J-Beauty Products Market Size

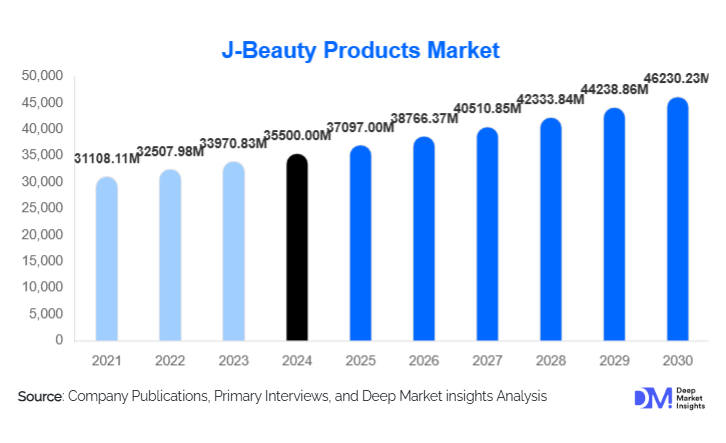

According to Deep Market Insights, the global J-beauty products market size was valued at USD 35,500.00 million in 2024 and is projected to grow from USD 37,097.50 million in 2025 to reach USD 46,230.23 million by 2030, expanding at a CAGR of 4.50% during the forecast period (2025–2030). This growth is primarily driven by increasing global recognition of Japanese beauty aesthetics, rising demand for premium skincare routines, and expanding e-commerce reach into new geographies.

Key Market Insights

- Skincare remains the dominant category in J-Beauty, accounting for roughly 55% of total market value in 2024, thanks to strong consumer demand for anti-aging, barrier-care, and sunscreen solutions.

- Conventional formulations still lead the market, representing about 90% of value in 2024, even as organic/natural lines gain traction.

- The Asia-Pacific region dominates worldwide demand, contributing approximately 65-70% of global revenue in 2024, led by Japan and China.

- Emerging markets within Asia-Pacific, such as India and Southeast Asia, are the fastest-growing segments, offering significant upside for Japanese beauty brands expanding abroad.

- E-commerce and direct-to-consumer (D2C) channels are reshaping distribution, enabling Japanese brands to reach global consumers, personalise offerings, and enhance repeat purchase behaviour.

- Sustainability, minimalistic beauty routine, and heritage Japanese ingredient stories are increasingly employed as differentiation levers, aligning with evolving consumer values and helping premium pricing strategies.

What are the latest trends in the J-Beauty products market?

Minimalistic Beauty Routines & Heritage Ingredients

The J-Beauty concept emphasises fewer steps and high-quality formulations built around heritage ingredients (e.g., rice bran, camellia oil, green tea). This “less is more” approach is gaining appeal in global markets where consumers seek efficacy with simplicity. Japanese brands are leveraging this by decluttering routines, offering multi-functional products, and highlighting their botanical and fermentation-based science. The result: increased conversion among overseas consumers drawn to perceived authenticity, premium experience, and skin-health benefits.

Digital-Commerce & Global Expansion of Japanese Brands

Japanese beauty brands are investing heavily in digital commerce, both domestically and internationally. With online channels enabling cross-border fulfilment, brands can access regions previously hard to penetrate. Social-media influencers, virtual try-ons, skin-analysis apps, and D2C platforms are enhancing customer engagement. This digital shift is particularly important for reaching younger consumers in emerging markets, who prioritise convenience and global brand access. As a result, growth in overseas markets is outpacing domestic growth in many cases.

What are the key drivers in the J-Beauty products market?

Growing Global Emphasis on Skin Health & Anti-Aging

Premiumisation & Brand Equity of Japanese Beauty

In many markets, “Japanese” as a descriptor conveys quality, innovation, and trust. This brand equity enables J-Beauty firms to command premium pricing, launch international flagship stores, and incremental product lines. The premiumisation trend supports higher margins and encourages R&D investment into value‐added features like fermentation, botanical actives, and eco-friendly packaging.

Rapid Growth in E-commerce & Cross-Border Retailing

The shift from offline department stores to online retail has accelerated. Japanese beauty brands are capitalising on this by establishing global D2C platforms, utilising influencer marketing, and leveraging travel retail and duty-free channels. The ability to reach consumers in Asia-Pacific, North America, and Europe from Japan supports faster international growth than purely domestic expansion.

