Home Shopping Market Size

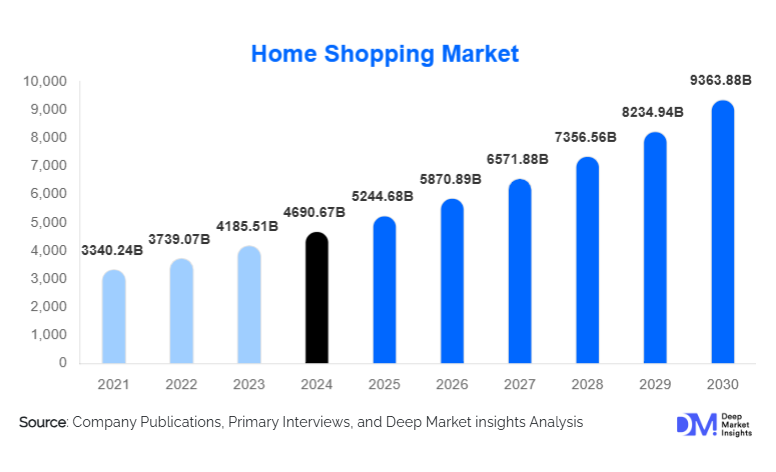

According to Deep Market Insights, the global home shopping market size was valued at USD 4,690.67 billion in 2024 and is projected to grow from USD 5,244.68 billion in 2025 to reach USD 9,363.88 billion by 2030, expanding at a CAGR of 11.94% during the forecast period (2025–2030). The home shopping market growth is primarily driven by rapidly rising e-commerce adoption, increasing smartphone penetration, expansion of digital payment ecosystems, and growing demand for convenient, contactless, and omnichannel retail experiences across both developed and emerging markets.

Key Market Insights

- Digital commerce now dominates global home shopping, with online and mobile channels accounting for nearly 60% of the 2024 market value.

- Asia-Pacific leads global demand with more than 40% of the total market share, driven by China, India, and Southeast Asia.

- Teleshopping continues to hold relevance among older demographics, but mobile-driven live shopping is transforming product discovery.

- Apparel and accessories remain the largest category, contributing around 25–30% of total home shopping sales.

- Digital and wallet-based payments dominate, reflecting high trust in online transaction systems.

- AI-driven personalization, AR/VR try-on tools, and livestream shopping are reshaping engagement and conversion rates globally.

What are the latest trends in the home shopping market?

AI-Powered Personalization and Predictive Commerce

Home shopping platforms are increasingly integrating advanced AI algorithms to personalize product discovery, dynamic pricing, and customer journey mapping. Recommendation engines analyze browsing patterns, purchase histories, and real-time behavioral data to deliver curated product feeds. Predictive commerce tools are enabling automated replenishment for consumables, subscription-driven purchases, and personalized promotion targeting. These technologies significantly increase conversion rates, reduce cart abandonment, and enhance customer satisfaction. Many global platforms are also implementing AI-driven customer support, virtual assistants, and predictive inventory management to streamline operations and meet rising customer expectations.

Rise of Live Commerce and Social Shopping Ecosystems

Live shopping, where hosts, influencers, and experts demonstrate products in real-time, is rapidly transforming the digital retail landscape. Popularized in Asia-Pacific, this trend is now gaining traction in North America and Europe. Consumers benefit from interactive Q&A, real-time promotions, and instant purchase options, creating a highly engaging shopping environment. Social media platforms are integrating in-app checkout, AR-based product visualization, creator-driven storefronts, and influencer-led campaigns. This shift is particularly appealing to Gen Z and Millennials, fostering impulse buying, community engagement, and product discoverability. The fusion of entertainment and retail is reshaping shopper expectations worldwide.

What are the key drivers in the home shopping market?

Rapid Digital Transformation and Smartphone Penetration

With billions of smartphone users globally, mobile-first shopping behaviors are accelerating. Consumers now rely on apps and mobile-optimized platforms for browsing, price comparisons, and fast checkout experiences. Advanced payment systems, including digital wallets, contactless payments, and instant UPI-style transfers, enhance convenience and encourage repeat purchases. The digital ecosystem’s scalability is enabling home shopping platforms to penetrate deep into rural and semi-urban areas where brick-and-mortar retail is limited, thus expanding global retail access.

