IQF Meat and Poultry Market Size

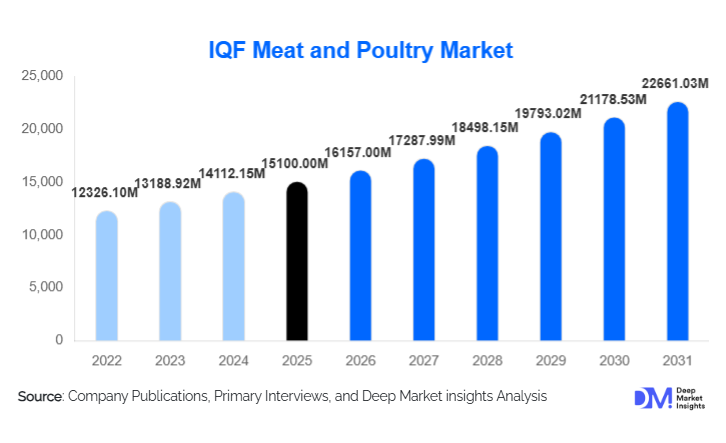

According to Deep Market Insights, the global IQF meat and poultry market size was valued at USD 15,100 million in 2025 and is projected to grow from USD 16,157 million in 2026 to reach USD 22,661.03 million by 2031, expanding at a CAGR of 7.0% during the forecast period (2026–2031). The market growth is primarily driven by rising consumer demand for convenience foods, increasing adoption of advanced freezing technologies, and the expansion of retail and foodservice channels for individually quick-frozen meat products.

Key Market Insights

- Poultry dominates the market, accounting for 55% of the global IQF meat market in 2024, led by chicken due to affordability, ease of preparation, and nutritional value.

- Retail packaging is the leading format, representing 42% of market share, fueled by growing online grocery penetration and demand for portion-controlled products in households.

- Foodservice is the largest end-use segment, contributing 45% of total demand as restaurants and catering businesses rely on IQF meat for consistent quality and portion management.

- North America holds 30% of the market, supported by high per capita meat consumption, advanced cold chain infrastructure, and technology adoption.

- Asia Pacific is the fastest-growing region, driven by rising disposable incomes, urbanization, and expanding modern retail in China, India, and Southeast Asia.

- Technological integration, such as cryogenic freezing, spiral freezers, and blockchain-enabled traceability, is enhancing product quality, reducing waste, and improving supply chain transparency.

What are the latest trends in the IQF meat and poultry market?

Rising Demand for Convenience and Ready-to-Cook Products

Consumers are increasingly seeking easy-to-prepare and portion-controlled protein options, making IQF meat a preferred choice. Pre-portioned boneless cuts, marinated IQF products, and ready-to-cook packs are gaining traction in retail and online channels. This trend is particularly strong among working professionals, nuclear families, and urban populations, where convenience and time-saving solutions are key drivers.

Technological Advancements in Freezing and Cold Chain

Innovations such as cryogenic freezing, high-speed spiral freezers, and vacuum packaging with modified atmospheres are improving product quality, extending shelf life, and minimizing spoilage. AI-enabled monitoring, cold chain optimization, and blockchain-based traceability solutions are increasingly adopted to ensure compliance with global food safety standards. Such technological adoption is reshaping competitive dynamics in the market and improving operational efficiency for manufacturers.

What are the key drivers in the IQF meat and poultry market?

Growth in Global Meat and Poultry Consumption

Rising population, urbanization, and disposable incomes are driving higher meat and poultry consumption, particularly in emerging economies. Chicken and poultry products are preferred due to affordability and lower fat content compared to red meats. IQF technology allows manufacturers to meet increasing demand efficiently, with reduced wastage and consistent quality across domestic and export markets.

Adoption of Modern Retail and Online Channels

Supermarkets, hypermarkets, and e-commerce platforms are expanding frozen food offerings, enabling wider availability of IQF meat products. Retailers are increasingly stocking portion-controlled packs and pre-marinated products to cater to consumer demand for convenience and high-quality frozen proteins. The trend is further supported by rising online grocery adoption and home delivery services.

What are the restraints for the global market?