Restraints

Strong Competitive Pressure & Market Saturation

While J-Beauty has strong fundamentals, it faces intense competition from K-Beauty (Korean beauty), Western global brands, and local/regional brands. Many of these competitors operate lower-cost models or faster trend-driven cycles, creating margin pressure and constraining growth in mature markets.

Supply-Chain, Ingredient Cost & Regulatory Complexity

Japanese brands rely on high‐quality ingredients, often from specialty botanicals or fermentation processes, which raises costs and makes them vulnerable to supply-chain disruptions or harvest variability. Additionally, global regulatory requirements (ingredient safety, import tariffs, certification) complicate export strategies and can slow market entry or increase cost burdens.

What are the key opportunities in the J-Beauty products market?

Expansion into Emerging International Markets

While Japan remains the home base, the most significant growth opportunities lie in emerging markets, India, Southeast Asia, Latin America, and the Middle East, where rising middle classes, increasing skincare awareness, and the growth of online retail are creating new demand. Japanese brands can leverage their reputation for quality and heritage to establish premium positioning abroad. By developing region-specific formulations (for climate/humidity), tailoring marketing to local consumer habits, and partnering with local e-commerce platforms or distributors, they can capture incremental growth beyond saturated developed markets.

Clean, Sustainable & Minimalist Beauty Innovation

Consumer preference is shifting toward clean beauty, sustainable sourcing, eco-packaging, and transparency around ingredients. J-Beauty brands are well-positioned to capitalise on this by emphasising botanical extracts, fermentation, minimal step routines, and environmentally friendly packaging. By launching dedicated organic/natural lines, reducing product steps, and promoting eco-credentials, they can differentiate from both mass-market and trend-driven fast-beauty competitors, tapping into higher-growth niches.

Digital Transformation & Omni-Channel Consumer Engagement

The integration of AI skin diagnostics, AR try-on experiences, personalised online routines, and subscription models offers Japanese brands the chance to deepen engagement, increase repeat purchase rates, and expand globally without excessive physical-store investment. Moreover, channel innovations, such as direct-to-consumer platforms, pop-up stores, travel-retail collaborations, and influencers, enable brand reach in new geographies and demographic segments (e.g., male grooming, younger consumers). By combining heritage brand assets with agile digital commerce, J-Beauty firms can accelerate growth and improve margins.

Product Type Insights

Skincare products dominate the J-Beauty market, accounting for nearly 58% of global market revenue in 2024. Japanese skincare emphasizes ritual-based routines, minimal formulations, and high-efficacy natural ingredients such as rice bran, green tea, and fermented extracts. Products like cleansers, serums, and moisturizers lead demand due to the global adoption of multi-step skincare regimens inspired by Japanese beauty rituals. Haircare products hold a significant share, supported by innovation in scalp treatments and botanical formulations. Makeup and cosmetics are gradually growing, especially hybrid products combining skincare benefits with aesthetic appeal. Fragrances and bath & body products, though smaller segments, are expanding through aromatherapy-based innovations and wellness-oriented branding.

Formulation Insights

Natural and organic formulations are emerging as the fastest-growing segment, representing 32% of total market sales in 2024 and expected to surpass 40% by 2030. Consumers globally associate J-Beauty with purity, safety, and ingredient transparency. Clean-label formulations that exclude parabens, sulfates, and synthetic fragrances are driving product innovation. Conventional formulations continue to dominate due to their affordability and proven efficacy in mass-market categories. However, hybrid products that combine biotechnology and natural actives, such as probiotic skincare and enzyme-based cleansers, are redefining modern Japanese beauty science. The trend aligns with sustainability and minimalism, two pillars of the J-Beauty ethos.

Distribution Channel Insights

Online and e-commerce platforms account for over 42% of total global J-Beauty product sales in 2024, becoming the leading distribution channel. Digital-first strategies, cross-border e-commerce, and influencer-led marketing on platforms like TikTok, YouTube, and Instagram have amplified global reach. Specialty beauty stores remain crucial for premium and experiential segments, offering exclusive brand consultations and in-store testing. Supermarkets and hypermarkets retain strong traction for mass-market skincare and haircare lines, particularly in Japan and Southeast Asia. Convenience stores play a unique role in Japan’s domestic market, selling travel-size beauty products and trial kits. Direct-to-consumer models and subscription-based skincare boxes are reshaping the J-Beauty retail landscape.

