Baby Car Seats Market Size

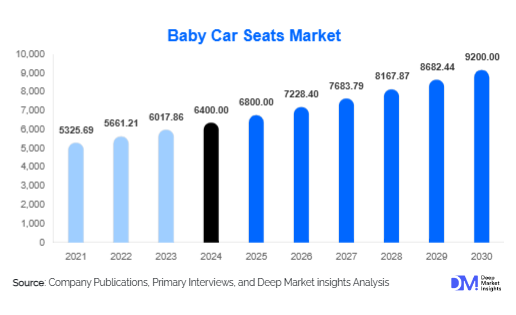

According to Deep Market Insights, the global baby car seats market size was valued at USD 6,400 million in 2024 and is projected to grow from USD 6,800 million in 2025 to reach USD 9,200 million by 2030, expanding at a CAGR of 6.3% during the forecast period (2025–2030). The market growth is primarily driven by increasing safety awareness among parents, stringent regulatory mandates for child restraint systems, and rising disposable incomes in emerging economies, coupled with innovative product offerings integrating smart safety and convenience features.

Key Market Insights

- Convertible and all-in-one car seats are dominating global demand, offering extended usability from infancy to booster stage and high safety compliance.

- Online channels are gaining significant traction, with e-commerce penetration allowing consumers to access a wider variety of models and compare prices and features conveniently.

- North America remains the largest market, driven by strict safety regulations, high parental awareness, and premium product adoption.

- Asia-Pacific is the fastest-growing market, led by China and India, due to urbanization, rising middle-class incomes, and increasing dual-income households prioritizing child safety.

- Technological integration in car seats, including smart sensors, mobile connectivity, and side-impact protection systems, is reshaping consumer preferences toward premium segments.

What are the latest trends in the baby car seat market?

Smart and Sensor-Enabled Car Seats

Manufacturers are increasingly integrating smart technology into baby car seats, including seatbelt alarms, temperature sensors, and mobile app connectivity that alert parents if the child is improperly secured. These innovations not only enhance safety but also allow companies to command premium pricing. Mobile applications provide reminders for seat installation, growth stage adjustments, and maintenance, creating a connected ecosystem for modern parents. The trend is particularly strong in developed markets like North America and Europe, where consumers are willing to invest in technology-driven safety solutions.

Eco-Friendly and Sustainable Materials

Consumer preference is shifting toward eco-conscious products, driving manufacturers to use bio-based plastics, recyclable fabrics, and low-emission materials. Companies adopting sustainable manufacturing processes are gaining competitive advantage, particularly in Europe and North America. Brands are increasingly marketing car seats as safe for both children and the environment, responding to regulatory pressures and growing consumer demand for greener alternatives.

What are the key drivers in the baby car seats market?

Regulatory Mandates and Child Safety Awareness

Global safety standards, such as ISOFIX in Europe and FMVSS 213 in North America, have significantly boosted the adoption of certified baby car seats. Awareness campaigns highlighting the risks of unsecured children in vehicles have further contributed to market growth. Parents are increasingly investing in advanced safety features, including side-impact protection, anti-rebound bars, and rear-facing modules, elevating overall market demand.

Rising Dual-Income Households

Urbanization and the increasing prevalence of dual-income families have led to higher spending on child safety products. Parents are seeking convenience-driven solutions such as travel-system car seats, which combine stroller and seat functionality, offering mobility and comfort without compromising safety.

What are the restraints for the global market?

High Product Costs

Premium car seats, equipped with smart safety features or eco-friendly materials, remain unaffordable for many consumers in emerging economies. This limits penetration and keeps lower-income households dependent on cheaper, less-compliant alternatives.

Compliance Complexity

Manufacturers face challenges in adhering to varying regional safety standards, requiring significant investment in certification, testing, and design adjustments. This complexity increases operational costs and can act as a barrier for smaller players entering the market.

What are the key opportunities in the baby car seats market?

Expansion in Emerging Markets

Countries such as India, China, and Brazil are experiencing rising awareness around child safety and increasing disposable incomes. Targeted distribution and localized production strategies in these regions can provide high growth potential. Additionally, government initiatives promoting child safety in vehicles create a favorable regulatory environment for new entrants.

