Interactive Projectors Market Size

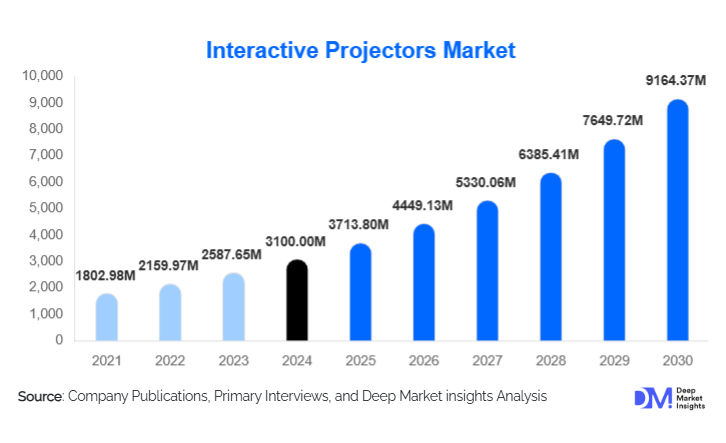

According to Deep Market Insights, the global interactive projectors market size was valued at USD 3,100.00 million in 2024 and is projected to grow from USD 3,713.80 million in 2025 to reach USD 9,164.37 million by 2030, expanding at a CAGR of 19.8% during the forecast period (2025–2030). The interactive projectors market growth is primarily driven by accelerating digital transformation in the education sector, rising adoption of hybrid collaboration tools in enterprises, and rapid advancements in ultra-short-throw and laser-based projection technologies.

Key Market Insights

- Education remains the dominant end-use segment, driven by global investments in smart classroom infrastructure and digital learning ecosystems.

- Ultra-short-throw (UST) projectors lead the projection distance category, supported by demand for shadow-free, space-optimized deployments.

- 3LCD technology accounts for the largest technology share, driven by superior color accuracy, high brightness, and cost efficiency.

- North America leads the global market due to well-funded education systems and strong corporate adoption of collaboration tools.

- Asia-Pacific is the fastest-growing region, supported by large-scale government digitization programs in China, India, and Southeast Asia.

- Laser light-source projectors are rapidly gaining traction as organizations prioritize long lifespan, low maintenance, and eco-friendly operation.

What are the latest trends in the interactive projectors market?

Rapid Integration of Hybrid Learning and Collaboration Technologies

Interactive projectors are increasingly being integrated with cloud-based collaboration platforms, enabling real-time co-annotation, wireless casting, and seamless content sharing in both physical and virtual environments. Schools and enterprises are adopting these solutions to support hybrid learning models, distributed teams, and flexible workspaces. As remote and hybrid modes continue to define digital workflows, interactive projectors equipped with multi-user touch capabilities, AI-assisted writing recognition, and remote collaboration tools are becoming mainstream across institutions.

Shift Toward Laser and Ultra-Short-Throw Projectors

Laser-based interactive projectors are rapidly replacing traditional lamp units due to their long operational lifespans, low maintenance, and consistent brightness. Ultra-short-throw projectors are also gaining momentum as they eliminate glare and shadows, making them ideal for classrooms and compact meeting spaces. Manufacturers are introducing high-lumen laser UST models with enhanced gesture recognition, broader color gamuts, and higher resolutions, offering a more immersive and interactive experience for users.

What are the key drivers in the interactive projectors market?

Growing Digital Transformation in Education

The education sector is the largest consumer of interactive projectors, driven by global initiatives to modernize classrooms, integrate digital content, and promote participatory learning. Governments and school districts are investing heavily in smart boards, interactive projection systems, and remote learning platforms. The demand is further fueled by interactive teaching methodologies, content-rich digital textbooks, and outcome-based learning models requiring interactive visualization tools.

Increasing Demand for Hybrid Work Solutions

Corporate environments are rapidly adopting collaborative technologies that support hybrid work models. Interactive projectors enhance team collaboration by enabling real-time annotation, multi-user interaction, and wireless connectivity in meeting rooms and innovation hubs. As enterprises modernize their office environments, interactive projection systems are being deployed to elevate engagement, communication, and productivity across distributed teams.

What are the restraints for the global market?

