Leave-in Conditioner Market Size

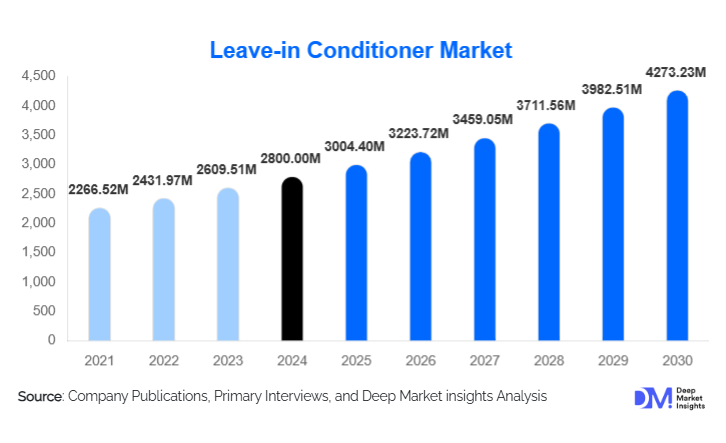

According to Deep Market Insights, the global leave-in conditioner market size was valued at USD 2,800.00 million in 2024 and is projected to grow from USD 3,004.40 million in 2025 to reach USD 4,273.23 million by 2030, expanding at a CAGR of 7.3% during the forecast period (2025–2030). Market growth is driven by rising consumer focus on daily hair care routines, increasing frequency of heat styling and chemical treatments, and growing demand for multifunctional hair care products that offer nourishment, protection, and styling benefits without rinsing.

Key Market Insights

- Leave-in conditioners are transitioning from niche to daily-use products, driven by time-efficient grooming routines and preventive hair care awareness.

- Natural and hybrid formulations are gaining traction as consumers balance clean-label preferences with performance-driven benefits.

- Asia-Pacific leads global demand by volume, supported by rising urbanization and expanding middle-class populations.

- Online and D2C channels dominate distribution, fueled by influencer marketing, subscriptions, and personalized product discovery.

- Mass-market products remain dominant, while premium and salon-grade products are driving higher value growth.

- Social media–driven hair trends, including curly hair care and damage repair routines, are accelerating adoption worldwide.

What are the latest trends in the leave-in conditioner market?

Shift Toward Clean, Natural, and Hybrid Formulations

Consumers are increasingly prioritizing ingredient transparency, leading to strong growth in leave-in conditioners formulated with plant-based oils, botanical extracts, and reduced chemical loads. While fully natural products are expanding rapidly, hybrid formulations that combine natural ingredients with functional actives such as ceramides, peptides, and lightweight silicones currently dominate due to superior performance. Brands are reformulating legacy products to align with “free-from” claims while maintaining efficacy, particularly in frizz control and heat protection.

Digital-First Product Discovery and Personalization

Digital platforms are reshaping how consumers discover and purchase leave-in conditioners. Influencer-led tutorials, AI-powered hair diagnostics, and personalized product recommendations are driving trial and repeat purchases. D2C brands are leveraging quizzes and subscription models to tailor formulations to hair type, climate, and lifestyle. This trend is especially influential among younger consumers seeking customized, routine-based hair care solutions.

What are the key drivers in the leave-in conditioner market?

Rising Heat Styling and Chemical Hair Treatments

The increasing use of hair dryers, straighteners, curlers, and chemical treatments such as coloring and rebonding has significantly increased hair damage concerns. Leave-in conditioners are widely adopted as protective and reparative solutions, offering heat defense, breakage reduction, and moisture retention. This has made them a staple product across diverse consumer demographics.

Growth of Preventive and Daily Hair Care Routines

Consumers are shifting from reactive hair care toward preventive routines focused on long-term hair health. Leave-in conditioners fit seamlessly into daily grooming, offering convenience and consistent benefits without additional washing steps. This behavioral shift supports recurring consumption and stable demand growth.

What are the restraints for the global market?

Price Sensitivity in Emerging Economies

While demand is growing globally, higher-priced premium and natural leave-in conditioners face adoption barriers in price-sensitive markets. Consumers in developing regions often favor multifunctional or lower-cost alternatives, slowing premium penetration beyond urban centers.

Product Saturation and Consumer Skepticism

The proliferation of brands and overlapping product claims has created decision fatigue among consumers. Differentiating efficacy and substantiating claims through testing and certification remain challenges, potentially limiting brand switching and slowing adoption for new entrants.

What are the key opportunities in the leave-in conditioner industry?

Emerging Market Expansion and Localization

Rapid urbanization and rising disposable incomes in India, Southeast Asia, Latin America, and the Middle East present significant growth opportunities. Localized formulations addressing humidity, pollution, and hair texture diversity can unlock substantial untapped demand.

Multifunctional and Science-Backed Innovations

There is a growing opportunity to integrate scalp care, UV protection, and hair growth support into leave-in conditioners. Advances in encapsulation and active delivery technologies enable brands to position products as both cosmetic and functional, supporting premium pricing and differentiation.

Product Form Insights

Cream-based leave-in conditioners dominate the global market, accounting for approximately 42% of total revenue in 2024. This leadership is primarily driven by their superior moisturizing, detangling, and repair capabilities, making them the preferred format for consumers with dry, damaged, textured, and chemically treated hair. Cream formulations allow for higher concentrations of emollients, conditioning polymers, and active ingredients, enabling deeper nourishment and longer-lasting effects compared to lighter formats. Their versatility across mass-market and premium price points further supports widespread adoption across both developed and emerging markets.

