Industrial Starch Market Size

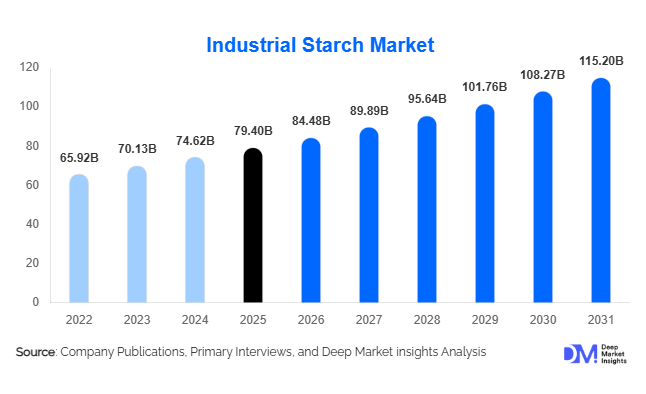

According to Deep Market Insights, the global industrial starch market size was valued at USD 79.4 billion in 2025 and is projected to grow from USD 84.48 billion in 2026 to reach USD 115.20 billion by 2031, expanding at a CAGR of 6.4% during the forecast period (2026–2031). Growth in the industrial starch market is primarily driven by rising demand from the paper & packaging industry, increasing use of modified starches in food processing, and the accelerating shift toward bio-based and renewable raw materials across industrial manufacturing sectors.

Key Market Insights

- Modified industrial starch dominates global demand, supported by its superior functional performance in high-temperature, high-shear, and moisture-sensitive industrial processes.

- Paper & packaging remains the largest end-use industry, accounting for nearly two-fifths of total industrial starch consumption globally.

- Asia-Pacific leads global consumption, driven by large-scale food processing, paper manufacturing, and rapid industrialization in China and India.

- Corn-based starch is the most widely used source, benefiting from high availability, cost efficiency, and strong global agricultural output.

- Sustainability regulations are accelerating substitution of petroleum-based binders and additives with starch-based alternatives.

- Technological advancements in enzymatic modification are enabling higher-value specialty starch applications in pharmaceuticals and bioplastics.

What are the latest trends in the industrial starch market?

Rising Adoption of Bio-Based and Sustainable Materials

One of the most prominent trends shaping the industrial starch market is the accelerating adoption of bio-based materials across manufacturing industries. Industrial starch is increasingly replacing synthetic polymers in paper coatings, adhesives, packaging binders, and molded fiber products due to its biodegradability, renewability, and lower environmental footprint. Regulatory pressure on single-use plastics and petroleum-based chemicals in Europe and North America has further strengthened demand for starch-based alternatives. Manufacturers are investing in sustainable starch formulations that meet performance requirements while supporting circular economy objectives, positioning industrial starch as a strategic material in green manufacturing.

Growing Demand for High-Performance Modified Starches

Modified starches are gaining significant traction as industries demand enhanced functional properties such as improved viscosity stability, thermal resistance, and controlled release behavior. Advances in chemical, physical, and enzymatic modification technologies are enabling starch producers to tailor products for specific industrial applications. This trend is particularly evident in food processing, pharmaceuticals, and specialty adhesives, where consistent performance under demanding processing conditions is critical. As a result, modified starch continues to capture a growing share of total market value compared to native starch.

What are the key drivers in the industrial starch market?

Expansion of the Paper & Packaging Industry

The global expansion of the paper and packaging industry remains the strongest growth driver for industrial starch. Starch is extensively used as a binder, surface sizing agent, and strength enhancer in paperboard, corrugated packaging, and molded fiber products. Growth in e-commerce, food delivery services, and sustainable packaging solutions has significantly increased demand for starch-based paper additives. As packaging producers shift away from synthetic binders, industrial starch consumption continues to rise in both developed and emerging markets.

Rising Processed Food and Beverage Production

Industrial starch plays a critical role in large-scale food processing, supporting functions such as thickening, stabilizing, moisture retention, and texture enhancement. The continued growth of processed foods, ready-to-eat meals, bakery products, and frozen foods—particularly in Asia-Pacific and Latin America—is directly contributing to higher industrial starch demand. Modified starches, in particular, are favored for their ability to maintain consistency and quality during industrial-scale processing.

What are the restraints for the global market?

Volatility in Agricultural Raw Material Prices

Industrial starch production is heavily dependent on agricultural feedstocks such as corn, wheat, cassava, and potatoes. Fluctuations in crop yields due to climate variability, geopolitical trade disruptions, and competing biofuel demand can lead to raw material price volatility. These fluctuations pose margin pressure for starch manufacturers and create uncertainty in long-term pricing strategies.

Competition from Alternative Functional Ingredients

Despite its advantages, industrial starch faces competition from synthetic polymers, gums, and cellulose-based alternatives in certain high-performance applications. In industries requiring extreme durability or chemical resistance, synthetic substitutes may still be preferred, limiting starch penetration in niche industrial uses.

What are the key opportunities in the industrial starch industry?

Growth in Bio-Based Packaging and Bioplastics

The rapid expansion of bio-based packaging and biodegradable plastics presents a significant opportunity for industrial starch producers. Starch-based polymers are increasingly used in compostable films, trays, and molded packaging solutions. As governments introduce stricter plastic regulations, demand for starch-derived biopolymers is expected to accelerate, particularly in Europe and Asia-Pacific.

