Interactive Streaming Market Size

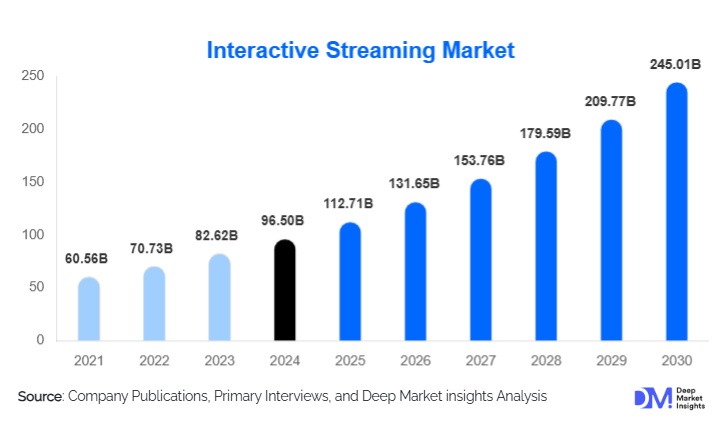

According to Deep Market Insights, the global interactive streaming market size was valued at USD 96.5 billion in 2024 and is projected to grow from USD 112.71 billion in 2025 to reach approximately USD 245.01 billion by 2030, expanding at a robust CAGR of 16.8% during the forecast period (2025–2030). The interactive streaming market growth is driven by the rapid shift from passive content consumption to real-time, participatory digital experiences, rising adoption of live commerce and gaming streams, and increasing monetization opportunities within the global creator economy.

Key Market Insights

- Live interactive streaming dominates the market, accounting for nearly half of global revenue due to strong demand from gaming, social media, and live events.

- Mobile-first platforms lead consumption, supported by smartphone penetration and 5G rollout across Asia-Pacific and emerging markets.

- Asia-Pacific is the largest regional market, driven by large-scale adoption of live commerce and social streaming ecosystems in China and Southeast Asia.

- North America remains a technology and monetization hub, with strong advertising revenues and creator-led platforms.

- Hybrid monetization models are gaining traction, combining advertising, subscriptions, and transaction-based revenue streams.

- AI-driven personalization and immersive technologies are reshaping user engagement and platform differentiation.

What are the latest trends in the interactive streaming market?

Rapid Expansion of Live Commerce Streaming

Live commerce has emerged as one of the most influential trends within the interactive streaming market. Real-time product demonstrations combined with instant purchasing capabilities are significantly improving conversion rates compared to traditional e-commerce formats. Influencer-led shopping streams, limited-time offers, and interactive Q&A sessions are driving strong engagement, particularly in Asia-Pacific. Retailers are increasingly integrating interactive streaming into omnichannel strategies, using live formats to bridge online and offline commerce. As payment infrastructure and logistics improve globally, live commerce streaming is expanding into North America, Europe, and the Middle East, creating a new high-growth revenue vertical.

Technology-Driven Personalization and Immersion

Advanced technologies such as artificial intelligence, augmented reality, and cloud-based streaming are transforming interactive experiences. AI-powered recommendation engines personalize content in real time, while AR features enable virtual try-ons and immersive overlays during live streams. Low-latency cloud infrastructure and edge computing are improving stream quality and interaction speed, enhancing user satisfaction. These innovations are particularly attractive to younger, digitally native audiences who prioritize immersive, customizable experiences over static video consumption.

What are the key drivers in the interactive streaming market?

Rising Demand for Real-Time Engagement

Consumers increasingly favor real-time interaction over passive viewing, driving demand for features such as live chat, polls, reactions, and gamification. These capabilities significantly increase user retention, session duration, and monetization potential for platforms. Brands and creators are leveraging interactive formats to build communities and foster deeper audience relationships.

Growth of the Global Creator Economy

The expansion of the creator economy is a major growth driver for interactive streaming. Independent creators, gamers, and influencers rely on live interaction to monetize content through subscriptions, tipping, sponsorships, and live commerce commissions. Platforms that provide robust creator tools and analytics are experiencing accelerated adoption and revenue growth.

Advancements in Network Infrastructure

The global rollout of 5G networks and improvements in broadband connectivity are enabling seamless, low-latency interactive streaming. Enhanced infrastructure supports higher-quality video, real-time interactivity, and scalability across regions, particularly in emerging markets.

What are the restraints for the global market?

High Infrastructure and Operating Costs

Interactive streaming platforms require significant investment in cloud infrastructure, content delivery networks, and moderation technologies. These costs can pressure margins, especially for smaller or emerging players, and may slow market entry in cost-sensitive regions.

Regulatory and Data Privacy Challenges

Increasing regulations related to data protection, content moderation, and digital payments vary across regions and create compliance complexity for global platforms. Navigating these regulatory frameworks remains a key challenge for sustained expansion.

What are the key opportunities in the interactive streaming industry?

Enterprise and Institutional Adoption

Enterprises and institutions are increasingly adopting interactive streaming for virtual events, employee training, education, and customer engagement. These applications offer stable, subscription-based revenue opportunities and reduce dependence on advertising-driven models.

Integration of Immersive Technologies

The integration of AR, VR, and AI presents significant opportunities for differentiation and premium monetization. Immersive interactive streaming is expanding beyond gaming into retail, education, and corporate training, enabling new use cases and revenue streams.

Content Format Insights

Live interactive streaming leads the market, accounting for approximately 46% of global revenue in 2024, driven by gaming, live events, and influencer engagement. On-demand interactive streaming holds a significant share by offering flexible consumption combined with interactive elements. Hybrid formats that blend live and on-demand content are gaining popularity as platforms seek to maximize engagement and content reuse.

Interaction Type Insights

Real-time audience interaction dominates the market with nearly 38% share, supported by live chats, polls, and reactions. Gamified interactions are growing rapidly, particularly in gaming and education, while transactional interactions such as tipping and live shopping are emerging as high-revenue segments.

Monetization Model Insights

Advertising-supported interactive streaming remains the largest monetization model, accounting for around 41% of market revenue in 2024. Subscription-based models provide recurring income, while transaction-based monetization is expanding rapidly due to live commerce and virtual gifting. Hybrid models are increasingly adopted to diversify revenue streams.

End-Use Industry Insights

Media and entertainment represent the largest end-use segment with approximately 34% market share. Gaming and esports are the fastest-growing segments, expanding at over 18% CAGR. Retail and e-commerce live streaming is emerging as a major growth engine, while education and enterprise applications are gaining traction due to recurring demand.

| By Content Format | By Interaction Type | By Platform Type | By Monetization Model | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for approximately 42% of the global interactive streaming market in 2024, led by China, India, Japan, and South Korea. The region benefits from large mobile-first user bases, strong live commerce adoption, and integrated digital payment ecosystems.

North America

North America holds around 27% market share, driven by the U.S. creator economy, advanced advertising markets, and high ARPU levels. The region is a leader in platform innovation and AI adoption.

Europe

Europe represents about 18% of global demand, supported by strong digital infrastructure and growing adoption of interactive formats in media, education, and enterprise communication.

Latin America

Latin America is an emerging growth region, led by Brazil and Mexico, with increasing mobile streaming adoption and social commerce penetration.

Middle East & Africa

The Middle East & Africa region is witnessing steady growth, driven by rising smartphone penetration, youth demographics, and government-led digital transformation initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Interactive Streaming Market

- Amazon

- Meta Platforms

- Tencent

- ByteDance

- Microsoft

- Sony Interactive Entertainment

- Alibaba Group

- Bilibili

- Huya

- Kuaishou

- Netflix

- Discord

- Zoom Video Communications

- Sea Limited