Clean Beauty Market Size

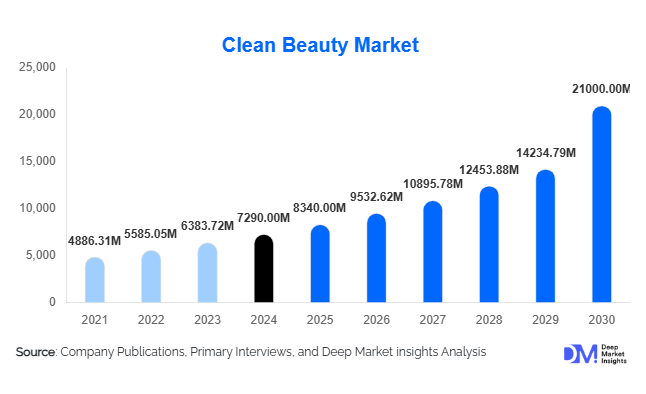

According to Deep Market Insights, the global clean beauty market size was valued at USD 7,290 million in 2024 and is projected to grow from USD 8,340 million in 2025 to reach USD 21,000 million by 2030, expanding at a CAGR of 14.3% during the forecast period (2025–2030). The clean beauty market growth is primarily driven by increasing consumer demand for non-toxic, sustainable, and ethically produced beauty products, rising awareness of harmful ingredients in traditional cosmetics, and the expansion of eco-conscious offerings by established brands.

Key Market Insights

- Skincare dominates the market, as consumers increasingly prefer natural and organic formulations that promote skin health and are free of harmful chemicals.

- Haircare products are witnessing rapid adoption, particularly sulfate-free and paraben-free formulations, driven by awareness of scalp and hair wellness.

- Color cosmetics and fragrances are expanding, with younger demographics seeking both ethical and vibrant product options.

- North America accounts for the largest market share, led by strong consumer awareness, regulatory compliance, and high disposable incomes.

- Europe is emerging as the fastest-growing region, influenced by strict cosmetic regulations, sustainability mandates, and eco-conscious consumer trends.

- Technological innovation, including biotech formulations, eco-friendly packaging, and digital marketing platforms, is accelerating product development and consumer engagement.

Latest Market Trends

Rise of Ethical and Sustainable Formulations

Brands are increasingly reformulating products to eliminate harmful chemicals, synthetic fragrances, and parabens. Eco-conscious packaging, cruelty-free certification, and organic ingredients are becoming standard requirements for consumer acceptance. Clean beauty products are now marketed with transparency, providing complete ingredient disclosure, sustainable sourcing information, and environmental impact data, reinforcing consumer trust and brand loyalty.

Integration of Biotechnology and Sustainable Innovations

Companies are leveraging biotechnology to create more effective natural ingredients, such as plant-based actives and lab-grown alternatives to animal-derived components. Innovative delivery systems enhance product efficacy while maintaining ethical standards. Digital tools like AI-assisted formulation and predictive analytics in consumer preference tracking are increasingly adopted, enabling precise targeting of clean beauty products to high-demand segments.

Clean Beauty Market Drivers

Rising Consumer Awareness and Demand for Transparency

Consumers are actively seeking products with clear labels, non-toxic ingredients, and ethically sourced components. This preference has pressured brands to offer formulations that are not only safe but also align with social and environmental values, driving repeat purchase behavior.

Environmental Sustainability Trends

Eco-conscious consumers are influencing the adoption of recyclable packaging, refillable containers, and cruelty-free testing protocols. Clean beauty brands are positioning themselves as environmentally responsible alternatives, appealing to consumers who prioritize green practices alongside product performance.

Influence of Social Media and Beauty Influencers

Social media platforms and influencer marketing have heightened visibility for clean beauty trends. Younger demographics, particularly Gen Z and Millennials, rely on reviews, tutorials, and endorsements when selecting products, accelerating the growth of ethically formulated and visually appealing clean beauty products.

Market Restraints

High Production Costs

Natural and organic ingredients are costlier than synthetic alternatives, leading to higher retail prices. This can limit adoption among price-sensitive consumers and pose challenges for market penetration in emerging regions.

Lack of Standardized Definitions

The absence of universally recognized definitions for terms like “clean,” “organic,” and “natural” can create consumer confusion and skepticism. Establishing certifications and standards is essential for consistent product labeling and trust-building in the market.

Clean Beauty Market Opportunities

Expansion into Emerging Markets

Asia-Pacific and Latin America offer significant growth potential due to expanding middle-class populations and increasing preference for sustainable, ethical products. Tailoring formulations to regional preferences and marketing culturally relevant campaigns can drive adoption in these markets.

Technological Integration in Product Development

Advancements in biotechnology, sustainable sourcing, and AI-driven analytics offer opportunities for companies to develop innovative products with better performance and minimal environmental impact. This can differentiate brands and strengthen market positioning globally.

Regulatory Advancements and Compliance

As governments introduce stricter regulations for ingredient safety, brands that comply early can capture consumer trust and gain a competitive edge. Transparent labeling, eco-certifications, and cruelty-free practices are becoming key differentiators.

Product Type Insights

Skincare dominates the market, accounting for the largest share due to heightened consumer focus on safe, effective, and natural ingredients. Haircare is rapidly growing with paraben-free and sulfate-free products. Color cosmetics and fragrances are also gaining traction as younger consumers prioritize ethical formulations without compromising aesthetics.

Application Insights

Individual consumers remain the largest end-use segment, with growing adoption in salons and spas. Personalized skincare routines, at-home treatments, and ethical beauty kits are expanding market opportunities. The rise of subscription-based and D2C models further fuels product accessibility and adoption.

Distribution Channel Insights

Online platforms, including e-commerce and D2C websites, dominate sales by offering convenience, transparency, and product education. Retail stores and specialty boutiques continue to attract premium customers seeking in-person experiences. Social media marketing and influencer endorsements are increasingly shaping purchasing decisions.

| By Product Type | By Application / End-Use | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share (35% in 2024), led by the U.S., driven by high consumer awareness, stringent regulations, and established brand presence. Canada shows growing adoption in eco-conscious urban centers.

Europe

Europe is growing rapidly (28% market share in 2024), with France, Germany, and the U.K. leading demand for certified clean beauty products. Strict cosmetic regulations and strong sustainability trends drive growth.

Asia-Pacific

APAC is the fastest-growing region, led by China, South Korea, and Japan. Rising middle-class populations, urbanization, and social media influence are driving adoption. Demand for ethical skincare and haircare is rising rapidly.

Latin America

Brazil and Mexico are the key markets, with increasing interest in natural and ethical formulations. Middle-class growth and urban retail expansion support market adoption.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, shows rising demand for premium clean beauty products. Africa is gradually emerging, with South Africa leading adoption due to urban consumer awareness and cosmetic regulations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Clean Beauty Market

- Estée Lauder Companies

- L'Oréal

- Unilever

- Procter & Gamble

- Coty Inc.

- Shiseido Company

- Beiersdorf AG

- Revlon

- Amorepacific

- Herbalife

- Johnson & Johnson

- Kao Corporation

- Clarins Group

- Avon Products

- Oriflame Cosmetics

Recent Developments

- In 2025, Estée Lauder launched a new line of lab-grown ingredient-based clean skincare products, emphasizing sustainability and ingredient transparency.

- In 2025, L’Oréal expanded its vegan and cruelty-free product portfolio in Europe, complying with stricter EU cosmetic regulations.

- In 2024, Unilever committed to 100% recyclable and biodegradable packaging for its personal care brands, reinforcing its clean beauty positioning globally.