Juvenile Products Market Size

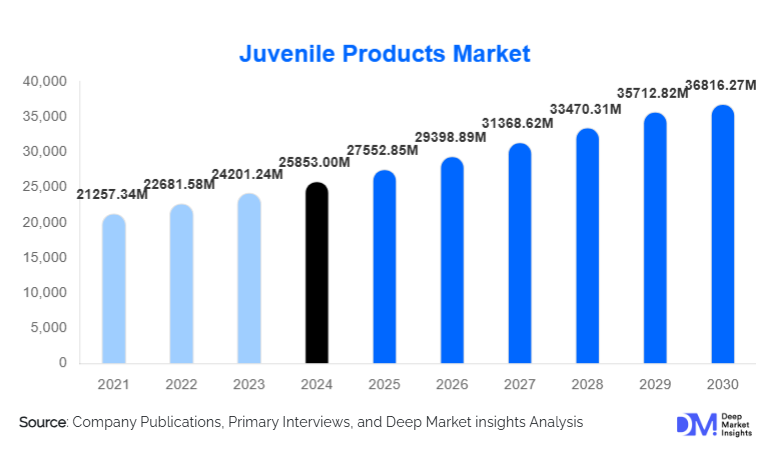

According to Deep Market Insights, the global juvenile products market size was valued at USD 25,853.00 Million in 2024 and is projected to grow from USD 27,552.85 Million in 2025 to reach USD 36,816.27 Million by 2030, expanding at a CAGR of 6.70% during the forecast period (2025–2030). Market growth is driven by rising disposable incomes, increasing parental focus on safety and hygiene, rapid urbanization, and the proliferation of e-commerce channels that make premium baby products more accessible globally.

Key Market Insights

- Baby personal care and hygiene products lead global demand, driven by recurring purchases of diapers, skincare, and toiletries.

- Asia-Pacific dominates market share in 2024, supported by large birth cohorts, urbanization, and expanding retail penetration.

- Premium and safety-certified baby products are growing faster than mass-market categories due to heightened parental awareness.

- Online distribution channels are expanding rapidly, becoming the preferred platform for product research and purchase decisions.

- Smart and tech-integrated juvenile products, including IoT-enabled monitors and app-connected feeding devices, are reshaping product innovation.

- Institutional demand from hospitals and daycare centers is steadily rising with global improvements in early childhood care infrastructure.

What are the latest trends in the juvenile products market?

Premiumisation and Safety-First Design

Parents across global markets are increasingly willing to spend on premium juvenile products that offer superior safety, ergonomic benefits, and high-quality materials. Safety-certified baby car seats, organic baby skincare, eco-friendly diapers, and convertible nursery furniture are among the fastest-growing categories. This premiumisation trend stems from evolving consumer expectations for long-lasting, non-toxic, and regulation-compliant products. Brands that offer third-party certifications, sustainable materials, and advanced safety engineering are gaining a notable competitive advantage. With shrinking family sizes, per-child spending on quality products continues to rise.

Smart Baby Products and Technology Integration

The juvenile category is rapidly evolving with the integration of digital technologies, particularly in baby monitoring, feeding, and sleep-management products. Smart baby monitors with AI-driven sleep analytics, temperature sensors, breathing monitors, and app-connected feeding equipment are gaining popularity among millennial and Gen-Z parents. Manufacturers are increasingly embedding IoT capabilities into traditional baby gear to enable real-time updates, parental alerts, and health-tracking features. This shift toward connected parenting devices is fueling a premium-tech niche within the global juvenile market.

What are the key drivers in the juvenile products market?

Urbanization and Dual-Income Households

Rapid urbanization and the rise of dual-income families are boosting demand for convenient, portable, and safety-compliant baby products. Compact strollers, multifunctional travel systems, and ready-to-use feeding and hygiene products are increasingly becoming essential for modern families. As time-constrained parents prioritize convenience, the adoption of premium and innovative baby gear accelerates significantly.

Rising Parental Awareness on Safety and Hygiene

Parents today are highly informed and place strong emphasis on hygiene, skin safety, nutrition, and developmental needs. This is driving substantial demand for organic baby care products, chemical-free toiletries, BPA-free feeding accessories, and certified safety gear. Baby skincare, bath products, and diapers remain high-volume segments due to their recurring purchase nature. The heightened focus on infant well-being is translating into strong market momentum across all care-related product types.

E-commerce Expansion and Digital Retail Penetration

The rapid growth of e-commerce has transformed purchase patterns, especially in emerging markets. Online platforms offer extensive product variety, transparent pricing, user reviews, and home delivery, making juvenile products more accessible. Digitally native brands are leveraging direct-to-consumer models to introduce premium, innovative products at competitive price points. This omnichannel retail expansion is a strong catalyst for market growth.

What are the restraints for the global market?

Regulatory Compliance and Safety Standards

Juvenile products must comply with some of the most stringent global regulations related to materials, ergonomics, and safety testing. Standards differ across countries, creating complexity and cost burdens for manufacturers. Extensive testing requirements for car seats, cribs, strollers, and feeding products increase production costs and slow product rollout—particularly challenging for smaller companies.