High Upfront Installation and Equipment Costs

Interactive projectors, especially laser and ultra-short-throw models, come with significant initial costs related to hardware, installation, mounting systems, and compatible surfaces. Budget constraints in emerging economies can limit adoption, particularly in small institutions where funding for digital upgrades is limited. The high cost of maintenance for older lamp-based models further challenges cost-sensitive deployments.

Infrastructure Limitations in Developing Regions

Successful deployment of interactive projectors depends on adequate infrastructure, including stable electricity, digital connectivity, and appropriate projection surfaces. Limited technology readiness, insufficient IT support, and inadequate training among educators or staff can hinder effective implementation, especially in rural or resource-limited regions. These infrastructure gaps remain a key barrier to widespread adoption.

What are the key opportunities in the interactive projectors industry?

Expansion of Smart Classroom Initiatives

Governments across Asia-Pacific, Latin America, and the Middle East are launching large-scale smart education programs aimed at integrating digital learning tools. Interactive projectors represent an affordable alternative to interactive flat panels, offering larger display areas at a lower cost. Manufacturers can leverage public–private partnerships, education grants, and large institutional tenders to accelerate adoption in schools, universities, and training centers.

AI-Enhanced Interactive Projection Experiences

AI integration presents significant opportunities for next-generation interactive projectors. Features such as gesture recognition, intelligent handwriting conversion, voice-based queries, real-time content suggestions, and adaptive learning analytics can transform user experiences. AI-enabled projectors can support personalized learning, advanced collaboration, and smarter content interaction, creating new value propositions for vendors and end-users.

Product Type Insights

Ultra-short-throw (UST) interactive projectors dominate the product type segment, accounting for the largest market share due to their ability to project large, clear images from extremely short distances. Their design eliminates shadows, reduces glare, and is particularly suited for compact classrooms, meeting rooms, and collaboration spaces. The rapid adoption of UST projectors is further supported by growing preference for laser light sources, which offer extended lifespan, superior brightness uniformity, and minimal maintenance requirements. Standard-throw and short-throw projectors continue to maintain relevance in traditional classrooms, large lecture halls, and corporate training spaces where room size allows flexibility in projector placement. Lamp-based units still serve as entry-level solutions for cost-conscious institutions, though their market share is gradually declining due to shorter lifespans and higher operational costs compared with laser-based alternatives. Overall, the combination of UST design and laser technology is driving innovation and adoption, positioning this segment as a critical growth driver for the global interactive projectors market.

Application Insights

The education sector remains the largest application segment, fueled by widespread adoption of interactive learning tools, digital content integration, and participatory teaching methods. Smart classroom initiatives and government-backed digital learning programs are key growth enablers in this segment, with UST and laser projectors becoming central to technology-enabled pedagogy. Corporate applications are expanding rapidly, driven by enterprises modernizing meeting rooms, training centers, and collaboration hubs with interactive presentation systems that support hybrid work models. Healthcare applications are emerging as high-potential segments, with medical schools, hospitals, and research institutes utilizing interactive projectors for 3D anatomical visualization, surgical planning, and telemedicine training. Additionally, retail, hospitality, and public spaces are increasingly deploying interactive projectors for immersive installations, digital signage, and customer engagement experiences, highlighting the growing importance of experiential interaction across multiple industries. Overall, the versatility of applications, combined with enhanced UST and laser projector capabilities, continues to fuel market growth.

Distribution Channel Insights

Offline channels, including system integrators, specialized AV distributors, and institutional resellers, dominate the market due to the technical complexity of installation, calibration, and integration services. These channels provide critical support for education and corporate customers, ensuring optimal deployment and maintenance of high-end interactive projection systems. However, online channels are gaining traction as manufacturers enhance digital storefronts, virtual demo capabilities, and remote consultation services. Direct-to-institution sales are increasingly preferred in the education and enterprise segments, allowing vendors to offer bundled hardware-software solutions that combine interactive projectors with collaboration tools, content platforms, and software licenses. Bundled packages not only simplify procurement but also improve overall user experience, which is driving adoption, particularly among institutions seeking turnkey solutions for classrooms and boardrooms.

