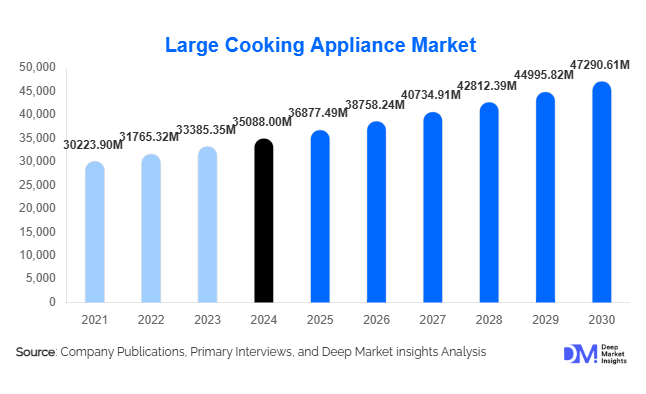

Large Cooking Appliance Market Size

According to Deep Market Insights, the global large cooking appliance market size was valued at USD 35,088.00 million in 2024 and is projected to grow from USD 36,877.49 million in 2025 to reach USD 47,290.61 million by 2030, expanding at a CAGR of 5.10% during the forecast period (2025–2030). The market growth is primarily driven by rising urbanization, increasing disposable incomes, growing adoption of smart and energy-efficient appliances, and expansion of commercial and institutional kitchens worldwide.

Key Market Insights

- Smart kitchen technologies are transforming the market, with AI-enabled ovens, induction cooktops, and connected appliances enhancing convenience and efficiency for residential and commercial users.

- Commercial kitchens are driving demand, with hotels, restaurants, cloud kitchens, and institutional food services investing in high-capacity, multifunctional cooking equipment.

- APAC and North America dominate the market, collectively accounting for over 60% of the 2024 market, due to high urban populations, technological adoption, and modern lifestyle trends.

- Energy-efficient and dual-fuel appliances are gaining popularity, catering to consumer preferences for sustainability and lower operational costs.

- Online retail channels are rapidly expanding, offering direct-to-consumer sales, product customization, and easy access to global brands.

- Government initiatives and regulations, such as “Make in India” and energy-efficiency incentives in Europe, are fostering growth and innovation in appliance manufacturing.

What are the latest trends in the large cooking appliance market?

Smart and Connected Appliances

Manufacturers are integrating IoT and AI technologies into large cooking appliances, enabling remote control, automated cooking programs, and energy monitoring. Smart ovens, induction cooktops with adaptive heating, and connected commercial equipment are increasingly preferred by tech-savvy consumers. These appliances not only improve cooking efficiency but also allow predictive maintenance and appliance optimization in commercial kitchens. Integration with mobile apps, voice assistants, and home automation systems is becoming a standard expectation, particularly in developed markets such as North America and Europe.

Energy Efficiency and Sustainability

Energy-efficient appliances are a major trend globally, driven by both regulatory requirements and consumer demand for eco-friendly products. Induction cooktops, dual-fuel ranges, and high-efficiency ovens reduce electricity and gas consumption. Governments in Europe, North America, and APAC are incentivizing energy-saving appliances, while commercial operators are adopting efficient solutions to lower operational costs. Sustainable manufacturing practices, including recyclable materials and low-emission production processes, are also gaining traction.

What are the key drivers in the large cooking appliance market?

Urbanization and Rising Disposable Income

Rapid urbanization and rising disposable income, especially in APAC and Latin America, are fueling demand for modern household appliances. Consumers increasingly prefer technologically advanced, multifunctional, and aesthetically appealing large cooking appliances. Compact urban kitchens and changing lifestyles are encouraging the adoption of induction ranges, built-in ovens, and smart cooking systems.

Growth of Commercial and Institutional Kitchens

The expansion of hotels, restaurants, cloud kitchens, and institutional facilities is creating strong demand for large-capacity, durable, and energy-efficient cooking equipment. Operators prioritize reliability, automation, and reduced maintenance costs, which is driving investment in advanced appliances and creating opportunities for manufacturers with robust commercial offerings.

Technological Innovation

Innovation in smart and connected appliances, dual-fuel ranges, and energy-efficient equipment is attracting both residential and commercial consumers. Integration of IoT, AI, and remote monitoring enhances operational efficiency and convenience, driving adoption in premium and emerging markets alike.

What are the restraints for the global market?

