Intimate Wear Market Size

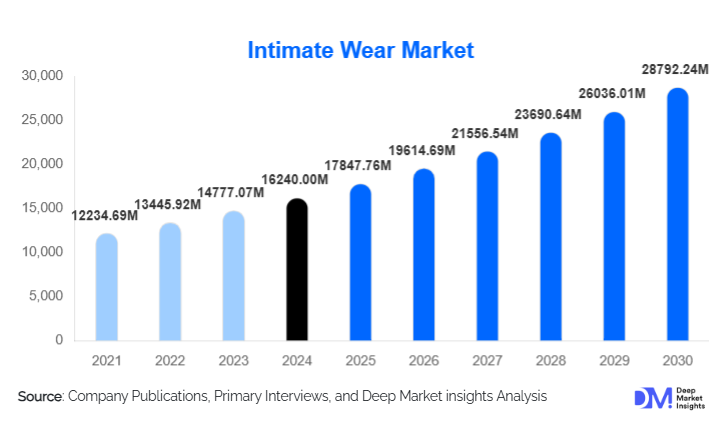

According to Deep Market Insights, the global intimate wear market size was valued at USD 16,240.00 million in 2024 and is projected to grow from USD 17,847.76 million in 2025 to reach USD 28,792.24 million by 2030, expanding at a CAGR of 9.9% during the forecast period (2025–2030). The intimate wear market growth is primarily driven by rising consumer focus on comfort and wellness, increasing participation of women in the global workforce, rapid penetration of e-commerce and direct-to-consumer brands, and continuous innovation in fabric technology and inclusive sizing.

Key Market Insights

- Comfort-driven and wellness-oriented intimate wear is reshaping product design, with strong demand for seamless, breathable, and functional innerwear.

- Women’s intimate wear dominates the market, accounting for over 60% of global demand, supported by higher product variety and frequent replacement cycles.

- Asia-Pacific leads global consumption, driven by China and India, while also serving as the largest manufacturing and export hub.

- Online and DTC channels are the fastest-growing distribution modes, transforming brand engagement, pricing transparency, and consumer reach.

- Sustainable and eco-friendly fabrics are emerging as a key differentiation strategy, particularly in Europe and North America.

- Men’s and gender-neutral intimate wear is gaining traction, supported by changing fashion norms and lifestyle branding.

What are the latest trends in the intimate wear market?

Shift Toward Comfort, Athleisure, and Lifestyle Innerwear

The intimate wear market is witnessing a strong shift from purely functional products toward lifestyle-oriented innerwear that blends comfort, aesthetics, and versatility. Consumers increasingly prefer wireless bras, bralettes, soft shapewear, and loungewear that can be worn throughout the day. The growing popularity of athleisure has accelerated demand for sports bras and multi-functional innerwear that supports both active and casual use. This trend is particularly strong among millennials and Gen Z consumers, who prioritize comfort, flexibility, and everyday usability over traditional structured designs.

Technology-Driven Fabric and Fit Innovations

Advancements in textile engineering are transforming intimate wear offerings. Moisture-wicking, anti-bacterial, temperature-regulating, and seamless knitting technologies are increasingly being integrated into products. Brands are also leveraging AI-based sizing tools, virtual try-ons, and data-driven fit optimization to improve customer satisfaction and reduce return rates, particularly in online channels. Smart manufacturing and automation are enabling faster design cycles and improved consistency across global supply chains.

What are the key drivers in the intimate wear market?

Rising Focus on Comfort, Health, and Body Positivity

Consumers globally are placing greater emphasis on comfort, health, and self-expression, driving demand for intimate wear that supports diverse body types and lifestyles. Body-positive marketing, inclusive sizing, and adaptive designs have expanded the addressable consumer base. This driver is particularly strong in women’s intimate wear, where comfort-focused innovations such as wireless bras and soft shapewear are replacing traditional rigid designs.

Expansion of E-commerce and Digital-First Brands

The rapid growth of e-commerce has significantly boosted market accessibility. Digital-first intimate wear brands are disrupting traditional retail by offering competitive pricing, customization, and direct consumer engagement. Online platforms enable brands to reach underserved regions, offer broader size ranges, and collect consumer insights that inform product development. This driver has been especially impactful in Asia-Pacific and Latin America, where organized offline retail penetration remains uneven.