End-Use Insights

Women remain the dominant consumer group, contributing to nearly 68% of the total market in 2024. The popularity of anti-aging and skin-brightening products among women drives consistent demand. However, men’s grooming and skincare are growing rapidly, with a CAGR of over 6% during 2025–2030, driven by the normalization of self-care routines and media influence from K- and J-pop culture. The unisex segment, characterized by gender-neutral packaging and formulations, is gaining traction among younger consumers seeking minimalist, inclusive brands. This evolution reflects shifting cultural perceptions toward self-expression, wellness, and equality in beauty consumption.

| By Product Type | By Formulation | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

The Asia-Pacific region dominates the J-Beauty products market, holding nearly 55% of the global share in 2024. Japan remains the core hub, driven by technological innovation, R&D excellence, and trusted heritage brands such as Shiseido, Kosé, and POLA ORBIS. China, South Korea, and Thailand are rapidly growing export destinations, fueled by rising disposable incomes and demand for high-quality Japanese imports. Expanding e-commerce infrastructure, combined with Japanese government initiatives to promote cosmetic exports, continues to strengthen the region’s dominance.

North America

North America accounts for approximately 18% of the global J-Beauty market in 2024, with the United States being the primary consumer. The region’s demand is driven by rising awareness of Japanese skincare routines, influencer marketing, and clean-beauty movements. Premium skincare products emphasizing hydration, anti-aging, and minimalist formulations are particularly favored among millennials and Gen Z consumers. Retail partnerships with Sephora, Ulta Beauty, and Amazon have further boosted product visibility and accessibility.

Europe

Europe contributes around 15% of the market share, with the U.K., Germany, and France leading in consumption. European consumers value J-Beauty’s sustainability, cruelty-free testing, and ingredient transparency. Skincare and bath & body segments dominate European demand, driven by lifestyle alignment with wellness and slow-beauty trends. Distribution expansion through European beauty retailers and cross-border digital sales continues to shape regional growth.

Latin America

Latin America is emerging as a promising market for J-Beauty products, particularly in Brazil and Mexico, where rising middle-class income and interest in Asian beauty trends are accelerating adoption. Distribution partnerships with regional beauty chains and local influencers are helping Japanese brands enter untapped consumer bases. While currently representing a small share, the region is projected to grow at over 5% CAGR through 2030.

Middle East & Africa

The Middle East & Africa region, led by the UAE, Saudi Arabia, and South Africa, is showing strong potential for J-Beauty expansion. Growing expatriate populations, luxury beauty consumption, and increasing awareness of Japanese skincare rituals are supporting steady market entry. The market aligns with the Middle East’s premium beauty preferences, emphasizing quality and exclusivity. Retail collaborations with leading luxury outlets in Dubai and Riyadh have improved brand accessibility in 2024–2025.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The J-Beauty products market is moderately consolidated, with the top five companies, Shiseido, Kao, Kosé, POLA ORBIS, and Fancl, collectively accounting for approximately 40% of the global market share in 2024. These companies lead across multiple categories, including skincare, cosmetics, and haircare, leveraging advanced R&D capabilities and extensive brand portfolios. Mid-tier players and niche clean-beauty brands are emerging rapidly through D2C channels and social commerce, intensifying competition across product segments.

Key Players in the J-Beauty Products Market

- Shiseido Co., Ltd.

- Kao Corporation

- Kosé Corporation

- POLA ORBIS HOLDINGS INC.

- Fancl Corporation

- Rohto Pharmaceutical Co., Ltd.

- Mandom Corporation

- Lion Corporation

- L’Oréal Groupe

- Unilever plc

Recent Developments

- In September 2025, Shiseido launched its AI-powered skincare diagnostic system in Tokyo, integrating personalized skin analysis with customized product recommendations through mobile apps.

- In August 2025, Kosé Corporation announced its expansion into India, targeting premium retail and e-commerce segments for skincare and cosmetics.

- In May 2025, Fancl Corporation introduced its “Zero Preservative” clean-beauty range in Southeast Asia, emphasizing natural formulations and eco-conscious packaging.