Household Appliances Market Size

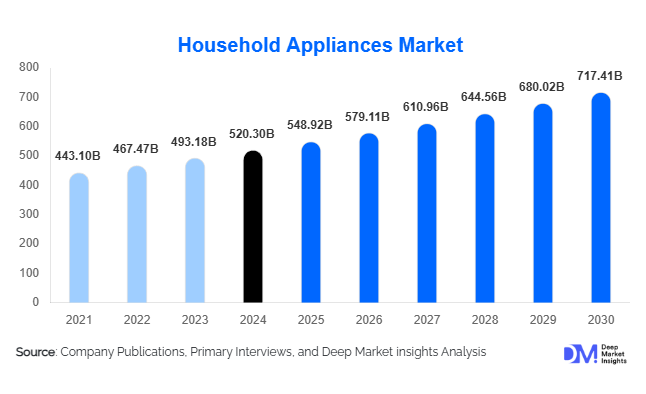

According to Deep Market Insights, the global household appliances market size was valued at USD 520.3 billion in 2024 and is projected to grow from USD 548.92 billion in 2025 to reach USD 717.41 billion by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The household appliances market growth is primarily driven by rising urbanization, increasing disposable income, and accelerating adoption of smart and energy-efficient appliances across residential and commercial applications.

Key Market Insights

- Major appliances continue to dominate global revenues, accounting for nearly 60% of the total household appliances market in 2024.

- Asia-Pacific leads the global market, representing approximately 45% of total industry revenue in 2024, driven by China, India, and Southeast Asia.

- Online and e-commerce sales channels are the fastest-growing, expected to capture over 35% market share by 2030.

- Smart and connected appliances are emerging as key growth drivers, driven by IoT integration, home automation, and voice-controlled ecosystems.

- Premium and energy-efficient products are gaining traction, with consumers willing to pay higher prices for sustainability and advanced features.

- The top five players hold roughly 30–35% of the market, indicating moderate consolidation amid intense price competition and technological advancement.

Latest Market Trends

Smart and Connected Home Appliances Revolution

Smart household appliances equipped with Wi-Fi connectivity, voice assistance, and AI-enabled control systems are transforming consumer lifestyles. Devices such as smart refrigerators, connected washing machines, and intelligent air conditioners are becoming mainstream, enabling remote operation and predictive maintenance. This trend is particularly strong in developed markets, where consumers prioritize convenience and sustainability. Manufacturers are investing heavily in R&D to integrate IoT, energy management, and user-friendly apps to enhance customer engagement and create new service-based revenue streams.

Shift Toward Energy Efficiency and Sustainability

Governments and consumers alike are emphasizing energy-efficient appliances due to increasing environmental awareness and rising energy costs. Energy Star-certified products, eco-friendly refrigerants, and recyclable materials are now key differentiators in product design. Regulatory initiatives in Europe, North America, and parts of Asia are pushing manufacturers toward compliance with higher energy standards, leading to faster replacement cycles. Sustainable manufacturing practices and green labeling programs are further boosting the appeal of environmentally responsible brands.

Household Appliances Market Drivers

Rising Urbanization and Disposable Income

The rapid pace of urban development, especially in emerging economies, is leading to an increase in new households and housing upgrades. Higher disposable income levels and lifestyle improvements have resulted in a surge in demand for both essential and premium household appliances. This driver is particularly strong in Asia-Pacific and Latin America, where first-time buyers are entering the market and middle-class populations are expanding.

Technological Innovation and Smart Home Adoption

Technological advancement is reshaping the industry, with the introduction of AI-powered appliances, IoT integration, and advanced sensors that improve user experience and operational efficiency. Consumers are increasingly adopting smart homes, where appliances are interconnected through centralized systems, enabling automation and control. This has led to increased competition among brands to offer differentiated, feature-rich products.

Replacement and Energy Efficiency Regulations

In mature markets such as North America and Europe, regulatory changes and the push for energy efficiency have accelerated replacement cycles. Consumers are replacing older appliances with energy-efficient, connected, and sustainable models, creating steady, recurring demand. Incentive programs, subsidies, and trade-in schemes have further supported this transition.

