Licensed Toy Market Size

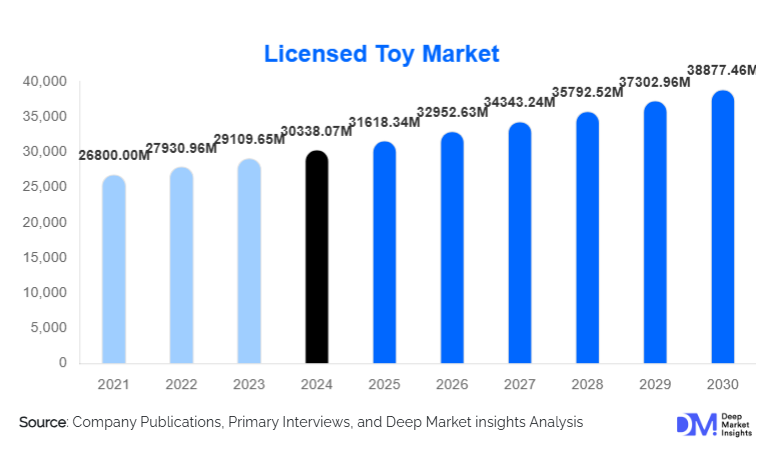

According to Deep Market Insights, the global licensed toy market size was valued at USD 30,338.07 million in 2024 and is projected to grow from USD 31,618.34 million in 2025 to reach USD 38,877.14 million by 2030, expanding at a CAGR of 4.22% during the forecast period (2025–2030). Growth in the licensed toy market is primarily driven by the continuous expansion of entertainment and media franchises, rising consumer preference for branded and character-based products, and the increasing influence of digital content platforms on children’s and collectors’ purchasing behavior.

Key Market Insights

- Entertainment and media-based licenses dominate the licensed toy market, supported by blockbuster movie franchises, streaming originals, and long-running TV series.

- Action figures and collectibles remain the leading product category, driven by demand from both children and adult collectors seeking premium and limited-edition items.

- North America accounts for the largest share of global demand, supported by high per-capita spending on branded toys and a mature licensing ecosystem.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, urbanization, and expanding penetration of global entertainment IPs.

- E-commerce and D2C channels are rapidly reshaping distribution, enabling exclusive launches, faster product cycles, and global reach.

- Nostalgia-driven purchasing and adult fandom culture are emerging as long-term demand stabilizers for licensed toys.

What are the latest trends in the licensed toy market?

Premiumization and Adult Collector Demand

The licensed toy market is witnessing a structural shift toward premium and collector-focused offerings. High-detail action figures, limited-edition collectibles, and franchise anniversary releases are increasingly targeting adult consumers and long-term fans. This segment is less price-sensitive and delivers higher margins compared to mass-market toys. Manufacturers are investing in superior design, packaging, and authenticity features to cater to this audience, while e-commerce platforms and fan conventions are strengthening direct engagement with collectors.

Digital-Physical Play Integration

Licensed toys are increasingly incorporating digital extensions such as mobile apps, augmented reality features, and interactive content. This convergence of physical play with digital ecosystems enhances engagement, extends product life cycles, and allows licensors to monetize content beyond the initial toy sale. Technology-enabled licensed toys are particularly appealing to younger demographics and are becoming a differentiating factor in competitive product launches.

What are the key drivers in the licensed toy market?

Expansion of Global Entertainment Franchises

The rapid growth of global entertainment content across movies, streaming platforms, and gaming ecosystems is a primary driver of licensed toy demand. Successful franchises generate multi-year merchandising opportunities, with toy sales extending well beyond initial content release windows. The continuous rebooting and expansion of established IPs further sustains recurring demand.

Strong Brand Recognition and Trust

Licensed toys benefit from high brand recall and consumer trust, particularly among parents who perceive branded products as safer and more reliable. Recognizable characters and franchises reduce purchase risk and improve conversion rates, especially in gifting scenarios. This brand-led purchasing behavior continues to favor licensed toys over unbranded alternatives.