High Capital and Operational Costs

The IQF process requires significant investment in freezing equipment, storage facilities, and skilled labor. High CapEx and operational costs pose barriers for small and medium-sized enterprises to enter or scale efficiently in the market.

Regulatory and Compliance Challenges

Stringent food safety regulations, import/export certifications, and regional variations in standards increase compliance costs. Companies operating in multiple geographies must navigate complex regulatory frameworks, which can slow expansion and increase operational risks.

What are the key opportunities in the IQF meat and poultry market?

Expansion in Emerging Markets

Emerging economies in the Asia Pacific, Latin America, and the Middle East present significant growth potential. Rising incomes, urbanization, and modern retail expansion in countries such as China, India, and Brazil create strong demand for frozen meat products. Companies can establish local production and distribution networks to capture early market share and reduce logistics costs.

Integration of Advanced Freezing Technologies

Implementing cryogenic freezing, spiral freezers, and AI-enabled monitoring enhances product quality, reduces wastage, and increases operational efficiency. Companies adopting smart cold chain solutions, including blockchain-based traceability, can differentiate through superior product safety and transparency, gaining a competitive edge.

Health & Convenience-Focused Product Innovation

Consumers increasingly seek high-protein, low-fat, and minimally processed options. IQF meat aligns with these trends, and innovation in ready-to-cook, pre-marinated, and single-serve packs is expanding market appeal. Product diversification targeting health-conscious and convenience-seeking segments can drive premium pricing and brand loyalty.

Product Type Insights

Poultry, particularly chicken, dominates the IQF meat market with 55% share in 2024. Its affordability, high nutritional content, and versatility for retail and foodservice applications make it the leading product. Red meats such as beef and pork are also significant but face slower growth due to higher costs and processing requirements. Game and exotic meats constitute niche segments for premium and gourmet applications, often targeting high-income urban consumers or specialty restaurants.

Application Insights

Foodservice is the largest application segment, accounting for 45% of global demand. Restaurants, hotels, and catering services rely on IQF meat for portion-controlled, consistent-quality products. Retail and e-commerce channels are expanding rapidly, offering convenience-focused packs to households. The processing industry, including ready-to-eat and frozen meals, is another major application, leveraging IQF meat for efficient production and extended shelf life. Institutional use in schools, hospitals, and airlines is also rising due to standardized portions and quality control benefits.

Distribution Channel Insights

Modern trade dominates the distribution landscape, with supermarkets and hypermarkets representing 50% of total market sales. E-commerce channels are rapidly growing, supported by increasing online grocery adoption. Direct B2B distribution to institutional clients ensures consistent supply and operational efficiency. Retailers and manufacturers are integrating digital ordering, subscription models, and home delivery services to expand reach and improve consumer convenience.

| By Product Type | By Cut Type | By Packaging Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 30% of the global IQF meat market. High per capita meat consumption, mature cold chain infrastructure, and technology adoption support strong demand. The U.S. is the largest contributor within the region, driven by poultry consumption and modern retail adoption.

Europe

Europe holds 25% of the market, with Germany, the U.K., and France leading demand. Consumers prefer convenience, quality, and sustainability, driving growth in IQF meat for retail and foodservice. Advanced cold chain systems further support market penetration.

Asia-Pacific

Asia-Pacific is the fastest-growing region. China and India are driving demand due to rising disposable incomes, urbanization, and growing foodservice and retail infrastructure. E-commerce penetration and modern retail expansion accelerate access to IQF meat products.

Latin America

Brazil, Argentina, and Mexico show increasing adoption of IQF meat, particularly in urban centers. Rising consumer awareness, modern retail expansion, and growing foodservice demand are fueling growth in the region.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is witnessing rising demand driven by high-income consumers and strong foodservice channels. Africa remains a supply hub, with regional markets growing slowly but steadily due to improved cold chain infrastructure and retail expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the IQF Meat and Poultry Market

- Tyson Foods

- JBS S.A.

- CP Kelco

- BRF S.A.

- Foster Farms

- Perdue Farms

- Sanderson Farms

- Hormel Foods

- OSI Group

- Marfrig Global Foods

- Vion Food Group

- Smithfield Foods

- CP Foods

- East Balt

- Golden State Foods