High Price Sensitivity in Emerging Markets

Despite rising income levels, many consumers in emerging economies remain price-sensitive. Premium and certified products often remain out of reach for broader populations, limiting the adoption of high-end gear. Affordability concerns particularly impact categories like baby mobility products, nursery furniture, and advanced smart devices. This cost barrier may restrict market penetration in value-driven segments.

What are the key opportunities in the juvenile products industry?

Premium, Eco-Friendly, and Sustainable Baby Products

The global shift toward sustainability offers significant potential for manufacturers offering biodegradable diapers, organic skincare, eco-friendly textiles, and responsibly sourced nursery furniture. As environmental consciousness grows among millennial parents, brands focusing on green materials and transparent sourcing practices stand to capture a rapidly expanding niche.

Emerging Market Expansion and Localization

Asia-Pacific, Latin America, and parts of the Middle East present major geographic opportunities due to expanding middle-class populations and improving retail infrastructure. Localized product design—such as climate-appropriate fabrics or regionally relevant feeding solutions—can accelerate penetration. E-commerce growth in these regions further enables international brands to enter with lower distribution barriers.

Smart Baby Ecosystems and Connected Parenting Products

IoT-enabled baby monitors, smart sleep solutions, AI-driven feeding assistants, and app-integrated strollers represent the next frontier of innovation. These technologies cater to tech-savvy parents seeking convenience, better tracking, and peace of mind. Companies investing early in R&D for connected parenting will capture long-term premium demand.

Product Type Insights

Baby Personal Care & Hygiene Products hold the largest market share in 2024, accounting for approximately 25–30% of global revenue. This dominance is attributed to the essential and recurring nature of diapers, skincare, wipes, and bath products. Infant Nutrition follows with 20–25%, driven by formula and packaged baby food consumption. Baby Mobility & Safety Products contribute 15–20%, supported by growing parental investment in safety-certified strollers and car seats. Nursery furniture, feeding and nursing gear, and baby toys make up the remaining share, collectively representing a robust and diverse product ecosystem.

Application Insights

Households remain the primary application segment, representing the vast majority of juvenile product purchases. Dual-income families and working parents are driving rapid uptake of convenience-oriented products such as lightweight strollers, ready-feeding solutions, and quick-sterilization devices. Hospitals, maternity centers, and neonatal clinics also represent a growing institutional end-use segment, particularly for bassinets, medical-grade feeding tools, and hygiene products. Daycare facilities increasingly contribute to demand for durable, safety-compliant furniture and hygiene supplies. Export-driven demand from manufacturing hubs in Asia further fuels production volumes, especially for mobility gear, apparel, and childcare accessories.

| By Product Type | By Age Group | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 20–25% of global juvenile product demand in 2024. The U.S. drives most of this consumption, backed by high household incomes, strong safety regulations, and a preference for premium baby care products. Canadian consumers show similar preferences, with strong uptake in organic skincare and safety-certified gear. Growth remains steady but moderate due to declining birth rates.

Europe

Europe holds roughly 18–22% of the global market. Germany, the U.K., France, and the Nordics lead demand for eco-friendly, certified, and high-quality products. European parents prefer sustainable textiles, chemical-free feeding equipment, and premium mobility gear. Strict EU safety standards also shape product design and innovation.

Asia-Pacific

The Asia-Pacific region dominates with 30–35% market share, driven by China, India, Japan, and Southeast Asia. Rising disposable incomes, expanding urban populations, and booming e-commerce platforms accelerate growth. China and India are the fastest-growing markets, with strong demand for personal care, mobility gear, nutrition, and infant apparel. Japan and South Korea show high adoption of premium and smart baby products.

Latin America

Latin America represents 8–12% of the market, with Brazil and Mexico leading growth. Urbanization, improving retail access, and rising awareness of proper childcare practices are fueling demand. Price-sensitive consumers primarily adopt mid-range and value-tier products, while premium categories show gradual improvement.

Middle East & Africa

MEA accounts for 5–8% of global demand. Gulf countries such as the UAE and Saudi Arabia exhibit a strong preference for premium juvenile products. African nations reflect growing but price-conscious demand, driven by increasing healthcare infrastructure and improving awareness of hygiene and nutrition.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Juvenile Products Market

- Procter & Gamble

- Johnson & Johnson

- Nestlé S.A.

- Kimberly-Clark Corporation

- Philips

- Chicco (Artsana Group)

- Graco

- Britax

- Pigeon Corporation

- BabyBjörn

- Evenflo

- Mattel – Fisher-Price division

- Dorel Industries

- Combi Corporation

- Mothercare (brand-level participation)

Recent Developments

- In June 2024, Philips Avent launched an AI-enabled smart feeding monitor integrated with an app-based parental dashboard.

- In March 2025, Chicco announced the expansion of its sustainable product line featuring organic textiles and recycled-plastic strollers.

- In January 2025, Procter & Gamble invested in new biodegradable diaper technology aimed at reducing landfill waste.