Growth of Omnichannel Retail

The expansion of omnichannel retail strategies, including online marketplaces, brand-owned platforms, and experiential retail stores, has significantly improved product accessibility and global reach. Manufacturers are leveraging data-driven marketing and direct-to-consumer models to optimize pricing, inventory, and customer engagement.

What are the restraints for the global market?

High Licensing and Royalty Costs

Licensing fees and royalty payments remain a major restraint, particularly for smaller manufacturers. Royalty structures can significantly compress margins and increase product pricing, limiting competitiveness in price-sensitive markets. Negotiating favorable licensing terms remains a key challenge.

Demand Volatility Linked to IP Performance

The success of licensed toys is closely tied to the performance of underlying intellectual properties. Poor reception of movies, shows, or games can result in sudden demand drops, excess inventory, and write-downs, making forecasting and inventory management complex.

What are the key opportunities in the licensed toy industry?

Emerging Market Localization

Rapidly growing consumer markets in Asia-Pacific, Latin America, and the Middle East present significant opportunities for localized licensed toy offerings. Adapting global IPs to regional preferences, price points, and cultural contexts can unlock substantial new demand. Partnerships with local manufacturers are further supporting market entry and scalability.

Cross-Industry Brand Collaborations

Licensing is expanding beyond traditional entertainment into lifestyle, fashion, and sports brands. Collaborations with apparel brands, athletes, and digital creators are opening new revenue streams and broadening the appeal of licensed toys across age groups.

Product Type Insights

Action figures and collectibles represent the largest product segment, accounting for approximately 31% of the licensed toy market in 2024. Dolls and plush toys follow closely, driven by character-based demand among younger children. Construction and building sets continue to gain share due to their educational value and strong alignment with popular entertainment franchises. Games, puzzles, and outdoor licensed toys represent smaller but steadily growing categories as manufacturers diversify product portfolios.

Application Insights

Household consumer use remains the dominant application for licensed toys, accounting for over 80% of total demand. Promotional and institutional applications, including theme parks, movie studios, and branded events, are growing rapidly and contribute to short-term demand spikes around major franchise launches. Educational and learning-based licensed toys are emerging as a niche application, particularly in developed markets.

Distribution Channel Insights

Offline retail continues to account for the largest share of licensed toy sales, supported by specialty toy stores and large-format retailers. However, e-commerce is the fastest-growing channel, driven by convenience, broader assortments, and exclusive online launches. Brand-owned stores and direct-to-consumer platforms are gaining traction as manufacturers seek greater pricing control and customer insights.

Age Group Insights

Children aged 4–7 years represent the largest consumer group, accounting for approximately 34% of global licensed toy demand due to peak character affinity and gifting frequency. The 8–12 age group follows closely, driven by action figures, building sets, and gaming-related licenses. The 13+ segment, including adult collectors, is the fastest-growing age group, supported by nostalgia-driven purchasing and premium collectibles.

| By License Source | By Product Type | By Age Group | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 35% of the global licensed toy market, led by the United States. High disposable incomes, strong entertainment franchises, and a mature retail ecosystem support sustained demand. The region also leads in premium and collector-focused licensed toys.

Europe

Europe holds around 27% of the global market share, with Germany, the U.K., and France as key markets. Demand is supported by strong licensing regulations, safety standards, and consumer preference for branded and educational toys.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 9% CAGR. China dominates manufacturing and consumption, while India and Southeast Asia are emerging as high-growth consumer markets driven by urbanization and rising middle-class spending.

Latin America

Latin America accounts for roughly 6% of global demand, with Brazil and Mexico leading regional consumption. Growth is supported by expanding retail infrastructure and increasing penetration of global entertainment franchises.

Middle East & Africa

The Middle East & Africa region holds approximately 5% market share, driven by demand in the UAE and Saudi Arabia, alongside growing intra-regional trade and gifting culture.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|