Probiotic Cosmetic Products Market Size

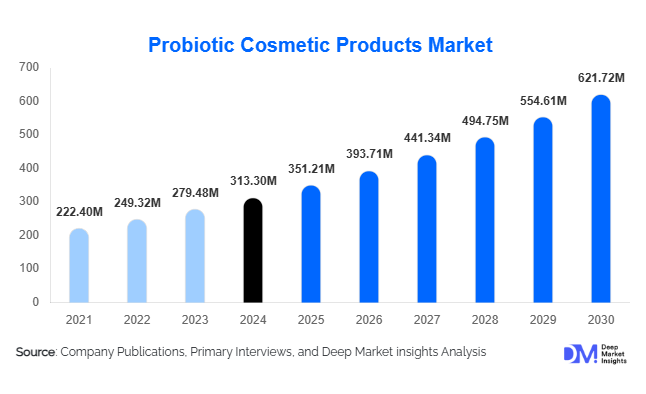

According to Deep Market Insights, the global probiotic cosmetic products market size was valued at USD 313.3 million in 2024 and is projected to grow from USD 351.21 million in 2025 to reach USD 621.72 million by 2030, expanding at a CAGR of 12.1% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer awareness of skin health, growing preference for natural and organic skincare, and advancements in microbiome research that enable innovative probiotic-infused formulations.

Key Market Insights

- Skincare remains the dominant application segment, accounting for the largest share of the market due to the popularity of probiotic creams, serums, and lotions that address acne, aging, and sensitive skin.

- Hair care is emerging rapidly as consumers recognize probiotic shampoos and conditioners for scalp health and hair quality improvement.

- North America holds a major market share, with the U.S. leading due to high consumer awareness and adoption of innovative cosmetic solutions.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes and urbanization in China, Japan, and South Korea.

- Technological integration in product development, including advanced microbiome research and biotechnology, is reshaping the product landscape with personalized and targeted probiotic skincare solutions.

- Online and direct-to-consumer channels are increasingly influential in driving adoption, particularly among younger, digitally engaged demographics.

Latest Market Trends

Rise of Natural and Microbiome-Friendly Skincare

Probiotic cosmetic products are benefiting from the global trend toward natural and microbiome-friendly skincare. Consumers are seeking formulations free from harsh chemicals and enriched with beneficial bacteria to promote skin health. Brands are emphasizing transparency in ingredients and highlighting scientifically-backed probiotic benefits, strengthening consumer trust. In addition, personalized skincare solutions leveraging skin microbiome insights are gaining traction, enabling products tailored to individual skin types and concerns.

Expansion of Hair Care Applications

Probiotic-based hair care products are emerging as a high-growth segment, with shampoos, conditioners, and scalp treatments being adopted to reduce irritation, maintain healthy scalp flora, and improve hair texture. Innovative formulations targeting scalp microbiome balance are attracting attention from wellness-focused and eco-conscious consumers, driving demand for specialized hair care ranges globally.

Probiotic Cosmetic Products Market Drivers

Growing Preference for Natural and Organic Ingredients

Consumers increasingly prioritize products containing natural and organic ingredients, avoiding synthetic chemicals that can harm the skin. Probiotic cosmetics, with their natural, skin-friendly formulations, align perfectly with this trend, leading to higher adoption rates.

Advancements in Microbiome Research

Scientific advancements have enhanced understanding of the skin microbiome, highlighting the importance of maintaining microbial balance for healthy skin. Probiotic cosmetics that restore and protect this balance are becoming highly desirable, driving market expansion.

Increased Consumer Awareness of Skin Wellness

Rising awareness about the effects of skincare on overall health has prompted consumers to choose products that promote long-term skin wellness. Probiotic cosmetic products are benefiting from this shift as effective alternatives to traditional chemical-based products.

Market Restraints

High Production Costs

The complex manufacturing processes and specialized probiotic ingredients contribute to higher production costs. These costs often translate to premium pricing, limiting accessibility for a wider consumer base.