Shift Toward Convenience, Contactless Buying, and Omnichannel Models

Urbanization and busy lifestyles are driving consumers toward convenient, home-delivered retail options. The preference for minimal physical interaction, accelerated by global health crises, has fueled widespread adoption of home shopping channels. Omnichannel retailing, combining apps, websites, live-commerce, and teleshopping, offers seamless multi-touchpoint experiences. Flexible delivery models, same-day services, easy returns, and subscription-based offerings strengthen customer loyalty and increase purchasing frequency.

Technological Integration Across Logistics and Payment Systems

Technology is optimizing back-end logistics through automated warehouses, AI-driven demand forecasting, integrated last-mile delivery systems, and real-time tracking. Payment technologies, including BNPL (Buy Now Pay Later) and EMI-based options, are enabling larger purchases and improving affordability. These advancements reduce operational costs, improve delivery speeds, and enhance customer trust, ultimately accelerating market expansion on a global scale.

What are the restraints for the global market?

Logistics Gaps and Last-Mile Delivery Challenges

Despite strong growth, the home shopping market faces significant limitations in regions with underdeveloped logistics networks. High delivery costs, delays, poor infrastructure, and complex return processes create friction in the customer experience. For bulky or fragile products, challenges increase due to handling and transportation constraints. These inefficiencies reduce customer trust, particularly in emerging economies, and can hinder market penetration.

Consumer Trust Barriers and Preference for In-Store Shopping

Security concerns regarding online payments, counterfeit goods, data privacy, and after-sales service continue to restrain market growth. In categories such as furniture, appliances, and fashion, many consumers still prefer tactile evaluation before purchase. Regional disparities in digital literacy also limit adoption. Building robust trust frameworks, transparent return policies, and product-authentication technologies is essential to overcoming these barriers.

What are the key opportunities in the home shopping industry?

Emerging Market Penetration and Mobile-First Consumers

The next wave of growth will come from emerging markets across Asia, Africa, and Latin America. Increasing internet penetration, falling smartphone costs, and financial inclusion programs are creating massive new consumer bases for home shopping platforms. Companies that localize products, language interfaces, mobile payment options, and last-mile delivery systems will gain early-mover advantages. Rural and semi-urban regions represent especially high-growth opportunities for mobile-first commerce.

Expansion into Subscription Commerce and High-Frequency Categories

Home shopping players are tapping into categories with recurring purchase cycles, such as groceries, personal care, wellness products, and home essentials. Subscription models offer predictable revenue, long-term customer engagement, and lower acquisition costs. Value-added services like curated boxes, seasonal assortments, and automated replenishment are gaining popularity. This opportunity segment will be crucial for companies seeking sustained, stable growth in a market increasingly driven by convenience.

Product Type Insights

Apparel and accessories dominate the home shopping market, driven by high frequency of purchase, trend-driven demand, and suitability for online retail presentation. Electronics and gadgets hold the second-largest share, supported by strong consumer appetite for smartphones, smart home devices, and personal electronics. Home and kitchen appliances represent a fast-growing segment as consumers prioritize convenience and lifestyle upgrades. Beauty and personal care products are also rapidly expanding due to rising interest in self-care, influencer marketing, and subscription beauty boxes. Grocery and FMCG categories, though newer to digital retail, are growing at a double-digit pace due to repeat consumption patterns.

Application Insights

Household consumption remains the core application segment, with families and individuals purchasing daily essentials, fashion, and lifestyle products. Commercial buyers, such as small businesses sourcing office supplies, electronics, or consumables, represent a growing niche. High-frequency applications like grocery replenishment, personal care restocking, and seasonal product shopping are driving recurring revenue streams. Cross-border shopping is an emerging application, enabling consumers to purchase international brands and specialized products unavailable in local markets. As delivery networks strengthen, applications such as home décor, furniture, and large appliances are gaining traction online.

