Scalp Care Market Size

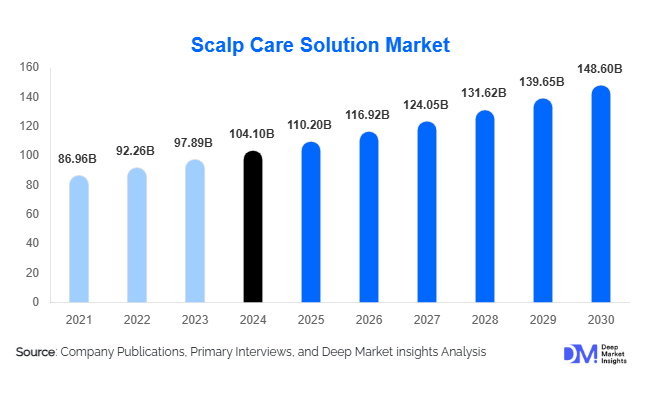

According to Deep Market Insights, the global scalp care market size was valued at USD 104.1 billion in 2024 and is projected to grow from USD 110.2 billion in 2025 to reach USD 148.6 billion by 2030, expanding at a CAGR of 6.1% during the forecast period (2025–2030). The growth of the scalp care market is primarily driven by increased consumer awareness of scalp health, rising demand for premium actives and formulations, the proliferation of device-assisted treatments, and the rapid expansion of e-commerce and DTC channels globally.

Key Market Insights

- Premium serums, scalp leave-ons, and device-bundled treatments are gaining dollar share, as consumers shift from mass shampoos toward higher-priced, clinically-backed, and targeted solutions.

- Microbiome-friendly and natural/botanical actives are among the fastest growing ingredient categories, meeting the rising demand for gentler, “clean” formulations that support skin-like scalp care.

- Online and DTC distribution channels dominate growth, offering brands lower customer acquisition costs, faster innovation cycles, and direct consumer feedback loops.

- Female Millennials (25-40) remain the largest end-user cohort, but male grooming, older age groups, and inclusive/multicultural product lines are showing accelerating adoption.

- Asia-Pacific is emerging as a critical growth engine, especially China and India, fueled by rising disposable incomes, pollution concerns, and urbanization, pushing demand for scalp health solutions.

- Regulatory/clinical validation pressures are increasing, making performance, safety, and evidence more important for brand credibility and pricing power.

What are the latest trends in the scalp care market?

Clinical & Device-Enhanced Regimens

Brands are increasingly combining formulations (serums, ampoules) with devices (scalp massagers, LED or laser tools) to deliver enhanced efficacy. These bundles help lock in consumers via both hardware adoption and recurring consumption of complementary treatments. Clinical trials supporting actives like peptides, growth-factor mimetics, and microbiome modulators are becoming more common, particularly in premium and dermatologist-endorsed lines. The trend reflects consumer expectations for visible, measurable results rather than just cosmetic benefits.

“Skinification” of the Scalp and Clean / Microbiome Ingredients

Consumers are treating the scalp similarly to facial skin, focusing on pH balance, microbiome health, gentleness, and avoiding harsh surfactants. Botanical extracts, prebiotics, probiotics, and postbiotics are increasingly used. Clean-beauty and natural formulations are no longer niche; they are moving toward mainstream premium offerings. Consumer preference for transparency in labeling “free from” claims, ethically sourced ingredients, and sustainability in packaging further reinforces this trend.

What are the key drivers in the scalp care market?

High Prevalence of Scalp & Hair Concerns

Scalp issues such as dandruff, itchiness, hair thinning, seborrheic dermatitis, and inflammation are widely prevalent across demographics globally. Combined with lifestyle stressors, pollution, and aging, these concerns lead consumers to invest in more frequent and better quality scalp care products. This demand underpins both volume and premium value growth.

Growth of E-commerce & D2C Models

Online sales, social commerce, and direct-to-consumer brands allow faster product launches, more precise targeting, and better cost structures. As online penetration rises (especially in Asia-Pacific, Latin America, and emerging markets), niche and indie scalp brands can compete more aggressively. Subscription models and recurring purchases (serums, leave-ons, device consumables) are boosting customer lifetime value.

What are the restraints for the global market?

Evidence & Regulatory Hurdles

Many product benefit claims (hair regrowth, follicle regeneration, microbiome restoration) require rigorous scientific or clinical evidence. Regulatory regimes in the U.S., European Union, and other mature markets scrutinize therapeutic vs cosmetic claims. For new entrants, especially, obtaining those studies (costly & time-consuming) and navigating regulations represents a significant barrier.

Raw Material Volatility and Supply Chain Complexity

Premium and biotech / botanical active ingredients often suffer from supply constraints, climate-sensitive sourcing, and price fluctuations. Device components likewise may require specialized parts. These factors push up costs, reduce margin cushions, and sometimes force reformulation. Brands that are less vertically integrated or unable to spread fixed costs may struggle in periods of volatility.

What are the key opportunities in the scalp care industry?

Personalization & Diagnostic-Based Solutions

Products tailored to individual scalp profiles and concerns (e.g., microbiome tests, derm-scans) represent a strong opportunity. Brands that package diagnostic tools with customized treatment regimens (serums, masks, devices) can differentiate and foster loyalty. Also, as consumer curiosity rises about scalp health, diagnostic-driven regimens help move beyond one-size-fits-all formulas.