Integration of Smart Safety Features

Smart car seats equipped with sensors, alerts, and mobile connectivity represent a significant growth opportunity. Integration of technology allows premium positioning, higher margins, and brand differentiation. Subscription services for app-based parental guidance and maintenance notifications also provide recurring revenue streams.

Eco-Friendly Product Development

Growing consumer preference for sustainable products is encouraging manufacturers to adopt bio-based materials, recyclable fabrics, and low-emission production processes. Eco-conscious offerings can capture new customer segments and strengthen brand reputation in both developed and emerging markets.

Product Type Insights

Convertible car seats dominate the market with approximately 42% share in 2024, due to their extended usability across the infant and toddler stages. Travel systems and all-in-one seats are also gaining traction, particularly in urban households valuing convenience and cost-effectiveness. Booster seats, although a smaller segment, show steady growth driven by school-aged children's requirements in regulated markets. The mid-range price category (USD 100–300) accounts for 45% of sales, balancing affordability and advanced safety features.

Application Insights

The most common application is for individual parental use, particularly for infants aged 0–4 years, representing over 70% of global demand. Secondary applications include daycare centers, preschool transport services, and rideshare safety programs. The fastest-growing applications are in urban dual-income households in APAC and LATAM, driven by awareness campaigns and government-backed child safety initiatives. Export demand from North America and Europe is increasing, supplying premium products to emerging economies with limited local manufacturing capabilities.

Distribution Channel Insights

Online platforms, including brand websites and e-commerce marketplaces, dominate the global distribution, accounting for 35% of sales. Consumers favor the convenience, competitive pricing, and wide variety available online. Offline channels, such as specialty baby stores, hypermarkets, and retail chains, remain important for premium and luxury product visibility. Direct-to-consumer strategies are increasingly adopted by leading brands to capture higher margins and gather customer data for product improvements.

| By Product Type | By Age Group | By Sales Channel | By Price Range | By Material Type |

|---|---|---|---|---|

|

|

|

|

|

Age Group Insights

The 0–12 months segment leads the market with 38% share, driven by mandatory rear-facing car seat adoption and high parental awareness. The 1–4 years segment is rapidly growing with convertible car seat adoption, while booster seats for 4–12-year-olds maintain stable demand in developed markets. Products for children aged 8–12 years are a smaller segment but show potential for growth in regions with mandatory child safety regulations.

Regional Insights

North America

North America represents 40% of the global market, led by the U.S. due to stringent safety standards, high disposable incomes, and premium product adoption. Canada contributes to steady growth with a preference for mid-range and premium car seats. The region’s market is mature but continues to expand with innovations in smart and eco-friendly designs.

Europe

Europe accounts for 25% of the market, driven by Germany, the U.K., and France. Strong regulations, parental awareness, and premium product penetration support growth. Convertible and all-in-one seats are increasingly adopted, while online sales growth is boosting market accessibility.

Asia-Pacific

APAC is the fastest-growing region (CAGR ~8%), led by China and India. Rising urbanization, dual-income households, and increasing disposable income are fueling demand for mid-range and premium car seats. Awareness campaigns and government regulations are gradually promoting safety-compliant product adoption.

Latin America

Brazil and Mexico are the leading markets in LATAM, driven by urban middle-class households. While growth is moderate, awareness campaigns and government initiatives are slowly increasing demand for certified car seats.

Middle East & Africa

UAE and South Africa lead regional demand, although overall penetration is lower due to cost sensitivity. Growth is supported by rising parental awareness and increasing availability of premium products through online channels.

Company Market Share

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Baby Car Seats Market

- Graco

- Chicco

- Britax

- Evenflo

- Maxi-Cosi

- Safety 1st

- Cybex

- Nuna

- Joie

- Peg Perego

- Diono

- Recaro

- Hauck

- Baby Trend

- Cosco

Recent Developments

- In May 2025, Graco launched a new line of smart convertible car seats with integrated temperature sensors and mobile app alerts across North America.

- In April 2025, Chicco introduced eco-friendly car seats using bio-based plastics in European markets, supporting sustainability initiatives.

- In February 2025, Britax expanded its travel system portfolio in APAC, integrating stroller-seat modules to capture urban dual-income households.