Distribution Channel Insights

Online e-commerce and mobile apps dominate the market due to convenience, personalization, and immense product variety. Live commerce platforms are gaining rapid momentum, especially in the Asia-Pacific region, transforming the retail engagement model with interactive product demonstrations. Teleshopping continues to attract senior demographics, maintaining a niche share. Direct brand websites and D2C models are increasing as companies bypass intermediaries to gain better margins and customer data. Catalog and phone-based orders remain relevant in emerging economies with lower digital penetration. Social-commerce integrations across Instagram, TikTok, and Facebook are shaping the next phase of discovery-led shopping.

Customer Type Insights

Individual retail consumers account for the majority of global market revenue, driven by strong adoption of online and mobile shopping channels. Families represent a significant and growing segment due to bulk purchasing, recurring consumption needs, and lifestyle-driven shopping. Young adults (18–35 years) drive growth through mobile-first buying behaviors, strong affinity for live commerce, and high brand experimentation. Older consumers (50+ years), while smaller in volume, remain loyal users of teleshopping and catalog-based channels, contributing steady demand.

Age Group Insights

Consumers aged 25–45 years constitute the largest age segment, reflecting high digital literacy, disposable income, and preference for convenience-driven retail. The 18–25 group fuels the rapid adoption of fast fashion, tech gadgets, and influencer-endorsed products. Middle-aged consumers (45–60 years) significantly contribute to categories such as home appliances, furnishings, and premium electronics. Senior consumers (60+ years) dominate teleshopping purchases due to familiarity with traditional shopping formats and limited digital adoption.

| By Sales Channel | By Product Category | By Payment Method | By End-User Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains a highly mature home shopping market, driven by strong digital infrastructure, high purchasing power, and sophisticated logistics. The U.S. accounts for the majority of regional demand, with consumers showing strong preference for fast delivery, subscription services, and premium electronics. E-commerce giants are continually enhancing their fulfillment networks, while live commerce is gaining traction among younger users.

Europe

Europe is experiencing steady growth, supported by high internet penetration, trust in digital payments, and strong cross-border shopping behaviors. The U.K., Germany, and France lead the region, with consumers valuing sustainability, curated product selections, and ethical brands. Live commerce and AR-assisted shopping are rapidly gaining adoption across urban centers.

Asia-Pacific

Asia-Pacific holds the largest global market share and is the fastest-growing region. China remains the powerhouse of global home shopping innovation, driven by super-app ecosystems and live-commerce dominance. India’s rapid digitalization, expanding middle class, and mobile-first population are propelling strong market gains. Southeast Asian nations, such as Indonesia, Vietnam, and the Philippines, are witnessing exponential growth fueled by social commerce and fintech expansion.

Latin America

Latin America is emerging as a high-potential region, with Brazil and Mexico leading adoption. Increasing internet access, smartphone affordability, and digital payment innovations are expanding the consumer base. Social commerce and influencer-driven shopping are particularly strong trends across the region.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is experiencing strong growth driven by high-income consumers and rapid digital transformation. Africa’s home shopping adoption is rising in urban hubs like Nigeria, Kenya, and South Africa, although infrastructure gaps slow penetration in rural areas. Foreign brands and cross-border e-commerce are gaining traction as logistics networks improve.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Home Shopping Market

- Amazon

- Alibaba Group

- JD.com

- Walmart

- eBay

- Rakuten

- Flipkart

- QVC / Qurate Retail

- HSN

- Shopee

- Lazada

- MercadoLibre

- Target Corporation

- Best Buy

- Etsy (core platform, not subsidiaries)

Recent Developments

- In March 2025, Amazon expanded its AI-powered personalization suite across Asia-Pacific, enhancing localized recommendations and real-time dynamic pricing for Indian and Southeast Asian markets.

- In January 2025, Alibaba launched a new AR-based virtual try-on technology for apparel and beauty segments within its Tmall ecosystem, aiming to reduce product return rates.

- In April 2025, Walmart unveiled a network of automated micro-fulfillment centers across the U.S. to reduce last-mile delivery times for grocery and household goods.