Lecithin & Phospholipids Market Size

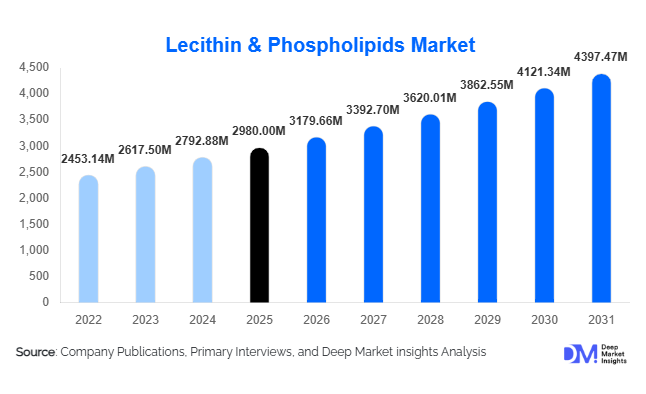

According to Deep Market Insights, the global lecithin & phospholipids market size was valued at USD 2,980 million in 2025 and is projected to grow from USD 3,179.66 million in 2026 to reach USD 4,397.47 million by 2031, expanding at a CAGR of 6.7% during the forecast period (2026–2031). The market growth is primarily driven by rising health-conscious consumer behavior, increasing adoption of functional foods and nutraceuticals, expanding applications in pharmaceuticals and cosmetics, and the growing preference for plant-based, sustainable lecithin sources.

Key Market Insights

- Food and beverage applications dominate the market, particularly bakery, confectionery, and functional beverage sectors, due to lecithin’s emulsifying, stabilizing, and antioxidant properties.

- Technological advancements, including enzymatic modification and liposomal formulations, are enabling higher-value applications in pharmaceuticals and personal care.

- North America and Europe lead the market, collectively accounting for 65% of the 2025 market, driven by strong functional food consumption, nutraceutical adoption, and cosmetic use.

- Asia-Pacific is the fastest-growing region, fueled by rising urbanization, disposable income, and processed food consumption in China and India.

- Sustainable and non-GMO lecithin demand is increasing, driven by consumer awareness and government initiatives promoting organic and eco-friendly ingredients.

- Export-driven growth opportunities exist for countries with strong production capacities, such as the U.S., Germany, and China, targeting emerging markets with rising functional food demand.

What are the latest trends in the lecithin & phospholipids market?

Functional Foods and Nutraceutical Fortification

Manufacturers are increasingly incorporating lecithin and phospholipids into functional foods, dietary supplements, and ready-to-eat products. These ingredients support cardiovascular, liver, and cognitive health, meeting rising consumer demand for preventive nutrition. Plant-based and vegan formulations, particularly sunflower and non-GMO soy lecithin, are gaining popularity due to sustainability and clean-label trends. Food manufacturers are actively marketing fortified snacks, beverages, and bakery items to capitalize on the health-conscious consumer base, expanding overall lecithin adoption.

Pharmaceutical and Cosmetic Applications Expanding

Lecithin and phospholipids are increasingly used in liposomal drug delivery, skincare, and haircare formulations. In pharmaceuticals, their bioavailability-enhancing properties enable more effective nutraceuticals and liposomal medicines. In personal care, lecithin improves emulsion stability, moisturization, and product texture. This diversification into high-margin applications allows manufacturers to target premium segments and differentiate their products in competitive markets.

What are the key drivers in the lecithin & phospholipids market?

Rising Health-Conscious Consumer Demand

Global awareness of nutrition and wellness is driving lecithin adoption in functional foods and supplements. Consumers increasingly seek ingredients that support liver, heart, and cognitive health. This trend has fueled the growth of fortified foods, beverages, and nutraceuticals, providing a steady growth pathway for lecithin manufacturers worldwide.

Industrial Versatility

The multifunctional properties of lecithin, such as emulsification, stabilization, and antioxidant capabilities, make it indispensable in diverse applications, from bakery and dairy products to pharmaceutical drug delivery systems and cosmetics. This wide applicability ensures consistent demand across industries and supports market expansion globally.

Rising Demand in Animal Feed

Lecithin and phospholipids enhance feed digestibility and nutritional quality in poultry, swine, and aquaculture. The growing livestock industry, particularly in the Asia-Pacific, is driving the adoption of phospholipid-enriched feed additives, contributing significantly to the market’s growth trajectory.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuating prices of soy, sunflower, and egg sources impact production costs and profit margins, potentially limiting expansion for smaller manufacturers. Supply chain disruptions and agricultural yield variations further exacerbate cost unpredictability, creating barriers to consistent growth.

Regulatory and Quality Compliance

Strict regulations governing food safety, pharmaceutical approvals, and cosmetic standards require manufacturers to invest in quality control and certifications. Compliance challenges, coupled with high approval costs, can delay product launches and affect market penetration, particularly in highly regulated regions such as North America and Europe.

What are the key opportunities in the lecithin & phospholipids market?

Emerging Functional Foods and Nutraceutical Applications

The health and wellness trend presents significant opportunities to integrate lecithin and phospholipids into functional beverages, protein bars, and dietary supplements. Manufacturers can innovate with plant-based and non-GMO formulations to capture the growing segment of health-conscious consumers, especially in developed and emerging economies.