Emerging Demand from Developing Economies

Industrialization in emerging economies such as India, Vietnam, Indonesia, and Brazil is creating new demand centers for industrial starch. Expansion of food processing, textile manufacturing, and paper production in these regions offers scalable growth opportunities for both global and regional starch producers, supported by improving industrial infrastructure and rising domestic consumption.

Source Type Insights

Corn (maize) starch dominates the global industrial starch market, accounting for approximately 63% of total market value in 2025. Its leadership is driven by abundant global corn production, high starch extraction efficiency, and cost advantages compared to other sources. Wheat and cassava starches hold significant regional importance, particularly in Europe and Latin America, while potato and rice starches are used in specialized applications requiring high purity and specific functional properties.

Product Type Insights

Modified industrial starch represents the largest product segment, contributing nearly 58% of global market value. Its leadership is primarily driven by its superior functional properties, including enhanced thermal stability, controlled viscosity, improved binding strength, and resistance to shear and pH variations. These attributes make modified starch indispensable across high-performance applications such as paper coating, corrugation adhesives, textile sizing, and processed food formulations.

The growing need for process efficiency, consistent product quality, and customized functional performance has further accelerated the adoption of modified starches, particularly in large-scale industrial operations. Meanwhile, native starch continues to maintain relevance in cost-sensitive and low-complexity applications where basic thickening and binding properties are sufficient.Starch derivatives, including dextrins, maltodextrins, and cyclodextrins, are witnessing steadily rising demand due to their expanding use in pharmaceuticals, food processing, nutraceuticals, and specialty industrial applications. Their ability to deliver improved solubility, controlled release, and functional versatility positions them as high-growth sub-segments within the broader industrial starch market.

End-Use Industry Insights

The paper & packaging industry remains the largest end-use segment, accounting for approximately 39% of global industrial starch consumption. Demand is driven by the critical role of starch in paper strength enhancement, surface sizing, coating, and corrugated board production. The rapid growth of e-commerce, rising consumption of sustainable packaging, and increased use of recycled paper have further amplified starch usage across packaging applications.

Food & beverage processing follows closely as a key end-use segment, supported by the rising demand for processed foods, convenience products, and clean-label ingredients. Industrial starch is widely used as a thickener, stabilizer, texturizer, and moisture retention agent in bakery, dairy, sauces, and ready-to-eat food products.Other significant end-use industries include textiles, pharmaceuticals, adhesives, animal feed, and emerging bio-based materials. Growth in these sectors is fueled by increasing adoption of starch as a renewable, biodegradable alternative to synthetic polymers, contributing to diversified and resilient demand across multiple industries.

| By Source Type | By Product Type | By End-Use Industry | By Functionality | By Application Process |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global industrial starch market, accounting for approximately 41% of total market share in 2025. The region’s leadership is underpinned by strong industrial growth, abundant availability of raw materials such as corn, wheat, and cassava, and expanding end-use industries.

China remains the largest consumer, driven by its massive paper manufacturing base, rapidly growing food processing sector, and strong domestic demand for packaging materials. India represents the fastest-growing market in the region, supported by rapid industrialization, population growth, rising packaged food consumption, and government initiatives promoting domestic manufacturing and agro-processing. Additionally, Southeast Asian countries benefit from cassava-based starch production and increasing exports of starch-derived products.

North America

North America accounts for approximately 22% of global industrial starch demand, with the United States serving as the regional growth engine. Market expansion is supported by abundant corn availability, advanced starch processing infrastructure, and continuous innovation in modified and specialty starches.

Strong demand from the paper & packaging and food & beverage industries, coupled with the increasing adoption of bio-based and sustainable materials, continues to drive starch consumption. Additionally, growth in pharmaceutical applications and industrial adhesives further strengthens regional market prospects.

Europe

Europe holds nearly 21% of the global industrial starch market, led by Germany, France, and the Netherlands. The region benefits from a well-established food processing industry, advanced paper manufacturing capabilities, and strong research and development in starch-based innovations.

Stringent environmental regulations and ambitious sustainability targets have accelerated the shift toward bio-based and biodegradable materials, significantly boosting starch usage across industrial applications. The increasing demand for clean-label food ingredients and eco-friendly packaging solutions further supports long-term market growth.

Latin America

Latin America contributes approximately 9% of global industrial starch demand, with Brazil emerging as the primary market. The region benefits from extensive cassava and corn cultivation, supporting competitive starch production.

Growth is driven by expanding food processing activities, rising paper and packaging demand, and increasing use of starch-based adhesives. Additionally, improving industrial infrastructure and export-oriented starch production continue to strengthen the region’s market position.

Middle East & Africa

The Middle East & Africa represent a smaller but steadily expanding market for industrial starch. Growth is supported by industrial diversification initiatives, increasing investments in food processing, and rising demand for packaged and convenience foods.

Gulf countries are witnessing increased starch consumption due to expanding manufacturing and packaging industries, while South Africa serves as a key regional hub for food processing and industrial applications. Improving supply chains and growing awareness of bio-based materials are expected to further accelerate market growth across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Industrial Starch Market

- Cargill

- Archer Daniels Midland (ADM)

- Ingredion Incorporated

- Tate & Lyle

- Roquette Frères

- Südzucker Group

- AGRANA Beteiligungs-AG

- Tereos Group

- Emsland Group

- Avebe

- Thai Wah Group

- Global Bio-Chem Technology

- COFCO Biochemical

- Manildra Group

- Gulshan Polyols