What are the restraints for the global market?

Price Sensitivity and Competition from Unorganized Players

In developing markets, price sensitivity remains a key challenge. Local and unorganized manufacturers offer low-cost alternatives, limiting premium brand penetration and pressuring margins. Consumers in these regions often prioritize affordability over branding, slowing the adoption of higher-priced products.

Volatility in Raw Material Prices

Fluctuations in cotton and synthetic fiber prices directly impact production costs and pricing strategies. Rising compliance and sustainability-related costs further increase operational complexity for manufacturers, posing challenges to maintaining profitability while remaining price-competitive.

What are the key opportunities in the intimate wear industry?

Sustainable and Eco-Friendly Intimate Wear

Growing environmental awareness presents significant opportunities for brands offering organic, recycled, and biodegradable fabrics. Sustainable intimate wear commands premium pricing and strong brand loyalty, particularly in Europe and North America. Regulatory pressure on textile sustainability further enhances this opportunity.

Untapped Demand in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and the Middle East offer substantial growth potential. Rising urbanization, increasing disposable income, and expanding organized retail are driving the first-time adoption of branded intimate wear. Localization of designs, sizing, and pricing strategies can unlock large volumes of new demand.

Product Type Insights

Bras represent the largest product segment, accounting for approximately 34% of the global intimate wear market in 2024, driven by continuous innovation and broad usage across demographics. Panties form the second-largest segment, supported by high replacement frequency and mass-market demand. Shapewear is one of the fastest-growing segments, fueled by rising demand for body-contouring and post-surgical products. Loungewear and sleepwear are gaining prominence as consumers increasingly blur the lines between innerwear and casual home apparel. Men’s intimate wear continues to expand steadily, supported by branding and comfort-driven product innovation.

Application (Usage) Insights

Everyday wear dominates the market, accounting for over 55% of total demand due to routine usage and consistent replacement cycles. Sports and active-use intimate wear is the fastest-growing application, driven by global fitness trends and athleisure adoption. Occasion wear, including premium lingerie and shapewear, contributes higher margins despite lower volumes. Medical and post-surgical intimate wear is emerging as a niche but growing application, particularly in developed healthcare markets.

Distribution Channel Insights

Offline retail remains the dominant distribution channel, accounting for nearly 58% of global sales in 2024, supported by specialty lingerie stores and department stores where fitting and brand experience are critical. However, online channels are expanding rapidly, driven by brand-owned websites and e-commerce marketplaces. Direct-to-consumer models are gaining traction, enabling better margins, data-driven personalization, and stronger customer relationships.

Gender Insights

Women’s intimate wear accounts for approximately 62% of the global market, driven by broader product portfolios, higher fashion orientation, and frequent purchasing behavior. Men’s intimate wear holds a significant share and continues to grow steadily, supported by premiumization and comfort-driven branding. Unisex intimate wear remains a smaller but emerging segment, aligned with inclusive fashion trends.

| By Product Type | By Gender | By Price Point | By Material Type | By Usage Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global intimate wear market with approximately 38% share in 2024. China is the largest contributor, driven by domestic consumption and export-oriented manufacturing, while India is the fastest-growing major market with double-digit growth supported by urbanization and organized retail expansion.

North America

North America accounts for around 27% of global demand, led by the United States. High disposable income, premium brand adoption, and strong DTC penetration support market growth, particularly in women’s and shapewear categories.

Europe

Europe holds nearly 22% of the market, with strong demand from Germany, the U.K., France, and Italy. Sustainability-focused purchasing behavior and regulatory standards are shaping innovation and material choices across the region.

Latin America

Latin America contributes about 7% of global demand, led by Brazil and Mexico. Rising middle-class populations and growing awareness of branded intimate wear are driving steady growth.

Middle East & Africa

The Middle East & Africa region accounts for approximately 6% of the market. The UAE and Saudi Arabia lead demand for premium intimate wear, while Africa serves as a growing manufacturing and export base.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Intimate Wear Market

- Victoria’s Secret

- Hanesbrands Inc.

- PVH Corp.

- Triumph International

- Jockey International

- Wacoal Holdings

- Marks & Spencer

- Calvin Klein

- Chantelle Group

- American Eagle (Aerie)

- Fruit of the Loom

- Spanx

- La Perla

- Cosabella

- MAS Holdings