Interactive Childres Books Market Size

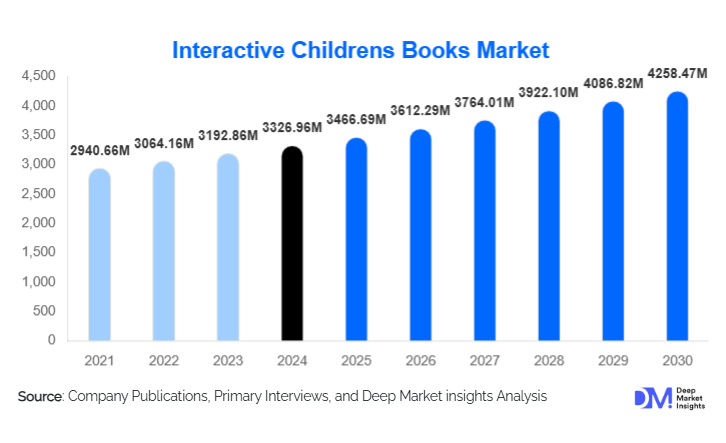

According to Deep Market Insights, the global interactive childrens books market size was valued at USD 3,326.96 million in 2024 and is projected to grow from USD 3,466.69 million in 2025 to reach USD 4,258.47 million by 2030, expanding at a CAGR of 4.20% during the forecast period (2025–2030). Market growth is driven by the rise of digital and hybrid reading formats, increasing parental focus on early literacy and learning engagement, and the rapid integration of AR/VR technologies within children’s educational content.

Key Market Insights

- Digital interactive books dominate the market, accounting for nearly 60% of 2024 global revenues.

- Preschoolers (ages 3–5) represent the largest target demographic, contributing about 35% of the total market share.

- Educational content remains the largest application area, driven by institutional adoption in schools and early-learning centers.

- Online channels lead distribution with around 55% share, supported by e-commerce, app stores, and subscription platforms.

- North America is the largest regional market ( 38% share), while Asia-Pacific is the fastest-growing region with an expected CAGR of 8–10% through 2030.

- AR and VR-enabled formats are creating new revenue streams, combining storytelling with gamified, immersive reading experiences.

What are the latest trends in the Interactive Childrens Books Market?

Technology-Enhanced Reading Experiences

Publishers and edtech companies are incorporating augmented reality (AR), voice narration, and gamification into interactive books. Children can now scan pages to trigger animations, character dialogues, or 3D models. This convergence of storytelling and technology is making reading more immersive and appealing to tech-savvy parents and educators. Companion apps, smart-pen systems, and adaptive reading algorithms are also reshaping how children interact with stories, enabling personalized reading experiences.

Hybrid Print-Digital Formats Gaining Popularity

A growing trend combines tactile print with digital interactivity, such as QR-enabled pages or embedded NFC tags, that unlock songs, puzzles, or augmented scenes. Parents seeking a balance between traditional reading and screen-based learning find hybrid formats appealing, especially for younger children. This hybridization expands publisher reach and encourages repeat purchases via connected apps and updates.

Localization and Multilingual Interactive Content

Emerging markets such as India, China, and Brazil are driving demand for localized, culturally relevant stories. Publishers are releasing interactive titles in local languages and culturally adapted versions of Western classics. This localization trend is broadening the market beyond English-speaking audiences, strengthening growth potential in developing economies.

What are the key drivers in the Interactive Childrens Books Market?

Rising Digital Device Penetration Among Children

With tablets, smartphones, and e-readers becoming household staples, children are increasingly consuming content digitally. Interactive books align naturally with this device environment, combining literacy with play. The result is sustained demand for digital and app-based interactive storybooks globally.

Focus on Early Childhood Education and Literacy

Governments, NGOs, and parents alike emphasize early learning outcomes. Interactive books, offering sound, animation, and touch-based engagement, enhance cognitive development and language skills, aligning perfectly with early-learning frameworks adopted by schools and pre-schools.