End-User Insights

Educational institutions represent the largest end-user segment, accounting for nearly half of the total market demand, driven by digital classroom adoption and government-led EdTech initiatives. Enterprises are the second-largest segment, adopting interactive projectors for meeting rooms, innovation hubs, and training environments, motivated by hybrid work trends and collaborative workspaces. Government agencies leverage interactive projection systems for public communication, training programs, and administrative coordination, particularly in smart city and digital governance initiatives. Emerging end-users include healthcare, retail, hospitality, and entertainment sectors, deploying projectors for immersive experiences, customer engagement, and training. The broadening adoption across multiple end-use industries demonstrates the versatility of interactive projectors and positions them as an essential tool for modern visualization, collaboration, and learning.

| By Technology | By Projection Distance | By Light Source | By Connectivity / Interface | By Application / End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global interactive projectors market, accounting for the largest regional share in 2024. Growth is driven by substantial investments in EdTech infrastructure, robust digital networks, and strong corporate demand for modern collaboration solutions. The U.S., in particular, dominates the region due to widespread adoption in K–12 and higher education institutions, coupled with government grants and technology modernization programs. Canada also contributes significantly, supported by smart classroom initiatives and hybrid learning adoption. Key growth drivers include increasing integration of laser UST projectors, rising corporate investment in interactive meeting rooms, and government funding for educational technology, positioning North America as a mature yet continuously expanding market.

Europe

Europe demonstrates steady adoption, led by technologically advanced and digitally mature markets such as Germany, the U.K., and France. The region benefits from structured education digitization strategies, corporate modernization initiatives, and energy-efficiency regulations that promote the use of laser-based projectors. Schools and universities in Europe are increasingly integrating UST projectors with collaborative software platforms to enhance interactive learning. Enterprises are adopting interactive projectors to improve hybrid work effectiveness. Drivers of regional growth include strong digital infrastructure, favorable government policies, and an emphasis on sustainability and energy-efficient projection solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing region globally, driven by the expansion of educational systems, rising disposable incomes, and large-scale government investments in digital classrooms and public-sector infrastructure. China and India lead adoption due to extensive classroom digitization programs, increasing EdTech penetration, and local manufacturing capabilities that lower costs. Japan, South Korea, and Australia contribute steady demand through mature technology adoption cycles and high institutional budgets. Growth is further fueled by government initiatives promoting smart classrooms, corporate adoption of collaborative solutions, and increasing awareness of UST and laser projectors for effective, space-optimized deployments. The combination of affordability, government support, and rising digital literacy positions APAC as a high-growth regional market.

Latin America

Latin America is gradually increasing adoption, with Mexico, Brazil, and Argentina leading regional demand. Education modernization programs and private-sector corporate training initiatives are the main drivers, while infrastructure gaps and budget constraints pose moderate challenges. Government-backed digital learning programs, increasing access to technology, and growing awareness of interactive projectors’ benefits are expected to drive long-term growth. Laser UST projectors are particularly gaining attention in urban schools and corporate centers, as they provide enhanced visibility and immersive collaboration in constrained spaces.

Middle East & Africa

MEA is witnessing growing adoption of interactive projectors, supported by smart city initiatives, educational reform programs, and corporate modernization investments. Gulf countries, including the UAE, Saudi Arabia, and Qatar, are leading demand due to high-income populations, government-backed digital initiatives, and increasing awareness of hybrid work tools. In Africa, adoption is slower but steadily growing, driven by investments from governments, NGOs, and international aid programs in technology-enabled classrooms. Drivers of growth include rising government funding for EdTech, corporate adoption of interactive collaboration systems, and the gradual shift to laser and UST projector technologies to overcome traditional infrastructure challenges.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Interactive Projectors Market

- Seiko Epson Corporation

- BenQ Corporation

- Optoma Technology

- NEC Display Solutions

- Panasonic Corporation

- Boxlight Corporation

- Casio Computer Co., Ltd.

Recent Developments

- In March 2025, Epson launched a new series of ultra-short-throw laser interactive projectors designed for modern hybrid classrooms and corporate environments.

- In January 2025, BenQ introduced cloud-connected interactive projector solutions with multi-user wireless collaboration features aimed at digital-first schools.

- In November 2024, Optoma partnered with leading EdTech platforms to integrate AI-assisted annotation and real-time content sharing into its interactive projector lineup.