining traction in digital learning environments. Home-theatre models benefit from rising 4K streaming trends and improved brightness levels in compact designs.

Application Insights

Education remains the largest application segment (>25% share), supported by widespread adoption of interactive projection systems. Enterprise applications continue to expand due to hybrid meetings and the modernization of corporate spaces. Home entertainment is accelerating rapidly, driven by lifestyle changes and the shift towards personalized entertainment setups. Emerging applications include digital signage, immersive art displays, simulation training, and medical education.

Distribution Channel Insights

Online channels, e-commerce, brand websites, and electronic marketplaces dominate projector sales due to price transparency, broad product availability, and ease of comparison. Retail electronics outlets remain strong for mid-range and premium projectors requiring demonstrations. Institutional procurement channels handle large-volume purchases for schools, corporates, and public-sector infrastructure, contributing significantly to overall revenues.

| By Product Type | By Technology | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 20–25% of the market, driven by strong home-theatre adoption, enterprise modernization, and widespread technology penetration. The U.S. leads consumption with robust demand from corporate offices, schools, and entertainment venues. High disposable incomes support the adoption of premium 4K and laser projectors.

Europe

Europe accounts for 15–20% of global demand, supported by education upgrades, innovation in enterprise collaboration tools, and growth in the event and entertainment sectors. Western Europe, Germany, the UK, and France represent the bulk of consumption. The region shows strong demand for eco-friendly, energy-efficient laser systems aligned with EU sustainability goals.

Asia-Pacific

Asia-Pacific dominates with 30–35% market share. China and India are driving massive adoption in classrooms, smart cities, and consumer electronics markets. Japan, South Korea, and Southeast Asia also contribute significantly due to rising tech integration and entertainment demand. APAC is the fastest-growing region through 2030.

Latin America

Latin America contributes 5–8% of demand, with Brazil, Mexico, and Argentina leading. Growth is supported by increasing investments in education and corporate infrastructure. Improvements in logistics and e-commerce have expanded access to portable and mid-range projector models.

Middle East & Africa

MEA accounts for 5% of the global market but is rapidly expanding. GCC countries demonstrate strong demand for high-end projectors in commercial real estate, hospitality, and education. Africa is experiencing rising adoption driven by government-led digital learning initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Light Projector Market

- Epson

- Optoma

- BenQ

- LG Electronics

- Sony

- ViewSonic

- Acer

- Panasonic

- Hitachi

- Samsung

- XGIMI

- Hisense

- Vivitek (Delta Electronics)

- NEC (Sharp NEC Display Solutions)

- Canon

Recent Developments

- January 2025: Epson introduced a new generation of ultra-bright laser projectors for education and corporate environments, featuring enhanced energy efficiency.

- March 2025: BenQ launched a 4K smart-home projector with integrated streaming apps and AI-based picture optimization.

- April 2025: ViewSonic expanded its portable LED projector lineup with long-life battery support, targeting outdoor and travel users.