High Initial Cost

Advanced cooking appliances often require significant upfront investment, which limits adoption in price-sensitive markets. Dual-fuel, smart, and high-capacity commercial ranges are particularly affected by cost barriers, slowing penetration in emerging economies.

Supply Chain and Raw Material Challenges

Volatility in raw material prices, including metals and electronic components, and disruptions in global supply chains can impact production costs and delivery timelines. Manufacturers must manage these challenges to maintain market growth and pricing stability.

What are the key opportunities in the large cooking appliance market?

Smart Appliance Integration

Increasing adoption of connected kitchens presents opportunities for appliance manufacturers to innovate with AI-enabled cooking systems, remote control, and predictive maintenance. Companies investing in smart features can differentiate their products and gain a competitive edge in developed and emerging markets.

Emerging Markets and Urbanization

Growing middle-class populations in India, China, Brazil, and Southeast Asia are driving residential demand for modern and energy-efficient appliances. Urbanization and nuclear households create opportunities for compact, multifunctional, and technologically advanced cooking solutions.

Commercial and Institutional Expansion

Rapid growth of restaurants, hotels, cloud kitchens, and institutional food services is increasing demand for high-capacity, durable, and multifunctional appliances. Manufacturers supplying energy-efficient, low-maintenance equipment can capitalize on this expanding segment.

Product Type Insights

Ranges and ovens dominate the product type segment, accounting for 35% of the 2024 market. Their versatility, technological upgrades, and adoption in both residential and commercial kitchens make them the leading segment. Electric appliances lead the fuel type segment at 40% share, driven by induction cooktops, electric ovens, and rising preference for energy-efficient solutions.

Application Insights

Commercial kitchens remain the fastest-growing application, accounting for 38% of market share. Hotels, restaurants, and institutional facilities prefer large-capacity, durable, and automated appliances. Residential kitchens are steadily growing due to urbanization and the demand for smart, energy-efficient appliances. Emerging applications include cloud kitchens, catering services, and industrial-scale cooking, particularly in APAC and North America.

Distribution Channel Insights

Offline retail dominates the market with 45% share, driven by in-store appliance testing, brand trust, and established networks. Online channels are expanding rapidly, providing D2C access, product comparisons, and direct engagement with consumers. B2B channels for commercial buyers are also significant, with direct supply to hotels, restaurants, and institutions supporting large-volume sales.

| By Product Type | By Fuel Type | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 30% of the 2024 market, led by the U.S. and Canada. High adoption of smart appliances, premium ranges, and energy-efficient equipment drives growth. Demand is also supported by commercial kitchens and government incentives for energy-efficient products.

Europe

Europe holds 25% of the 2024 market, driven by Germany, France, and the U.K. Energy-efficient appliances, premium product adoption, and smart kitchen technologies contribute to market growth. Regulatory standards for energy consumption and eco-design further shape product development.

Asia-Pacific

APAC is the fastest-growing region with an expected CAGR above 8%, led by China, India, and Japan. Rising disposable income, urbanization, and increasing commercial kitchen expansion are key drivers. The growing middle-class population is boosting demand for technologically advanced and energy-efficient appliances.

Middle East & Africa

The region is experiencing increasing demand in Saudi Arabia, the UAE, and South Africa, particularly for commercial and high-end residential appliances. Investment in hospitality infrastructure supports growth.

Latin America

Brazil and Mexico are key markets with moderate growth. Demand is primarily in commercial kitchens and premium residential segments, with expansion opportunities in urban households and hospitality sectors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Large Cooking Appliance Industry

- Whirlpool Corporation

- Electrolux AB

- Midea Group

- LG Electronics

- Samsung Electronics

- Haier Group

- Panasonic Corporation

- Bosch Siemens Hausgeräte

- Sharp Corporation

- GE Appliances

- Arcelik A.S.

- Sub-Zero Group, Inc.

- Viking Range, LLC

- BlueStar, Inc.

- Aga Rangemaster Group

Recent Developments

- In March 2025, Whirlpool launched a new series of smart induction ranges in North America, integrating IoT-enabled cooking management and remote monitoring.

- In January 2025, Electrolux introduced energy-efficient industrial ovens for commercial kitchens in Europe, reducing energy consumption by 20%.

- In February 2025, Midea expanded its APAC production capacity for dual-fuel ranges and electric cooktops to meet growing urban residential demand.