Untapped Emerging Markets

Regions such as South Asia (India, Southeast Asia), parts of Latin America, and Africa are under-penetrated for premium scalp care. Urbanization, rising spending power, and rising awareness of scalp and hair health are creating demand. Brands that localize formulations for hair type, climate, ingredient safety, and distribution (including rural e-commerce access) have room to grow rapidly.

Device + Consumable Ecosystems & Subscription Models

Consumers are showing willingness to pay for devices (LED, massagers, etc.) when matched with ongoing treatment regimes. Subscription models for complementary consumables (serums, ampoules) increase revenue predictability. Device + consumable bundles also elevate ASPs. Furthermore, as awareness around scalp diagnostics and technology increases, demand for such ecosystems is expected to accelerate.

Product Type Insights

Premium serums & ampoules are the product type showing the fastest growth globally. While mass shampoos remain dominant in volume, serums offer much higher margins and are increasingly becoming lead products in premium lines. Scalp leave-ons, oils, and masks are also gaining importance, especially those promoted for specific concerns like hair thinning, microbiome balance, or scalp aging. Devices and tools are still niche in many regions but growing rapidly in high-income and digitally savvy markets. Medicated treatments (OTC/therapeutic) retain stable demand, particularly in regions with established pharmacy or clinical channels.

Application Insights

Anti-dandruff & scalp health remains the single largest concern application globally in terms of revenue, but applications around hair loss/thinning, sensitive or inflamed scalp (eczema, psoriasis), and oily scalp are growing faster in recent years. Consumers are increasingly seeking multifunctional formulations that address more than one concern (e.g., anti-dandruff + hydration + microbiome support) rather than single-concern products.

Distribution Channel Insights

Online and direct-to-consumer channels are rapidly increasing their share of scalp care product sales globally. E-commerce marketplaces, social commerce, and brand-owned web stores enable niche and premium brands to reach global audiences. Offline modern trade and pharmacies remain strong, particularly in mass / medicated categories. Salon / professional channels are important both for the discovery of premium lines and for in-salon treatment demand. Specialty natural/clean beauty stores also play a growing role in premium and clean-label scalp care.

User Demographic Insights

Female consumers in the 25-40 age group remain the most important and highest value user segment, driving premium product adoption and new product trial. Male consumers are closing the gap, especially in hair-loss and multi-benefit scalp treatments. Older demographics (40-60, 60+) are adopting scalp health routines, but usually at slower rates or with more medical/therapeutic orientation. Gen Z (18-24) drives awareness and social media influence; their purchases tend to be lighter / lower price but are important for future brand loyalty.

| By Product Type | By Application / Usage | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest regional market, accounting for approximately 30% of global scalp care value in 2024, with the U.S. driving the majority of demand. High spend per capita, strong online and professional/clinical channels, and readiness to adopt device-assisted and premium formulations contribute to dominance. Demand in the U.S. is especially heavy for hair thinning, device bundles, anti-dandruff, and leave-on serums.

Asia-Pacific

Asia-Pacific is nearly as large in share (≈ 28% in 2024), and is the fastest-growing region in percentage terms. China (premium and indie brands, heavy social-commerce), India (large base for mass, rising premium demand), South Korea (innovation in biotech & microbiome), and Southeast Asia are key contributors. Rising pollution, urban stressors, and high awareness of hair/scalp issues drive demand.

Europe

Europe holds about 22% of the global market in 2024. Western Europe leads in regulatory rigor, premiumization, and salon / professional demand, while Eastern Europe is gradually catching up in e-commerce and mass premium lines. Countries like the UK, Germany, and France are leading importers/consumers of advanced scalp treatments.

Latin America

Latin America contributed about 10% in 2024. Brazil and Mexico are the top markets. Key drivers are rising grooming culture, expanding modern retail and eCommerce, and increased interest in premium lines among urban consumers. Price sensitivity remains higher than in more mature markets, meaning product value and messaging are critical.

Middle East & Africa

Accounting for roughly 10% of global value in 2024, this region is heterogeneous: GCC countries have a high demand for luxury and premium scalp care, South Africa has strong professional and salon channels, while parts of Africa are still largely untapped. Infrastructure, regulatory standardization, and distribution can be constraints, but are rapidly improving in many urban areas.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Scalp Care Market

- L’Oréal S.A.

- Unilever PLC

- The Procter & Gamble Company

- Shiseido Co., Ltd.

- Johnson & Johnson

- Beiersdorf AG

- Estée Lauder Companies Inc.

- Amorepacific Corporation

- Kao Corporation

- Henkel AG & Co. KGaA

- Revlon, Inc.

- Colgate-Palmolive Company

- Coty Inc.

- Natura &Co

- Olaplex, LLC

Recent Developments

- In mid-2025, several premium scalp care brands launched LED scalp device bundles in North America, pairing massagers with bespoke serums to tap into the device/consumable ecosystem opportunity.

- In 2024–2025, brands in Asia-Pacific (especially China & South Korea) increased launches of microbiome-friendly formulations and “clean label” scalp serums, targeting younger demographics via social commerce platforms.

- In 2024, major CPG players acquired or invested in indie scalp-focused brands to gain prestige, specialist formulations, and expand their premium & DTC footprints.