Innovation in Publishing and EdTech Collaboration

Major publishers are partnering with edtech firms to develop interactive titles that integrate seamlessly with classroom digital platforms. AI-driven narration, real-time feedback, and progress tracking are transforming books into holistic learning tools.

What are the restraints for the global market?

High Production and Maintenance Costs

Developing advanced interactive content, especially AR/VR-enabled or app-based titles, requires significant investment in design, coding, and updates. Smaller publishers often struggle to manage these costs, slowing overall market expansion.

Screen-Time Concerns Among Parents

Excessive digital exposure for children remains a sensitive issue. Many parents still prefer physical, tactile experiences. As a result, purely digital interactive books face resistance in some markets, moderating growth relative to hybrid print-digital solutions.

What are the key opportunities in the Interactive Childrens Books Industry?

AR/VR-Driven Immersive Storytelling

Augmented and virtual reality integration offers publishers new avenues to transform static pages into fully interactive environments. As hardware costs decline and accessibility improves, immersive reading will redefine storytelling and educational engagement.

Educational Institution Partnerships

Collaborations with schools, libraries, and early-learning centers are a major opportunity. Interactive textbooks and story apps aligned with curricula can secure long-term licensing deals, ensuring recurring revenue and scalability.

Emerging Market Localization

The surge in literacy initiatives across Asia-Pacific, Latin America, and Africa provides strong potential for localized content. Publishers tailoring stories to regional languages and cultural narratives can unlock large, underserved markets.

Product Type Insights

Digital interactive books dominate the market, commanding approximately 60% of total revenues in 2024. Their popularity stems from the growing use of tablets and smart devices among children, the convenience of access, lower distribution costs, and the ability to continuously update and personalize content through apps. Parents and educators also value their portability and integration with digital learning ecosystems, particularly in developed economies. Print interactive books, including pop-up, touch-and-feel, and sound books, maintain a strong foothold among younger readers and caregivers seeking tactile, sensory-based learning experiences that support fine motor development and cognitive engagement. Hybrid AR/VR-enabled formats represent the fastest-growing product segment, fueled by technological innovation, rising affordability of AR-enabled devices, and increasing collaboration between publishers and edtech firms. These formats bridge physical and digital storytelling, transforming reading into an immersive, gamified experience that enhances retention and interactivity.

Application Insights

Educational interactive books remain the dominant application segment, accounting for nearly 50% of total market revenues in 2024. Their dual appeal, combining entertainment with structured learning, drives adoption in both households and educational institutions. Integration with early literacy curricula, adaptive reading levels, and voice-narration features makes these books highly effective tools for language acquisition and comprehension development. Entertainment-focused interactive books also hold a significant share, particularly among parents seeking engaging, screen-based storytelling alternatives to passive media. Activity-based books, including puzzles, crafts, and gamified reading titles, are gaining momentum as repeat-purchase products that reinforce creativity and skill-building, especially in middle-income markets where affordability and educational value are key decision factors.

Distribution Channel Insights

Online distribution continues to dominate with approximately 55% market share in 2024, supported by the expansion of e-commerce platforms, app stores, and subscription-based digital libraries. Convenience, variety, and instant accessibility make online channels particularly appealing to tech-oriented parents. Publishers are leveraging direct-to-consumer (D2C) models and interactive marketing through social media to enhance visibility and user engagement. Offline channels, including bookstores, schools, and libraries, remain essential for print-based interactive titles and institutional adoption. Hybrid distribution models that combine online subscriptions with physical book delivery are emerging as the preferred format for parents who value both tactile and digital experiences, ensuring steady cross-channel demand.