Spray and mist-based leave-in conditioners are gaining significant traction, particularly among consumers with fine, straight, and oily hair types. These formats offer lightweight hydration without weighing hair down, aligning well with daily-use grooming routines and on-the-go lifestyles. Growth in this segment is also supported by increased demand for heat protection and frizz control in humid climates. Meanwhile, serum and oil-infused leave-in conditioners are expanding rapidly within the premium and salon-grade segments. These products are positioned for targeted repair, shine enhancement, and anti-frizz performance, appealing to consumers seeking high-efficacy, concentrated solutions, and professional-quality results.

Ingredient Composition Insights

Hybrid formulations lead the leave-in conditioner market with an estimated 46% share in 2024, as they successfully balance consumer demand for cleaner ingredient profiles with the need for proven performance. These products typically combine natural extracts, plant oils, and vitamins with functional actives such as silicones, ceramides, peptides, and conditioning polymers. This combination enables brands to deliver visible results in smoothness, damage repair, and heat protection while maintaining “clean beauty–aligned” positioning.

Natural and organic leave-in conditioners are the fastest-growing ingredient segment, driven by rising consumer awareness of ingredient safety, sustainability, and environmental impact. Demand is particularly strong in Europe and North America, where clean-label regulations and eco-conscious purchasing behavior are well established. However, fully synthetic formulations continue to dominate value-conscious and high-volume segments, especially in developing economies. Their affordability, long shelf life, and consistent performance ensure continued relevance among price-sensitive consumers and mass-market retail channels.

Distribution Channel Insights

Online and direct-to-consumer (D2C) platforms account for nearly 34% of global leave-in conditioner sales, making them the leading distribution channel. Growth is driven by convenience, competitive pricing, influencer endorsements, and the ability to offer personalized recommendations through digital tools. Subscription-based models and social media–led product education have further accelerated online adoption, particularly among younger consumers and urban populations.

Supermarkets and hypermarkets remain a critical channel for mass-market leave-in conditioners, especially in Asia-Pacific and Latin America, where high foot traffic and promotional pricing support volume sales. Specialty beauty retailers and professional salons play a pivotal role in premium product positioning, offering expert guidance, product trials, and professional endorsements. Salons, in particular, act as influential touchpoints for introducing high-margin, salon-grade leave-in conditioners to end consumers.

End-Use Insights

Individual and household consumers represent approximately 88% of total global demand, reflecting the widespread adoption of leave-in conditioners as daily-use hair care essentials. Rising awareness of preventive hair care, combined with busy lifestyles, has positioned leave-in conditioners as convenient, multifunctional products suitable for routine use. This segment benefits from high purchase frequency and strong brand loyalty.

Professional salons and spas, although smaller in volume, play a disproportionately important role in value generation and trend-setting. Salons drive early adoption of premium and technologically advanced formulations, influencing consumer preferences through professional recommendations. Retail sales of leave-in conditioners within salons further support premiumization and brand credibility, particularly in North America, Europe, and developed Asian markets.

| By Product Form | By Hair Type | By Ingredient Composition | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 31% of the global leave-in conditioner market in 2024, led by the United States. Regional growth is driven by high per-capita spending on personal care, strong consumer preference for premium and salon-grade products, and widespread adoption of hybrid and clean-label formulations. Digital influence, including social media tutorials and professional stylist endorsements, continues to shape purchasing decisions. Additionally, the high prevalence of hair coloring and heat styling in the region sustains consistent demand for damage-repair and protective leave-in conditioners.

Asia-Pacific

Asia-Pacific represents the largest regional market with around 34% share, supported by China, India, Japan, and South Korea. Growth is driven by rapid urbanization, rising disposable incomes, and increasing awareness of modern grooming practices. India is the fastest-growing country in the region, with a CAGR exceeding 11.5%, fueled by expanding e-commerce penetration, younger demographics, and growing exposure to global beauty trends. In East Asia, demand is further supported by innovation in lightweight and multifunctional formulations tailored to diverse hair textures and climatic conditions.

Europe

Europe accounted for roughly 22% of global demand, led by Germany, the U.K., and France. The region’s growth is driven by strong consumer preference for sustainable, organic, and dermatologically tested products, supported by stringent cosmetic regulations. European consumers are highly receptive to eco-friendly packaging and ethically sourced ingredients, which has accelerated the adoption of natural and hybrid leave-in conditioners. Premiumization and professional salon influence also remain key growth drivers.

Latin America

Latin America is experiencing steady market expansion, particularly in Brazil and Mexico. Growth is driven by a young population, high engagement with beauty and grooming trends, and increasing penetration of international hair care brands. Climatic factors such as humidity and heat further support demand for frizz-control and moisture-locking leave-in conditioners. Expanding modern retail and online channels are improving product accessibility across the region.

Middle East & Africa

The Middle East and Africa region is witnessing gradual but sustained growth, supported by high grooming expenditure in the GCC countries and rising urban populations in South Africa and Nigeria. Demand is driven by premium and imported products, particularly those offering protection against heat, dryness, and environmental stress. Increasing beauty consciousness, expanding salon infrastructure, and higher disposable incomes in urban centers are further strengthening regional market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the Leave-in Conditioner Market

- L’Oréal

- Unilever

- Procter & Gamble

- Estée Lauder Companies

- Henkel

- Kao Corporation

- Shiseido

- Coty

- Amorepacific

- Revlon

- Johnson & Johnson

- Beiersdorf

- Church & Dwight

- Natura &Co

- Godrej Consumer Products