Regulatory Challenges

Inconsistent regulations across regions regarding probiotic labeling, safety, and efficacy pose challenges to global commercialization. Companies need to navigate these hurdles to ensure compliance while maintaining product quality and efficacy.

Probiotic Cosmetic Products Market Opportunities

Integration of Advanced Biotechnology

Biotechnology advancements allow the development of more targeted probiotic skincare products. Companies leveraging genetic engineering and microbiome research can create formulations addressing specific skin concerns such as aging, sensitivity, and acne, providing competitive differentiation and attracting health-conscious consumers.

Expansion into Emerging Markets

Regions like Asia-Pacific offer untapped potential due to increasing urbanization, disposable incomes, and rising awareness of skincare benefits. Strategic entry into these markets allows brands to capture growing consumer demand and establish a strong regional presence.

Personalized Skincare Solutions

Personalization is a growing trend, with consumers seeking skincare products tailored to their individual skin types and microbiome profiles. Data-driven insights enable brands to deliver customized probiotic products, enhancing consumer satisfaction and brand loyalty.

Product Type Insights

Skincare products dominate the market, contributing over 55% of the total 2024 market revenue due to their wide-ranging applications in creams, serums, and lotions. Hair care products are rapidly gaining traction, especially probiotic shampoos and conditioners that target scalp health. Body care and bath products also contribute to the market, but at smaller volumes compared to skincare and hair care categories.

Application Insights

Skincare remains the most popular application, addressing acne, aging, and sensitive skin. Hair care is growing fast, with probiotic formulations promoting scalp health. Body care applications, including creams and bath products, are emerging as niche categories. The rising interest in personalized formulations, such as microbiome-based creams, is expanding opportunities across all applications.

Distribution Channel Insights

Online platforms, e-commerce, and D2C websites are increasingly dominant, providing real-time product information, reviews, and convenient purchase options. Retail chains, specialty cosmetic stores, and salons remain important offline channels, particularly for premium and experiential probiotic products. Influencer marketing and social media campaigns are shaping buying decisions, especially among younger consumers.

End-Use Insights

The personal care and wellness industry represents the primary end-use sector. Skincare enthusiasts and wellness-focused consumers are driving growth. The hair care segment is an emerging end-use category, with increasing demand for scalp-friendly products. Export demand is rising, particularly from the U.S., Germany, and Japan, where consumers are adopting innovative probiotic solutions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 35% of the global market, led by the U.S., where high consumer awareness, advanced retail infrastructure, and adoption of innovative formulations drive demand. Consumers increasingly prefer microbiome-friendly skincare products, contributing to steady growth.

Europe

Europe accounts for 28% of the global market. Germany and France are key contributors, with consumers emphasizing natural, organic, and efficacy-backed probiotic products. Sustainable product trends and high skin health awareness drive adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region due to rising disposable income, urbanization, and increasing awareness of skin wellness. China, Japan, and South Korea are leading markets, driving the adoption of both skincare and hair care probiotic products.

Latin America

Brazil and Mexico are emerging markets, showing growing interest in personal care products. Affluent consumers are increasingly purchasing probiotic cosmetics, while niche e-commerce channels are expanding market reach.

Middle East & Africa

Gradual growth is observed due to rising awareness of natural ingredients and skincare benefits. The UAE and South Africa are key markets, with a focus on premium and natural probiotic products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Probiotic Cosmetic Products Market

- Amorepacific Corporation

- L'Oréal

- Unilever

- Beiersdorf AG

- Shiseido Company

- Probi AB

- Danone Nutricia

- Yakult Honsha Co., Ltd.

- Mother Sparsh

- Givaudan

- Evonik Industries

- Chr. Hansen Holding A/S

- BioGaia

- Estée Lauder Companies

- GlaxoSmithKline

Recent Developments

- March 2025: Amorepacific launched a new probiotic serum line targeting anti-aging and sensitive skin in the U.S. and Asia-Pacific.

- January 2025: L'Oréal introduced microbiome-based skincare products in Europe, emphasizing personalization and natural ingredients.

- November 2024: Beiersdorf expanded its probiotic skincare portfolio, integrating microbiome-friendly ingredients into existing body and facial care ranges.