Age Group Insights

The preschool segment (ages 3–5 years) leads the market, capturing around 35% share in 2024. Growth is driven by strong parental focus on early literacy, phonics learning, and cognitive development through multisensory engagement. Digital interactive titles in this category often include read-aloud narration and adaptive learning paths that support preschool curricula. The 6–8 years segment is expanding rapidly, fueled by the gamification of reading and integration with educational apps that combine story comprehension with challenges and rewards. Younger age groups (0–2 years) continue to favor tactile print formats such as cloth and sound books, while older children (9–12 years) increasingly adopt advanced reading platforms featuring customizable avatars, interactive quizzes, and cross-platform learning progression.

| By Product Type | By Application | By Distribution Channel | By Age Group |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the leading market, holding approximately 38% share ( USD 1.2 billion in 2024). The United States dominates, supported by high disposable incomes, widespread access to digital devices, and a mature edtech infrastructure. Canada contributes significantly through public education programs that integrate interactive e-learning tools into classrooms. Key growth drivers include the strong presence of leading publishers such as Scholastic and HarperCollins, expanding school digital reading initiatives, and the high penetration of subscription-based reading apps. The market is expected to maintain a steady CAGR of around 5% through 2030, with continued innovation in hybrid and AR-integrated titles reinforcing its leadership position.

Europe

Europe accounts for roughly 25% of global revenues ( USD 800 million in 2024). The region’s demand is driven by sustainable publishing practices, growing adoption of digital classroom tools, and bilingual education initiatives across the UK, Germany, and France. Regional growth drivers include strong government support for early childhood education, widespread implementation of digital learning frameworks under the EU’s “Digital Education Action Plan,” and rising parental preference for eco-friendly, non-toxic materials in print interactive books. Additionally, increased adoption of AI-narrated and multilingual storybooks aligns with Europe’s emphasis on inclusivity and linguistic diversity.

Asia-Pacific

Asia-Pacific represents about 20% of the market ( USD 640 million in 2024) and is the fastest-growing region, projected to expand at a CAGR of 8–10% through 2030. Regional drivers include massive government investments in digital education (notably in China and India), growing middle-class consumer bases with rising literacy awareness, and expanding smartphone and tablet penetration, enabling affordable access to interactive content. Japan and South Korea lead in technology-driven educational publishing, while India and Southeast Asia are witnessing a surge in localized, vernacular-language story apps that make early learning accessible to broader audiences.

Latin America

Latin America captures around a 10% share ( USD 320 million in 2024). Brazil and Mexico dominate the region, with growing bilingual content adoption and the expansion of online reading platforms. Key growth drivers include national literacy campaigns, government partnerships with international publishers to supply interactive textbooks, and the rising use of low-cost tablets in public schools. The region’s young demographic and expanding internet access are expected to sustain steady growth in the coming years, particularly for Spanish- and Portuguese-language digital storybooks.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for about 7% of the market ( USD 220 million in 2024). While still emerging, MEA is demonstrating strong potential driven by educational reforms and the rapid digitization of learning systems. Growth drivers include government-led smart education initiatives in the GCC (notably the UAE and Saudi Arabia), increasing private school adoption of interactive reading technologies, and the expansion of mobile learning platforms in South Africa and Nigeria. Infrastructure improvements, coupled with growing local-language publishing efforts, are expected to accelerate digital adoption and position MEA as a promising future growth frontier.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Interactive Childrens Books Market

- Scholastic Inc.

- Penguin Random House

- HarperCollins Publishers

- Hachette Livre

- Macmillan Publishers

- Bloomsbury Publishing PLC

- Lerner Publishing Group

- Usborne Publishing Ltd

- TouchPlay Inc.

- Osmo (Part of Byju’s)

- MeeGenius

- Arbordale Publishing

- Koehler Books

- StoryToys

- Highlights for Children

Recent Developments

- June 2025 – Scholastic launched a global AR-enabled storybook series integrating multilingual voice narration for early learners.

- April 2025 – Penguin Random House announced new partnerships with edtech firms to develop interactive e-book apps for schools in Europe and North America.

- February 2025 – Osmo introduced AI-powered reading games linked to tactile storybooks for the 3–8 age group, expanding hybrid learning offerings.