Market Restraints

Raw Material Price Volatility and Supply Chain Challenges

Fluctuating prices of metals, plastics, and electronic components, along with global supply chain disruptions, have increased production costs and reduced profit margins for manufacturers. Semiconductor shortages and logistics bottlenecks have further stressed the production pipeline, leading to potential delays in product launches and distribution.

Market Saturation in Developed Economies

In mature regions such as North America and Western Europe, high appliance penetration has led to slower growth rates. The market is now driven primarily by replacement and upgrade demand rather than new installations, which limits volume growth. This saturation necessitates innovation and product differentiation to sustain competitiveness.

Household Appliances Market Opportunities

Emerging Market Penetration

Countries such as India, Indonesia, Vietnam, and Nigeria present vast untapped opportunities due to low appliance penetration rates and rising disposable incomes. Manufacturers can achieve long-term growth by focusing on affordable, value-driven products tailored for these high-potential markets. Localization of production and distribution networks further enhances profitability and resilience.

Smart IoT Ecosystems and Integration

The shift toward interconnected ecosystems provides a new opportunity for manufacturers to create device networks that communicate seamlessly with smartphones, energy grids, and AI assistants. Partnerships between appliance makers, telecom firms, and tech companies are enabling new business models such as subscription services and predictive maintenance solutions.

Sustainability and Circular Economy Models

With growing regulatory emphasis on sustainable manufacturing, appliance companies can benefit by investing in recyclable materials, energy-efficient components, and take-back programs. Circular economy models, focusing on refurbishment and extended product life, are increasingly favored by eco-conscious consumers and governments alike.

Product Type Insights

Major (Large) Appliances continue to dominate the global household appliances market, accounting for nearly 60% of total revenue in 2024. This category includes refrigerators, washing machines, dishwashers, and air conditioners, essential appliances for both emerging and developed markets. The leading driver here is energy efficiency and lifecycle replacement. As stricter energy-efficiency standards become mandatory, consumers are upgrading to premium, high-efficiency models that reduce power consumption and utility costs. Replacement cycles, often every 7–10 years, sustain steady market demand. Additionally, smart integration and AI-powered diagnostics are enhancing value propositions in this segment.

HVAC Appliances, comprising heating, ventilation, and air-conditioning units, are witnessing accelerated adoption, particularly in tropical and rapidly urbanizing regions. The key growth drivers are climate change and new housing development, which are pushing demand for cooling and water-heating solutions. Rising global temperatures, construction booms in emerging economies, and increasing comfort expectations are propelling HVAC’s expansion, with air conditioners alone projected to post a CAGR of around 7% through 2030.

Built-in & Kitchen Appliances are gaining popularity as home renovation and remodeling trends rise worldwide. The segment benefits from the premiumization and modernization of kitchens, especially in developed markets such as the U.S., Western Europe, and Japan. Consumers are increasingly investing in built-in ovens, induction cooktops, and integrated dishwashers that enhance space utilization and aesthetics. This segment is also supported by growing urban apartment construction and higher disposable incomes.

Distribution Channel Insights

The online and e-commerce channel has emerged as the fastest-growing distribution mode, representing approximately 25% of global market share in 2024 and projected to surpass 35% by 2030. This growth is propelled by the convenience of digital shopping, transparent price comparisons, and direct-to-consumer (D2C) sales initiatives by leading brands. Brick-and-mortar stores remain critical, particularly for large appliances requiring installation and after-sales support. Hybrid omni-channel strategies, combining physical showrooms with online customization and virtual assistance, are increasingly standard among market leaders such as LG, Haier, and Bosch.