Expansion in Emerging Markets

Rapid urbanization and increasing disposable income in Asia-Pacific, Latin America, and the Middle East are driving demand for processed foods and nutraceuticals. Countries like China, India, Brazil, and Mexico present high-growth opportunities for domestic manufacturing and localized distribution, allowing companies to meet regional consumer needs efficiently.

Technological Innovation and Sustainable Sourcing

Advanced extraction and enzymatic modification technologies allow companies to produce high-purity, specialty lecithin for premium applications. Sustainable sourcing of sunflower and non-GMO soy lecithin aligns with consumer preferences and environmental regulations, offering differentiation opportunities and premium pricing potential.

Product Type Insights

Liquid lecithin continues to lead the global market due to its ease of incorporation into industrial applications, particularly in bakery, dairy, and beverage production. Its superior emulsification and dispersibility make it ideal for large-scale manufacturing, allowing consistent product quality and operational efficiency. Powdered and granular lecithin serve the nutraceutical and cosmetic industries where precise dosing, extended shelf life, and stability are critical. Functional forms of lecithin dominate overall market adoption, as they provide multifunctional benefits including emulsification, antioxidant protection, and product stabilization. The increasing demand for clean-label, non-GMO, and organic formulations is further accelerating the adoption of high-purity liquid and granular lecithin in both premium and mass-market applications. Additionally, growing use in liposomal drug delivery and high-end cosmetic formulations is driving technological innovation, making these forms highly sought after globally.

Application Insights

The food and beverage sector remains the largest application segment, accounting for approximately 60% of the 2025 market. Key subsegments such as bakery, confectionery, dairy, and functional foods are driving growth due to the high demand for texture improvement, shelf-life extension, and nutrient fortification. Pharmaceutical applications, particularly liposomal drug delivery and dietary supplements, are expanding rapidly as lecithin enhances the bioavailability and functional efficacy of active ingredients. In the cosmetics and personal care industry, lecithin is increasingly used for skin hydration, anti-aging formulations, and product stabilization. Animal feed applications are also growing steadily, particularly in the Asia-Pacific region, where rising livestock production and aquaculture demand high-quality phospholipid-enriched feed to improve digestibility and overall animal health. The integration of lecithin across these diverse applications demonstrates its versatility and positions it as a critical functional ingredient in multiple high-growth industries.

| By Product Type | By Application | By End-Use Industry |

|---|---|---|

|

|

|

Regional Insights

North America

North America represents approximately 35% of the global market in 2025, led by the U.S. and Canada. Growth is driven by high functional food and nutraceutical consumption, increasing demand for premium and clean-label products, and widespread adoption of non-GMO lecithin. The pharmaceutical and cosmetic sectors are also key growth drivers, supported by advanced R&D and regulatory frameworks that favor high-quality, multifunctional ingredients. Additionally, strong investment in health-conscious product innovations, coupled with robust manufacturing infrastructure, enables rapid scale-up and market penetration, reinforcing North America’s leading position in the global market.

Europe

Europe accounts for roughly 30% of the market, with Germany, France, and the U.K. as major contributors. The region’s growth is driven by rising consumer preference for clean-label and fortified foods, increasing adoption of dietary supplements, and expanding use in premium cosmetics. Regulatory compliance requirements in Europe encourage high-quality lecithin production and premiumization, which incentivizes manufacturers to innovate in organic, non-GMO, and specialty lecithin variants. Furthermore, strong demand from functional foods and nutraceuticals, coupled with sustainability-focused production practices, is propelling European market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region with an estimated CAGR of 8.5%, led by China and India. Growth drivers include rapid urbanization, rising disposable income, and increased processed food consumption. Expanding pharmaceutical and nutraceutical industries are leveraging lecithin for functional formulations and liposomal drug delivery, while the animal feed sector drives consistent adoption due to growing livestock and aquaculture production. Additional drivers include supportive government policies for domestic manufacturing, increasing health awareness, and rising demand for plant-based and non-GMO products, which collectively position Asia-Pacific as a high-growth, export-oriented market.

Latin America

Brazil and Mexico are emerging markets for lecithin and phospholipids, primarily driven by the bakery, dairy, and functional foods segments. Growth is supported by increasing urbanization, a rising middle-class population, and the expansion of processed food industries. Additionally, demand from the pharmaceutical and cosmetic sectors is slowly increasing, providing opportunities for specialty and high-purity lecithin products. While overall market penetration is moderate, investments in manufacturing facilities and local distribution channels are expected to create stronger growth prospects for this region.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is witnessing increasing demand for functional foods, nutraceuticals, and cosmetic formulations. High-income populations, growing awareness of health and wellness, and a preference for premium, imported lecithin products drive regional growth. Africa’s demand, primarily domestic and export-oriented, focuses on industrial-grade lecithin for food and animal feed applications. Growth is further supported by government initiatives promoting food processing and agricultural value addition, while expanding pharmaceutical and personal care sectors are creating additional opportunities for high-quality lecithin adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Lecithin & Phospholipids Market

- Cargill

- ADM (Archer Daniels Midland)

- DuPont Nutrition & Biosciences

- Bunge Limited

- E. H. Scharf GmbH

- Lipoid GmbH

- Lecico GmbH

- Kerry Group

- Ingredion Inc.

- Vevy Europe

- Soya International

- Bioriginal Food & Science Corp

- E.G. Corporation

- SunOpta Inc.

- Fuji Oil Holdings