End-Use Insights

The residential sector dominates the household appliances market, holding nearly 70% of global value in 2024. Growth in this sector is supported by continuous replacement and upgrade cycles as consumers adopt smart, energy-efficient, and sustainable appliances. Rapid urbanization and higher living standards are expanding the market base, especially in the Asia-Pacific and Latin America. The multi-family housing and rental segment also contributes substantially, driven by urban migration and the rise of co-living models. Non-residential applications, particularly in hospitality, serviced apartments, and institutional settings, continue to show steady demand, supported by increasing tourism and short-stay accommodation trends. Moreover, export-driven production from the Asia-Pacific ensures global supply stability and competitive pricing.

| By Product Type | By Distribution Channel | By End-Use |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

The Asia-Pacific (APAC) region dominates the global household appliances market, commanding approximately 45% share in 2024. The region’s growth is powered by rapid urbanization, expanding middle-class populations, and a vast base of first-time buyers. Countries such as China, India, Indonesia, and Vietnam are witnessing significant increases in appliance ownership as disposable incomes rise. Strong local manufacturing capabilities, supported by policies like “Made in China 2025” and “Make in India,” have fostered cost competitiveness and export strength. Additionally, intense price competition among regional players (e.g., Midea, Haier, Hisense) continues to expand product accessibility. The APAC region is expected to maintain its leadership, growing at a CAGR of about 6.5% through 2030.

North America

North America represents roughly 28% of the global household appliances market in 2024, led by the United States. Regional demand is driven by high smart-home penetration, widespread IoT adoption, and strong replacement cycles. Consumers in this region show a strong preference for premium, connected, and energy-efficient appliances. Additionally, ongoing housing renovation projects and replacement demand for aging appliances continue to sustain steady volumes. Canada contributes to regional growth through aggressive energy-efficiency incentives, while Mexico’s appliance manufacturing base strengthens the regional supply chain. North America’s steady CAGR of around 4.5% reflects mature but resilient consumer dynamics.

Western Europe

Western Europe remains a mature yet innovation-driven market, accounting for nearly 18% of the global share in 2024. The key regional drivers are strict energy-efficiency and ecodesign regulations as well as heightened consumer sustainability expectations. Countries like Germany, the U.K., and France are at the forefront of adopting A+++ rated appliances and smart, eco-friendly models. Renovation-driven kitchen upgrades and replacement demand for compliant models are boosting sales of built-in and premium appliances. Meanwhile, Eastern Europe is emerging as a new demand hub, supported by construction growth and improved living standards.

Latin America

Latin America is undergoing structural transformation, supported by e-commerce expansion and replacement demand from an expanding middle class. Countries such as Brazil, Argentina, and Chile are benefiting from digital marketplaces that improve product access and affordability. Regional growth is also linked to rising household spending and improved logistics infrastructure, which enable direct online distribution. Retail partnerships with marketplaces like Mercado Libre and Amazon are redefining sales models. Latin America is projected to grow at a CAGR of around 5.2% through 2030, driven by digitalization and rising consumer aspirations.

Middle East & Africa (MEA)

The Middle East & Africa (MEA) region represents a smaller yet fast-growing segment of the global market. The main growth drivers include electrification initiatives, rapid urban housing expansion, and high demand for cooling appliances in GCC and African nations. Rising temperatures across the region are boosting the uptake of HVAC and air-cooling units. Additionally, multi-brand retail and e-commerce expansion are improving product reach and accessibility. Government housing projects and favorable import policies in the UAE, Saudi Arabia, and South Africa further stimulate appliance demand. MEA’s market is forecast to expand at a CAGR of nearly 6% through 2030, with strong momentum in smart and affordable appliance categories.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Household Appliances Market

- Haier Smart Home Co., Ltd.

- LG Electronics Inc.

- Samsung Electronics Co., Ltd.

- Whirlpool Corporation

- Robert Bosch GmbH

- Panasonic Corporation

- Electrolux AB

- Midea Group Co., Ltd.

- Sharp Corporation

- Miele & Cie. KG

- Hisense Co., Ltd.

- Philips NV

- Fisher & Paykel Appliances Holdings Ltd.

- Gree Electric Appliances Inc. of Zhuhai

- Dyson Ltd.

Recent Developments

- In August 2025, Haier announced the opening of a new smart appliance factory in India under the “Make in India” initiative, increasing localized production of connected appliances.

- In June 2025, LG Electronics launched its next-generation AI-enabled washing machines integrated with smart home platforms for predictive maintenance and energy optimization.

- In April 2025, Whirlpool Corporation unveiled a sustainability-focused product line using recyclable materials and low-GWP refrigerants to meet global environmental standards.